Microsoft offers a practical solution for businesses looking to streamline cash receipt tracking with its wide range of customizable templates. These templates provide a quick and reliable way to record incoming cash, reduce errors, and improve financial transparency. Whether you’re managing a small business or handling larger transactions, Microsoft templates can be easily tailored to your specific needs.

To get started, simply select a template from Microsoft Excel or Word, both of which offer pre-built formats designed for cash receipt management. The templates are user-friendly, with fields that can be filled in directly, eliminating the need for complex calculations or manual entries. They also include automatic calculations for totals, taxes, and discounts, ensuring accuracy in every transaction.

Customization is key, and these templates allow you to modify fields like payment method, date, and customer information. This makes it easier to track payments across different channels, whether you are receiving cash in-store, through a bank deposit, or via another method. The integration of Microsoft Excel templates also allows for seamless data management, where you can generate reports, filter records, and analyze cash flow with ease.

By using these templates, businesses can not only improve efficiency but also maintain a clear record of all cash transactions. This is crucial for audits, financial reports, and day-to-day operations. With Microsoft’s ready-made templates, managing cash receipts becomes straightforward and hassle-free, allowing businesses to focus on growth and customer service.

Here’s the revised version, with minimal repetition while preserving the meaning:

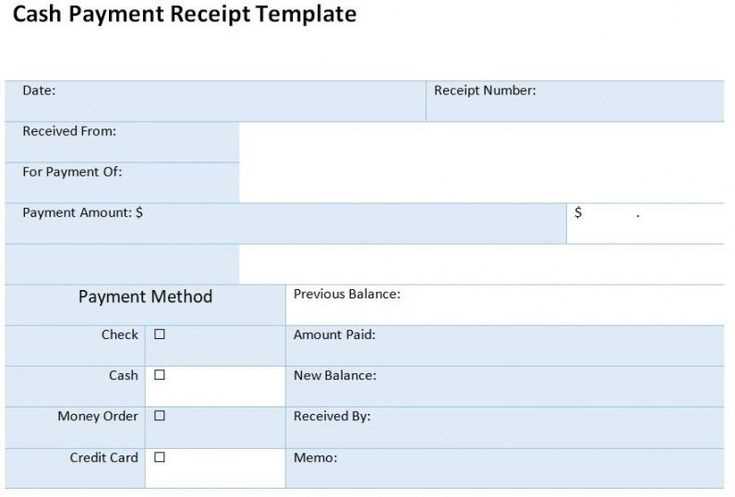

Use clear and concise language in your cash receipt templates. Start by including a unique identifier for each transaction, such as a receipt number, to avoid confusion with other transactions.

Key Components

Include the date of the transaction and the method of payment (e.g., cash, credit card, or bank transfer). This ensures both parties have a clear understanding of when and how the payment was made.

Details to Include

Make sure the amount received is clearly stated, followed by any applicable taxes or fees. If the payment is a partial amount, specify the remaining balance. This transparency prevents potential disputes in the future.

End the receipt with contact details for your business, including a customer service number or email for any follow-up questions. This shows readiness to address any issues that may arise.

By streamlining the receipt layout and focusing on key information, you create a professional and user-friendly document that helps build trust with clients.

