A Microsoft Excel cash receipt template is a practical solution for documenting cash transactions. It allows you to track payments, maintain accurate records, and simplify your accounting processes. With this template, you can instantly generate receipts for customers or clients, ensuring clarity and organization in your financial dealings.

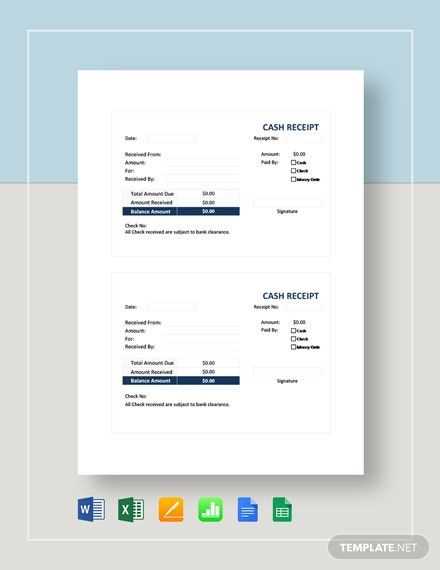

To get started, download a cash receipt template that fits your needs. Many options offer predefined fields such as date, receipt number, payer details, amount received, and payment method. Customize it by adding your business logo and relevant details for a professional touch. Excel’s built-in formulas can also automate calculations, helping you avoid errors and saving time.

Once set up, using the template is straightforward. Simply fill in the details for each transaction as they occur. This can be especially useful for small businesses, freelancers, or individuals managing cash flow without a dedicated accounting system. You can easily track past payments and keep records organized for tax purposes or future reference.

Here are the corrected lines:

Ensure that all fields in the cash receipt template are clearly labeled. Include sections for the date, payer’s name, amount received, and the payment method. It’s helpful to add a line for notes to clarify the purpose of the payment. Double-check that the totals section updates automatically, so you avoid errors in manual calculations.

Clarify Payment Types

Update the payment method field to allow users to select between cash, check, or digital payments. This ensures a streamlined process and reduces confusion. Include a drop-down menu or radio buttons for easy selection. Ensure that the layout accommodates this change without overcrowding the form.

Improve Formatting

Adjust the margins and cell spacing to create a cleaner look. This makes the template more readable and visually appealing. Consider using alternating row colors to differentiate between fields, and ensure that the font size is large enough for easy reading on all devices.

- Microsoft Excel Cash Receipt Template

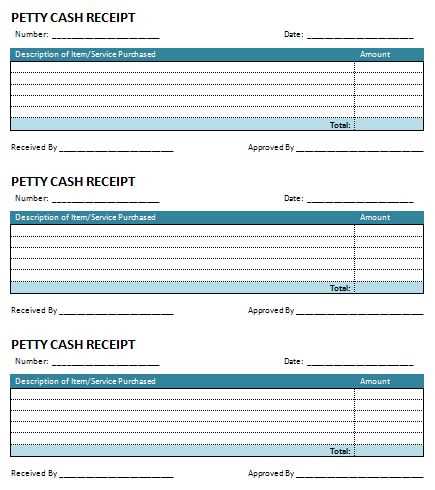

To quickly create a cash receipt in Excel, begin by opening a new workbook. Use a template to simplify data entry, ensuring it’s tailored for tracking cash transactions. Follow this structure to create a straightforward and clear cash receipt.

Key Fields to Include

- Date: Add the transaction date to keep records organized and accurate.

- Receipt Number: Use a unique number for each receipt to track transactions easily.

- Received From: The payer’s name or company.

- Amount: Specify the exact cash received, in a clear currency format.

- Payment Method: Indicate if the payment is by cash, cheque, or another method.

- Description: Describe the purpose or nature of the payment, like a service fee or product sale.

- Signature: Reserve space for the recipient’s signature or approval, if required.

Formatting Tips

- Ensure each field is clearly labeled with bold headings for easy reference.

- Use currency formatting for monetary amounts to avoid errors.

- Consider adding a border or shading to the rows to separate sections visually.

- Keep the layout simple and well-spaced for readability.

Using a cash receipt template in Excel helps streamline accounting tasks and maintains clear documentation of cash flow. With this basic structure, you can modify the template to fit your specific needs while ensuring all necessary details are included.

Begin by adding your business’s name, logo, and contact information at the top of the receipt. Include the business address, phone number, and email address to ensure your customers can easily reach you if needed. A clear and professional header builds credibility and strengthens your brand.

Customize the Item and Pricing Fields

Edit the item section to suit your offerings. Change the column headings to match your inventory or service categories. Include spaces for quantity, unit price, and total cost for each item. Add any extra fields for discounts or promotional offers, allowing for flexibility when issuing receipts.

Adjust Payment and Tax Details

Modify payment options to reflect what you accept (e.g., cash, credit card, bank transfer). Add a line for tax percentages such as sales tax or VAT. Ensure these fields can be updated based on local regulations or specific business requirements.

| Section | Customization Options |

|---|---|

| Header | Business name, logo, address, contact info |

| Items | Item name, quantity, unit price, discount, total price |

| Payment Method | Cash, credit card, PayPal, bank transfer |

| Tax | Sales tax, VAT, service charges |

Make the receipt easy to read by adjusting the font size and bolding key information, such as the total amount and payment method. A clean and organized layout ensures clarity, making it simple for both your business and customers to track transactions effectively.

