Using a money donation cash receipt template simplifies the process of acknowledging contributions, ensuring transparency and accountability. A clear, well-structured receipt provides both the donor and the receiving organization with a record of the transaction. This record helps avoid misunderstandings and serves as proof of donation for tax or personal purposes.

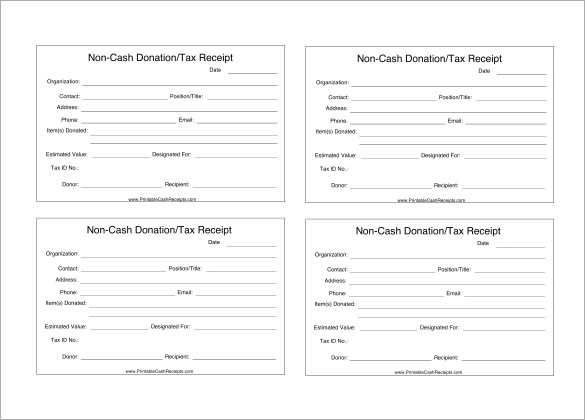

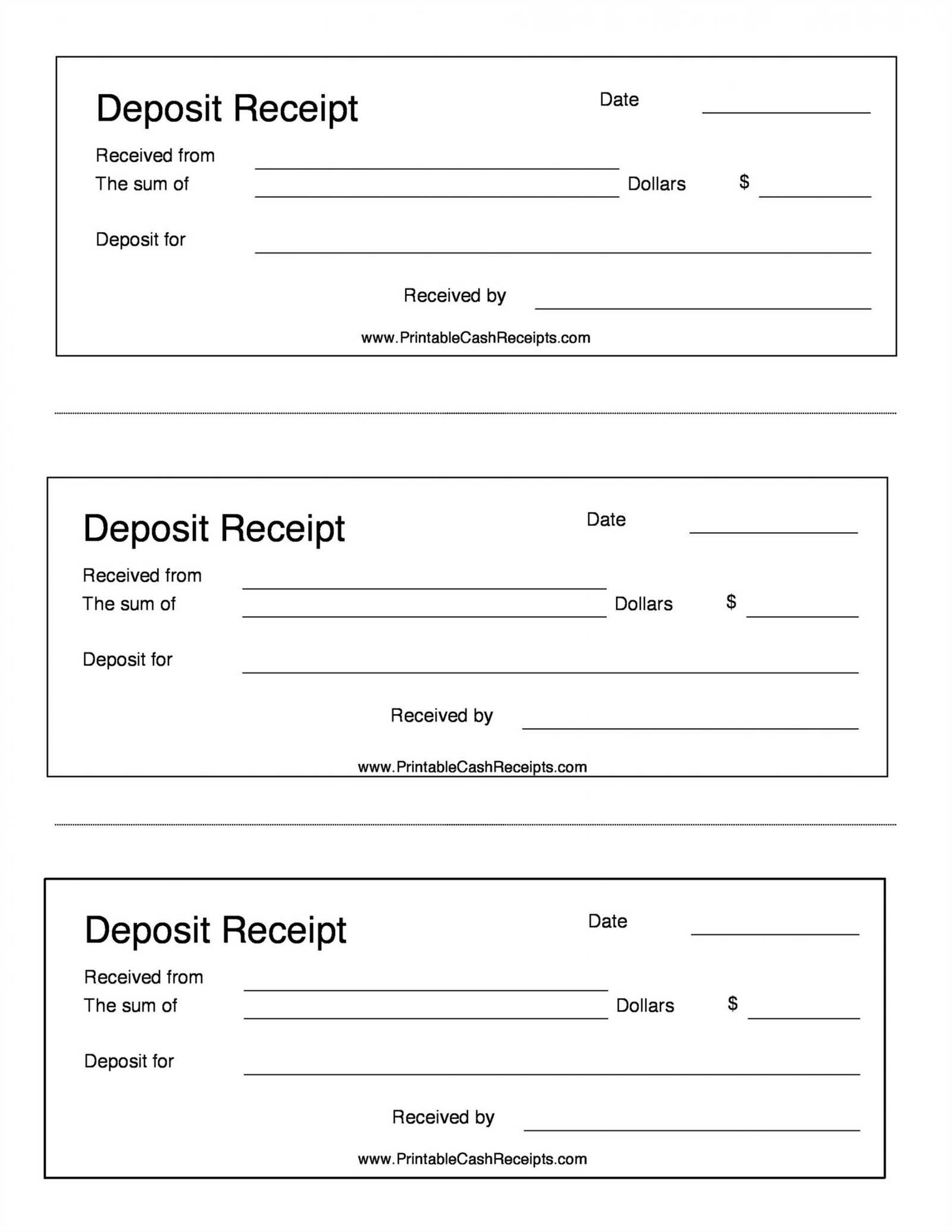

A typical money donation receipt includes essential details such as the donor’s name, the donation amount, the date of the transaction, and a description of the funds. The receipt may also include the donor’s contact information and a statement confirming the donation was made without any goods or services exchanged in return. Providing this information ensures both parties are on the same page and can verify the legitimacy of the donation.

