Track your daily cash flow with a well-structured template for cash receipts. Organize every transaction accurately by noting the date, source, and amount received. This makes reviewing your finances at the end of each day a quick and easy task.

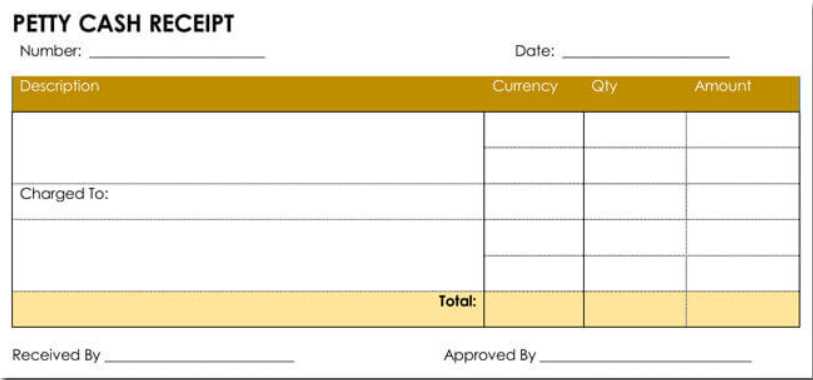

Use clear categories to classify cash sources. For example, separate receipts from sales, refunds, or other income streams. This not only ensures better clarity but also helps identify trends in revenue flow. With this method, you avoid confusion and reduce the risk of errors.

At the end of each day, add up the total amount received. Record the balance promptly, as this helps maintain accurate financial tracking. Use simple formulas or spreadsheet tools to streamline the process, making daily reconciliations straightforward.

Keep it consistent: the key to accuracy in your daily summary is maintaining consistency. Each entry should follow the same format, ensuring that future comparisons are reliable and easy to interpret.

Here are the corrected lines with removed word repetitions:

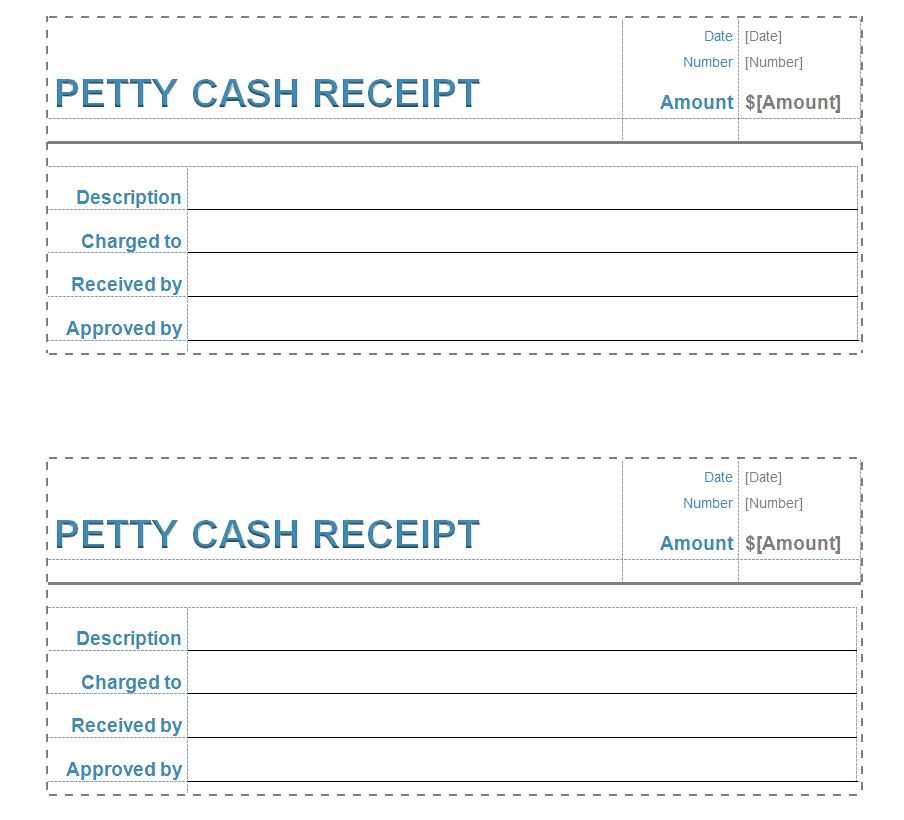

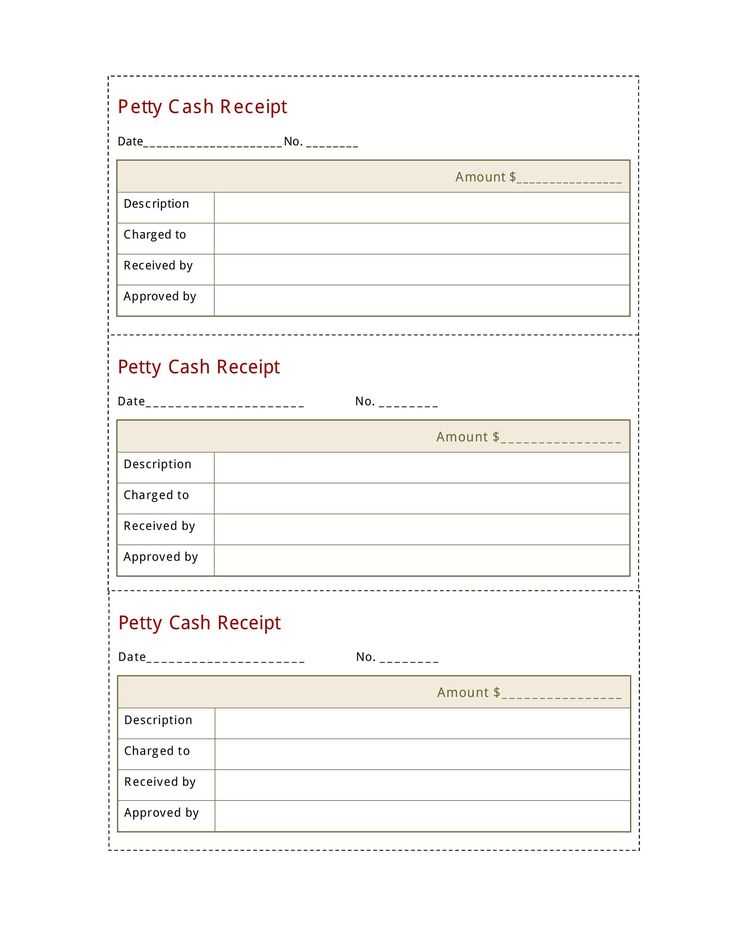

The following template streamlines the cash receipt recording process by eliminating redundant terms and focusing on clarity.

Step 1: Simplify the structure

Replace overly complex phrases with more concise expressions. For example, instead of “the total amount of cash received for the day”, use “daily cash total”. This reduces unnecessary repetition and improves readability.

Step 2: Avoid redundancies

Ensure that no information is repeated unnecessarily. For instance, when listing transaction categories, avoid using “receipt of payment” multiple times. A clear, direct “payment received” is sufficient and avoids duplication.

By following these simple rules, you can create a more efficient and reader-friendly daily cash receipt summary template.

