When preparing a receipt for a non-deductible cash donation, clarity is key. A well-structured receipt helps avoid confusion about the donation’s tax status and ensures the donor understands their contribution is not eligible for tax deductions.

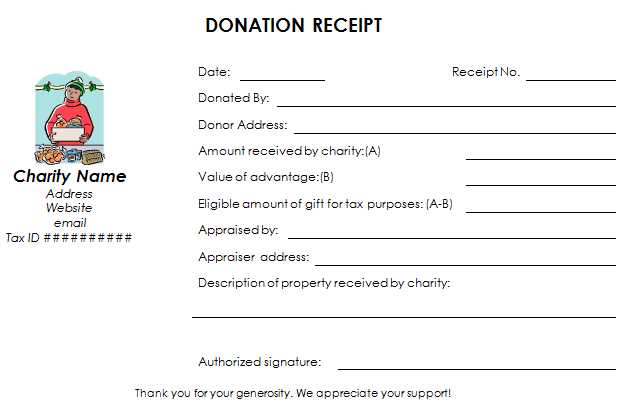

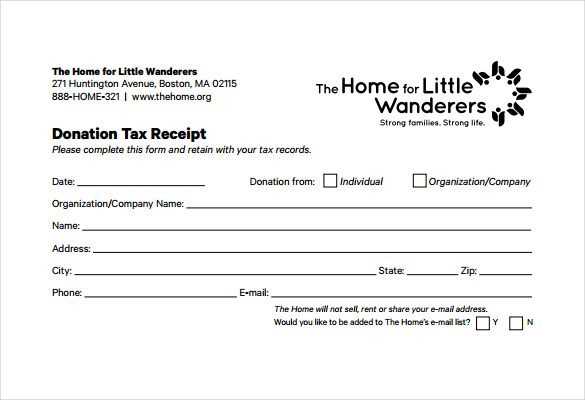

Start by including the name of your non-profit organization, its address, and tax identification number (TIN). This provides clear identification of the charity and its tax-exempt status. Then, specify the date of the donation and the amount given, followed by a statement clearly noting that the donation is non-deductible.

Make sure to include a short but precise declaration, such as: “This donation is not tax-deductible under IRS regulations.” This ensures that the donor knows their gift cannot be used as a tax deduction. Include a section that describes the nature of the donation if relevant, such as whether it was in cash or another form.

It’s also helpful to provide contact information for any follow-up questions. This ensures transparency and fosters trust between your organization and the donor. Keep your receipts simple, accurate, and informative for both compliance and convenience.

Here’s the corrected version:

For a non-deductible donation receipt, ensure the following points are clearly stated:

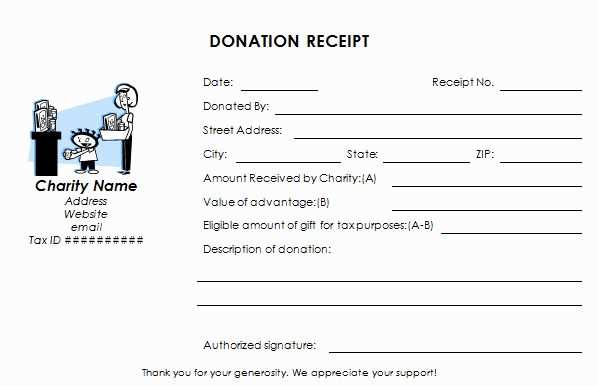

1. Donation Amount: Specify the exact amount of the cash donation. This is necessary for both the donor and the organization to have a clear record of the contribution.

2. Non-Deductible Notice: Include a clear statement confirming that the donation is non-deductible. This distinction helps avoid confusion for the donor when filing taxes.

3. Organization’s Information: Provide the full name and address of your nonprofit organization. This ensures the receipt is valid and provides verification if needed.

4. Date of Donation: Record the specific date on which the donation was made. This detail is important for both accounting and verification purposes.

5. Signature of Authorized Representative: A signature from a designated individual within the organization adds authenticity and formality to the receipt.

