When you need a fast and professional way to issue receipts, an online cash receipt template is the perfect solution. This template simplifies the process of recording transactions, whether for small businesses, freelancers, or personal use. Instead of creating receipts from scratch every time, you can use a template that already includes the necessary fields for accurate documentation.

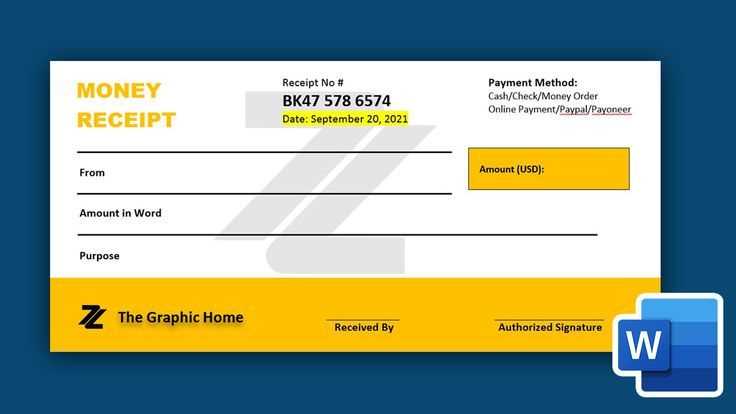

Start by customizing the template with your business information–name, address, and contact details. Include the date, amount received, payment method, and a unique receipt number. This ensures that every receipt is traceable and clear for both you and your customers. Many online templates even allow you to add items or services sold, making them a great tool for detailed transaction records.

By choosing a well-structured template, you can maintain consistency across all your receipts. This not only saves you time but also helps in organizing your financial records. Some templates even include an option for adding taxes or discounts, which is ideal for businesses that need to track additional charges or offers.

Whether you need to print the receipt or send it electronically, online templates offer flexibility in how you distribute them. This feature makes them ideal for various business environments, from retail stores to service providers. Investing a bit of time into setting up a template now means less hassle and better documentation in the long run.

Here are the corrected lines:

The following changes improve the clarity and accuracy of your cash receipt template:

- Ensure the header includes the correct company name and address at the top.

- Replace “Amount Paid” with “Total Payment” for better clarity.

- Include a field for “Receipt Number” to track transactions more effectively.

- Clearly define the payment method (Cash, Credit, Debit) in a separate line.

- Ensure the “Date of Payment” is displayed prominently in the top right corner.

- Provide a “Signature” field to confirm receipt by the customer.

- Include a “Description of Goods/Services” section to outline the purpose of the payment.

- Specify taxes or additional fees in a distinct line, if applicable.

- Review the footer to make sure the company’s contact details are up-to-date.

By making these updates, the template becomes clearer and more professional for both the issuer and the recipient.

- Online Cash Receipt Template

An online cash receipt template should clearly state the transaction details, providing transparency for both the payer and the receiver. It is crucial to include specific fields like the date, receipt number, payer’s name, the amount paid, and the payment method. Include a space for both parties to sign or confirm the transaction digitally for added authenticity.

Key Sections to Include

The template should have the following sections:

- Date of Transaction – Include the exact date the cash was received.

- Receipt Number – A unique identifier for each receipt.

- Payer’s Information – Include the full name and contact details of the individual or company making the payment.

- Amount Paid – Clearly state the amount received in both numerical and written form.

- Payment Method – Specify whether the payment was made in cash, cheque, or any other method.

- Transaction Description – A brief note explaining what the payment is for.

- Signatures or Confirmation – Space for signatures or an electronic confirmation of receipt from both the payer and receiver.

Benefits of Using a Template

Using an online cash receipt template helps maintain consistency across transactions. It reduces the likelihood of errors and ensures that all necessary information is captured. Additionally, templates make it easier to track payments, especially in businesses with high-volume transactions. This system also aids in legal and financial documentation, should any disputes arise in the future.

