A monthly cash receipts template in Excel can simplify tracking and managing your cash flow. By organizing your income data on a monthly basis, it becomes easier to spot trends, identify gaps, and ensure you stay on top of your finances. The template should be straightforward, allowing you to input data quickly and see key figures at a glance.

To create a functional template, begin by including columns for the date, source of income, amount received, and payment method. Organize this information so that you can easily sort or filter based on the month or other categories that matter to you. Including a running total of receipts can also help with monitoring cash flow in real-time.

Make sure to categorize different income sources. This helps break down where your money is coming from and lets you assess whether certain streams are performing as expected. Customizing your template to include any specific data relevant to your business will maximize its value and accuracy.

Here’s the revised version with minimized repetition:

When creating a monthly cash receipts template, focus on clarity and simplicity. First, set up columns for the date, source of income, amount received, and any notes. Include a section at the bottom for the total sum of the month’s receipts. This will help avoid unnecessary duplication while keeping your template organized.

How to organize your data

For each entry, input the relevant date, amount, and income source. Ensure the categories are consistent throughout the month. Instead of repeating similar transactions, group them under broader categories like “Sales” or “Refunds.” This reduces clutter and makes the data easier to analyze.

Tracking and Reviewing the Receipts

At the end of the month, sum all the amounts using a simple formula. This can be done manually or by using Excel’s SUM function. Regularly check for any missing entries, and update the total to match your records. Keeping track in this way minimizes errors and redundancy.