6. Statement of No Goods or Services Provided: Clearly state that no goods or services were exchanged in return for the donation. This statement is necessary to confirm the non-deductible nature of the donation.

By including these key elements, you’ll create a clear, professional, and accurate donation receipt for non-deductible contributions.

- Non-Profit Cash Donation Receipt Template (Non-Deductible)

A Non-Profit Cash Donation Receipt Template is a useful tool for non-profits to issue receipts for cash donations received. This specific template applies when the donation is non-deductible, meaning the donor cannot claim it as a tax deduction. It’s vital to clearly state this on the receipt to avoid any confusion.

Key Components

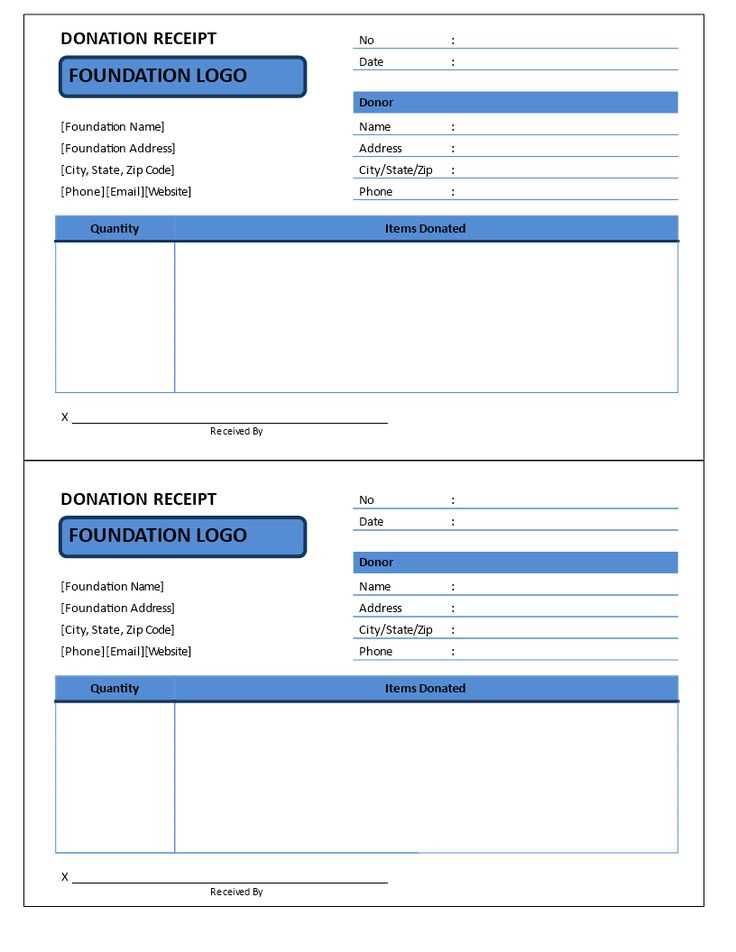

The receipt should include the following elements:

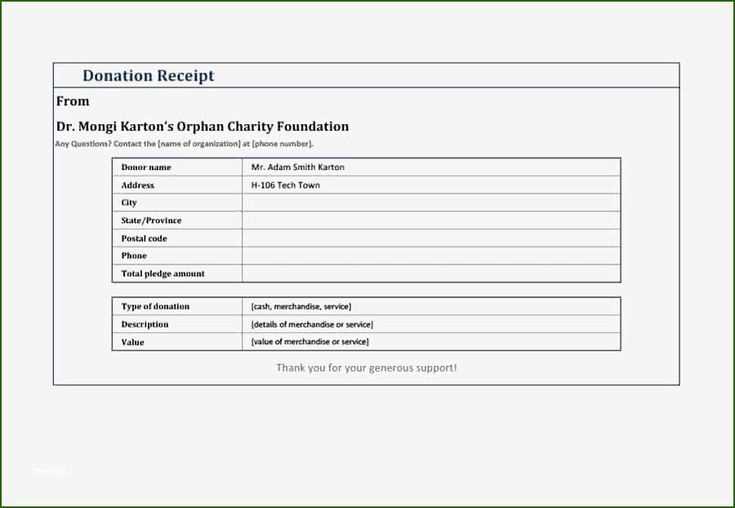

- Non-Profit Name: Clearly state the organization’s name.

