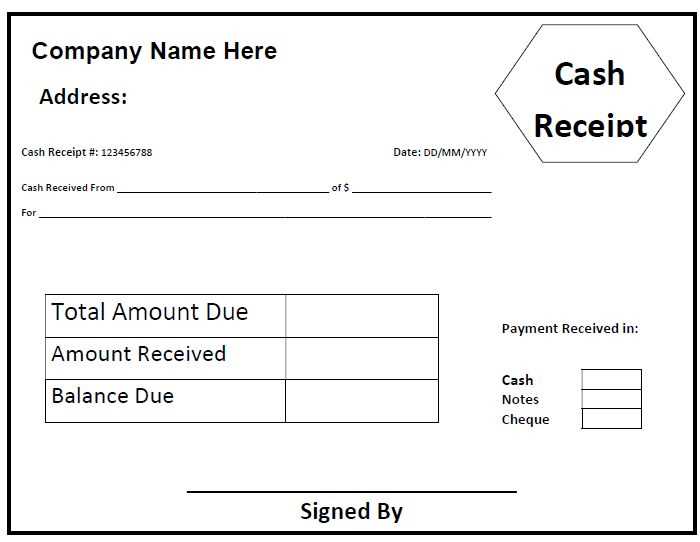

To create a reliable manual cash receipt template, start by including clear, concise sections. This ensures both the payer and recipient have the necessary details for record-keeping. Begin with a space for the date the transaction took place, which helps in organizing receipts chronologically.

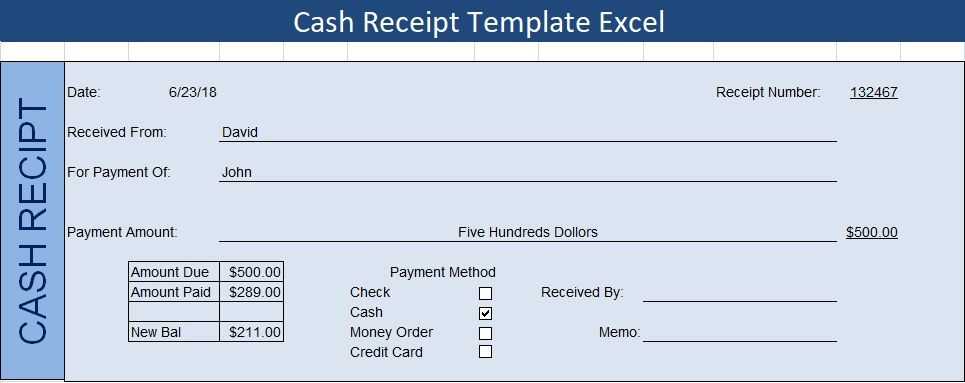

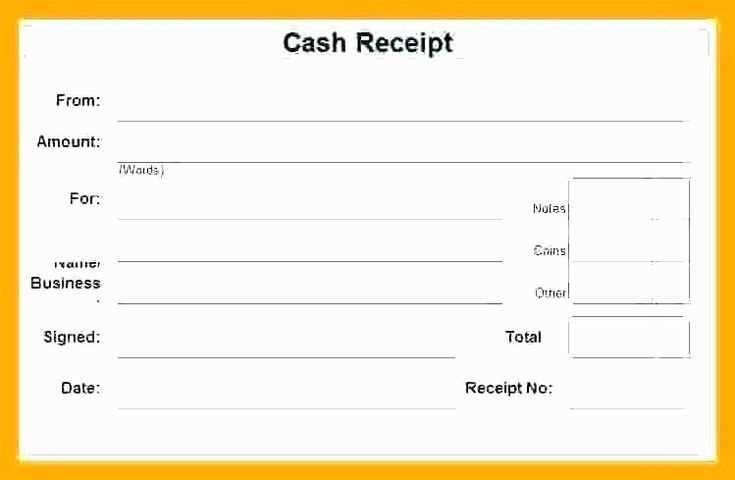

Next, include a field for the amount received, specifying the currency and a breakdown if multiple denominations are involved. This will help maintain transparency and avoid confusion. The payee name and payer name should be clearly listed to establish the parties involved in the transaction.

