Using a well-structured petty cash receipt template in Microsoft Office can streamline financial tracking and reduce errors in your record-keeping. These templates provide a clear format to record cash transactions, ensuring that every receipt is documented accurately and efficiently.

Choose a template that fits your business needs, whether you are managing personal or business-related expenses. Customizable fields allow you to add relevant details such as the date, amount, purpose, and signature. By doing so, you maintain consistent and organized records, which can be essential for financial audits or reviewing past transactions.

Microsoft Office offers various pre-designed templates that can be easily downloaded and adapted for your specific requirements. Whether using Excel for calculations or Word for documentation, these tools make petty cash management more manageable without needing advanced skills. Adjusting templates to align with your accounting system allows for seamless integration into your current processes.

Microsoft Office Petty Cash Receipt Templates

Microsoft Office provides convenient templates for tracking petty cash transactions. These templates allow you to document small business expenses efficiently. They help maintain clarity and ensure proper accounting for minor purchases.

Use a petty cash receipt template in Microsoft Word or Excel to simplify your record-keeping process. Both tools offer user-friendly templates that you can customize according to your needs. Excel is ideal for automatic calculations, while Word offers a straightforward layout for manual entries.

| Date | Description | Amount | Approved By |

|---|---|---|---|

| 02/10/2025 | Office Supplies | $25.00 | John Doe |

| 02/11/2025 | Parking Fee | $10.00 | Jane Smith |

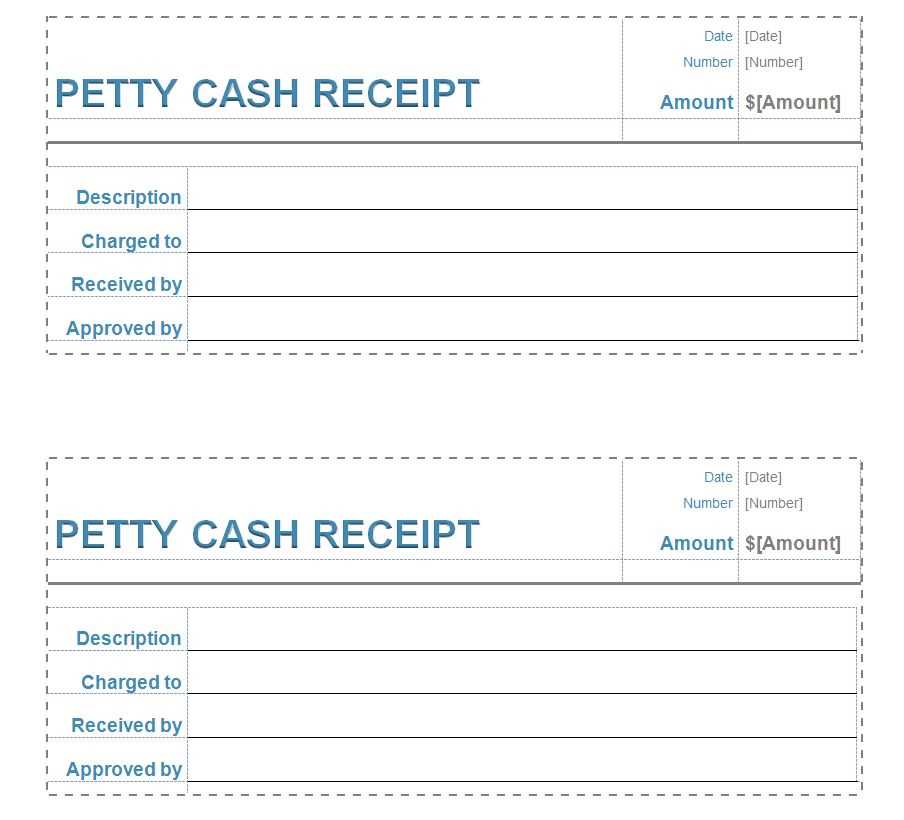

Templates typically include fields for the date, description of the expense, amount spent, and the name of the person who authorized the transaction. Customizing these templates with your company’s name and other relevant details will streamline the process.

