Donation Receipt Template for Non-Cash Items

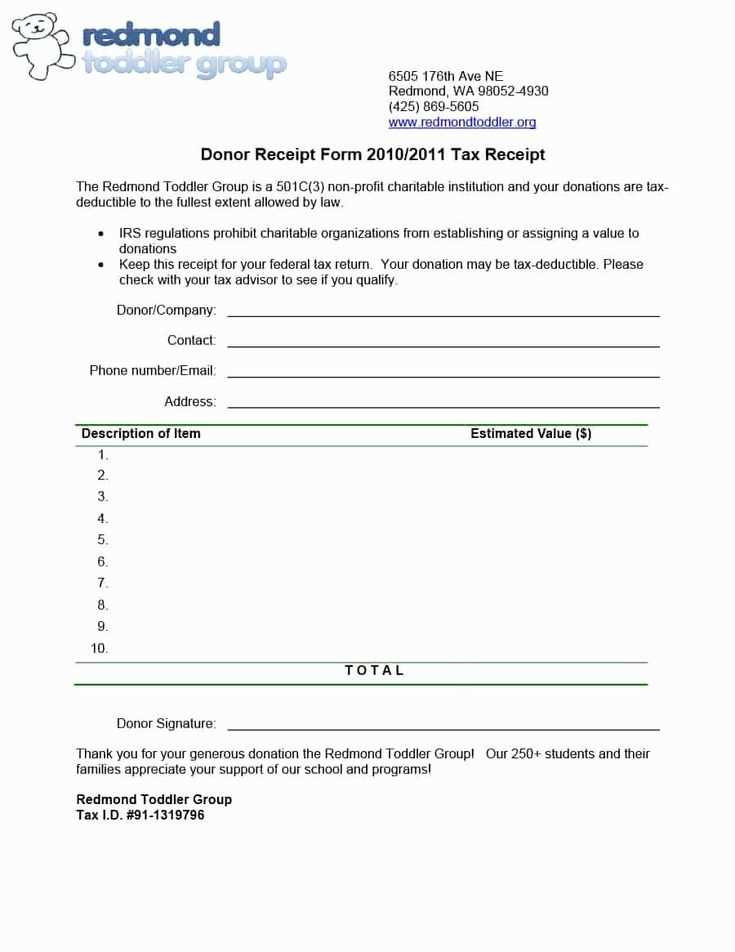

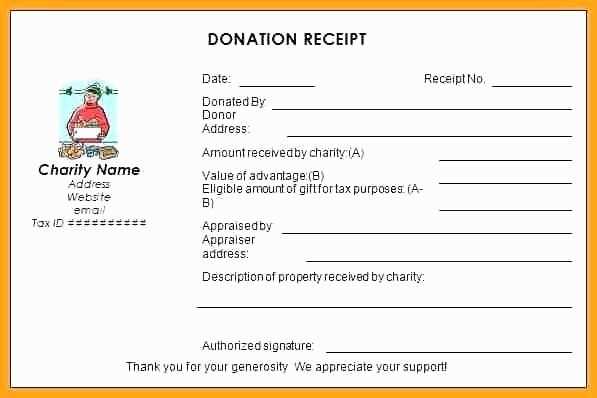

For non-cash contributions such as clothing, electronics, or other goods, provide a receipt that acknowledges the donation. The receipt should include key information to meet tax requirements. Use the following template to create a clear, concise letter for your donors:

Non-Cash Donation Receipt Template

Dear [Donor’s Name],

We gratefully acknowledge the donation of [list donated items] received on [date]. The estimated fair market value of the items donated is [value of items]. We thank you for your generosity and support. Your contribution helps us [mention the specific impact of the donation on your organization].

Details of Donation:

- Donor Name: [Donor’s Full Name]

- Address: [Donor’s Address]

- Donation Date: [Date of Donation]

- Description of Donated Items: [Detailed list of items]

- Fair Market Value: [Value of Donation]

