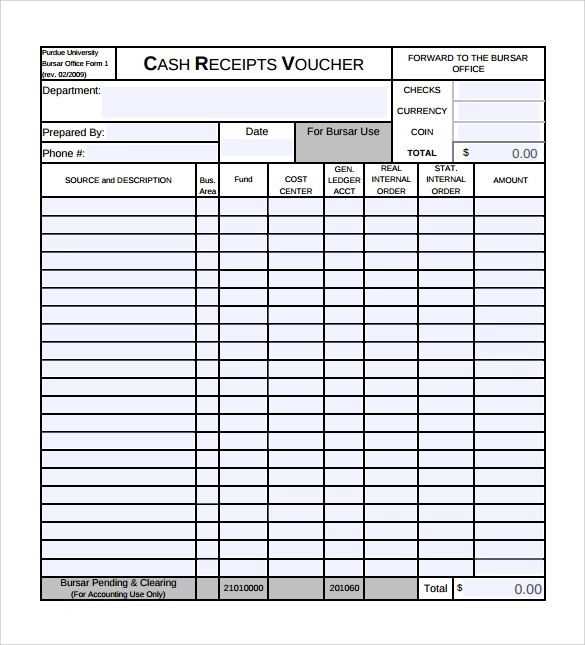

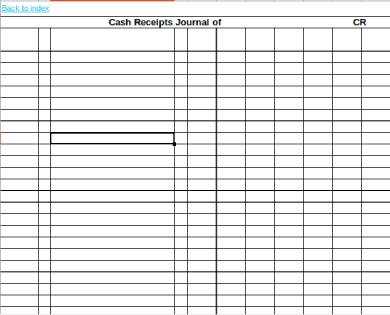

Using a daily cash receipts template can streamline the process of tracking your incoming payments. This template helps you maintain accurate records of all cash transactions, making it easier to monitor cash flow on a day-to-day basis. Whether you’re managing a small business or simply need a reliable way to organize daily transactions, this template serves as an effective tool for ensuring financial clarity.

Fill in the necessary details like the date, payer name, amount received, and any additional notes about the transaction. This ensures that every entry is recorded in an orderly manner, minimizing the risk of missing crucial information. By keeping your records updated daily, you can avoid errors and ensure your accounting remains accurate.

For added precision, include categories for different types of payments, such as sales revenue, loan repayments, or miscellaneous income. This will help you quickly identify where the cash is coming from and whether you’re meeting your financial goals. Consistent use of this template can also simplify end-of-month reporting and budgeting tasks.

Here’s the revised version with minimized word repetition:

Focus on simplifying your daily cash receipt entries by grouping similar transactions together. This reduces redundancy and makes the document more concise. Avoid repeating transaction categories or payment methods. Instead, list them once and use subtotals for better clarity.

Key Structure for Daily Cash Receipts

Organize your template with these key sections:

| Date | Transaction Type | Amount | Notes |

|---|---|---|---|

| 2025-02-06 | Cash Sale | $150.00 | Customer paid by cash. |

| 2025-02-06 | Refund | -$50.00 | Returned goods. |

| 2025-02-06 | Bank Deposit | $1000.00 | Deposit made via bank transfer. |

How to Streamline Entries

For consistent recording, define a set of transaction categories. Limit them to the most common payment methods and types to avoid overloading your template with repetitive options. Adjust your categories as needed, but keep the number manageable.

