If you need a quick and professional way to document financial transactions, a fillable cash receipt template in PDF format can simplify the process. It helps maintain accurate records and ensures clear communication between parties involved in a transaction.

One of the key benefits of using a fillable PDF template is its adaptability. You can easily customize fields such as date, payment amount, recipient name, and transaction details without altering the overall structure. This makes it suitable for both personal and business use.

Why choose a PDF format? The answer lies in its universal compatibility. PDF documents preserve formatting across different devices, making them accessible on computers, tablets, and smartphones. Additionally, most modern browsers and software come with built-in tools to open and edit PDF files.

To get started, download a template that meets your specific needs. Look for one with editable fields for maximum convenience. With the right template, creating polished and reliable cash receipts becomes a seamless task, saving you time and reducing paperwork errors.

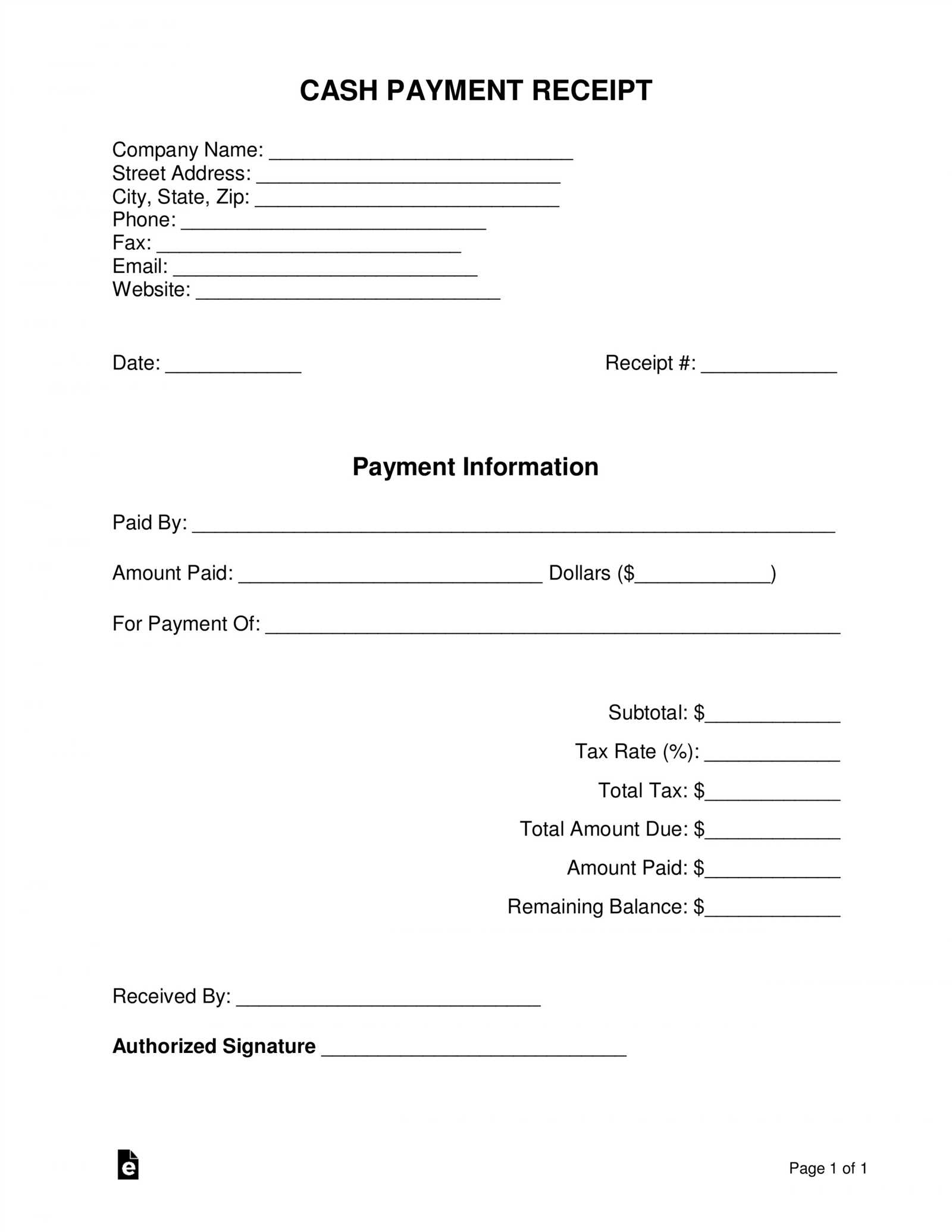

Fillable Cash Receipt Template PDF

To create a fillable cash receipt template in PDF format, use simple tools such as Adobe Acrobat or online PDF editors. This format ensures easy customization and quick usage for businesses and individuals alike.