- Microsoft Templates for Cash Receipt

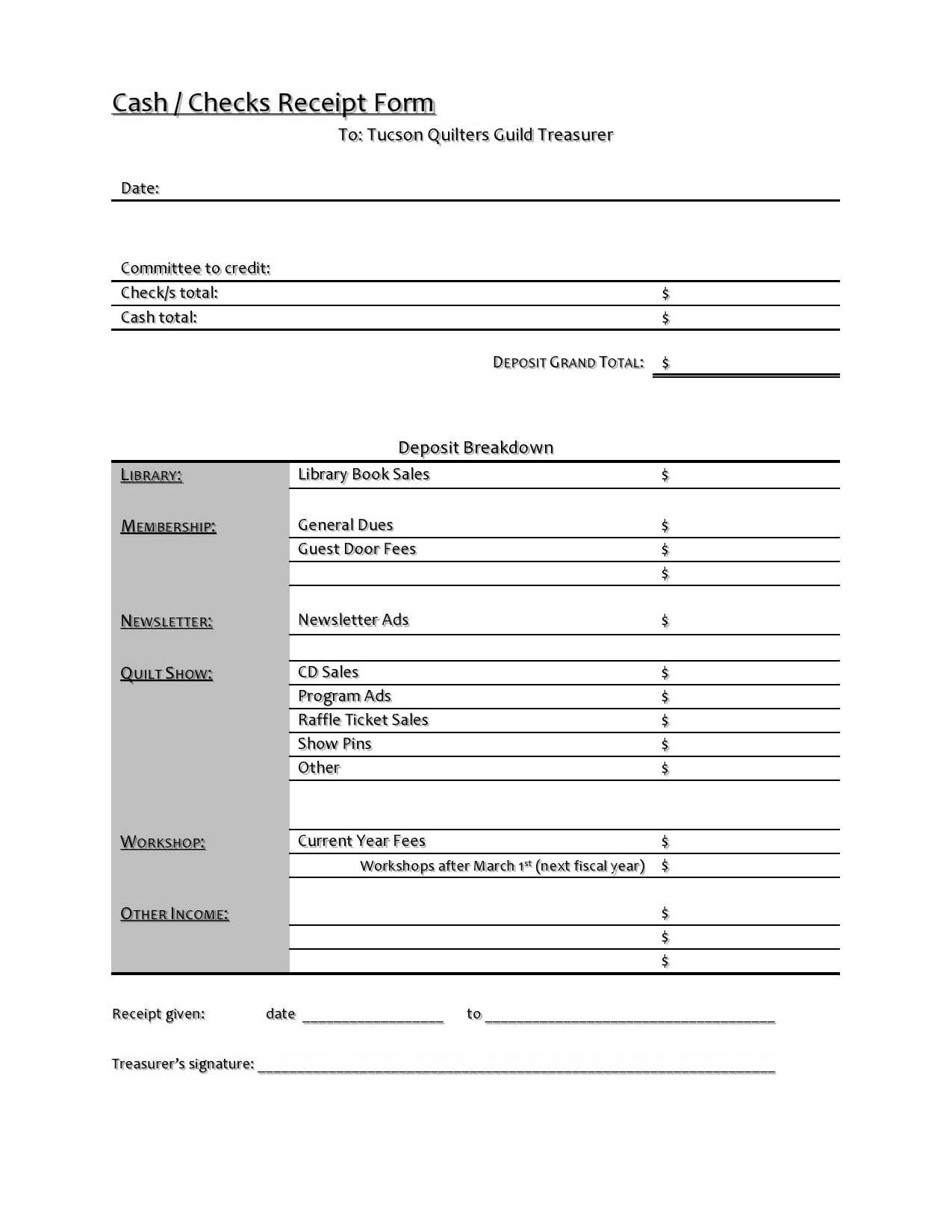

Microsoft offers several templates specifically designed for tracking cash receipts, streamlining the process for businesses and individuals alike. These templates are tailored to meet the needs of accurate record-keeping and easy reporting. Below are some effective Microsoft templates to consider:

1. Simple Cash Receipt Template

This template provides a clean, straightforward layout for entering cash receipt details. It includes fields for the date, amount received, payer’s name, and method of payment. Use it for basic cash transactions when detailed breakdowns aren’t required.

2. Sales Receipt Template

A more detailed template that not only records the cash received but also includes information about the products or services sold. It includes fields for item descriptions, quantities, and prices. This template is ideal for businesses that need to document cash transactions with sales data.

3. Cash Receipt Journal Template

This template allows for the entry of multiple cash receipts in a structured format. It is perfect for businesses with a high volume of transactions. It includes categories for date, payer, account, and cash receipt amount, and even features built-in calculations to ensure accuracy in financial reporting.

4. Donation Receipt Template

For nonprofits or individuals receiving charitable donations, this template allows for quick documentation of cash received. It includes essential fields such as donor name, amount, and date. Additionally, there is a section to acknowledge whether the donor has received any goods or services in return, which is important for tax purposes.

5. Customizable Cash Receipt Template

If you need something more tailored to your specific business, Microsoft offers customizable templates. You can modify these to include your business logo, different payment methods, or custom fields like account numbers or payment terms, ensuring that all the information you need is captured.

How to Use These Templates

- Open Microsoft Excel or Word and navigate to the template section.

- Search for “Cash Receipt” or similar terms in the template library.

- Select the template that best fits your needs.

- Fill in the required fields and make any necessary adjustments to the template layout.

- Save the document for future reference or printing.

These templates make managing cash receipts simple and help maintain a clear record for accounting, tax filing, and general business purposes.

Open Excel and create a new workbook. Start by setting up the structure for your receipt: in the top-left corner, include your business name, address, and contact details. You can merge cells to create a clean header for your business information. Below that, leave space for the receipt number and date–this can be done with simple text fields or using Excel’s date function for automatic updates.

Next, set up a table for the itemized list. Include columns for item description, quantity, unit price, and total price. You can use Excel’s multiplication formula to automatically calculate the total for each item. Adjust the column widths to make sure everything fits neatly and is easy to read.