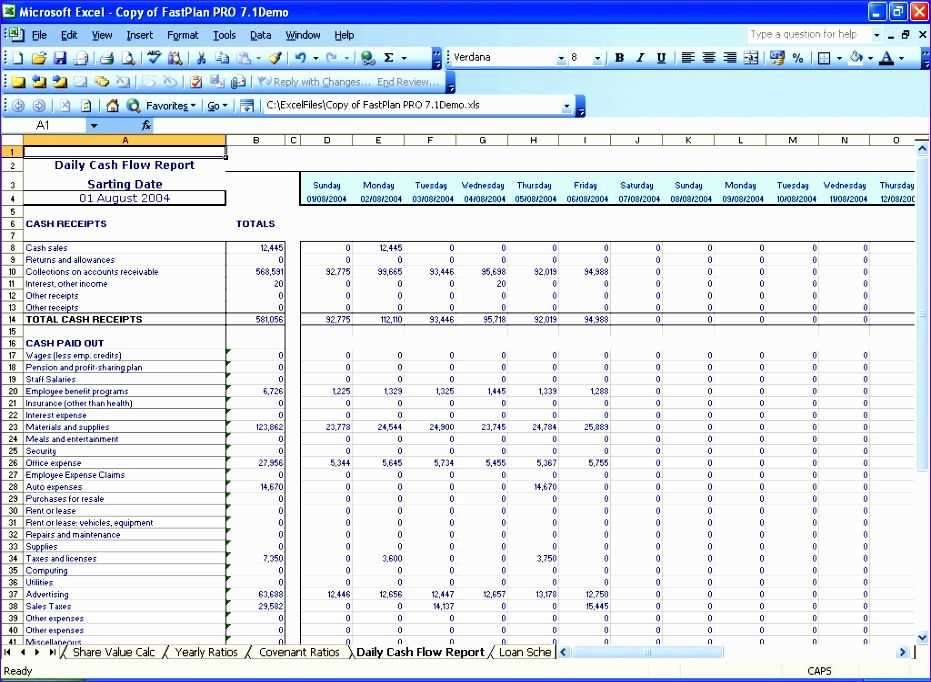

- Monthly Cash Receipts Excel Template

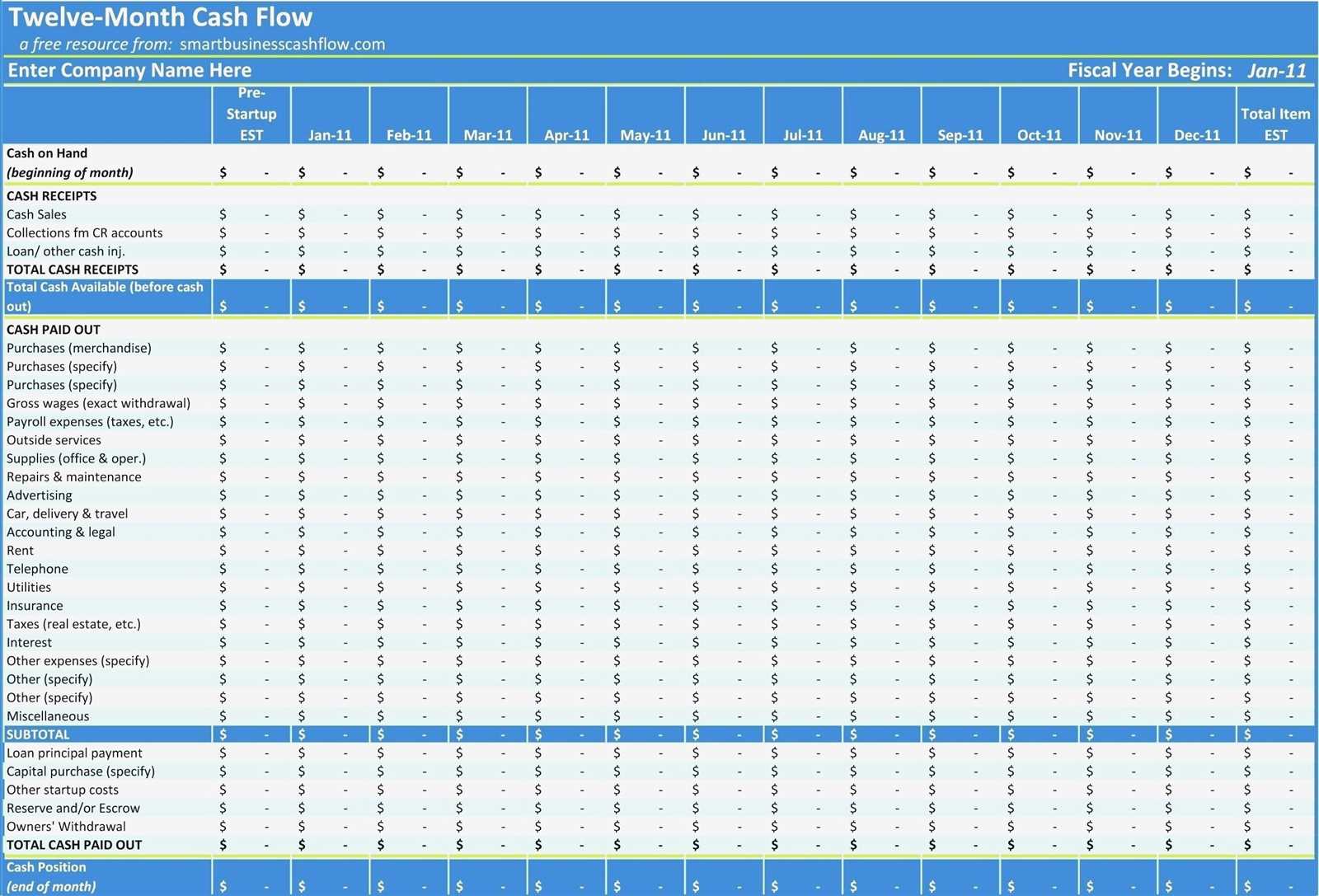

A well-structured monthly cash receipts template simplifies tracking incoming funds. It ensures clarity and makes it easier to manage finances effectively. Follow these tips to maximize the template’s potential:

- Categories for Incoming Funds: Break down receipts into categories such as sales revenue, loans, investment returns, or any other cash inflow types. This helps in monitoring and analyzing the cash flow more effectively.