- Daily Cash Receipts Template

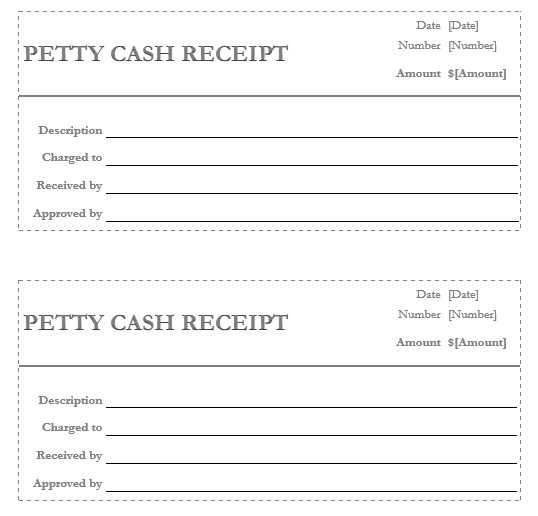

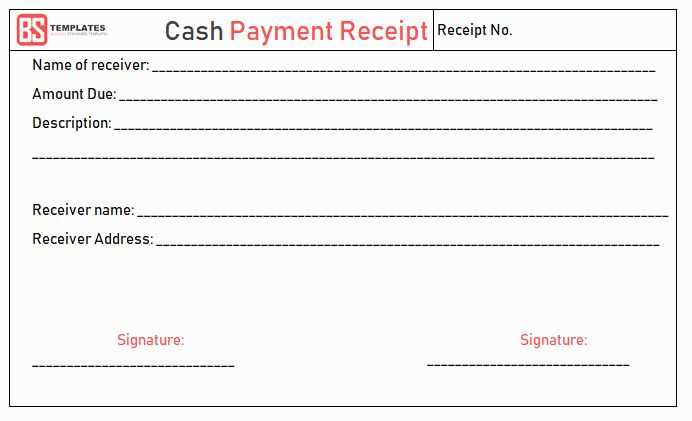

A well-structured daily cash receipts template ensures accurate tracking of cash flow. This template can be used to log every cash transaction, whether it’s a payment received from a customer, a refund, or any other form of cash inflow.

Start by including the following columns:

- Date: Record the exact date of the transaction.

- Description: Provide a brief note on the nature of the receipt (e.g., product sale, service payment, etc.).

- Amount Received: Enter the total amount received in cash.

- Payment Method: Specify the method (e.g., cash, cheque, bank transfer) for each transaction.

- Received By: Track who handled the transaction for accountability.

- Account or Category: Categorize the receipt for financial reporting (e.g., sales, refunds, deposits).

Each entry should be followed by a running total at the bottom of the sheet to provide an overview of daily cash receipts. This helps in balancing the books at the end of the day. Regularly update this template and cross-check it with your cash register to avoid discrepancies.

Finally, include a section for notes, where special circumstances or irregularities in the receipts can be recorded. This will assist in maintaining clear records for auditing or future reference.

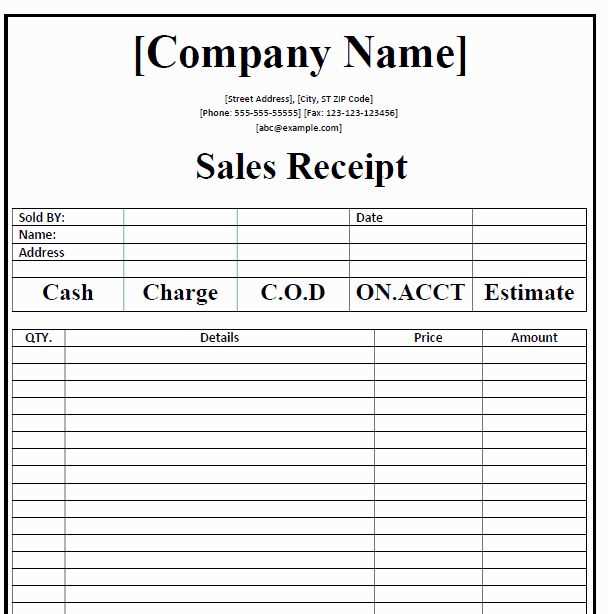

Choose a template format that suits your business’s transaction style and complexity. For small businesses or solo entrepreneurs, a simple, straightforward spreadsheet template will work well for tracking daily cash receipts. If your business handles more complex transactions or deals with multiple revenue streams, a more detailed format with categories for sales, refunds, discounts, and taxes is a better fit.

Spreadsheet Templates

Spreadsheets offer a flexible, customizable approach to cash receipt tracking. Use columns for date, receipt number, payer name, amount, and payment method. You can also add more columns for notes or tax details. Spreadsheets are easy to update and can be quickly adjusted as your business needs grow.

Accounting Software Integration

If you use accounting software, choose a template that integrates directly with your system. This saves time and reduces the risk of errors. Many accounting platforms offer customizable receipt templates, with built-in features for tax calculations, invoicing, and detailed reports.

- Keep the format simple if your business deals with basic transactions.

- Include more fields as your transaction volume increases or becomes more complex.

- Ensure the format is compatible with your existing accounting tools for seamless integration.

Set up clear columns for date, source, amount, and category. This ensures easy tracking and categorization of each transaction. Record the cash inflow as soon as it’s received, noting the exact amount and the payer’s name or business. Use separate columns for different categories like sales, services, or miscellaneous to avoid confusion later.

Regularly update your log throughout the day, instead of waiting until the end. This minimizes the chances of missing any details and keeps the process streamlined. For accuracy, double-check the amounts and sources for consistency before finalizing each entry.