- Daily Summary of Cash Receipts Template

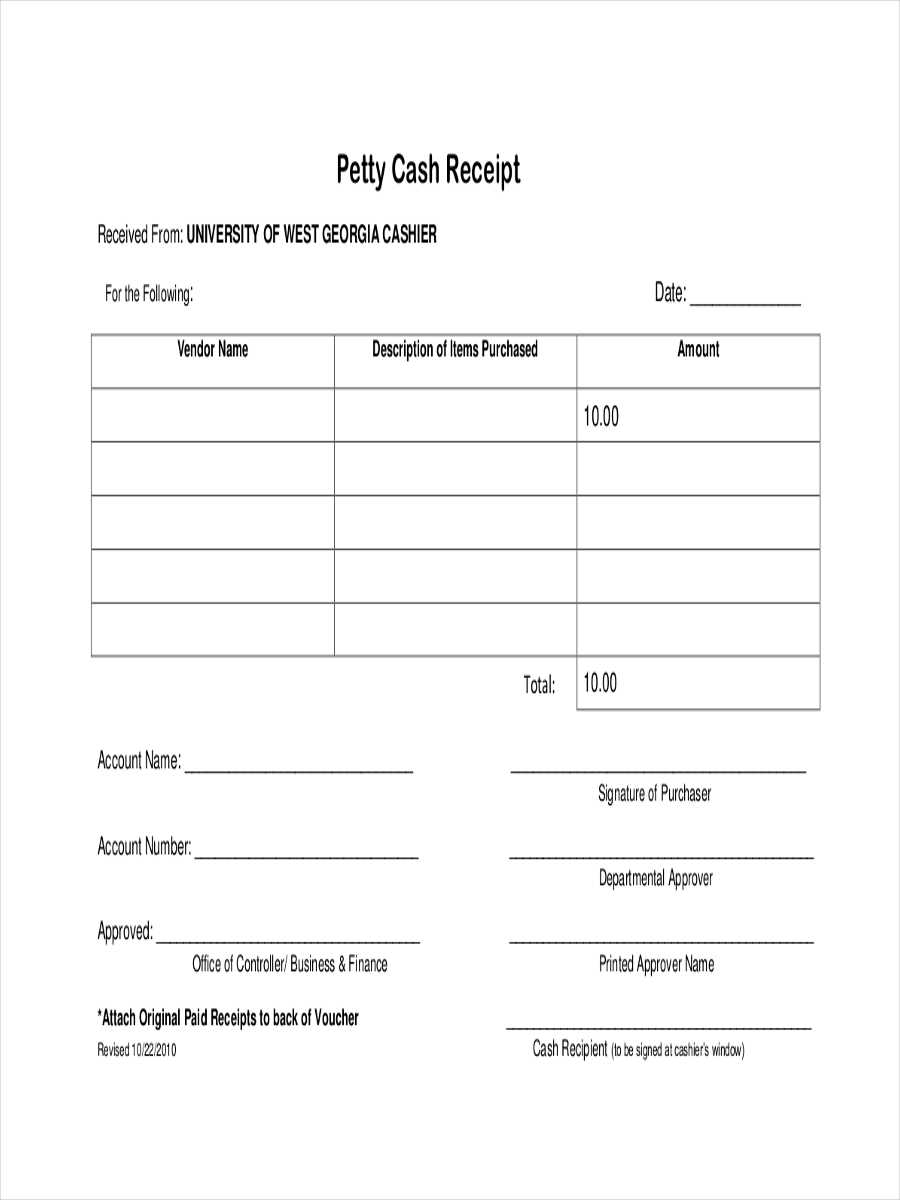

Track daily cash receipts with the following template for clear documentation:

Template Structure

- Date: Indicate the exact date of each transaction.

- Receipt ID: Assign a unique identification number for each receipt.

- Amount: Specify the total amount of cash received.

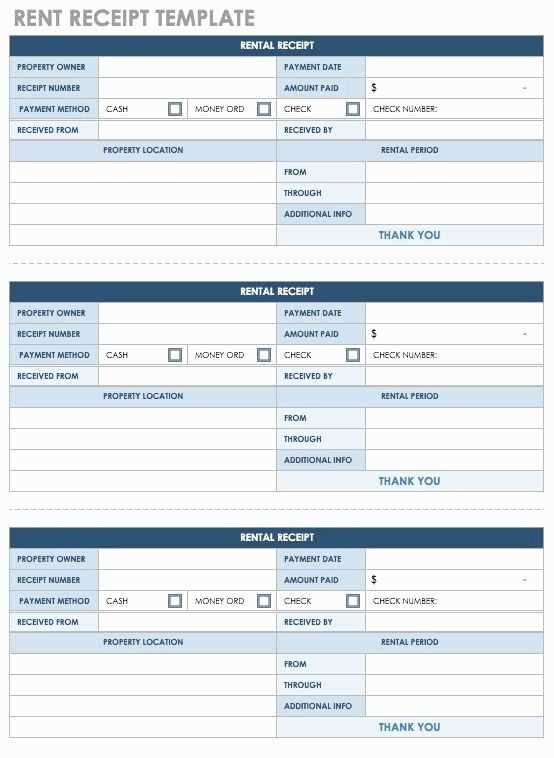

- Payment Method: State the method of payment, such as cash, cheque, or card.

- Customer/Client Name: Include the name of the individual or business making the payment.

- Payment Description: Briefly describe the purpose of the payment.

- Outstanding Balance: Update the remaining balance if applicable.

Best Practices for Tracking Cash Receipts

- Update Immediately: Record payments as soon as they are received to maintain accurate records.

- Verify Accuracy: Double-check the amounts and details before finalizing the entry.

- Use Software: Consider using accounting software for easy tracking and error reduction.

- Review Regularly: Frequently review summaries to identify trends or errors.

Adhering to this structure ensures that daily cash receipts are properly documented and easily accessible for future reference or financial analysis.

Organize your daily cash receipts by setting up a clear and structured log. Record the date, time, and amount of each transaction right away to avoid errors later. Include the source of the payment and categorize the receipt (e.g., customer payment, refund, etc.). Keep it simple but thorough, ensuring that all fields are filled out completely.

Consistency is key. Use the same format every day to streamline data entry and make tracking easier. Consider adding a column for notes to capture any additional details about the transaction, like special instructions or payment methods. This will help in case any follow-up is required.

At the end of the day, tally the totals to verify accuracy. Compare your log with the actual cash on hand and make adjustments if necessary. A daily review helps to spot discrepancies quickly and ensures that your records remain up to date.