To streamline the donation process, consider using a template that covers all necessary fields and is easy to modify. The template should allow for quick customization based on the specifics of each donation. By doing so, you create a standardized approach that saves time and reduces errors, helping organizations maintain consistent and accurate records.

Here’s the revised version where repetition of words is avoided:

To create a clear and effective money donation cash receipt template, focus on keeping the structure clean and easily understandable. Provide essential details such as the date, donor’s name, the amount donated, and the purpose of the donation. Including a unique receipt number will help track each donation for future reference.

Ensure the receipt includes both the donor and recipient’s addresses, as well as a brief note on the donation’s purpose. It is useful to provide a thank-you message to express gratitude for the contribution.

| Date | Receipt Number | Donor’s Name | Amount Donated | Purpose of Donation | Recipient’s Name |

|---|---|---|---|---|---|

| 01/01/2025 | 123456 | John Doe | $200 | Supporting Local Education | XYZ Foundation |

After filling out all the necessary fields, provide space for both parties to sign and confirm the transaction. This ensures accountability and clarity for both the donor and the recipient.

Finally, make sure the template is easy to print or save for digital records. A clean design with minimal distractions will help recipients focus on the relevant details.

- Money Donation Cash Receipt Template: A Practical Guide

Creating a money donation cash receipt template is straightforward if you include the right details. A well-designed receipt helps build trust with donors and ensures transparency. Follow these steps to craft an effective and professional template.

