Using an editable cash receipt template streamlines your record-keeping process and ensures accuracy every time you issue receipts. Whether you’re a small business owner or a freelancer, having a customizable receipt at hand can save you time and prevent errors. A well-structured template allows you to quickly input transaction details, making it easy to track payments and maintain financial transparency.

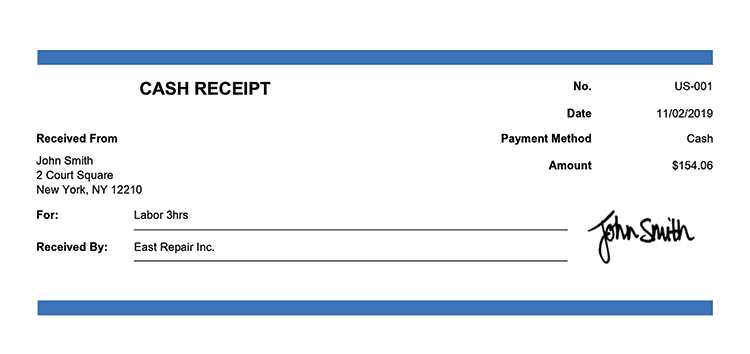

When selecting or creating a template, focus on the key elements: payment date, amount, payer details, and the purpose of the payment. Adding a unique receipt number can also help in organizing your records. Most editable templates let you adjust fields to meet your specific needs, whether you’re handling one-time payments or recurring transactions.

Make sure the template is compatible with the software you use. For example, formats like Excel, Google Sheets, or even Word documents provide flexibility for editing while offering sufficient space for the required details. Choose a clean and simple layout that highlights the most important information without unnecessary clutter.

By implementing an editable cash receipt template, you ensure that your documentation is not only accurate but also consistent, reducing the potential for misunderstandings or disputes with clients.

Here’s the revised version:

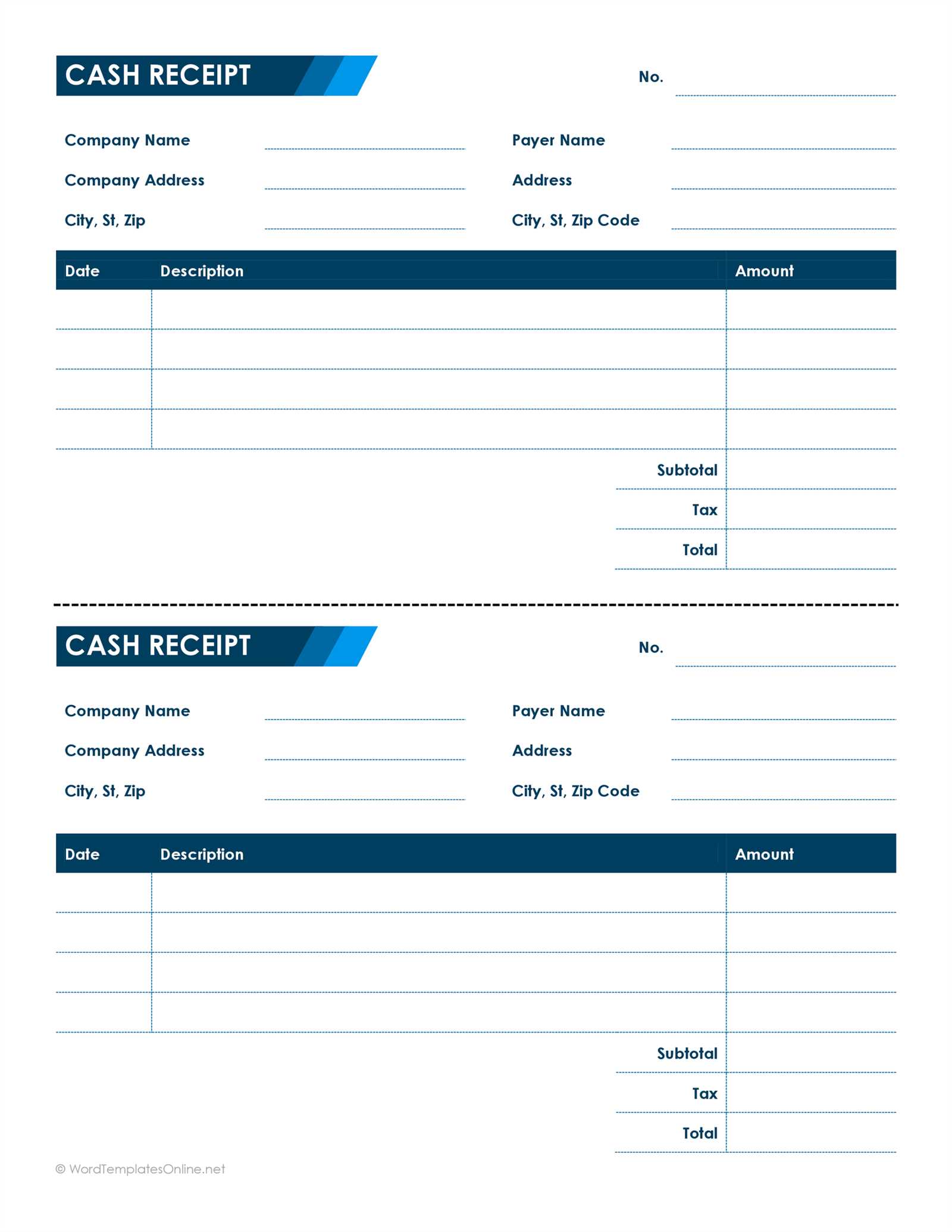

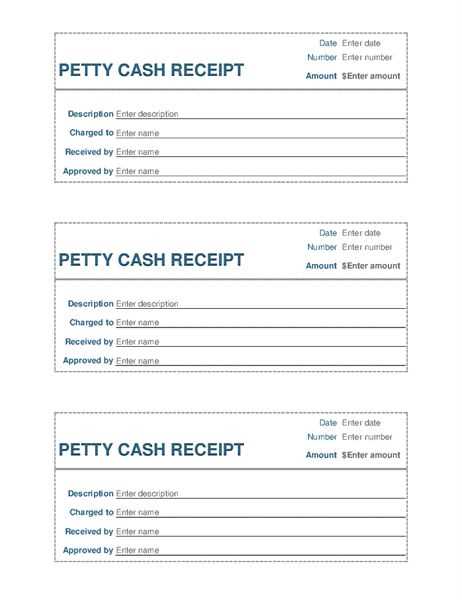

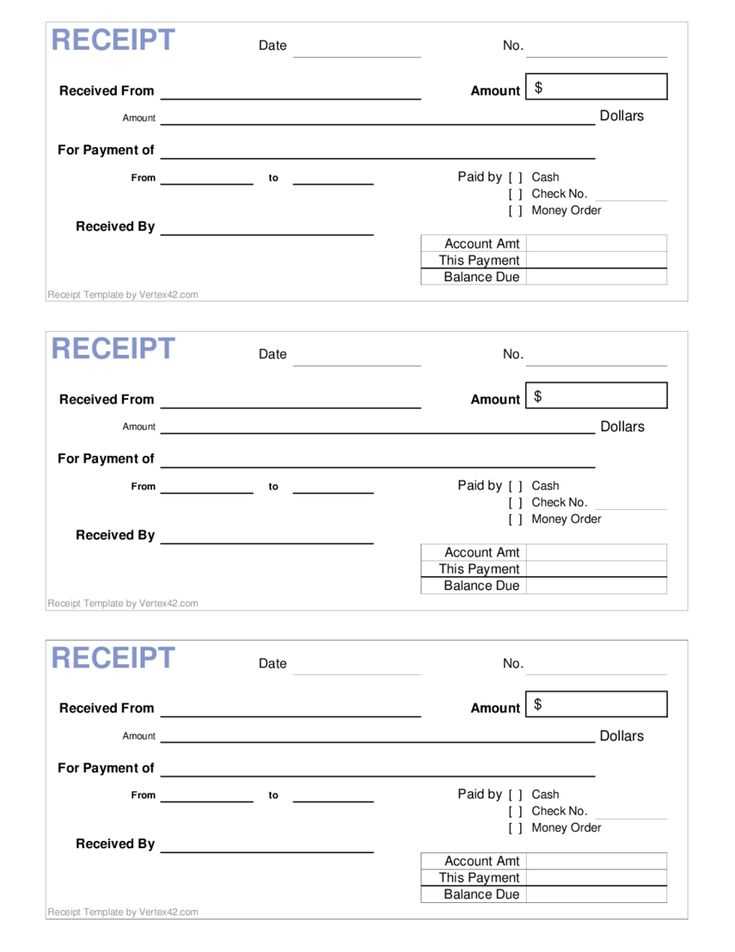

When creating an editable cash receipt template, ensure that all fields are clearly defined and easy to modify. Start with a section for the receipt number, date, and payment method. Include customizable fields for payer details, transaction amount, and any additional notes. Make sure the template is user-friendly by keeping the layout simple and logical.