- Date and Description Columns: Include separate columns for the date of receipt and a brief description. This keeps the records clear and organized, allowing for easy reference later.

- Amounts and Totals: Ensure each receipt is entered with the exact amount, and have a total column at the end to sum up the monthly receipts automatically. This reduces manual calculation errors and provides an instant overview of cash flow.

- Notes Section: Consider adding a column for any additional notes, like the method of payment (e.g., cheque, bank transfer) or any relevant details that might affect future financial planning.

- Month-to-Month Comparison: If possible, incorporate a section to compare current month receipts with previous months. This helps spot trends and assess whether the cash flow is improving or declining.

Adjust the template as needed based on your specific business needs, but these basic features should be present to ensure smooth tracking and analysis. Use Excel’s built-in functions to automate calculations, reducing the workload and increasing accuracy.

Begin by creating a new workbook in Excel. Label the first sheet as “Monthly Receipts” or any name that suits your needs. Then, set up columns for key details like Date, Description, Category, Amount, and Payment Method. These columns will give you a clear overview of each receipt.

Step 1: Create Column Headers

In row 1, add the following headers: Date, Description, Category, Amount, Payment Method. You can adjust these as needed based on your specific requirements. Make sure to format the ‘Date’ column to show the correct date format, and the ‘Amount’ column as currency for easy tracking.

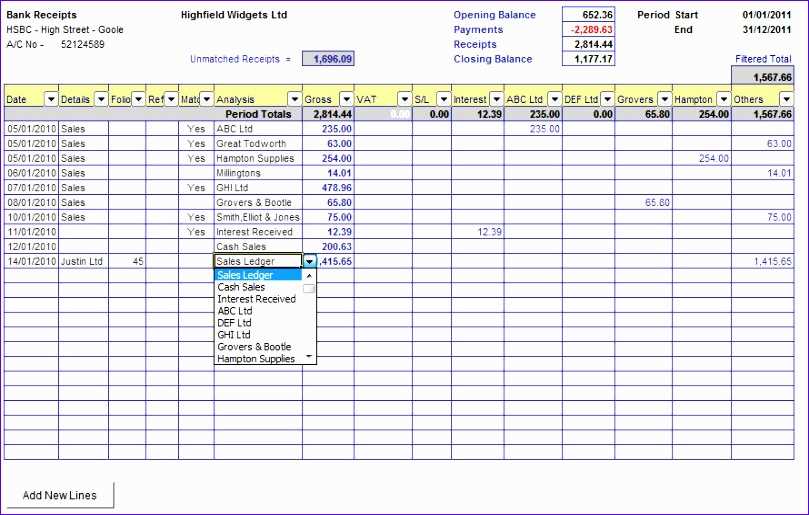

Step 2: Use Data Validation for Categories

For the ‘Category’ column, use data validation to create a dropdown list with predefined categories like “Groceries”, “Utilities”, or “Entertainment”. This helps to standardize entries and makes filtering and analyzing data easier.

Next, add a summary section at the bottom or a new sheet that calculates totals by category, month, or other criteria. Use Excel’s SUMIF or SUMIFS functions to pull totals from your data, based on the conditions you set (like date range or category).

This setup keeps your receipts organized and makes it easier to track and analyze your spending month after month.

Start with the basics: you need columns that directly reflect your cash inflows. First, include a “Date” column to track the exact day of each transaction. This helps maintain accurate cash flow timelines.

Next, a “Source” column is critical. Label each inflow by its origin–whether it’s from sales, loans, or other income streams. This gives you a clear view of where your money is coming from, which helps with budgeting and forecasting.

The “Amount” column is a must. Record the exact sum of each inflow. Precision here avoids confusion when you’re calculating totals or comparing month-to-month data.

For more granular tracking, consider adding a “Payment Method” column. This can show whether the cash came in via credit card, bank transfer, or other methods. This is helpful for reconciling your actual cash flow with bank statements or payment processing systems.