Regularly updating petty cash records using these templates ensures accurate financial reporting and helps prevent discrepancies. Save your templates and reuse them for each transaction, minimizing the effort needed to maintain proper documentation.

How to Create Petty Cash Receipts in Microsoft Word

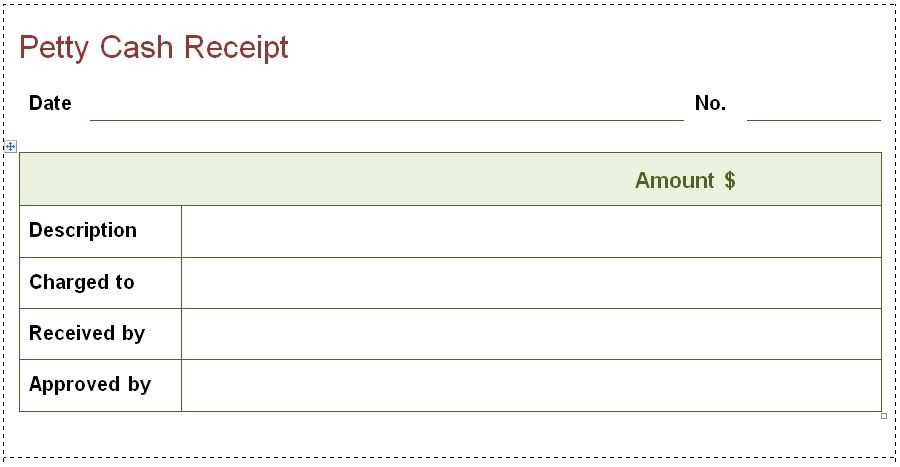

Begin by opening a new document in Microsoft Word. Use a clean, simple template, or create one from scratch for clarity. Add a title at the top, such as “Petty Cash Receipt,” making it clear and easy to identify.

Include fields for basic information: date, receipt number, amount received, purpose of the transaction, and the person receiving the cash. Align the text for easy reading, using a table if necessary. Tables help to neatly organize the receipt details.

Set up a section for the payment method, indicating whether it was cash, check, or another form of payment. Next, add a line for the signature of both the giver and receiver of the petty cash. This ensures accountability and adds a level of formality to the transaction.

Don’t forget to leave space for the description of the purpose of the petty cash expenditure. This helps track where the money is going and ensures transparency. Finally, format the document so it’s professional, with bold headings for each section and appropriate spacing for readability.

Once complete, save the document as a template so you can reuse it for future petty cash transactions. This allows for consistent record-keeping with minimal effort.

Customizing Template Fields for Specific Expenses

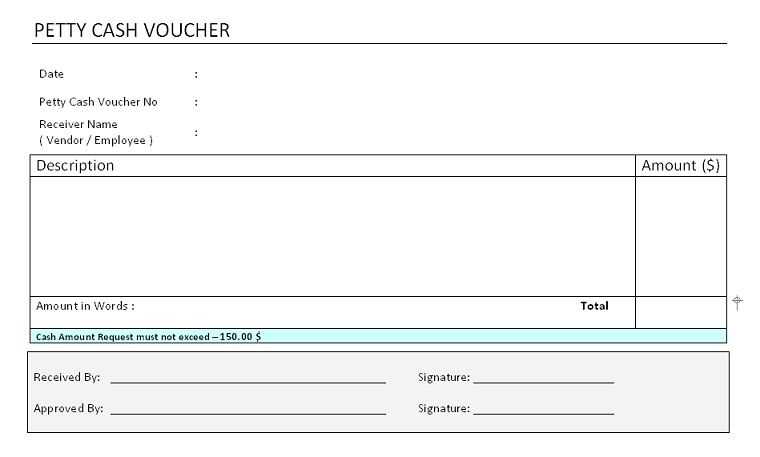

Adjusting template fields for specific expenses streamlines tracking and ensures accuracy. Focus on aligning the fields with the nature of each expense type. Here are some practical steps to tailor your petty cash receipt template:

- Identify Key Expense Categories: Customize fields to reflect the categories you deal with most frequently, such as travel, office supplies, or meals. For instance, add a “Purpose of Expense” field to clarify the reason behind the expenditure.