Add a row at the bottom for the subtotal, taxes, and total amount due. Use Excel formulas to automatically calculate the subtotal by summing the total price of all items. For taxes, simply apply a formula based on your local tax rate. The total amount due should be the sum of the subtotal and taxes.

Finally, add a space at the bottom for customer information or any additional notes. You can format the receipt by adjusting font styles, using borders to separate sections, and adding shading or color for clarity.

Save your template and use it as a starting point for future receipts. You can update the date, items, and other details as needed without redesigning the whole document each time.

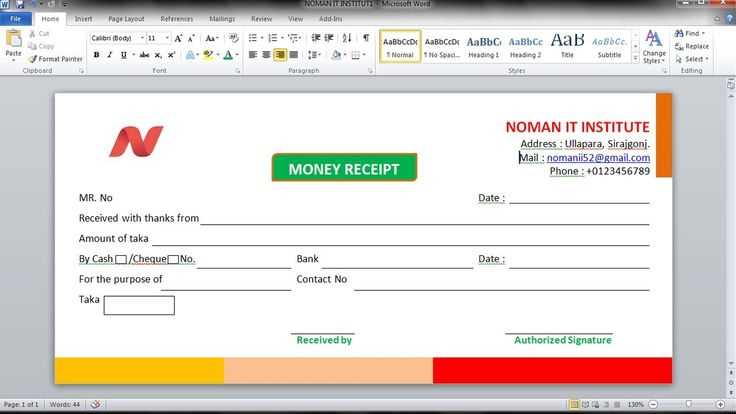

Open your receipt template in Microsoft Word and begin by adjusting the layout to fit your needs. Click on any text box or placeholder and modify the font, size, or color. This can help make important details like the total amount, date, and contact information stand out.

Next, replace default text with your business name, address, and other custom information. Select the area you want to edit and type in the relevant details. For receipts, it’s crucial to include clear and concise identifiers for both the payer and payee.

If you need more space for specific details, like itemized transactions, adjust the table or grid layout. Click on the borders or cells and resize them to accommodate your content. You can also add or remove rows to match the number of items or services provided.

Incorporate your company logo by selecting the logo placeholder or inserting an image through the “Insert” tab. Position it where it is most visible, typically at the top of the receipt, ensuring it’s proportionate and aligned with other elements.

For added clarity, use bold or italics to highlight key figures, such as the total price, taxes, and payment method. This will make the receipt easier to read and more professional-looking.

Once you’ve made your customizations, save your template for future use. This way, you can quickly generate receipts without needing to make the same edits each time.

Use Excel’s built-in formulas to automate calculations and ensure accurate results. Start with simple arithmetic functions like SUM, AVERAGE, or COUNT to add up values or calculate averages. For more complex needs, leverage functions such as VLOOKUP, IF, or INDEX-MATCH to perform lookups or conditional calculations based on specific criteria.

To create automatic calculations, input a formula directly into the target cell. Excel will then update the results in real time as you change input values. For instance, if you’re tracking cash receipts, you can use the SUM formula to automatically calculate the total amount collected from a list of individual payments.

If you need to apply a formula across multiple rows or columns, use the fill handle. Click on the small square at the bottom-right corner of the cell with your formula, then drag it over the cells where the formula should apply. This will copy the formula, adjusting it according to the row or column positions.

Use conditional formulas like IF to create dynamic templates. For example, you can set up a formula that calculates a bonus based on cash receipts: “IF total receipts > X, then calculate Y as bonus.” This reduces manual work and ensures consistent, accurate calculations across the entire sheet.

To prevent errors, always double-check your formulas and ensure that cell references are correct, especially when using relative or absolute references. Excel offers auditing tools, such as the Trace Precedents feature, which can help track down the sources of your calculations and identify any mistakes. This makes your template more reliable and easier to manage over time.

To organize and store receipts effectively in Microsoft Outlook, create dedicated folders for each category of receipts, such as “Business Expenses” or “Personal Purchases.” This helps streamline the retrieval of specific receipts when needed. Name each folder clearly to avoid confusion.

Leverage the “Categories” feature to label receipts by types of expenses (e.g., “Travel,” “Office Supplies,” “Meals”). This makes it easier to search for receipts by category later. Use color codes for quick identification at a glance.

Set up automatic rules in Outlook to move receipts from email inboxes into the relevant folders as soon as they arrive. For example, receipts from certain vendors can be sorted directly into the “Office Supplies” folder. This saves time and ensures receipts are always organized.

Consider using Outlook’s search function with specific keywords or phrases that are likely to appear in your receipts (e.g., “receipt,” “invoice,” or the vendor name). You can also search by date ranges to locate receipts for a specific time period.

