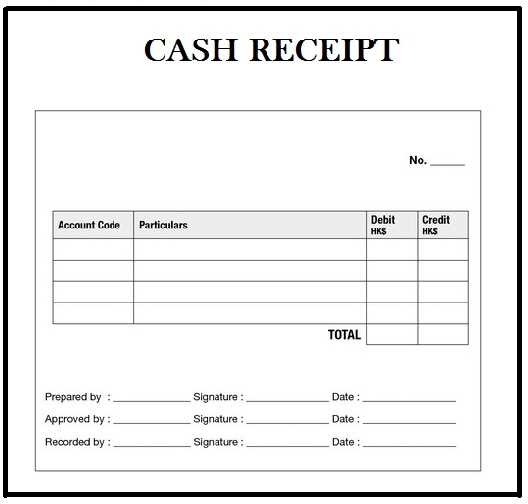

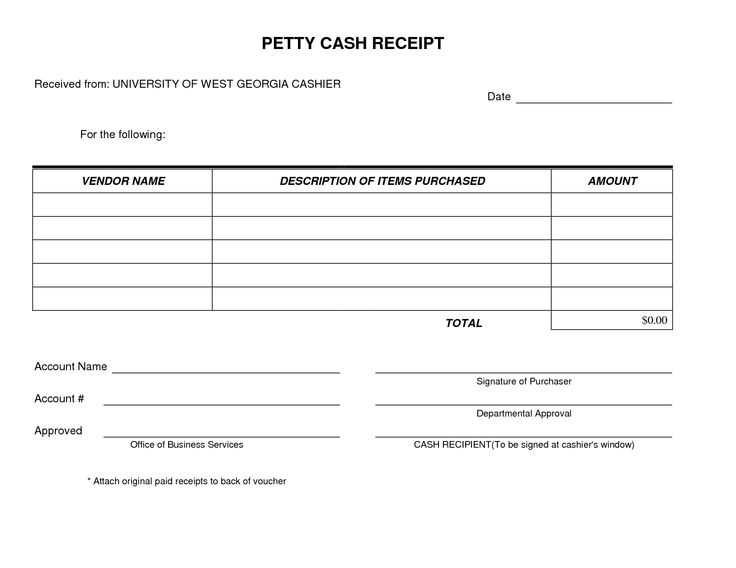

A well-structured cash receipt template is an invaluable tool for businesses and individuals tracking cash transactions. This simple yet powerful document ensures accuracy and clarity in financial record-keeping. The template should include essential fields such as the date, amount received, payer details, and the reason for the transaction.

Make sure to use a clear layout with spaces for both the payer’s name and contact information. Adding a unique receipt number helps with organization and prevents confusion in case of audits or disputes. You can also include a section for the signature of the receiver to add an extra layer of authenticity.

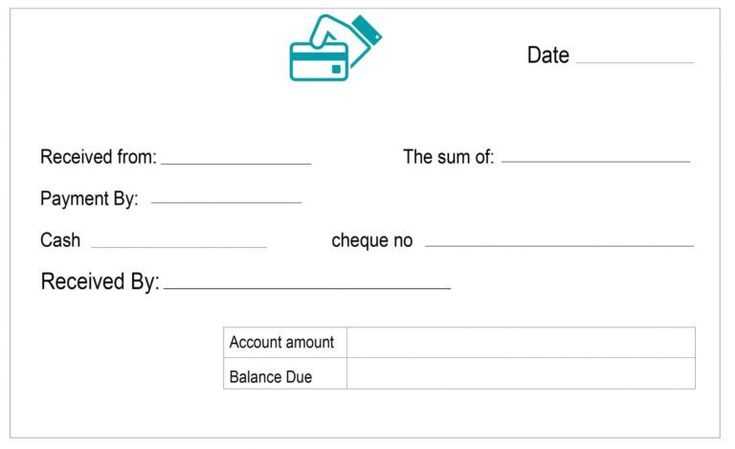

Customizing the template for specific needs is easy, especially if you’re working with regular clients or transactions. For instance, include a “payment method” section if you want to track cash, credit card, or check payments. This small adjustment enhances the template’s functionality, making it adaptable to different business environments.

By using a detailed template, you can reduce errors, increase transparency, and streamline financial documentation. Whether you’re managing a retail business, a small personal project, or keeping track of freelance payments, this template will help you maintain accurate financial records with minimal effort.

