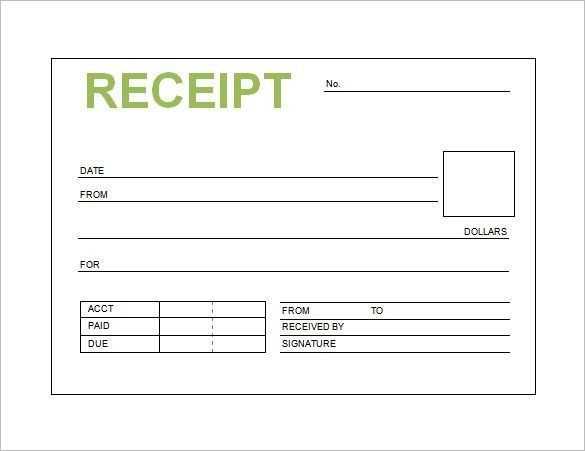

Use a generic cash receipt template to ensure smooth and clear record-keeping for any cash transactions. This template helps both the sender and receiver track payments accurately, providing clear evidence for future reference. Having all necessary details included in one place helps avoid confusion, especially during audits or reviews.

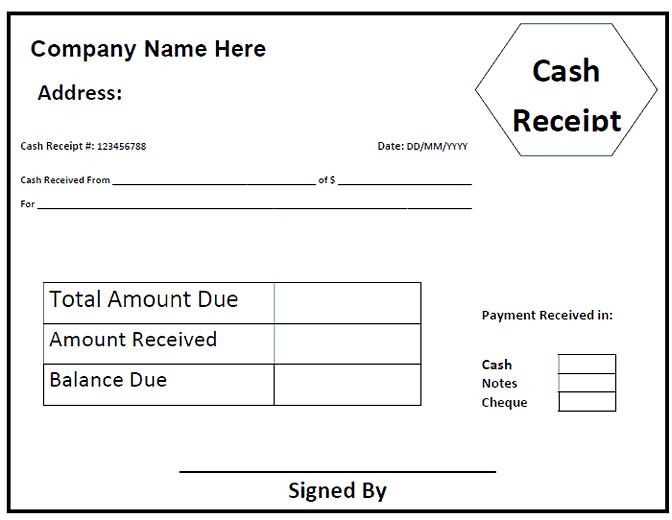

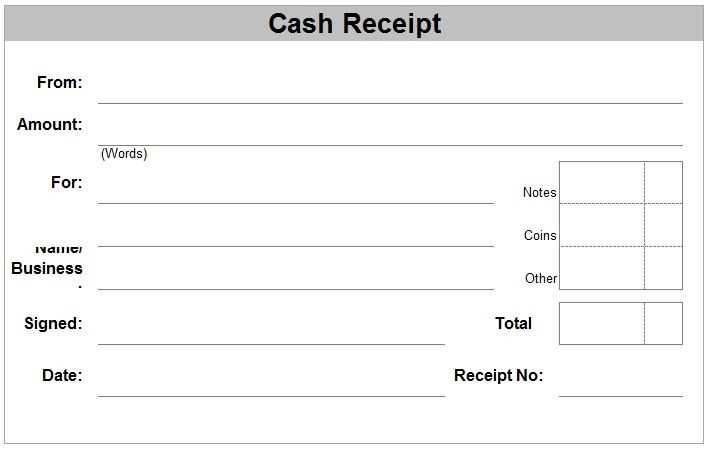

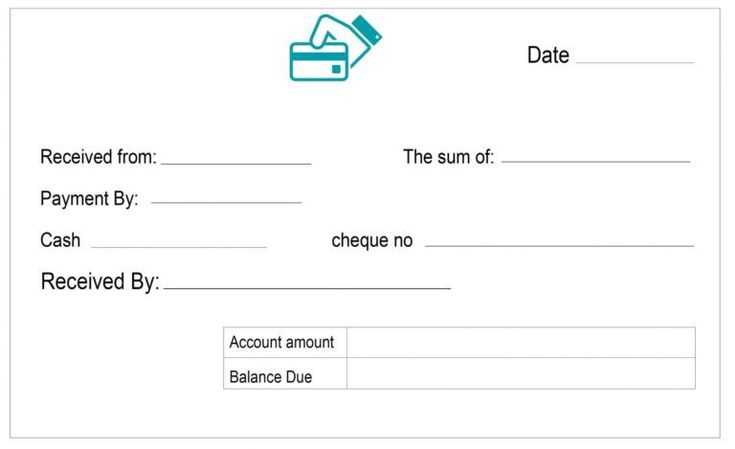

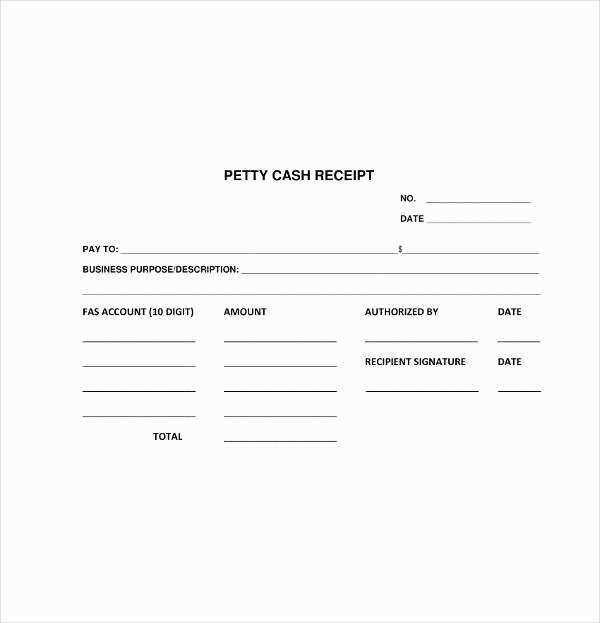

Make sure to include key information such as the date of transaction, the amount received, the name of the payer, and the purpose of the payment. This ensures all parties are on the same page regarding the details of the payment. A well-structured template will include fields for the receipt number, payment method, and the name of the recipient to further clarify the transaction.