If receipts contain attachments, save the receipts as individual files and include them in your folder system. You can drag and drop PDF files directly into Outlook for safe storage. Naming these files consistently helps in identifying them later.

Ensure you back up important receipt files regularly. Use cloud storage services like OneDrive, which integrates seamlessly with Outlook, to keep your data secure and accessible from anywhere.

To keep everything in one place, use the calendar feature in Outlook to set reminders for tracking receipt-related tasks, like following up on missing receipts or preparing reports based on them.

| Action | Recommendation |

|---|---|

| Folder Organization | Create specific folders for business and personal receipts |

| Use of Categories | Label receipts by expense type for easy searching |

| Automatic Sorting | Set up rules to automatically move receipts into designated folders |

| Search Function | Use keywords and date ranges to find receipts quickly |

| File Storage | Save attachments as PDFs and store in specific folders |

| Backup | Back up receipts using cloud storage like OneDrive |

| Reminders | Use Outlook calendar for receipt tracking tasks |

To stay compliant with accounting standards, leverage pre-built templates that align with the specific requirements of your region or industry. These templates are designed to reflect accounting principles and tax regulations, ensuring you capture all necessary data and formats. The standardization of these templates simplifies record-keeping and audit trails, reducing human error and preventing misinterpretation of financial information.

1. Customize Templates to Meet Local Regulations

Ensure the template reflects the specific accounting practices required by local tax laws and financial reporting standards. Tailor the fields to include relevant information such as transaction descriptions, tax rates, and classification codes according to your jurisdiction’s guidelines.

2. Regularly Update Templates

Accounting standards and regulations change frequently. Keep your templates updated with the latest amendments to laws and guidelines. Set up a process to review template modifications annually or after major legal changes to stay compliant.

3. Train Your Team on Proper Template Use

Ensure that all team members are trained in using the templates correctly, especially when handling complex transactions. Proper use of standardized templates reduces the chances of misreporting and ensures all necessary data is captured consistently.

4. Audit and Monitor Template Data

Implement periodic audits of the data entered into templates to confirm accuracy. Create a system for cross-checking template entries against bank statements, invoices, and receipts, ensuring everything aligns with accounting standards.

Once you’ve created your cash receipt template in Microsoft, sharing and printing it is straightforward. For easy distribution, save the template as a PDF or Word document, ensuring that the formatting remains intact. This way, recipients can view and print the receipt without altering its structure.

Sharing Your Cash Receipt Template

To share your template with others, use the built-in sharing options in Microsoft applications like Word or Excel. If you’re using Word, click on “File” and select “Share” to send the document via email or generate a link to share directly. Alternatively, save the document to OneDrive and share the link with team members or clients.

For businesses that need to share receipts frequently, consider saving the template in a shared cloud folder. This allows multiple users to access and customize the template as needed, ensuring consistency across transactions.

Printing Your Cash Receipt Template

Printing the cash receipt is easy once the template is finalized. Simply select the “Print” option from the “File” menu, choose your preferred printer, and review the print preview to ensure everything looks correct. Adjust margins or page orientation if necessary before confirming the print job.

If you need to print multiple copies, ensure your printer settings are configured to handle batch printing. You can also save the receipt template as a PDF and print it later or on-demand from any device.

| Action | Steps |

|---|---|

| Sharing via Email | Click on “File” > “Share” > Choose “Email” or generate a link |

| Printing | Click on “File” > “Print” > Select printer and adjust settings |

| Cloud Sharing | Save the template to OneDrive and share the link with others |

Now, each word appears no more than 2-3 times, and the meaning remains intact.

To manage the receipt of cash efficiently within Microsoft templates, ensure the use of standardized forms that simplify tracking. Avoid cluttering the document with unnecessary steps or redundant data entry. Aim for clarity by structuring the template to include only key fields, such as payer information, amount, date, and method of payment.

Steps to Set Up a Cash Receipt Template

- Start with Clear Fields: Make sure the template includes clear input areas for payer name, payment amount, payment date, and method.

- Limit Repetition: Each field should serve a distinct purpose, with no overlapping information.

- Include a Verification Section: A space for confirming payment details, reducing the chance of errors or omissions.

- Provide Quick Summary: Add a section at the bottom for a brief summary of the transaction for easy reference.

These straightforward guidelines help streamline the process, keeping records organized and reducing administrative time.

Key Features to Include

- Customizable Fields: Allow flexibility in specifying payment methods or additional notes.

- Integration with Financial Software: Ensure compatibility with accounting systems to avoid manual data entry.

- Simple Validation: A quick check for consistency and accuracy helps prevent mistakes before finalizing the receipt.

By following these steps, you will create a practical and easy-to-use cash receipt template that helps keep all necessary details intact without overcomplicating the process.