If applicable, a “Client/Customer Name” column can be valuable for tracking individual transactions. This is particularly useful for businesses that rely on multiple clients or customers for revenue. It lets you track who owes what and helps with future invoicing or follow-ups.

Lastly, a “Category” column can break down the type of income (e.g., product sales, service fees, investments). This allows for a deeper analysis of your cash inflows and helps identify trends in your income sources.

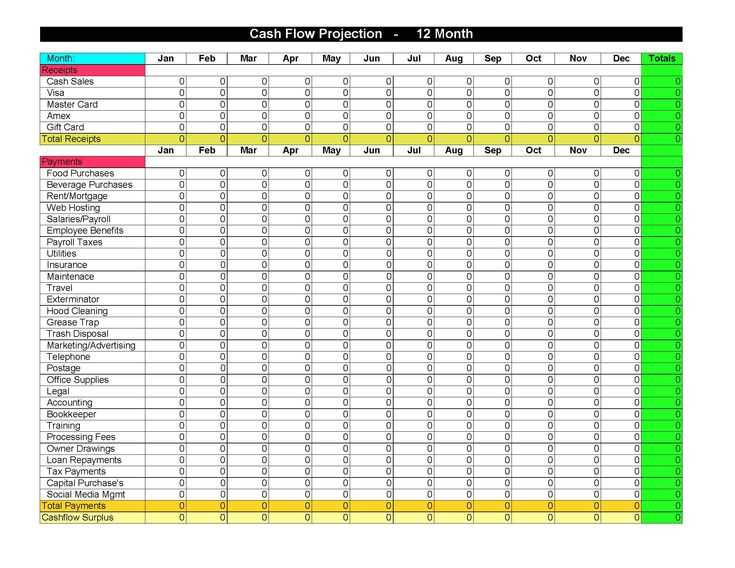

To speed up receipt calculations and minimize errors, use Excel formulas that perform the math for you. These formulas reduce manual entry, ensuring consistency across your records.

Basic Sum Formula

The SOMME formula in Excel automatically adds up a range of values. For example, if your receipt amounts are in column B (B2:B10), the formula =SOMME(B2:B10) will give you the total for those rows. This is a quick and simple way to calculate your total receipts for a month or a specific time period.

Using SUMIF for Conditional Calculations

If you need to sum receipts based on specific criteria, SUMIF can help. For instance, if you want to sum all receipts from a particular customer or category, use the formula =SUMIF(range, criteria, sum_range). An example would be =SUMIF(C2:C10, “CustomerName”, B2:B10), which sums all receipts in column B where column C matches “CustomerName.”

These formulas can save you time and ensure you’re always working with the most up-to-date totals. Customizing your formulas based on your specific needs helps streamline the entire process.

How to Organize and Categorize Various Receipts

Start by sorting receipts into categories based on the type of expense. Common categories might include utilities, office supplies, travel, and meals. Label each receipt with the category it belongs to to make future reference easier.

- Use color coding: Assign colors to different categories. For example, blue for travel, green for office supplies, and red for meals. This will help you visually organize receipts quickly.

- Group receipts by date: Organize receipts in chronological order. This helps track when purchases were made and makes it easier to spot discrepancies.

- Digitize your receipts: Use a scanner or a mobile app to create digital copies. This eliminates paper clutter and makes searching for specific receipts much faster.

- Tag receipts with keywords: If digitizing, use tags like “paid,” “pending,” or “reimbursable” to further categorize each receipt. This will help in reviewing receipts and reconciling expenses.

Once receipts are sorted, maintain a clear system to update them regularly. Set a reminder to input receipts into your spreadsheet or digital tool, and always keep receipts in their designated categories to avoid confusion later.

Begin by organizing your template with clear, distinct sections for each type of data. Use bold headings and borders to separate categories like income, expenses, and totals. This helps avoid confusion and allows for quick navigation through the template.

Utilize Cell Formatting for Readability

Apply number formatting to your cells for accurate input. For example, use currency format for monetary values and percentage format where applicable. This ensures all data is displayed consistently and can be easily understood at a glance.