Here’s the corrected version:

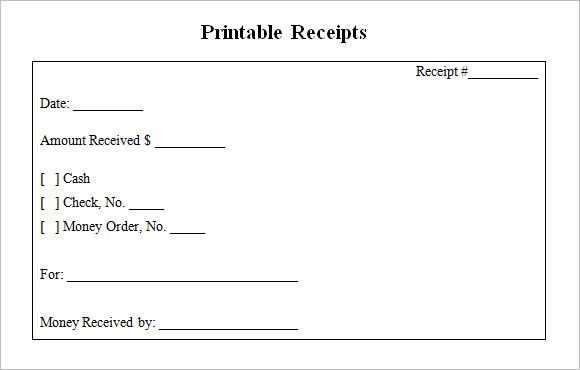

To create a well-structured general cash receipt template, start with these basic elements:

- Date of transaction: Always include the exact date the payment was received. This helps maintain accurate records.

- Payer details: Include the name and contact information of the individual or business making the payment.

- Amount received: Specify the total sum paid. Be clear on whether it’s in full or partial payment.

- Payment method: Indicate the method of payment used (e.g., cash, check, bank transfer). If applicable, include transaction reference numbers for digital payments.

- Receipt number: Assign a unique receipt number to each transaction for easy tracking and reference.

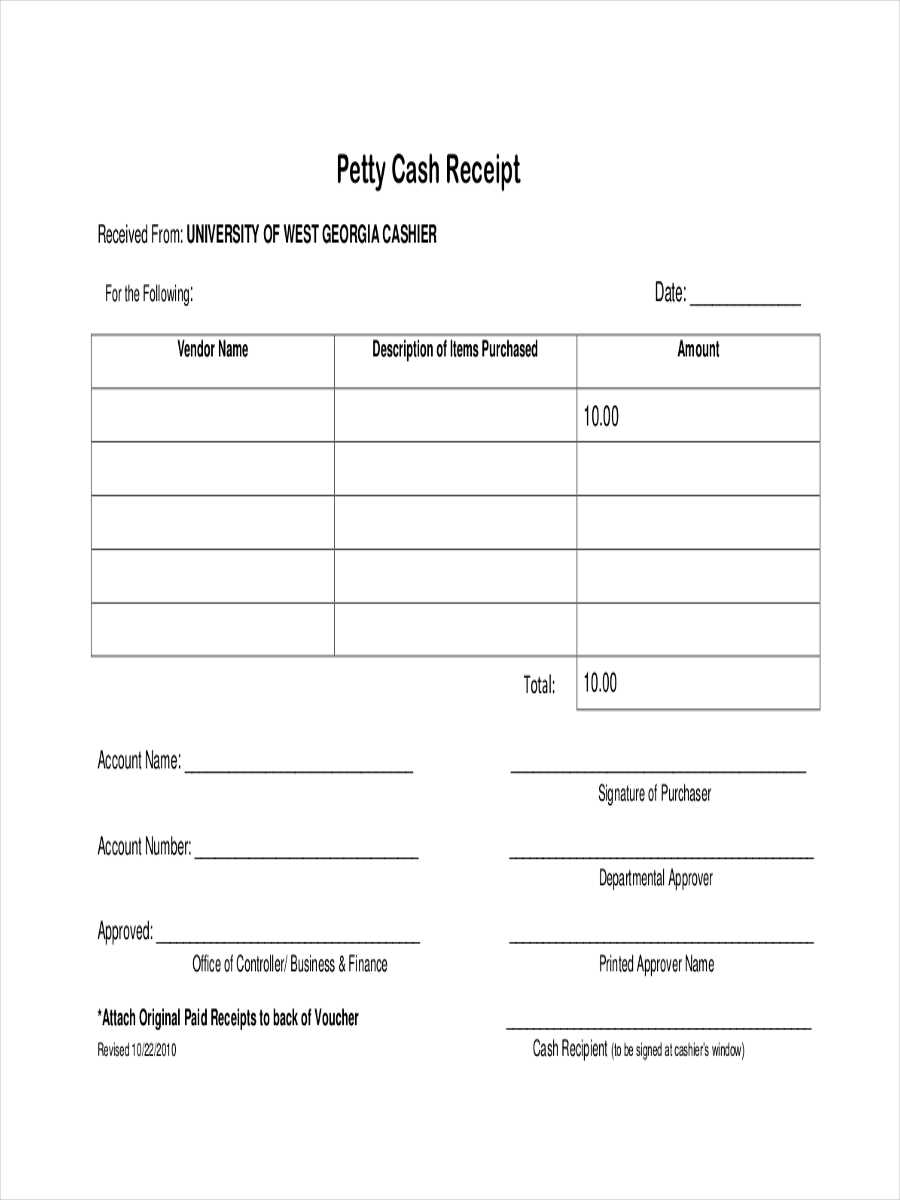

- Details of goods or services provided: Describe what the payment covers, including any relevant product or service information.

