To manage farm cash receipts effectively for a restaurant, it’s critical to track incoming payments systematically. Begin by categorizing the sources of income, such as produce sales, dairy, or meat. This clear categorization simplifies financial reporting and helps identify the profitability of different farm products supplied to the restaurant.

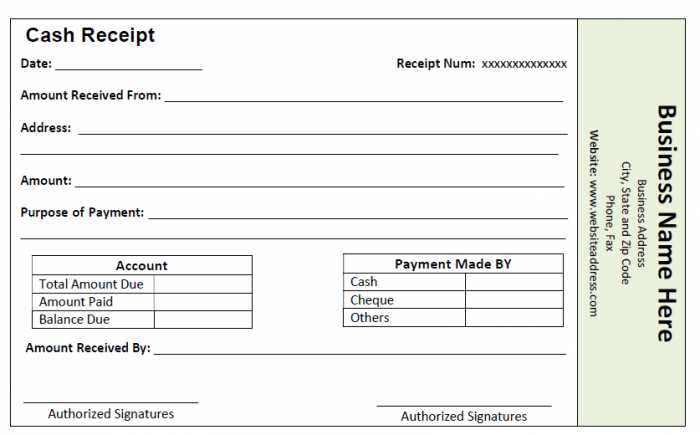

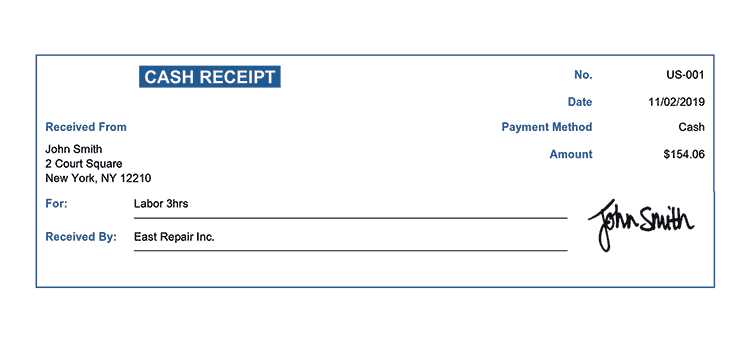

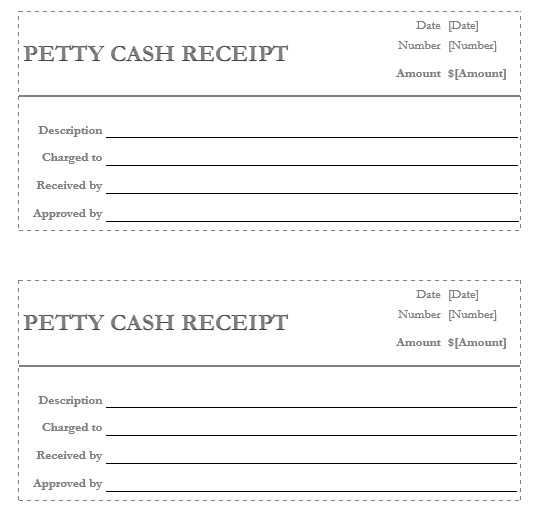

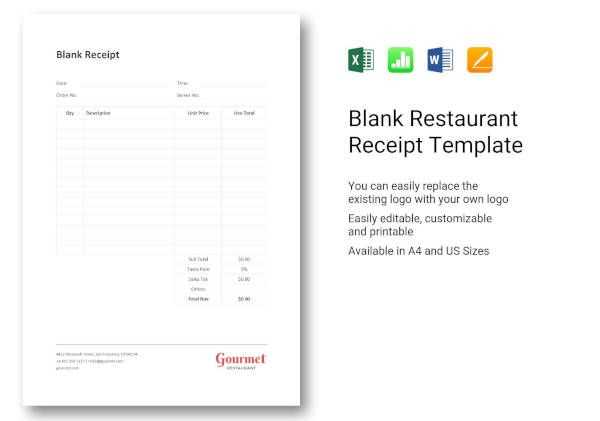

Create a template that includes all necessary fields for tracking cash receipts. This should cover the date, customer details, amount paid, and the specific items purchased. Additionally, include a section for payment method to distinguish between cash, credit card, or other forms of payment. By keeping this information organized, you can quickly assess farm income and make more informed purchasing decisions for the restaurant.

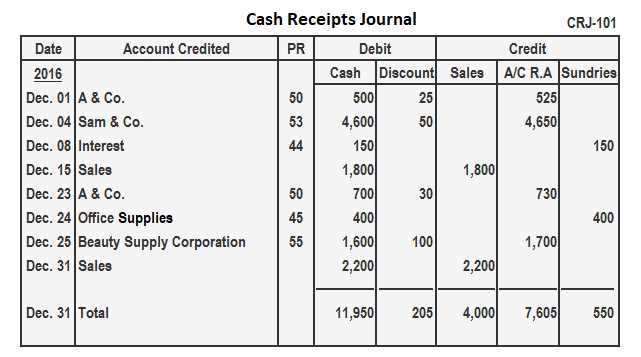

Keep track of receipts weekly to ensure that you can evaluate trends in income. A simple yet effective strategy is to compare the receipts on a monthly basis, which allows for early identification of any discrepancies or areas for improvement. Over time, this approach will lead to better cash flow management and more accurate budget forecasting for the restaurant.

Here is the revised version with minimized repetitions, while maintaining the meaning and integrity of the sentences:

To improve farm cash receipt management for restaurants, streamline the process by categorizing receipts based on type of transaction, such as wholesale, retail, or direct-to-consumer sales. This segmentation allows for better tracking and analysis of cash flow. Additionally, employ a consistent template for recording each receipt, ensuring that key details such as date, amount, and payment method are clearly indicated. This practice reduces errors and provides clarity in financial reporting.

