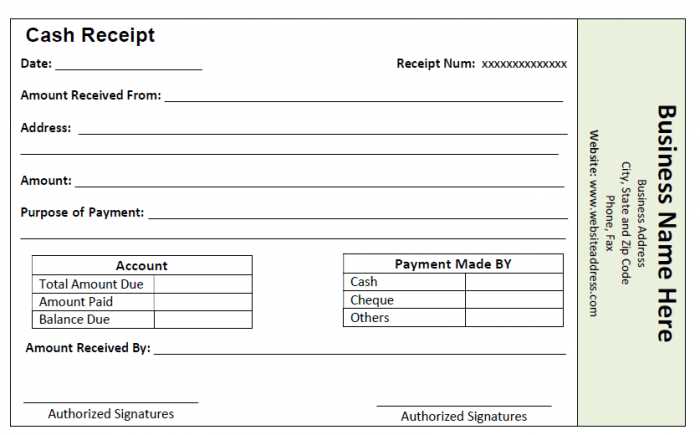

Use this simple cash receipt template to quickly document cash transactions. It’s designed to capture key details like the date, amount, payer, and purpose of payment. You can adjust the fields to match the needs of your specific transaction, whether it’s for a sale, donation, or service rendered.

Start by filling in the recipient’s name and the amount received. Add a brief description of the transaction type, whether it’s for a product or service. This ensures clarity for both the payer and recipient, and helps maintain accurate records.

The template also includes space for a signature line, which is recommended for verification. Having a signature on hand ensures accountability and adds a layer of professionalism to the transaction. By keeping your receipts organized, you avoid confusion and make future reference easier.

Tip: Save this template on your computer or print it out for physical use. You can customize the layout if needed to include additional fields, but the basic structure is all you need to handle most cash payments smoothly.

Here are the corrected lines without word repetition:

To create a clean and professional cash receipt, it’s crucial to eliminate unnecessary repetitions. Below is a refined version of the template with clear and concise phrases:

Key Details to Include:

- Receipt Number

- Date and Time

- Amount Received

- Payment Method

- Recipient’s Name

Example of an Improved Receipt Template:

- Receipt Number: 00123

- Date: March 5, 2025

- Received From: John Doe

- Amount: $100.00

- Payment Method: Credit Card

- Notes: Payment for invoice #456

Each entry should be brief and clear to avoid confusion. Make sure to use consistent formatting throughout the receipt template for a professional appearance.

- Easy Cash Receipt Template Guide

To create a simple yet effective cash receipt, focus on the essential fields. A clear format will help both the payer and payee easily understand the transaction details.

Start with the date of the transaction. It’s crucial to mark the exact day the payment was made. Next, include the amount received, specifying the currency for clarity. The name of the payer should be listed along with a brief description of the payment (e.g., product or service purchased).

Don’t forget to include the receipt number for record-keeping. This helps maintain a traceable system for your transactions. The signature of the payee is important for verifying the receipt’s authenticity. If the payment was made in cash, a note stating that the amount was paid in full will prevent confusion later.

To make your template even more effective, use a simple layout with easily readable fonts. Make sure the columns and rows are aligned, so the information is organized. Avoid unnecessary distractions–focus on the core transaction details.

Lastly, include a footer with contact information or terms of service, if relevant. This ensures the document is not just a receipt but a useful reference for both parties. This format can be adapted for various business needs and ensures a professional and clear cash receipt system.

Focus on clarity and organization when setting up a basic cash receipt template. Ensure it includes the key information that both parties need: date, transaction amount, payment method, and purpose of the payment.

Key Sections to Include

Start with the transaction date, followed by a clear itemization of the goods or services paid for. Specify the total amount received and the method of payment–whether it’s cash, credit card, or another form. You can also add a receipt number for easy reference.

Layout Tips

Organize the receipt into easy-to-read sections. Use bold headings for each part, like “Payment Amount” and “Method of Payment,” to guide the reader. Align the content in a clean, structured way, making it easy for both the payer and the receiver to understand at a glance.

Include the date of the transaction. This helps both the buyer and the seller keep track of when the payment occurred.

Clearly state the total amount paid. Break it down if necessary, showing the cost of items or services separately, along with taxes and discounts.

Provide a detailed description of the goods or services. List the items, their quantities, and unit prices to avoid confusion and ensure transparency.

List the method of payment. Whether it’s cash, card, or online payment, specify how the transaction was completed.

Include your business contact information, such as a phone number or email address, so customers can reach out for follow-ups or issues.

State the transaction reference number or order ID. This makes it easy to locate and verify the purchase in case of any future inquiries.

If applicable, note any return or exchange policies, including deadlines and conditions for refunds or exchanges.