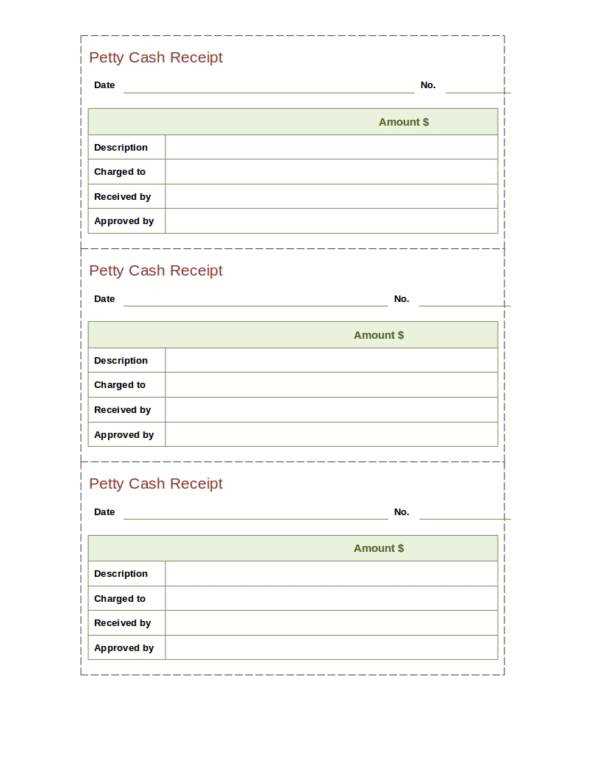

Choose a receipt template that offers clear sections for buyer and seller details, including names, addresses, and contact information. This ensures easy identification of both parties and streamlines communication if needed later. Ensure it includes an itemized list for every transaction, breaking down the quantity, description, unit price, and total for each item. This promotes accuracy in your records and provides transparency to your customers.

A customizable date and payment method section is crucial. Make sure it accommodates multiple payment methods, such as credit card, cash, or check, to suit various transaction types. Incorporate a unique receipt number for each transaction to facilitate tracking and retrieval, reducing the likelihood of duplicate entries. This feature can simplify future reference and audits.

The template should allow space for taxes, discounts, or additional charges. This flexibility helps in accurately calculating the final amount and adjusting to changes in pricing or taxes over time. A subtotal line before taxes and after any discounts is key to keeping calculations clear and correct.

Include a signature line for both parties, which adds a layer of professionalism and helps in confirming the agreement. Ensure that the template offers a clean layout, using adequate spacing and legible fonts to make the receipt easy to read at a glance. A well-structured format contributes to better organization and faster data entry.

Set up formulas to streamline your cash receipt template and save time. Begin by applying simple functions like SUM and IF to automatically calculate totals, tax amounts, or discounts based on the entered data. These formulas update in real-time as new figures are added.

1. Use Cell References

By using cell references (e.g., A1, B2) instead of hardcoding values, Excel will automatically update calculations when you modify any data. This ensures accuracy and avoids manual entry mistakes, keeping all calculations up-to-date without additional input.

2. Automate Tax Calculations

If your receipts involve taxes, use the percentage formula to automate tax calculations. For example, if the total amount is in cell A2, and the tax rate is in B1, you can use the formula =A2*B1 to quickly determine the tax without manually recalculating it each time.

Example: In your Excel sheet, set up the tax formula in the row below the subtotal, and it will update as you input different transaction values.

3. Use Conditional Formatting for Quick Error Detection

Conditional formatting highlights any issues such as missing values or incorrect data entry. Set rules that flag discrepancies, like a negative value or missing required fields, ensuring that errors are immediately visible for quick correction.

By automating these steps, you’ll cut down on manual entry and make transactions more efficient. Excel’s built-in functions provide a straightforward way to handle common calculations automatically, freeing up your time for other tasks.

Creating a cash receipt template in Microsoft Excel helps streamline financial transactions. It is practical for tracking payments and providing clear documentation. Here’s how to structure it:

Structure and Columns

Start with these key columns:

- Receipt Number: Unique identification for each transaction.

- Date: The date the payment was made.

- Payer Information: Include the payer’s name or business name.

- Amount Received: The payment amount.

- Payment Method: Cash, check, credit, or other methods.

- Description of Goods/Services: Briefly describe what the payment covers.

- Notes: Any additional details, such as invoice reference or payment terms.

Formatting Tips

For a clean, professional appearance, use borders and shading to separate sections. Apply bold text to headers, and ensure data is aligned for easy reading. This makes the template visually appealing and functional. Keep the font consistent throughout, such as using Arial or Calibri at a readable size (10-12 pt).

Once your template is set, save it for future use, ensuring quick access whenever a new receipt needs to be issued. This template can be adapted for multiple types of transactions by simply adjusting the payment method or description columns as needed.