Template Features

A useful template includes columns for transaction ID, customer information, items sold, and unit prices. Ensure there is a section for notes, where any adjustments or special conditions can be recorded. By keeping this information consistent across all receipts, you reduce the chances of errors when reviewing records. It is also helpful to include a summary section for totals, which gives a snapshot of the day’s revenue.

Data Accuracy and Consistency

Accuracy is key in farm cash receipts. Regularly review the template to ensure it meets the restaurant’s needs and accommodates changes in pricing or item offerings. Consistently update any tax rates or legal requirements to maintain compliance. Regular audits will help identify discrepancies early, preventing larger issues later on.

- Farm Cash Receipts for Restaurant Template

To manage your farm cash receipts efficiently for restaurant use, create a detailed template that captures every transaction with precision. This ensures proper tracking and easy integration into accounting systems. The template should include the following sections:

- Date: Capture the date of each receipt to maintain an organized record.

- Supplier: Include the name of the farm or supplier providing the goods.

- Description: A brief description of the items received, such as fresh vegetables, dairy, or meats.

- Quantity: Specify the quantity of each item, ensuring you match it with invoices and deliveries.

- Unit Price: Document the price per unit for each item. This helps track your restaurant’s spending over time.

- Total Price: Calculate the total cost by multiplying the unit price by the quantity.

- Payment Method: Indicate whether the payment was made by credit, cash, or other means.

- Notes: Add any relevant notes about the transaction, such as discounts or specific delivery instructions.

Ensure the template is easily adjustable to accommodate fluctuating prices, varying quantities, and different suppliers. This setup simplifies accounting and inventory management, contributing to smoother operations and cost control.

Track farm cash receipts by setting up a straightforward system that connects each purchase with your restaurant’s inventory. Start by categorizing receipts by vendor, product type, and date. This method ensures that every item purchased is linked to specific inventory items, allowing you to easily monitor stock levels.

Step 1: Categorize and Record the Receipt Details

Each receipt should include clear details about the farm’s product, quantity, and price. Record these details in a digital or paper log, assigning them to specific inventory categories like produce, dairy, or meat. Consider using software that integrates inventory management with receipts, so data entry becomes more streamlined.

Step 2: Implement a System for Regular Updates

Update inventory counts regularly by comparing farm receipts with current stock levels. After each delivery, adjust the inventory quantities to reflect the received goods. Use a table format for easy tracking of the items and their respective quantities. This helps identify trends and avoid stockouts or overordering.

| Vendor | Product | Quantity | Price | Date |

|---|---|---|---|---|

| Local Farm A | Carrots | 30 lbs | $45 | 2025-02-12 |

| Farm Fresh Co. | Chicken Breasts | 50 lbs | $150 | 2025-02-12 |

Regularly check the accuracy of your receipt records and inventory levels. Cross-reference your inventory system with physical counts to ensure consistency and avoid discrepancies that could impact restaurant operations.

Create a dedicated template within your accounting software or spreadsheet program that includes all key fields for farm payments. This should include columns for supplier names, payment dates, amounts, product descriptions, and payment methods. Ensure that the template allows you to track each transaction against specific farm suppliers to maintain transparency and clarity.

Label each column clearly to avoid confusion. Add a section for notes where you can record any specific details or adjustments related to the payment. For example, if the payment is part of a larger bulk order, indicate the percentage or portion paid. Use consistent formatting for easier review and cross-checking.

Include a column to categorize the payments, such as “Produce,” “Dairy,” or “Meat,” depending on the type of farm product received. This will help in later financial reports, allowing for better categorization of farm-related expenses.

Ensure the template is easy to update as new payments are made. Automate calculations like totals for each supplier or product category to streamline the accounting process. This way, you can easily spot trends or discrepancies in farm payment patterns throughout the accounting period.

Begin by cross-checking the farm cash receipts with payment records to ensure they match. First, verify that the date and amounts listed on the receipts correspond with the transactions in the restaurant’s payment system. A quick comparison of the total amount on both documents should help identify discrepancies early.

Match Itemized Purchases with Payment Method

Next, review the itemized list of farm products on the receipt. Cross-reference these items with the payment method used by the restaurant. For example, if the payment was made via credit card, ensure the payment date and amount match the one on the receipt. This step is crucial for confirming that all transactions are recorded correctly in both systems.

Reconcile Any Discrepancies

If discrepancies arise, investigate the cause by looking for missing transactions or clerical errors. Contact the supplier or payment processor to clarify any doubts about the transaction. If the payment was processed via check, ensure the check number, date, and amount align with the restaurant’s records.

Incorporating detailed tracking for each transaction and regularly reviewing cash receipts will streamline the reconciliation process and reduce errors. It also helps build transparency in the payment process between the farm and the restaurant.

To organize farm cash receipts for a restaurant, use a structured template that simplifies tracking and reporting. This allows for efficient financial planning and analysis. Break down receipts into categories like fresh produce, dairy, meat, and grains. Each category should include columns for date, amount, farm name, and payment method. For better clarity, include a running total at the bottom of each section to monitor expenditures.

Customizing the Template

Adjust the template for specific restaurant needs. If your restaurant sources a variety of products, consider adding separate columns for organic or local items. This can help identify premium costs versus standard purchases. Incorporate sections for recurring payments or seasonal purchases, making it easier to track regular expenses over time.

Tracking Payment Methods

Include a column for payment methods to monitor whether payments are made by credit, cash, or via bank transfer. This helps identify trends in payment processing and improves cash flow management. Group payments by month to ensure consistency in tracking, helping both farm and restaurant teams stay aligned.