- Donation Date: Include the exact date when the donation was received.

- Amount Donated: Specify the exact amount of the cash donation.

- Non-Deductible Statement: Add a note stating, “This donation is not tax-deductible” to clarify the non-deductible nature of the gift.

- Donor’s Name: Mention the full name of the donor.

- Organization’s Tax ID: Provide the organization’s tax identification number for transparency.

Example Template

Here is a simple structure for your Non-Deductible Cash Donation Receipt:

[Non-Profit Organization Name] [Non-Profit Organization Address] [Tax Identification Number] Date: [Insert Date] Received From: [Donor’s Full Name] Amount Donated: $[Amount] This donation is not tax-deductible. Thank you for your generous support! Signature: ______________________

Ensure that your receipt template is professional, clear, and accurate. This minimizes any misunderstanding with donors and helps maintain good relations. The receipt is not just a formal record; it serves as an acknowledgment of the donor’s contribution, even though the donation is non-deductible.

For non-deductible cash donations, it’s important to clearly outline that the contribution is not tax-deductible. Design a simple and straightforward receipt that highlights the key details for the donor’s reference.

Key Elements to Include

The receipt should have the following sections:

- Organization Name and Contact Information: Include the full legal name of the nonprofit, along with its address, phone number, and email.

- Donor’s Information: List the name of the donor as well as any other relevant identifying information, like address or email.

- Donation Date and Amount: Specify the exact date of the donation and the cash amount received.

- Statement on Non-Deductibility: Clearly state that the donation is not tax-deductible. For example: “This donation is a charitable contribution, but it is not eligible for a tax deduction under current tax laws.”

Formatting the Receipt

Keep the format clean and readable. Use a professional font and ensure all text is legible. Highlight the non-deductibility statement in bold or italics to make it stand out. Avoid cluttering the receipt with unnecessary details, focusing on the donation’s specifics and your organization’s info.

Conclude the receipt with a thank-you note to show appreciation for the donor’s support.

Acknowledging a non-deductible donation should be clear and concise. Include the following elements to ensure the receipt is complete and accurate:

1. Date of Donation

Always record the exact date the donation was made. This ensures there is no ambiguity about the timing of the gift.

2. Donor’s Name and Contact Information

List the full name of the donor and, if applicable, their contact details such as address, phone number, or email. This helps avoid confusion for both parties, especially if multiple donations are made throughout the year.

3. Donation Amount

State the amount of money donated. If it’s a cash donation, clearly indicate the dollar amount. For non-cash gifts, specify the nature and approximate value of the donation.

4. Statement Clarifying Non-Deductibility

Since the donation is not tax-deductible, provide a direct statement such as: “This donation is not tax-deductible.” Be transparent about the non-deductible status to prevent any misunderstandings.

5. Organization’s Details

Include the legal name of your nonprofit organization and your tax-exempt status, such as your IRS or other relevant tax authority identification number. This provides clarity on the legitimacy of your organization.

6. Signature of an Authorized Person

To validate the receipt, include the signature of an authorized individual from your organization. This adds credibility and authenticity to the acknowledgment.

These elements ensure the acknowledgment is comprehensive, straightforward, and legally sound. Avoid unnecessary information, and focus on the details that are relevant for both the donor and the organization.