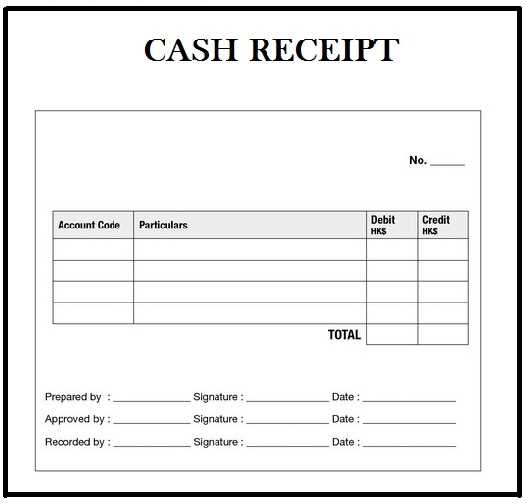

Choose a layout that aligns with the type of transactions you’re handling. A clear, organized format enhances readability and streamlines data entry. Keep in mind the number of fields you need and how the information should flow across the page.

Key Layout Elements to Consider

When selecting a layout, prioritize clarity and functionality. If your receipts involve detailed itemized listings, a two-column layout works best. If you handle simpler transactions, a single-column format keeps things straightforward and easy to read.

Table Layout Example

| Item | Quantity | Price | Total |

|---|---|---|---|

| Product 1 | 2 | $15.00 | $30.00 |

| Product 2 | 1 | $20.00 | $20.00 |

The table layout above allows you to present multiple items with clarity, ensuring customers can easily review their purchase details. Avoid overly complex designs that might overwhelm the customer or distract from key transaction details.

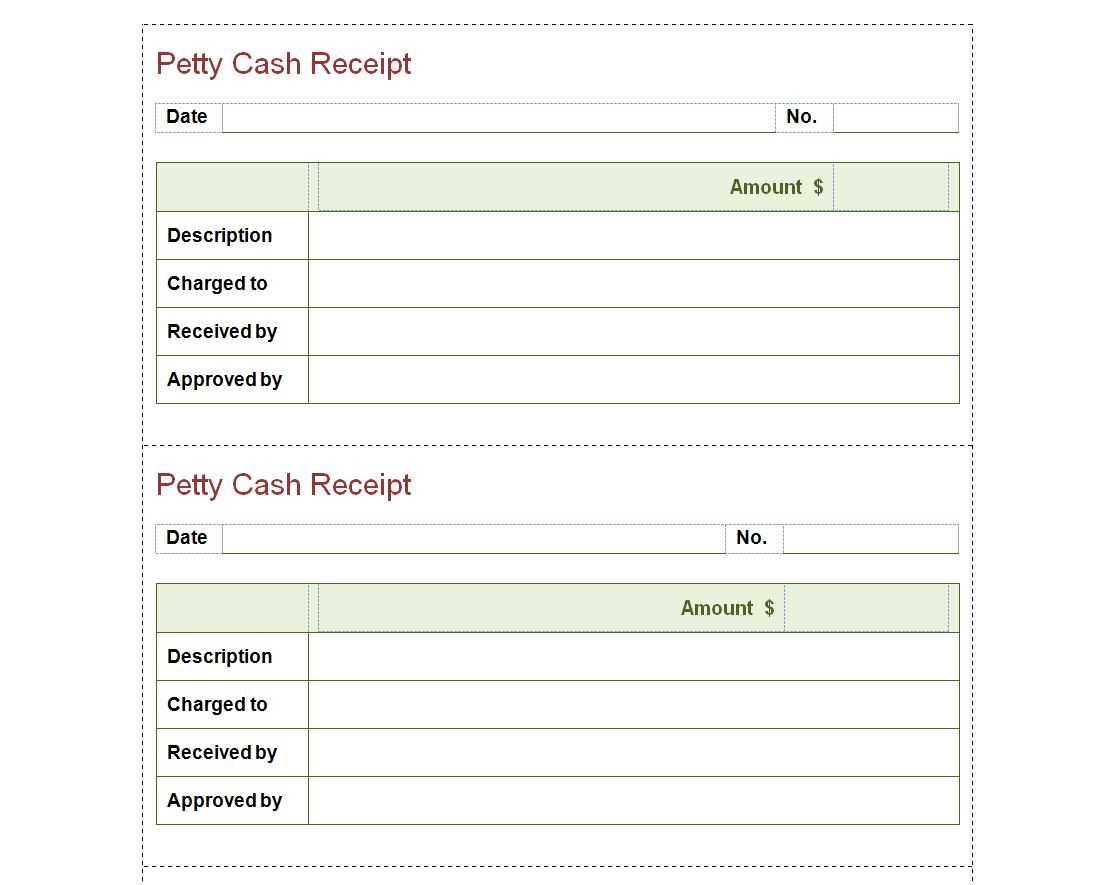

Tailor your receipt to reflect the specific details of each transaction. For sales, include product descriptions, quantities, and individual prices. In service transactions, list the service type, date, and time to ensure accuracy. For returns, adjust the receipt to reflect the refunded amount and the reason for the return. Keep fields such as transaction ID or reference number to help with future inquiries. Customize the footer with additional information, like warranty details or customer service contacts, depending on the type of sale. These adjustments will make your receipts clearer and more relevant to your clients.