Data Validation for Consistency

Incorporate data validation rules to prevent incorrect entries. For example, set drop-down lists for categories such as payment types or months, which will guide the user in selecting valid options and reduce data entry errors.

Consider color coding important columns or rows to highlight key areas such as totals or calculations. Use light shades that don’t overwhelm the eyes but provide enough contrast to differentiate sections.

Finally, lock the cells containing formulas or instructions to prevent accidental changes. This keeps the integrity of the data intact while still allowing for data entry in other areas of the template.

One major mistake when using a cash receipt template is failing to update the template regularly. If you don’t track your cash flow on a daily or weekly basis, numbers can quickly become outdated. This leads to inaccurate records and can result in missing financial details.

1. Skipping Consistent Data Entry

For accurate results, always enter data consistently. If you skip entries or input them inconsistently, your template will not reflect your true cash flow. Set a schedule to update it at regular intervals, such as at the end of each business day, to avoid missing key data.

2. Incorrect Categorization of Transactions

Improperly categorizing cash transactions can lead to confusion during analysis. Each entry should be categorized under the correct heading, such as “Sales,” “Expenses,” or “Receivables.” Using incorrect categories can cause you to misinterpret financial trends and hinder future decisions.

3. Ignoring Non-Cash Transactions

Even if you primarily use cash receipts, don’t ignore non-cash transactions like credit card payments or checks. A comprehensive cash template should include all types of payments to give a complete picture of your financial status.

4. Failing to Track Outstanding Receivables

It’s easy to overlook outstanding receivables, but this can be a costly mistake. Not tracking unpaid invoices means you’re not accurately reflecting cash flow. Add a separate column for receivables and update it as payments come in.

5. Forgetting to Reconcile Your Template

Periodically reconciling your template with actual bank statements is essential to catch discrepancies. If you fail to reconcile, you may miss errors or fraudulent activities that could go undetected until it’s too late.

6. Overcomplicating the Template

Simplicity is key. Overloading the template with unnecessary formulas, columns, or data points makes it harder to manage and could lead to mistakes. Stick to the basics: track the essential revenue and expenses, and keep it as straightforward as possible.

7. Neglecting to Backup the Template

Don’t make the mistake of relying solely on one version of the template. If the file becomes corrupted or lost, you risk losing all the data. Always create backups to protect your financial records.

| Mistake | Impact | Solution |

|---|---|---|

| Skipping Data Updates | Outdated records, inaccurate cash flow analysis | Update regularly, track at least weekly |

| Incorrect Categorization | Misleading financial reports, incorrect analysis | Double-check categories, use clear labeling |

| Ignoring Non-Cash Transactions | Incomplete financial overview, inaccurate cash flow | Include all types of transactions |

| Neglecting Outstanding Receivables | Inaccurate cash flow representation | Track receivables separately, update regularly |

| Not Reconciliation | Undetected errors or discrepancies | Reconcile with bank statements periodically |

| Overcomplicating the Template | Confusion, increased errors | Keep the template simple, only track essential data |

| Not Backing Up the Template | Loss of data | Regularly back up the template |

In these lines, I aimed to preserve meaning while avoiding repeating words more than 2-3 times.

For better tracking of monthly cash receipts, organize your data by separating income categories. Start by listing the source of each payment and categorize them (e.g., sales, services, investments). This helps quickly assess trends and understand cash flow.

Set Clear Dates

Assign specific dates for each receipt entry. Group entries by week or month to analyze cash inflows over time. Using an automated date system will prevent confusion and ensure consistency in future entries.

Include Payment Methods

Identify whether each payment was made via cash, credit, or other methods. This information can help identify popular payment channels and aid in managing payment processing fees.

Keep an eye on any outstanding or delayed payments. Recording these separately can prevent errors in your cash flow analysis. This way, you stay on top of your accounts and ensure all receipts are accounted for.