Key Information to Include

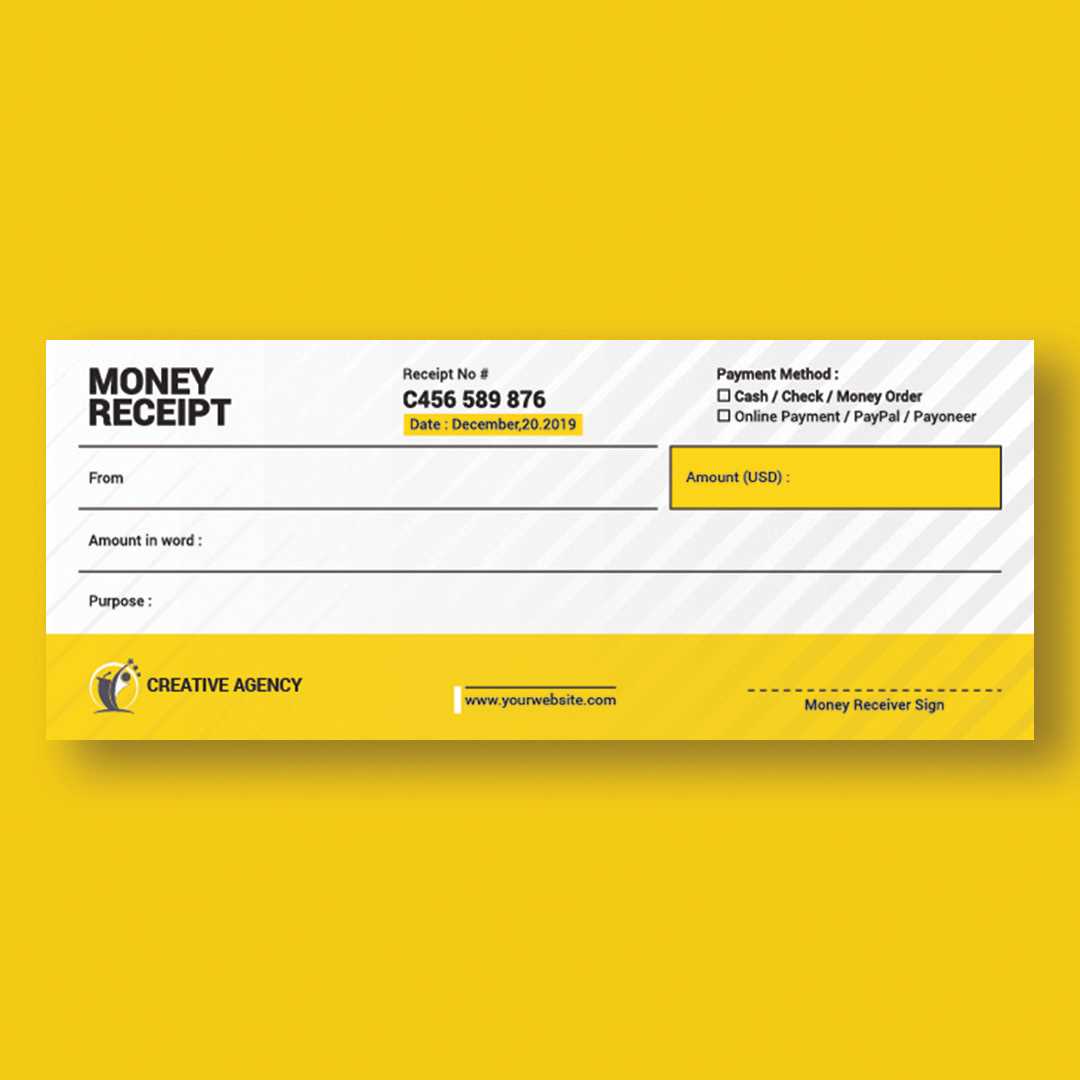

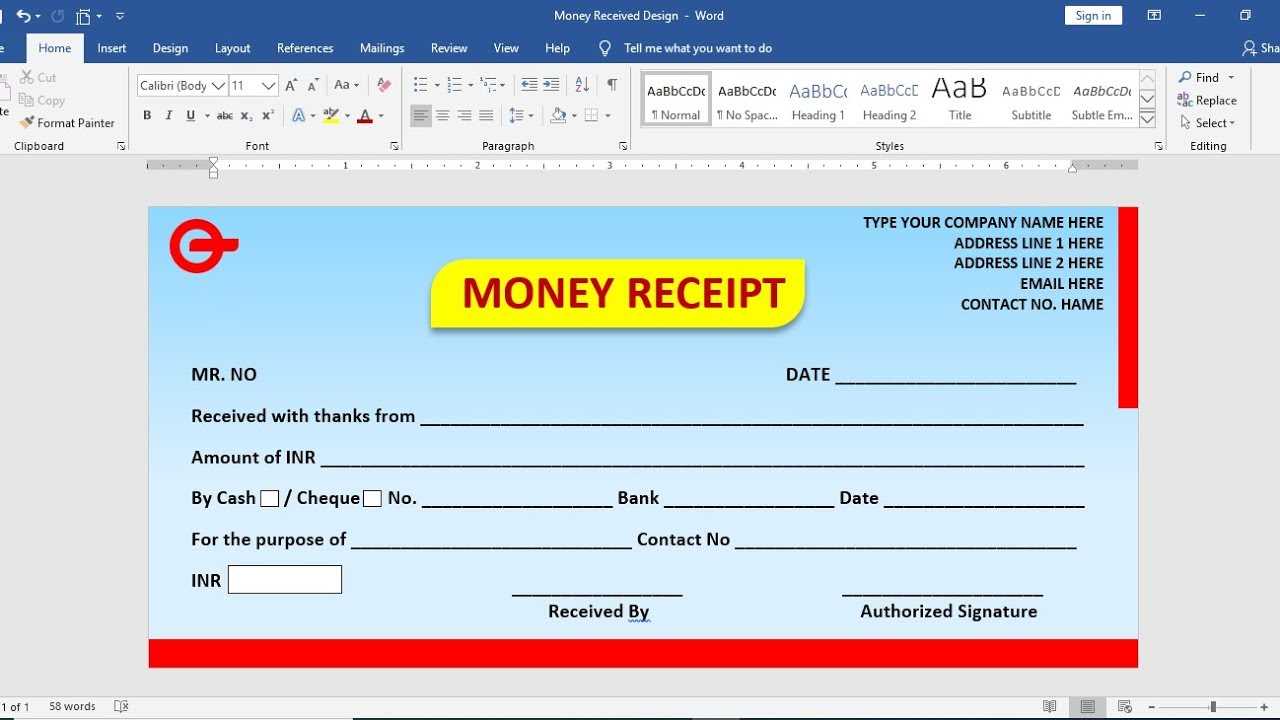

- Receipt Title: Clearly label it as a “Money Donation Cash Receipt” at the top of the document.