Integrate receipt templates into your workflow by aligning them with your daily processes. Start by selecting a template that suits your business needs, whether for sales transactions, service fees, or refunds. Customize the template with relevant fields such as transaction details, customer information, and payment method to make the process seamless.

Automate Data Entry

Minimize errors and save time by automating data entry. Link the receipt template to your invoicing or sales system to automatically populate fields like dates, amounts, and customer details. This reduces manual work and ensures accuracy in every transaction.

Train Your Team

Ensure everyone involved in the process understands how to use the template. Provide training on when to generate receipts, how to adjust the template for different payment types, and how to handle issues that may arise. This will improve consistency and reduce confusion across your team.

- Schedule regular reviews of receipt templates to keep them up to date.

- Encourage team members to report any challenges they face with the template.

- Consider integrating feedback from clients to improve template design.

Using a receipt template simplifies transaction tracking and improves customer service by offering clear, professional receipts quickly. Make it part of your standard operating procedure for smoother business operations.

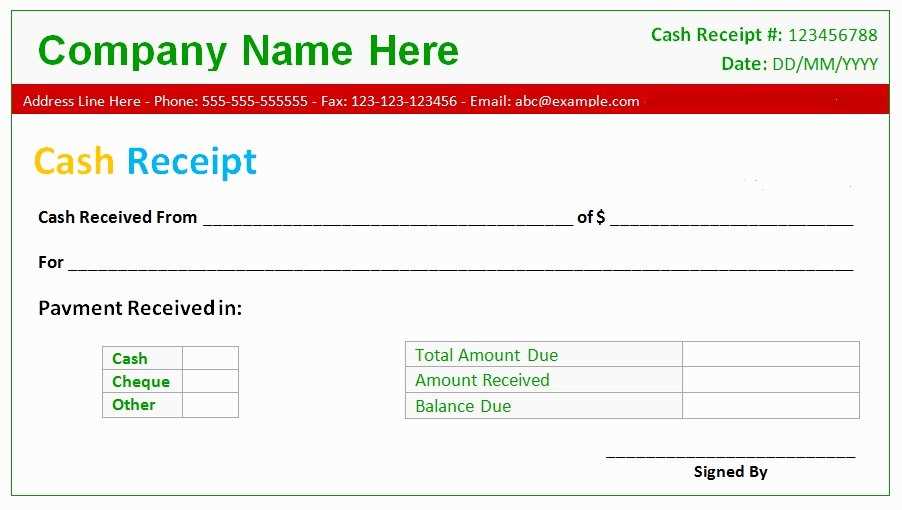

One of the most common mistakes when using cash receipt templates is failing to accurately record the payment amount. Double-check all figures before finalizing the receipt to avoid discrepancies that could lead to confusion or disputes later on.

Incomplete Customer Information

Another frequent issue is leaving out crucial customer details such as their full name or contact information. Missing these details can complicate record-keeping or future follow-ups, so always ensure that all customer data is complete and clear.

Not Updating Payment Methods

Using outdated or incorrect payment method options is another error. If a customer pays via a new platform or method not listed in your template, be sure to update the template accordingly to maintain accuracy in your records.

Ensuring all fields are correctly filled, and the information is up-to-date can prevent many headaches down the road. Keep your receipts consistent and error-free to maintain clarity and professionalism in all transactions.

For a simple and clear approach to creating a cash receipt template, organize the information into key sections. Ensure that each element is labeled and easy to understand. Here’s a basic structure:

| Field | Description |

|---|---|

| Date | Include the date of the transaction to document the exact time the payment was made. |

| Amount | List the amount paid in both numbers and words to avoid confusion. |

| Payee | Include the name or company that received the payment to clarify who collected the funds. |

| Payer | Record the name of the person or entity making the payment. |

| Purpose | Briefly describe the reason for the payment, such as for goods, services, or a loan repayment. |

| Signature | Both the payee and payer should sign the receipt for verification purposes. |

Each section should be formatted clearly, allowing for quick reference in future financial records. This layout ensures all necessary details are documented without excess clutter. The inclusion of a signature line adds an extra layer of accountability.