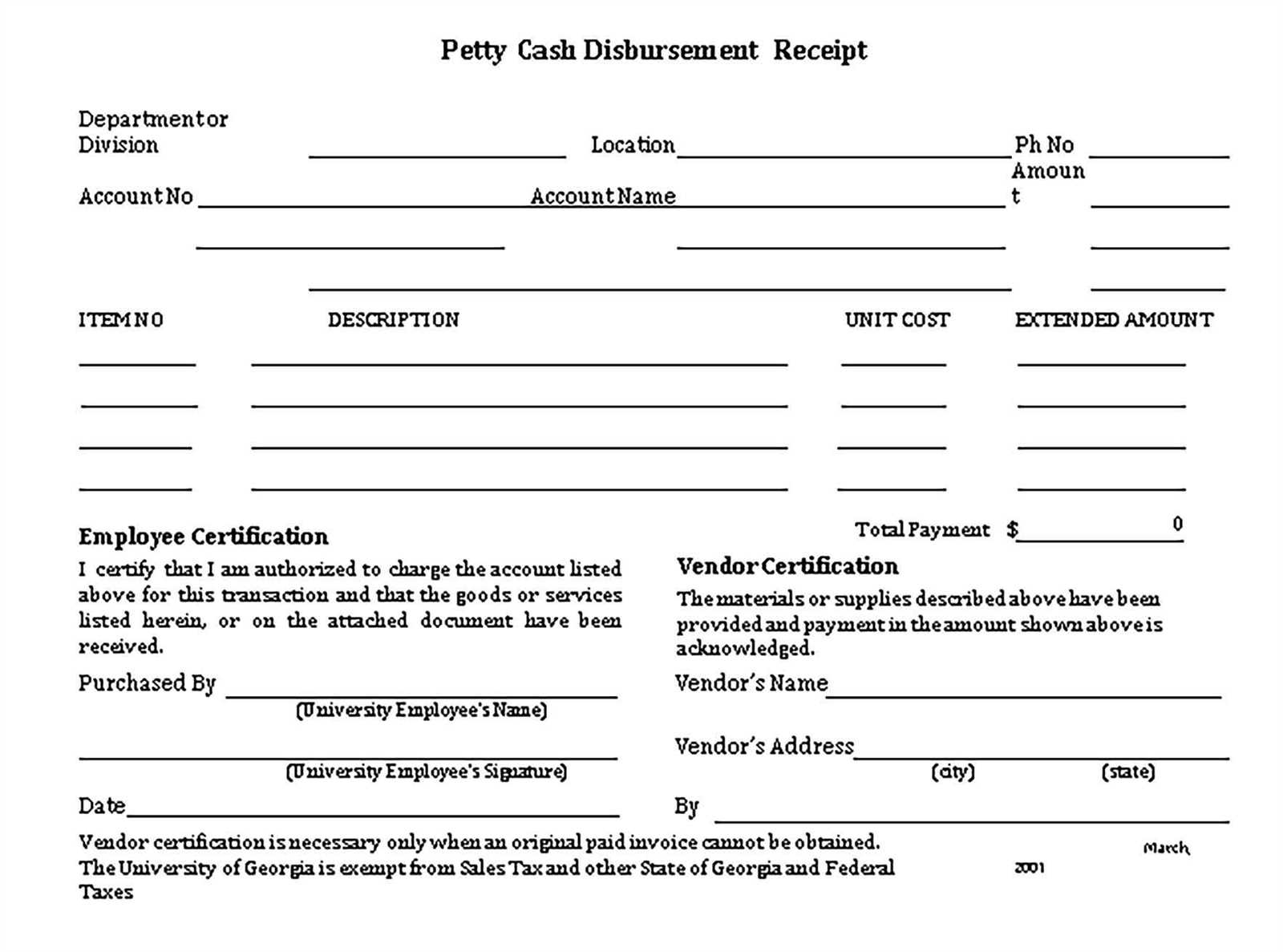

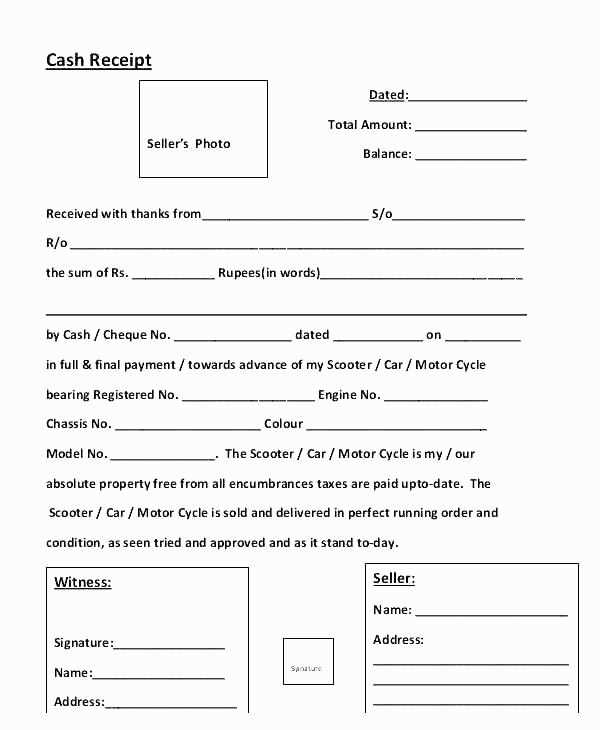

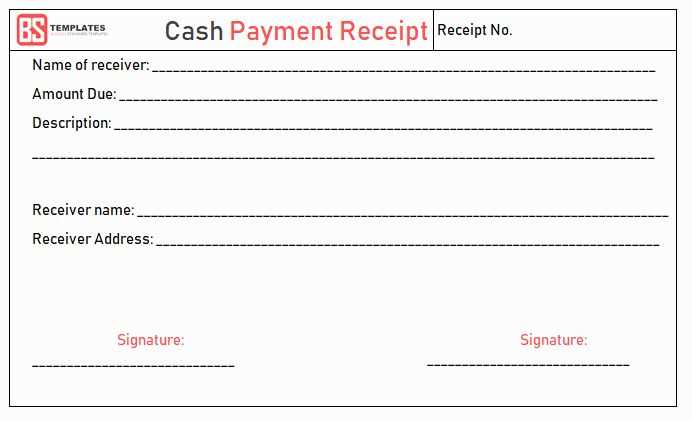

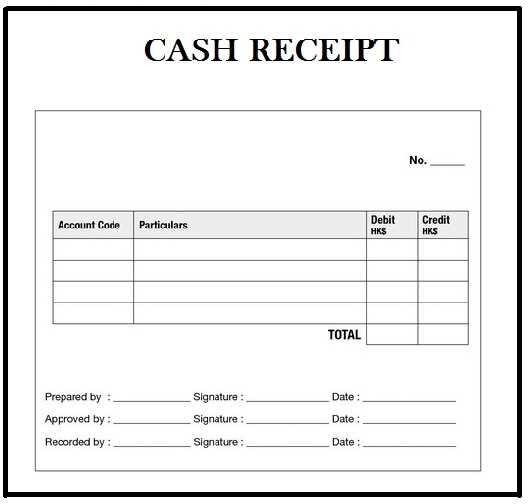

- Clear layout: Include fields for the date, amount received, payer’s name, and signature space. This keeps the receipt organized and ensures all necessary information is captured.

- Editable fields: Ensure fields for entering data are clearly marked. Fields should include payer information, payment method, and transaction details.

- Automatic calculation: Add formulas where possible to automatically calculate totals and taxes. This reduces the risk of errors in manual calculations.

- Save and reuse: Save your template and reuse it for different transactions. Having a pre-made template ensures consistency across receipts.

- Easy access: A PDF format allows you to store and share receipts easily, providing a professional and consistent way to handle payments.

Using these elements will help you build a clear, professional fillable cash receipt template that meets your needs while ensuring accuracy and efficiency in your financial records.

How to Choose the Right Template Format

Select a template that matches your specific needs. If you need to print receipts, choose a PDF format for its consistency across devices and printers. For ease of use and editing, a fillable PDF works well, allowing you to quickly input data without altering the layout. Consider the template’s compatibility with your devices; PDFs work across most systems, ensuring no issues with file formatting.

For digital record-keeping, opt for a format that allows seamless storage and sharing. Fillable PDFs are ideal since they can be saved and emailed easily, keeping the original format intact. If you need to integrate with accounting software, ensure that the template format supports importing and exporting data in a usable way.

Lastly, review the customization options. A good template will let you adjust fields to fit your business needs without losing clarity or functionality. Pick a template that allows flexibility for different types of transactions while maintaining a clean, professional appearance. Choose the one that aligns with your workflow and ensures smooth operation every time.