Staying disciplined in this practice will prevent confusion during audits and provide a clear financial record for future reference. Use your log not only as a tool for tracking but also as a foundation for improving cash flow management over time.

List the total amount received each day to maintain a clear record of daily cash inflows. This total should reflect both physical and digital transactions, providing an accurate snapshot of your daily finances.

Document the sources of cash receipts to identify where the money is coming from. This category helps in tracking sales, services rendered, and any other incoming payments, ensuring you can categorize revenue effectively.

Track the method of payment, including cash, checks, credit card payments, or other forms. Knowing the payment method allows for better reconciliation and can assist in addressing any discrepancies between recorded and actual receipts.

Note any discounts or adjustments applied to transactions. These figures can affect the overall total and are critical for accurate reporting, especially when reconciling your records at the end of the month.

Include any applicable taxes collected on sales. This ensures transparency and makes it easier when calculating tax liabilities or preparing for audits, while also giving a comprehensive view of your daily transactions.

Consider keeping track of refunds issued. This information is vital for spotting trends, identifying customer complaints, and ensuring that your cash flow reflects accurate figures after returns or cancellations.

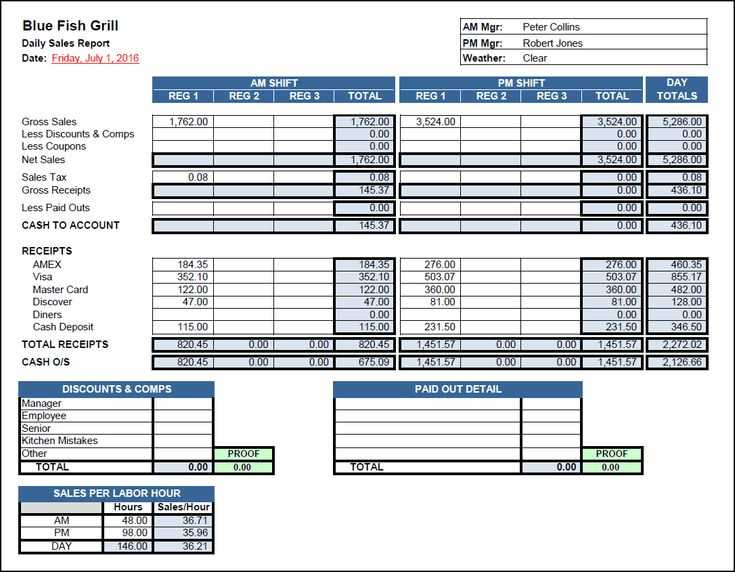

Focus on key metrics such as total receipts, transaction volume, and category-wise breakdown. Identify trends and discrepancies to highlight areas that need attention. Compare the current day’s results with previous periods to assess performance.

Start with the overall cash flow: Check the total amount received and how it aligns with the expected figures. Look for significant fluctuations, which could point to issues such as overpayments or missed receipts. Follow up with detailed transaction reports to ensure accuracy.

Segment the summary by categories like cash, checks, or electronic transfers to spot patterns. A high volume in one category may suggest a shift in customer preferences or operational changes. Use this information to adjust your forecasts or operational priorities.

| Transaction Type | Amount | Comparison with Previous Day |

|---|---|---|

| Cash | $3,500 | +5% |

| Checks | $2,000 | -2% |

| Electronic Transfers | $7,000 | +3% |

Look for irregularities, like missing entries or unaccounted amounts. These could point to system issues or human errors. Investigating these anomalies quickly ensures your records stay accurate and your financial health remains stable.

Lastly, track daily trends over time. Regular review of cash receipts can reveal seasonal patterns or identify persistent issues. This consistent analysis builds a clearer picture of financial health and enables more informed decision-making.

Using a daily summary of cash receipts template streamlines the tracking of incoming payments. This approach ensures no transaction goes unnoticed and helps maintain accurate records for financial review.

Creating a Template for Cash Receipts

A clear, simple structure is key for an effective daily summary. Focus on the following key elements:

- Date: Include the transaction date to maintain chronological order.

- Source: Specify the payer, whether it’s a customer, vendor, or another party.

- Amount: Clearly state the exact amount received.

- Payment Method: Note the type of payment (cash, check, credit card, etc.) for future reference.

- Reference Number: Add any reference or invoice number related to the transaction for easy tracking.

- Total Amount: At the bottom, include a total sum of all daily receipts.

Best Practices for Daily Summary Updates

- Review entries regularly to spot discrepancies or missed transactions.

- Record receipts as soon as possible to ensure accuracy and timeliness.

- Keep the template consistent daily to reduce errors in documentation.