Key Sections to Include

1. Receipt Number: This is crucial for tracking purposes. Include a field that automatically generates a unique number for each transaction.

2. Date: Provide an editable date field that users can adjust according to the transaction date.

3. Payer Information: Include fields for the name, address, and contact information of the payer, allowing them to be customized if necessary.

Additional Tips

Consider adding a notes section where extra details about the transaction can be written. This could be useful for recording special instructions or reminders. Also, ensure that the template can be saved in different formats (PDF, DOCX, etc.), allowing users to choose the one that suits their needs best.

- Editable Cash Receipt Template Guide

An editable cash receipt template provides a simple way to document cash transactions. With this template, businesses can track payments, providing clear and accurate records for both customers and accountants. Here’s a quick guide on how to make the most out of your editable cash receipt template:

- Customize Fields: Make sure the template allows you to edit key fields like the date, amount received, payer’s name, and payment method. This will ensure that the receipt is tailored to each specific transaction.

- Design for Simplicity: Choose a layout that is clean and easy to read. Avoid unnecessary elements that may distract from the core information–focus on the essential details like the total amount, payer, and reason for the payment.

- Incorporate Automatic Calculations: Some templates allow you to include formulas, making the math easier for you. For example, you could set up a section that calculates the balance after the payment is made.

- Include Legal or Business Information: Ensure that your template includes necessary details like business name, address, and contact information. This is important for both legal purposes and customer service.

- Provide Options for Additional Notes: Add a field where additional comments can be entered, such as “Thank you for your payment” or a reference to a particular invoice number. This adds clarity in case of disputes or follow-up communication.

- Save Templates in Multiple Formats: After customizing the template, save it in formats such as Word, PDF, or Excel for easy distribution and editing. Ensure the template is accessible to your team or clients as needed.

By following these steps, you’ll create a practical, versatile cash receipt template that can easily adapt to various types of transactions.

To create an editable cash receipt in Excel, begin by setting up a clean and organized template. Start with a table layout to capture key details: date, receipt number, payer, amount, payment method, and any notes. Below is a basic structure for your receipt template.

| Receipt Number | Date | Payer | Amount | Payment Method | Notes |

|---|---|---|---|---|---|

Next, use Excel’s cell formatting to make sure all entries are aligned properly. For instance, set the amount column to a currency format. To ensure the receipt is editable, use Excel’s “Data Validation” tool to create drop-down menus for repetitive fields like payment method or notes. This will make it quicker to fill out future receipts without needing to type in the same data repeatedly.

To make the receipt look professional, adjust the fonts and add borders around the table cells for a clear and readable layout. You can also create a logo section in the top left corner of the sheet to represent your business, which you can update as needed.

Save the template and share it as an editable file. Each time a new receipt is generated, simply copy and paste the template into a new sheet, update the relevant fields, and save it with a new name for easy tracking.

Adjust your receipt template to reflect the payment methods used. Including specific details for each payment type enhances clarity and accuracy. Customize fields to cover cash, credit/debit cards, checks, and digital wallets. Each payment method has unique requirements, which should be clearly documented in the receipt.

Cash Payment

For cash transactions, include the total amount paid in cash, as well as the change given (if applicable). If necessary, provide a brief note about the denomination breakdown. This ensures both the seller and buyer have a clear understanding of the transaction.

Credit/Debit Card Payment

For card payments, specify the card type (Visa, MasterCard, etc.) and the last four digits of the card number for reference. Avoid storing full card numbers for security reasons. If the transaction was processed through a terminal, include the authorization code to verify the payment.

Check Payment

When accepting checks, include the check number and the bank name. You may also want to note the payment clearance status (pending or processed) for future reference.

Digital Wallet Payment

For digital wallets like PayPal, Apple Pay, or Google Pay, include the transaction ID, payment provider, and any additional reference codes provided by the wallet service. This ensures easy tracking and verification of digital payments.

Table Example

| Payment Method | Details to Include |

|---|---|

| Cash | Amount Paid, Change Given (if applicable), Denomination Breakdown |

| Credit/Debit Card | Card Type, Last 4 Digits, Authorization Code |

| Check | Check Number, Bank Name, Payment Status |

| Digital Wallet | Transaction ID, Payment Provider, Reference Codes |

Adjust these fields to match the specific needs of your business and the preferred payment methods used by your customers. This customization will provide transparency and streamline your transaction process.

To properly include tax and discounts in a cash receipt, begin by clearly listing the original price of the items or services provided. Then, calculate the applicable tax and discounts separately. This ensures that the customer can easily see the breakdown of charges before finalizing the transaction.