Key Elements to Include in a Cash Receipt

Always include the transaction date on the receipt. This helps both parties track the payment history clearly.

List the full name of the payer. This ensures that the receipt can be properly attributed to the correct individual or business.

Specify the amount paid in both numerical and written form. This minimizes the chance of confusion or errors related to the amount received.

Describe the payment method used, whether it’s cash, credit, check, or another form. This gives clarity about how the transaction was processed.

Include a description of the goods or services provided. This ensures transparency and serves as a record of the transaction details.

A unique receipt number helps organize records and makes it easier to locate specific transactions if needed.

Make sure to include the name and contact details of the business or individual issuing the receipt. This provides accountability and a point of contact for questions.

If applicable, list any taxes applied to the transaction. This makes the receipt more accurate and informative for both parties.

| Element | Details |

|---|---|

| Transaction Date | The date the payment was received. |

| Payer’s Name | The full name of the person or business making the payment. |

| Amount Paid | The total amount, written both numerically and in words. |

| Payment Method | The method used, such as cash, check, or credit. |

| Goods/Services Description | A brief explanation of the products or services exchanged. |

| Receipt Number | A unique number for tracking the transaction. |

| Issuer’s Information | Name and contact details of the issuer. |

| Taxes | Details on any taxes applied to the transaction. |

Step-by-Step Guide to Filling Out the Template

First, open the cash receipt template on your device. Ensure you are using a fillable PDF version to make editing easier.

Locate the “Date” field and enter the exact date of the transaction. This helps keep track of when the payment was made.

Next, in the “Received From” section, write the full name of the person or company making the payment. Double-check spelling to avoid mistakes.

In the “Amount Received” field, input the total amount of money received. Be sure to include any currency symbols as needed for clarity.

Move to the “Payment Method” area. Select the appropriate method (cash, check, credit card, etc.) to reflect how the payment was made.

In the “Description of Goods or Services” section, briefly describe the item or service for which payment was made. Keep it clear and concise.

In the “Issued By” section, write your name or the name of the person issuing the receipt. This confirms who created the document.

Finally, check the entire template for accuracy before saving or printing the receipt. Correct any errors before finalizing it.

Benefits of Using Fillable PDF Templates for Receipts

Fillable PDF templates offer a quick and simple way to create receipts without the hassle of manual entry. They allow businesses to customize receipts according to their needs, saving time and ensuring accuracy in the process.

With fillable PDF templates, users can input data directly into the fields, eliminating the chance of errors that come with handwriting. This leads to clearer and more professional-looking receipts, enhancing your brand’s image.

These templates are easily reusable. Once set up, you can save the document and fill it out repeatedly, reducing the need for new designs or formats each time a receipt is issued. This saves both time and money.

Editable fields in PDF templates allow for flexibility. Whether you’re handling sales tax, discounts, or varying item prices, each field can be adjusted as necessary to fit the transaction at hand.

Moreover, PDF format ensures that the receipt’s layout remains consistent across all devices and platforms, providing a uniform customer experience regardless of the viewer’s software or device.

Common Errors to Avoid When Creating Receipts

Ensure that all necessary details are clearly listed. Missing essential information like the date, transaction amount, or vendor details can cause confusion and make the receipt legally invalid.

Incorrect Formatting

Stick to a consistent layout throughout the document. Avoid cluttering the receipt with unnecessary information or using different fonts. This helps customers understand the transaction details easily and ensures professionalism.

Wrong Tax Calculation

Check your tax rates before finalizing a receipt. An incorrect tax calculation, whether too high or too low, could lead to problems for both you and your customer. Double-check the applied tax percentage based on the relevant jurisdiction.

Don’t forget to test the fillable fields in your template. Sometimes, the fields might not align properly, preventing the user from entering necessary details. Always preview the form to confirm that it’s user-friendly.

Storing and Sharing Completed Cash Receipts Securely

Use password-protected storage solutions, such as encrypted cloud services, for securely storing completed cash receipts. These services provide an extra layer of protection by ensuring that only authorized individuals can access the files.

Secure Cloud Storage Options

Consider well-known, reliable cloud platforms that offer built-in encryption, such as Google Drive or Dropbox. Make sure to enable two-factor authentication (2FA) for an added security measure. This ensures that even if your login credentials are compromised, access to your files remains protected.

Sharing Receipts with Confidence

When sharing receipts, always opt for secure methods like encrypted email or file-sharing services. Avoid sending sensitive information through unprotected channels like regular email or messaging apps. Tools like ProtonMail or Tresorit allow you to send encrypted files directly, ensuring only the intended recipient can access the data.