- Donor’s Name: Include the full name of the individual or organization donating the money.

- Date of Donation: Specify the exact date the donation was made.

- Donation Amount: State the exact amount donated in both numerical and written form (e.g., $50.00 Fifty dollars).

- Payment Method: Indicate how the donation was made (cash, check, or other). This can help in tracking payments accurately.

- Recipient Organization’s Name: Include the name of the charity or organization receiving the donation.

- Authorized Signature: A signature from an authorized representative verifies the receipt.

- Tax Exemption Status: Mention if the donation qualifies for tax deductions, as applicable.

Formatting Tips for Clarity

- Use a Simple Layout: A clean, minimal design will ensure readability. Avoid cluttering the template with unnecessary graphics or text.

- Include Contact Details: Provide the organization’s contact information (address, phone number, email) for further inquiries.

- Save as a Template: Once designed, save the template for easy reuse. Customizing it for different donations can save time.

By following these guidelines, you’ll create a money donation receipt template that is both functional and professional. This template will not only help with record-keeping but also enhance the donor’s experience by providing clear documentation of their generous contributions.

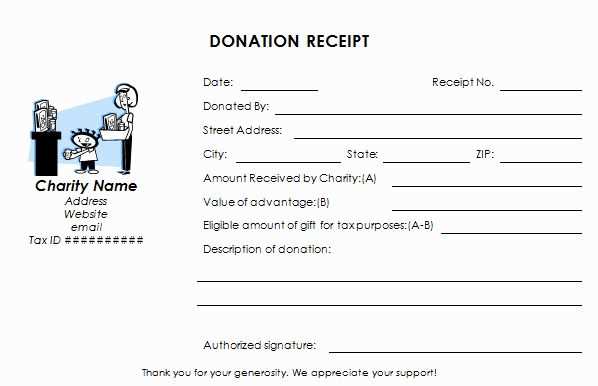

Design a clear and straightforward receipt to acknowledge donations. Keep it simple but informative, providing all the necessary details for record-keeping and transparency. Here’s how to structure your template:

- Receipt Title: Use a clear heading like “Donation Receipt” at the top of your document.

- Donor Information: Include the name of the donor, address (optional), and contact details if applicable.

- Donation Details: Specify the amount donated, date of donation, and the method (cash, check, credit card, etc.).

- Organization Information: Include your organization’s name, address, and contact information. Include a tax-exempt status if applicable.

- Thank You Statement: Add a short, genuine note of appreciation for the donation. A simple “Thank you for your generous contribution” can suffice.

- Tax Information: If relevant, mention that the donation is tax-deductible (or note the value of any goods or services provided in exchange for the donation).

- Receipt Number: Assign a unique number for each receipt to keep records organized.

- Signature (optional): You may add a place for an authorized person to sign, depending on the organization’s policy.

This format will help maintain transparency and ensure you meet necessary reporting requirements. Once created, save the template for future use or adjust it as needed for different donation types.

First, include the name and address of your organization. This ensures that the donor can easily identify the charity or entity they contributed to. Follow this with the donor’s name and address, especially for tax-deduction purposes.

Clearly state the donation amount in both numbers and words. This avoids any potential confusion regarding the contribution. If the donation was made in cash, specify it explicitly, as it may not be as obvious as a check or online transfer.

The date of the donation is critical, as it determines the tax year the donation falls under. Make sure this is accurate and easy to find on the receipt.

If the donor received anything in return for the cash donation, such as goods or services, note the fair market value of those items. This ensures that the donor knows how much of their contribution is eligible for tax deductions.

Include a statement that the donation was voluntary and that no goods or services were provided in exchange unless applicable. This is a key detail for tax reporting.

Provide a unique receipt number. This helps in keeping your records organized and assists in tracking donations, especially for large organizations or for audits.

Finally, don’t forget to add a thank you message. A brief note of appreciation can go a long way in maintaining a positive relationship with the donor.

Adjusting your donation receipt based on the donation amount helps keep your records accurate and clear for both you and your donors. Tailor the wording, layout, and information based on the donation size to reflect the contribution level appropriately.

For Small Donations

For smaller donations, keep the receipt simple but still personalized. Clearly state the amount donated, the donor’s name, and the date. You can use a basic template with these key details, as smaller donations typically don’t require extensive breakdowns.