- Signatures: If necessary, add spaces for signatures from both the payer and the recipient to confirm the transaction.

Design Considerations:

Ensure the layout is clean and easy to read. A clear font, consistent headings, and enough space for each section will improve usability. For digital templates, make sure it is easy to fill out and save for future reference.

Sample Template Example:

Receipt # [Insert receipt number] Date: [Insert date] Payer Name: [Insert payer's name] Amount Received: [Insert amount] Payment Method: [Insert payment method] Goods/Services: [Insert description of goods/services] Signature: ______________________

- General Cash Receipt Template

A general cash receipt template should include several key components to ensure accurate documentation of any cash transaction. These elements are necessary for both the payer and the receiver to clearly understand the details of the payment.

Key Components of a Cash Receipt

The template must clearly display the following details:

- Receipt Number: A unique identifier for each transaction helps maintain order in records.

- Date of Payment: Always include the date when the transaction took place to ensure accurate timing of payment.

- Payer’s Information: Include the payer’s full name or business name. This ensures there is no confusion about who made the payment.

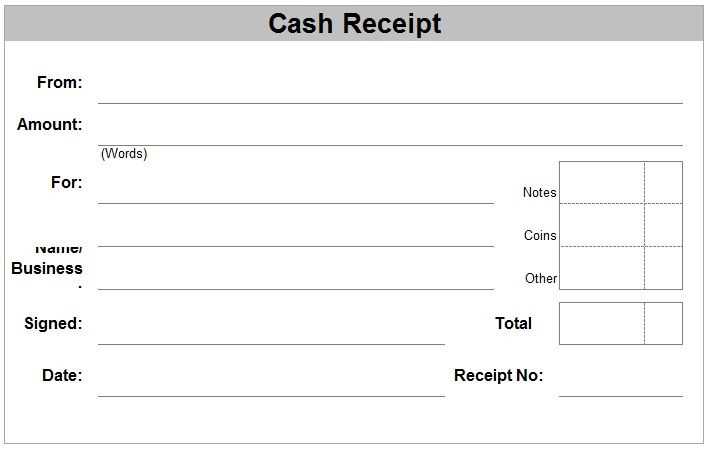

- Amount Received: Clearly state the total amount of cash received. It’s important to include both numeric values and a written description of the amount (e.g., “Five hundred dollars”).

- Purpose of Payment: Specify what the payment is for, whether it’s a service, product, or loan repayment.

- Method of Payment: While this template is for cash, it’s still helpful to note if the payment was in physical currency, coins, or another form of cash.

- Receiver’s Information: Include the name of the person or entity receiving the payment and their position, if applicable.

- Signature: Both parties should sign the receipt to confirm that the transaction took place.

How to Structure the Template

The general layout of the template should be clean and organized. Start with the header, which includes the business or individual’s name and contact information, followed by the receipt details listed in a logical order. Provide enough space for signatures at the bottom. For better readability, break up information into sections, and use a simple font for clarity.

This format will ensure both parties have a clear, concise record of the transaction, minimizing confusion and providing transparency for future reference.

Open a new Excel worksheet. In the first row, set up your header by merging cells A1 through D1 and typing “Receipt” in the merged cell. Below that, leave space for the receipt number and date.

In row 2, label column A as “Receipt Number,” column B as “Date,” column C as “Description,” and column D as “Amount.” These columns will track the details of each transaction. Adjust column widths so the text fits neatly.

For consistency, format the “Amount” column as currency. Select column D, right-click, choose “Format Cells,” and select “Currency” to ensure all amounts display with the correct symbol.

Under “Description,” provide a brief explanation for each payment or transaction. In the “Amount” column, enter the payment value corresponding to each description. If needed, use the SUM function at the bottom of the “Amount” column to calculate the total for the receipt.