Consider implementing a daily total section where you sum up all receipts by the end of each day. This allows you to quickly review the cash flow and spot any discrepancies before closing your log for the day.

Make use of simple tools, like spreadsheets, to structure your daily log. Templates in spreadsheet applications can automate the summation and categorization processes, reducing manual errors. This way, you can focus more on managing your cash flow rather than entering data repeatedly.

Use Excel or Google Sheets to automate calculations for faster updates and reduce manual errors. Start by setting up formulas for key fields, such as total amounts and taxes, so that as you input data, the calculations update in real-time.

Utilize Built-in Functions

Take advantage of built-in functions like SUM(), AVERAGE(), or IF() for quick calculations. These functions automatically update every time new data is entered, saving time and ensuring accuracy.

Implement Dynamic Range References

Instead of hardcoding specific cell ranges, use dynamic references such as OFFSET() or INDIRECT() to allow your formulas to expand or contract based on the amount of data entered. This makes your spreadsheet adaptable to fluctuating data sets.

For more complex needs, explore using VLOOKUP() or INDEX-MATCH combinations for advanced data retrieval, making it easier to pull and calculate values from multiple sheets or tables.

Separate your cash receipts based on the payment method used. Record transactions for each method–cash, credit cards, checks, and digital payments–into distinct categories. This helps avoid confusion and ensures clarity when reviewing your finances. Use separate columns in your daily template for each payment type, such as “Cash,” “Credit Card,” “Check,” and “Digital Payments.” Be precise with entry details, noting the exact payment method for each receipt. This structure simplifies tracking and allows easy identification of trends and discrepancies, helping you make more informed financial decisions.

At the end of each day, tally the receipts for each payment method. This process will not only give you a quick snapshot of your daily cash flow but also help in balancing your books more efficiently. It also makes it easier to identify any discrepancies between physical cash, card transactions, or other payment forms, helping you take immediate corrective actions if needed.

Daily Reconciliation of Receipts Against Bank Deposits

To ensure accurate financial tracking, reconcile daily receipts with bank deposits. This practice helps detect discrepancies early, maintaining integrity in accounting records.

Steps for Daily Reconciliation

- Start by gathering the daily receipts, including cash, checks, and electronic payments.

- Obtain the bank deposit records for the same period. Ensure you have transaction details, deposit slips, and bank statements.

- Match each receipt with the corresponding deposit in the bank statement.

- Check for any missing or incorrect transactions. Cross-reference the amounts to identify discrepancies.

- If discrepancies arise, investigate the cause–whether it’s an error in recording, missing deposits, or bank processing issues.

- Update the receipts log and bank records to reflect any adjustments or corrections.

Tips for Accurate Reconciliation

- Always perform reconciliation at the same time each day to stay consistent.

- Use software tools that can automate the process and generate reports for better accuracy.

- Set up a process to handle overages or shortages in receipts to prevent errors from compounding.

- Establish a routine for reviewing and updating the bank reconciliation reports regularly.

Use the daily cash receipts template to generate accurate financial reports that help with analysis and audits. Consolidate data from each transaction and categorize it based on predefined revenue streams. Ensure consistency by setting up automatic formulas that calculate totals, balances, and tax amounts. Regularly updating these reports provides an accurate snapshot for auditors and management alike.

Steps for Report Generation

Follow these steps to create detailed financial reports:

- Start by collecting daily cash receipts data, including date, amount, and payment method.

- Input the data into a spreadsheet or accounting software that allows easy categorization and summarization.

- Generate a summary of receipts by day, week, or month for trend analysis.

- Ensure that receipts are matched with the corresponding bank deposits and cash drawers.

- Review the report for any discrepancies or missing data.

Example Table for Receipts

| Date | Transaction ID | Amount | Payment Method | Category |

|---|---|---|---|---|

| 02/06/2025 | TRX001 | $500 | Credit Card | Product Sale |

| 02/06/2025 | TRX002 | $250 | Cash | Service Payment |

| 02/06/2025 | TRX003 | $150 | Debit Card | Product Sale |

By organizing the receipts this way, you can identify patterns, detect errors, and easily prepare for audits. This structured approach minimizes the risk of financial discrepancies during analysis and audits.

Daily Cash Receipts Template

Keep the structure of your daily cash receipts template simple and clear. Focus on including columns for the date, transaction description, amount received, and payment method. Make sure to avoid overcomplicating the layout; simplicity will help prevent mistakes. Regularly review the template to ensure it’s capturing all necessary details for your business without excess information. This approach keeps your records accurate and straightforward.