- Add Dynamic Fields: Include fields that can be adjusted based on the type of expense. For travel-related expenses, add “Destination” and “Travel Dates” to help track trip details more accurately.

- Include Tax Information: If applicable, modify the template to include a “Tax” field where the percentage or amount can be entered for specific items that require tax reporting.

- Allow Custom Descriptions: Provide a text box where users can briefly describe the expense or attach notes. This ensures clarity in case of future audits or reviews.

- Incorporate Approval Fields: A “Manager Approval” section helps in streamlining the review process, ensuring that each expense is authorized before reimbursement.

- Integrate Receipt Upload: Allow for digital uploads or links to images of receipts directly within the template, making the process paperless and more efficient.

By customizing these fields, you create a tailored system that matches your unique expense tracking needs, reducing errors and saving time on manual entries.

Incorporating Date and Time Fields in Your Receipts

Include clear and accurate date and time fields in your petty cash receipts to streamline your financial tracking. This helps maintain transparency and ensures all records are time-stamped, preventing any confusion in audits or financial reports.

Date Field

Always include a dedicated date field to mark the transaction day. Use a simple format like “MM/DD/YYYY” for consistency. This avoids ambiguity and ensures your records are aligned with your business’s accounting periods. If your receipts span multiple time zones, consider adding the time zone for added clarity.

Time Field

The time field should follow a 24-hour format (HH:MM) for accuracy. This is especially important if you handle multiple transactions per day. It’s beneficial to automate the time entry, reducing human error. If your system allows, use time-stamped logs for further precision.

Designing a Simple and Clear Receipt Layout

Focus on clarity by using simple fonts and consistent formatting. Choose a readable sans-serif font like Arial or Helvetica, ensuring the text is easy to read at a glance. Keep the font size between 10-12 points for body text, with headings slightly larger for distinction.

Clear Section Organization

Divide the receipt into distinct sections: company details, transaction details, and the total amount. Use lines or borders to separate these sections, making the receipt visually organized. Align text properly, ensuring that the key information such as the date, amount, and description is easy to find.

Minimalist Design

Avoid unnecessary graphics or colors that may distract from the important information. Stick to a simple color scheme with dark text on a light background. This keeps the focus on the data while ensuring that the receipt is professional and easy to interpret.

Tracking Multiple Petty Cash Transactions with Templates

To track multiple petty cash transactions efficiently, use organized templates that allow quick data entry and minimize errors. Set up separate columns for the transaction date, description, amount, and balance. This structure ensures that you can instantly see the total balance after each transaction.

- Separate categories: Organize receipts by category (e.g., office supplies, meals, transportation) to track spending trends.

- Running balance: Keep a running balance column to ensure the accuracy of funds at all times.

- Unique identification numbers: Assign transaction numbers to each receipt to easily reference and track transactions.

Templates also help streamline reconciliation by allowing you to easily compare totals with your financial records. This minimizes errors and saves time during audits. You can also incorporate a “comments” section for additional notes or clarifications about specific transactions.

- Monthly summaries: Add a section at the end of each month to summarize total petty cash usage, making it easier to monitor trends and adjust budgets.

- Automated calculations: Use formulas to automatically calculate totals and balances to reduce manual errors.

By structuring your templates in a clear and consistent manner, you can track multiple transactions without confusion, ensuring that your petty cash records remain organized and reliable.

Tips for Organizing and Storing Printed Receipts

Use labeled folders or filing cabinets to separate receipts by category, such as travel, office supplies, or client expenses. This helps to quickly locate specific receipts when needed.

Use a Consistent Filing System

Assign specific sections for each type of expense. Keep receipts related to the same category together, making it easier to track spending for accounting or tax purposes. Group receipts by date or month for an organized system that prevents clutter.

Consider Digital Backups

After organizing printed receipts, scan or photograph them to create digital copies. Store these backups in a cloud storage service for easy access and long-term preservation. This method also protects against damage or loss of physical receipts.