Incorporating Tax

Apply the appropriate tax rate based on your location or the nature of the goods/services. If the tax is percentage-based, multiply the total price by the tax rate and add it to the total amount. For example, if the total is $100 and the tax rate is 8%, the tax amount would be $8, bringing the total to $108.

Applying Discounts

For discounts, subtract the discount amount from the subtotal before applying tax. If the discount is percentage-based, calculate it by multiplying the subtotal by the discount rate. For instance, a 10% discount on a $100 subtotal would be $10, making the adjusted price $90. Then, apply tax on the discounted total.

Make sure to display both tax and discount amounts clearly on the receipt, so the customer can verify each part of the calculation. This transparency helps avoid confusion and ensures your receipt is accurate.

Adding Payment Terms and Due Dates to Your Receipt

Including payment terms and due dates on your receipt ensures clear communication between you and your customer, reducing potential confusion. Here’s how to structure them effectively:

- State Payment Terms Clearly: Specify if payments are due immediately, within a certain number of days, or upon completion of a service. For example, “Payment due within 30 days” or “Due upon receipt.” Make sure the terms are easy to read and unambiguous.

- Specify Late Fees or Penalties: If applicable, mention any late fees that will apply if the payment is not made by the due date. For example, “A late fee of 5% will be applied after the due date.”

- Set Clear Due Dates: Always provide a specific due date in a clear format, such as “Due on March 1, 2025” or “Payment due within 30 days of receipt.” Avoid vague terms like “next month” or “soon.”

- Use Consistent Date Formatting: Stick to one format for dates throughout your document, such as “DD/MM/YYYY” or “Month Day, Year” to avoid misunderstandings.

- Offer Multiple Payment Methods: Let customers know how they can pay, whether it’s via bank transfer, credit card, or online services. This flexibility encourages timely payments.

Adding these elements not only improves the clarity of your receipts but also enhances professionalism and helps maintain healthy cash flow.

Protect your editable template by setting up password protection. Ensure only authorized individuals can make changes by using strong, unique passwords. You can also limit access by sharing the file only with trusted users.

Use digital signatures to verify the integrity of the template. This adds an extra layer of security by ensuring the document has not been tampered with since it was signed.

Enable file encryption. Encrypting your template helps secure sensitive data and prevents unauthorized access or modifications. Most PDF and word processing software have built-in encryption features.

Regularly back up your templates. Keeping copies of your templates in multiple secure locations, such as encrypted cloud storage, ensures you can recover them if someone attempts to alter or delete the original file.

Track and monitor changes made to the document. Many file-sharing platforms provide version control, which allows you to see who made modifications and when, making it easier to spot suspicious activities.

Consider restricting editing permissions. Many software tools allow you to set specific rights, such as view-only or comment-only permissions. This way, you can prevent unauthorized alterations while still sharing the document with others.

To share and print your cash receipt template, follow these steps:

- Share via Email: Save your receipt as a PDF or Word document and attach it to an email. Most email platforms allow for easy file attachments. Make sure the file is named appropriately for easy reference.

- Upload to Cloud Storage: Upload the file to cloud services like Google Drive or Dropbox. Share the link with the recipient. This ensures easy access from any device without needing to send large attachments.

- Print Directly from Software: If your template is open in a word processor or PDF viewer, simply click the ‘Print’ option. Make sure your printer settings are correct, such as selecting the right paper size and orientation.

- Check Print Preview: Before printing, always review the print preview to ensure the template fits on the page as expected. Adjust margins or page breaks if needed.

- Print Multiple Copies: If you need more than one copy, adjust the number of copies in the print dialog box. Ensure your printer has enough paper and ink to handle the print job.

- Share via Messaging Apps: Some apps allow you to send files directly through text or instant messaging. Simply select your file and send it directly to the recipient.

Editable Cash Receipt Template: Key Features

An editable cash receipt template allows for quick modifications, whether it’s for recording payments, adjusting amounts, or personalizing the format. By choosing a template designed for easy updates, users can ensure the document reflects the correct transaction details without the hassle of creating a new one from scratch.

Benefits of Using an Editable Template

Using a flexible template enables seamless customization to match the specific needs of your business. With editable fields, you can input transaction information swiftly, eliminating the need for handwritten receipts or complicated software. The template can be saved for future use, making it simple to generate accurate receipts as needed.

How to Customize Your Receipt

After downloading the template, fill in the necessary fields such as the buyer’s name, transaction date, and the amount received. You can adjust the layout and fonts if required, giving the receipt a more professional or personal touch. This flexibility ensures you can maintain consistency across all receipts issued.