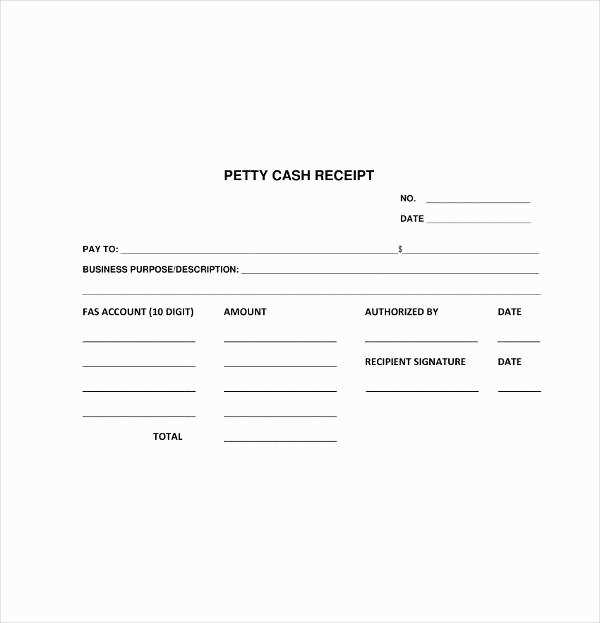

Ensure there is room for a transaction reference number to easily track and verify receipts when needed. A description of the goods or services provided will also prevent misunderstandings later on. Close with a space for both parties to sign, confirming that the transaction has been agreed upon and completed.

This straightforward template can be adapted for various uses, from small business sales to personal transactions. By sticking to a few key details, you’ll maintain clear records while avoiding unnecessary complexity.

Creating a Custom Template for Your Business

Choose the layout that fits your needs. If you’re selling physical products, include fields for item descriptions, quantities, and prices. For services, consider adding sections for hourly rates, project names, and task details. Ensure the format is clean and straightforward, so it’s easy for your customers to read and understand.

Incorporating Key Information

Your template should include basic details such as your business name, address, phone number, and email. Make sure the date of the transaction and a unique receipt number are present for easy reference. These simple touches help create a professional image while maintaining clarity in all transactions.

Customizing for Flexibility

Design the template to allow quick updates or changes. For example, if your pricing changes or you introduce new services, leave space for adjustments. Having editable sections ensures the receipt always matches your current offerings. Keep things adaptable without overcomplicating the structure.

Best Practices for Documenting Cash Transactions

Always record each cash transaction immediately after it occurs. Write down the date, time, and amount of cash exchanged. Include a clear description of the transaction purpose, whether it’s for goods or services, and note any relevant reference numbers like invoice or receipt numbers.

Use a Consistent Format

Consistency ensures that all records are easy to follow and verify. Stick to a standard layout for each cash receipt and document, whether using a manual template or a digital system. Keep it simple, with clear columns for date, amount, description, and reference details.

Double Check Entries

Review all cash transactions before finalizing the records. Ensure that the amounts match the actual cash received or disbursed. This reduces the risk of errors and ensures that the documentation is accurate, which is vital for both financial clarity and audit purposes.

Common Mistakes to Avoid When Using a Manual Receipt

Always ensure that the receipt is filled out completely and clearly. Missing details like the date, transaction amount, or business name can lead to confusion or disputes later on.

1. Skipping the Itemized List

Never omit the itemized list of products or services. This information should be accurate and match the customer’s purchase. If it’s not included, it can cause misunderstandings or questions about the transaction.

2. Forgetting to Sign

Signing the receipt confirms its validity. Without a signature, the receipt may not hold up as proof of transaction. Always add your signature at the bottom of the document.

Also, double-check for typos or incorrect numbers. Small mistakes can become bigger issues later, especially if the receipt is used as proof in a dispute.