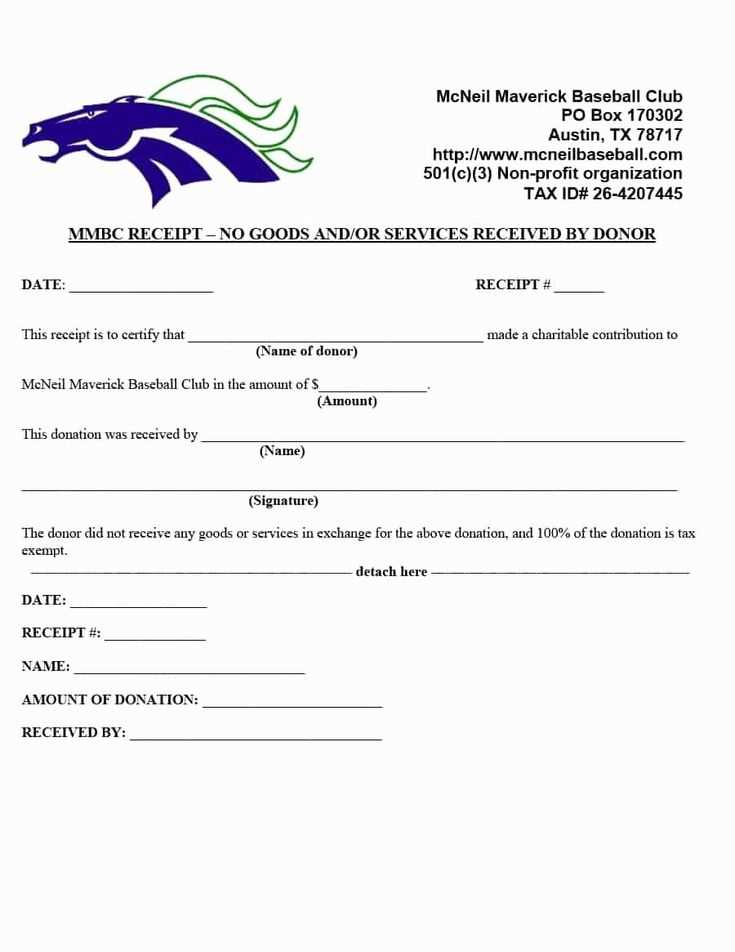

This letter serves as a receipt for tax purposes. No goods or services were provided in exchange for this donation.

Organization Details:

- Organization Name: [Non-Profit’s Name]

- Address: [Organization’s Address]

- Tax ID Number: [Tax Identification Number]

Thank you once again for your contribution. Your support makes a significant difference in helping us achieve our mission.

Sincerely,

[Your Name]

[Your Title]

[Organization Name]

[Contact Information]

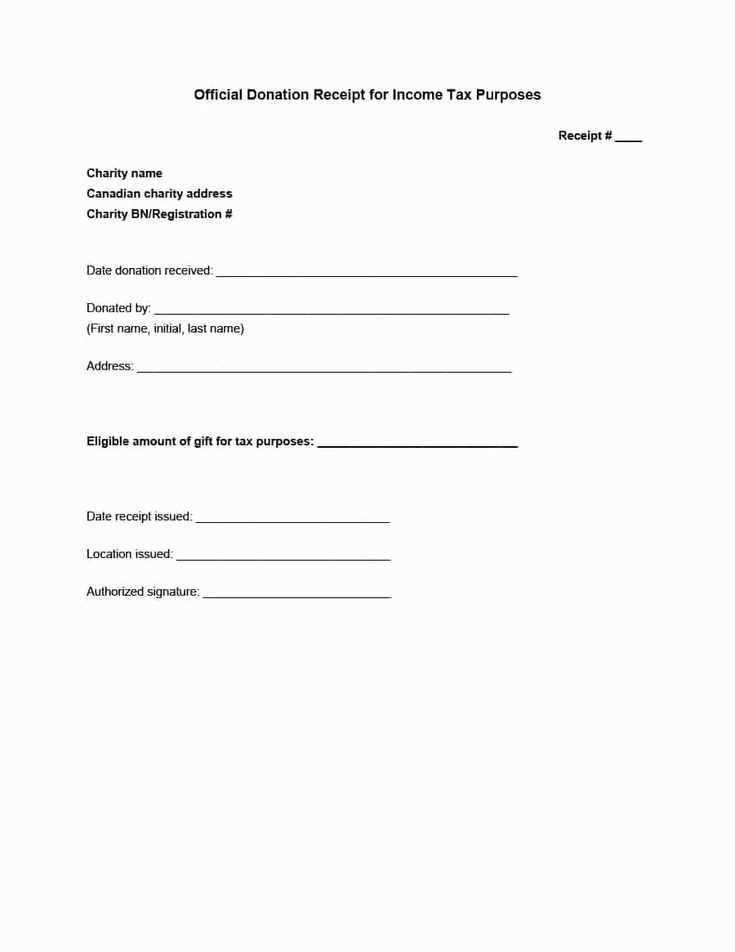

Key Points to Include in a Donation Receipt for Non-Cash Contributions

- Donor Information: Always include the donor’s name and address.

- Donation Details: Provide a detailed list of the items donated, including their description and estimated fair market value.

- No Goods or Services Provided: State that no goods or services were exchanged for the donation.

- Tax ID Number: Include the non-profit’s tax identification number for verification purposes.

Non-Profit Donation Receipt Letter Template for Non-Cash Contribution

For accurate documentation of non-cash donations, follow these steps to create a clear and concise receipt letter:

Detailed Steps for Writing a Non-Cash Donation Receipt Letter

Begin the letter with your organization’s name, address, and the date. Include a statement confirming the receipt of the donation, and specify the description of the donated item(s), including the condition of the items. Acknowledge that no goods or services were provided in exchange for the donation. End with a thank-you note, reinforcing the donor’s contribution.

Key Information for Tax Deduction Purposes

Include the following for tax deduction purposes:

- Organization’s legal name and tax-exempt status

- Detailed description of the donated items, including their estimated fair market value

- Statement confirming no goods or services were exchanged for the donation

- Donor’s name and address

- Donation date

Ensure that all information is accurate and clear to prevent any complications during tax filing.

Best Practices for Acknowledging Non-Cash Donations

Express genuine appreciation for the donor’s contribution. Acknowledge the value and significance of their non-cash donation. Follow up with a reminder that the donor is responsible for valuing the donated items. Include your contact information in case the donor has further questions. This approach ensures transparency and strengthens your relationship with the donor.