For better organization, ensure the template is easy to fill out and understand. You can adjust it based on your needs, whether you are receiving payments for services, goods, or donations. A good receipt template prevents misunderstandings and provides a professional, trustworthy record.

Here are the corrected lines:

Ensure that the receipt template includes fields for both the buyer and seller’s details. This helps in providing accurate information for future reference.

The date format should be consistent and clear, using the MM/DD/YYYY format to avoid confusion in international transactions.

Itemized Listing

For each item, include a description, quantity, unit price, and total price. This ensures transparency and provides a clear breakdown of charges.

Payment Information

Clearly state the payment method used, such as credit card, cash, or bank transfer. This helps in tracking payments efficiently.

- Generic Cash Receipt Template

Include the transaction date, payer’s name, and payment amount in clear, separate fields. Specify the method of payment–whether it’s cash, check, or card–and add a reference or receipt number for tracking purposes. If applicable, indicate tax or service fees separately.

State the purpose of the payment, such as for goods or services rendered, to avoid any confusion. This helps clarify the transaction for both parties. Ensure the payment amount is written numerically and in words to reduce the chance of disputes.

End the receipt with a confirmation phrase, such as “Paid in full” or “Payment received,” to verify the completion of the transaction. This reinforces clarity and protects both parties in case of future queries.

To create a simple receipt, focus on clarity and basic details. Start with the date of the transaction, as this is key for both the buyer and seller for record-keeping purposes.

- Date: Include the specific day and month. It’s important for tracking and accounting purposes.

- Transaction Details: Clearly list the items or services purchased, along with their respective costs. This helps avoid confusion later.

- Amount Paid: State the total cost of the transaction, including any taxes or discounts applied. Ensure that the amount is clearly visible.

- Payment Method: Indicate whether the transaction was done via cash, card, or other methods. This is useful for both parties to know how the payment was made.

Including your business name and contact information is a good practice, especially if the customer needs to follow up. It adds professionalism and ensures accountability.

- Business Information: List the business name, address, phone number, and email address. It’s important for building trust and handling customer queries.

- Receipt Number: Adding a unique receipt number can be helpful for referencing specific transactions in the future.

Finally, leave some space for additional notes if needed, such as return policies or warranty information. This makes the receipt more versatile and ensures you cover any special terms related to the transaction.

Tailor your receipt template to match your business’s specific needs by adding your logo, address, and any other relevant information. This helps to reinforce your brand identity and provides customers with important details about your business.

Adjust the layout to reflect the type of transaction. For example, if you’re running a service-based business, include fields for service description, hours, and rates. If you sell physical products, make space for itemized lists, quantity, and price per item. Include a section for taxes, discounts, and total amount, ensuring accuracy in every transaction.

Set a clear format for payment methods, including cash, card, or online payments. Provide an area for payment status to track whether a payment is pending, completed, or partially paid. This feature can help you stay organized and manage finances more effectively.

Integrate a unique receipt number for easy tracking. This is especially useful if you handle returns or need to reference past transactions. Additionally, consider a space for custom notes where you can include personalized messages, promotions, or terms and conditions relevant to your business.

Ensure that all fonts and design elements are clear and professional. Use a readable font size for all text and ensure that the colors align with your business branding, providing a clean and polished look for your receipts.

Double-check the date on the receipt. Incorrect dates can lead to confusion and complications when referring back to transactions. Always ensure the transaction date matches the actual purchase date.

Misspelling or Incorrect Details

Verify customer information such as name, address, and contact number. Even minor errors in these details can cause problems in future correspondence or returns. Be sure to spell everything correctly and fill in all required fields accurately.

Wrong Payment Information

Ensure the payment method and amount are clearly stated. Double-check for discrepancies between the total price and the payment amount. If a discount or tax was applied, make sure it’s reflected correctly.

Avoid omitting tax details or the breakdown of the total amount. If the transaction involves multiple items, the tax amount should be calculated correctly, and the individual item prices must match the total given.

Finally, ensure that the receipt includes an appropriate signature or proof of authorization if required. Missing signatures could lead to disputes or issues with returns or refunds.

Customizing Your Cash Receipt Template

Adjust the layout of your receipt template to reflect the transaction’s specifics. Use clear sections to show the amount, date, and itemized list of products or services purchased.

Key Sections to Include

| Section | Details |

|---|---|

| Receipt Number | Assign a unique identifier for each receipt to track payments. |

| Transaction Date | Record the exact date of the transaction to avoid confusion later. |

| Customer Information | Include the customer’s name or contact details if applicable. |

| Items/Services | Break down each item or service provided, along with the unit price. |

| Total | Display the total cost including taxes, discounts, and additional charges. |

| Payment Method | Specify whether the payment was made via cash, card, or another method. |

| Company Info | Ensure your business name, address, and contact info are clearly visible. |

Formatting Tips

Ensure the receipt is easy to read by using clear fonts and a clean layout. Avoid overcrowding the document with unnecessary details. Make sure the total amount is prominent and easy to locate.