For a simple receipt template, you can add a footer with your business name, address, and contact information. Merge cells in the footer and format the text to align as needed.

Save the file as a template for future use, or save it as a new document for each transaction. You now have a clear and functional receipt template in Excel.

To keep your records accurate, make sure your receipt template contains the following key details:

- Date of Transaction: Always include the exact date the transaction took place to ensure you can track payments over time.

- Receipt Number: A unique reference number helps both you and your customer easily identify and retrieve the receipt when needed.

- Business Information: Clearly list your business name, address, phone number, and email address. This makes it easy for customers to contact you if necessary.

- Customer Details: If relevant, include the customer’s name, especially for larger transactions. This can assist with future follow-ups or queries.

- Itemized List of Goods or Services: Break down the individual items or services purchased, including quantity, description, and unit price. This provides transparency and clarity.

- Total Amount: Display the total amount paid, including applicable taxes, fees, or discounts. Make sure to separate each element for easy understanding.

- Payment Method: Specify how the payment was made, such as cash, credit card, or online payment system. This helps with record-keeping for accounting purposes.

- Sales Tax: If applicable, clearly show the tax rate and amount paid for taxes. This ensures proper tax filing and audit readiness.

- Return or Exchange Policy: Include a note about your return or exchange policy, so customers know their options in case of issues with the purchase.

- Authorized Signature: If needed, provide a space for the authorized signature of the seller or representative. This adds legitimacy to the receipt.

Organizing Your Template for Easy Use

Ensure that these details are organized logically and visually distinct from one another. A clear layout helps both your team and customers quickly grasp the transaction details without confusion.

Consistency Across Receipts

Maintain uniformity in your receipt format to simplify future record-keeping. A consistent layout helps reduce errors and streamline your accounting process over time.

Customizing your cash receipt template ensures accurate and organized records for various transaction types. Tailor the fields and structure of your template to match the specifics of each transaction, whether it’s a sale, refund, or donation. Here’s how you can adjust your template to suit different needs:

1. Sales Transactions

For standard sales transactions, include the following key details:

- Customer name and contact details

- Invoice or receipt number

- Item description, quantity, and price

- Sales tax or applicable discounts

- Total amount paid

Ensure the template is clear and concise to help both parties track the sale. Using a unique receipt number or transaction code helps prevent any confusion when referencing a past transaction.

2. Refunds and Returns

Modify the template for refunds or returns to account for reversed payments. Include these additional sections:

- Original receipt or invoice number

- Reason for the refund

- Refund amount and payment method

- Condition of returned items (if applicable)

This allows for easy tracking of refunds and ensures clarity when dealing with returns.

3. Donations

Donation receipts often require different details, particularly for tax purposes. Add the following fields to your template:

- Donor name and contact information

- Date of donation

- Amount donated

- Charity’s registration number (if applicable)

- A statement confirming the donation is tax-deductible (if necessary)

This format helps both the donor and the organization maintain accurate records for tax filings.

4. Adjusting for Different Payment Methods

If the transaction involves different payment methods (e.g., cash, card, check, online transfer), make sure the template accommodates these variations. For example, if payment is made by card, include fields for card type and last four digits. For cash payments, a simple “Paid in cash” notation will suffice. For online payments, include transaction IDs or reference numbers.

| Transaction Type | Custom Fields |

|---|---|

| Sales | Item list, sales tax, total amount |

| Refund | Original receipt number, reason for refund, refund amount |

| Donation | Donor info, donation amount, charity number |

| Mixed Payment | Payment method details, transaction ID |

Customizing your template to fit each transaction ensures clarity, accuracy, and smooth record-keeping. Tailor it to your specific needs and be sure to regularly update it for any changes in regulations or business requirements.

Use a clean and simple layout to ensure that all key details are captured without confusion. Include fields for the payer’s name, payment date, amount received, and the purpose of the payment. Make sure there is a space for both the payer’s and the receiver’s signatures, confirming the transaction.

Keep the design consistent, with clear labels for each section. This allows users to fill in the required fields quickly. Avoid unnecessary text or overly complex instructions–clarity is key. Additionally, having a footer with your contact details or terms of receipt can provide added value.

Incorporate a sequential numbering system for your receipts to keep track of all transactions. This will help maintain a well-organized record-keeping system. It’s also advisable to offer a copy of the receipt to the payer, ensuring transparency and preventing misunderstandings.