For Larger Donations

For higher amounts, include more specific details, such as a breakdown of the donation (if applicable), a formal thank-you note, and mention of any benefits the donor may receive (like tax-deductible status). Larger donations may also require more formal language to convey appreciation and recognition.

Always ensure the receipt includes your nonprofit’s tax-exempt status, especially for substantial contributions, as donors often need this for tax purposes.

Donation receipts must meet specific legal criteria to be valid for tax purposes. Ensure that your acknowledgment includes the donor’s name, donation date, and the amount or description of the donated property. This applies to both monetary donations and in-kind gifts. For cash donations, include the amount donated and for non-cash contributions, a description of the items donated.

Include the Nonprofit’s Information

The acknowledgment should also contain your nonprofit’s name and address. It should identify the donation as a charitable contribution, and include your tax-exempt status or IRS identification number if applicable.

State Whether the Donor Received Any Goods or Services

If the donor received something in return for their gift, the acknowledgment must specify the value of any goods or services provided. If no goods or services were exchanged, state that explicitly to ensure the donor can claim the full deduction.

Nonprofits should issue a receipt for donations of $250 or more to meet IRS requirements for substantiating deductions. For donations under $250, a written acknowledgment is still recommended, but it’s not mandatory.

Use a PDF format for your receipt. This ensures consistency across all devices and easy printing if needed. Tools like Adobe Acrobat or online services like PDFescape allow you to create and edit receipts with ease. Make sure the font is clear and the text size is appropriate for readability. Avoid overly decorative fonts that may make the receipt harder to read.

After formatting, double-check that all necessary information is included: the donor’s name, amount donated, transaction date, and your organization’s details. Keep the layout clean and organized for a professional presentation.

When distributing your digital receipt, use email as the primary method. Attach the PDF file to the email, and in the subject line, mention the donation and the receipt for clarity. For security, consider using a unique donation reference number in the email body or subject to help the donor verify the transaction.

Alternatively, you can upload the receipt to a secure online platform that allows the donor to download it. Include a link to the platform in your email or on your website to provide easy access. Make sure to set proper access permissions to prevent unauthorized access.

Ensure that your emails are concise and professional, with a friendly tone. Donors should feel appreciated for their contribution, and the digital receipt should reflect that gratitude. If possible, include a personalized thank-you message or acknowledgment within the email to enhance the donor’s experience.

| Receipt Component | Details |

|---|---|

| Donor Name | Full name of the donor |

| Donation Amount | The exact amount donated |

| Date of Donation | Date the donation was made |

| Transaction Reference | A unique identifier for the donation |

| Organization Details | Your organization’s name and contact info |

Make sure to include accurate and clear details on the donation receipt. One common mistake is not including the donor’s full name or contact information. Always verify the spelling and accuracy of the donor’s details before finalizing the receipt.

Incomplete Information

Ensure that the donation amount and date are clearly stated. Leaving out either of these details can cause confusion or make the receipt invalid for tax purposes. Be specific about the donation type, whether it’s cash, check, or goods, and indicate any non-monetary donations separately.

Lack of Legal Compliance

Check the legal requirements for donation receipts in your region. Failure to include mandatory statements such as the organization’s tax-exempt status can lead to legal issues. Make sure the receipt mentions whether the donor received anything of value in exchange for their donation, as this can affect tax deductions.

Avoid using vague language or generic terms. Be precise with the wording to ensure donors fully understand the receipt’s purpose. Use clear language, especially when describing the donation’s value or the charitable organization’s status.

Finally, don’t forget to double-check all information for accuracy before sending the receipt. Mistakes can undermine trust with donors and lead to confusion down the line.

Now repetition of words is minimized, while meaning remains intact.

To create a clear and concise donation cash receipt, focus on structuring it in a way that eliminates redundancy. Each element should serve a specific purpose, ensuring that every detail adds value to the document.

Key Elements to Include

- Donor’s name and contact information

- Donation amount, date, and method

- Purpose or cause of the donation

- Tax-exempt status, if applicable

- Receipt number or ID for tracking purposes

Use straightforward language that conveys the necessary information without unnecessary repetition. If the receipt includes a reference to the donor’s tax benefits, mention it once in a clear manner rather than repeating it in different sections.

Streamline for Clarity

- Keep the format consistent and easy to follow.

- Ensure that each part of the receipt is clearly labeled and organized.

- Avoid long paragraphs; use bullet points where applicable for easy readability.

This approach reduces the chance of confusion, ensuring the donor receives all the necessary details without overwhelming them with repetitive text.