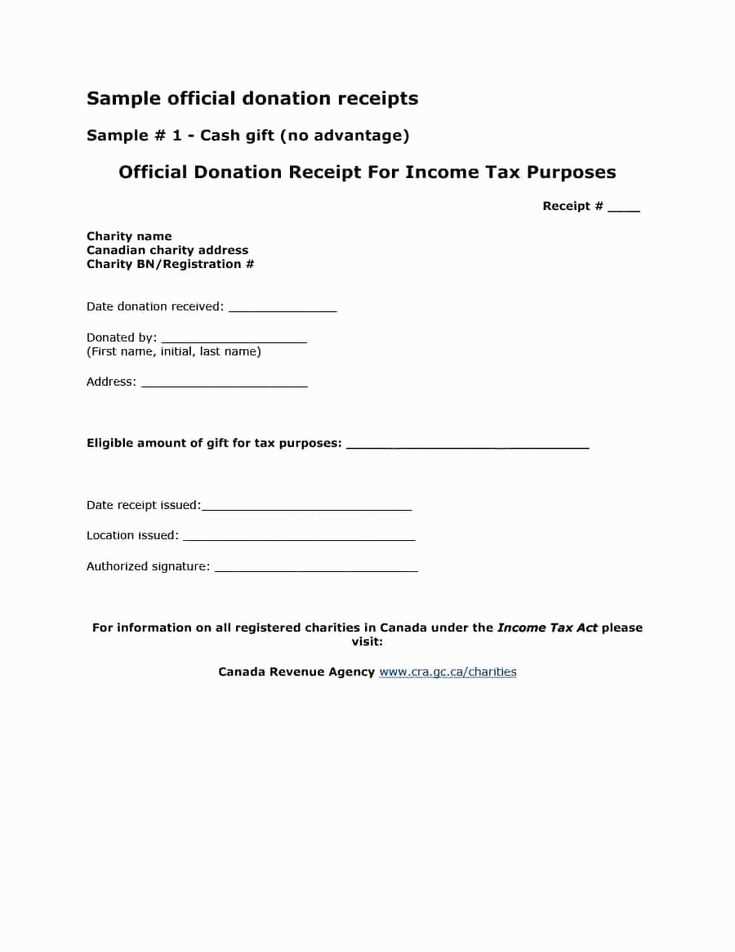

When issuing donation receipts for non-deductible gifts, clarity is key. Tax authorities require precise documentation, especially for non-deductible contributions. Non-deductible donations do not provide the donor with tax benefits, so it’s important to reflect this in the receipt. Follow these guidelines:

1. State the Non-Deductible Nature of the Gift

- Clearly indicate that the donation is not tax-deductible. This prevents any misunderstandings with the donor about potential tax benefits.

- For example, include a statement like: “This is a non-deductible gift and does not qualify for a charitable tax deduction.”

2. Avoid Misleading Language

- Avoid using phrases that could imply a tax deduction, such as “tax-deductible” or “tax benefits,” in relation to non-deductible gifts.

- Donors should not be left with the impression that they can claim a deduction for the contribution when they cannot.

3. Confirm the Purpose of the Donation

- Specify the intended use of the donation. For non-deductible gifts, donors often give without expecting tax relief, so being transparent about the purpose reinforces the nature of the contribution.

4. Legal Language for Non-Deductible Donations

- Use appropriate legal language to protect both the organization and the donor. The receipt should affirm the organization’s compliance with tax laws and guidelines surrounding non-deductible donations.

5. Be Aware of Local Tax Regulations

- Some jurisdictions may have specific rules for non-deductible donations. Ensure your receipts align with local requirements to avoid any legal issues for both the organization and the donor.

- Consult a tax professional or legal expert to ensure compliance with relevant tax laws for non-deductible gifts.

Nonprofit Cash Donation Receipt: Non-Deductible Template Guidelines

To issue a non-deductible donation receipt, it’s important to specify that the donation does not qualify for a tax deduction. This ensures clarity for the donor, preventing any misunderstandings about the tax status of their contribution.

Key Components to Include

Include the following in the receipt:

- Donor’s name and address

- Amount donated

- Date of the donation

- Statement that the donation is non-deductible

- Nonprofit’s name, address, and tax-exempt number

Template Example

The template should clearly state that the contribution is not eligible for tax deductions. Here’s a basic structure:

| Component | Details |

|---|---|

| Donor’s Information | Donor’s full name, address |

| Donation Amount | Specify total donation amount |

| Donation Date | Include date of donation |

| Non-Deductible Statement | Clear note indicating the donation is non-deductible for tax purposes |

| Nonprofit Details | Name, address, and tax-exempt ID number |

Make sure to use clear and precise language. Avoid any confusion regarding the nature of the donation and its tax status.