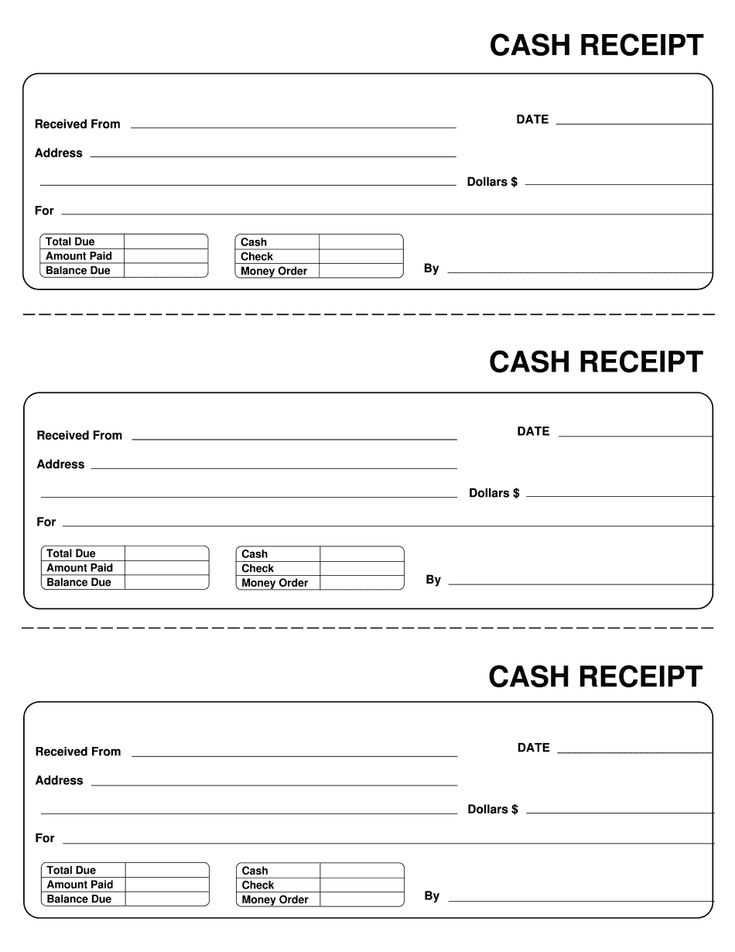

Adjust your cash receipt template to align with your business’s needs. Customize fields such as the company name, address, and contact information to ensure that your receipt reflects your brand. This allows customers to easily recognize your business in the transaction.

Add a unique receipt number to each document for better tracking and reference. This can be automated through your accounting software or manually added in the template.

Ensure the payment details section is clear. Include the date of transaction, method of payment (cash, credit card, etc.), and the amount paid. A breakdown of items or services purchased should be included if necessary, which helps maintain transparency.

Consider adding a section for tax calculation if applicable. Some businesses may need to specify tax rates or include a separate tax total in the receipt.

Finally, customize the footer with your return policy, website URL, or customer service contact details. This adds value and enhances the professional appearance of your receipts.

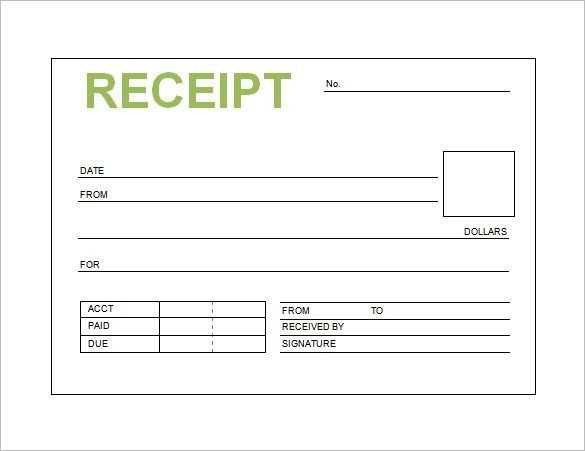

| Field | Details |

|---|---|

| Company Information | Customize with business name, address, and contact details. |

| Receipt Number | Unique identifier for each transaction. |

| Payment Method | Indicate whether the payment was made by cash, card, or another method. |

| Item Breakdown | List the items or services purchased, including prices and quantities. |

| Tax Information | Include tax rates and amounts where applicable. |

| Footer | Provide return policy, website link, or customer support contact. |

Ensure the receipt contains accurate details, including the correct date, amount, and description of the transaction. A common mistake is failing to double-check the amount, which can lead to discrepancies later.

Don’t forget to include both the buyer’s and seller’s contact information. Missing details like this may cause confusion or disputes if follow-up is needed.

Avoid vague descriptions. Be specific about the purpose of the transaction, whether it’s for goods, services, or a combination of both. Ambiguous notes can cause misunderstandings or problems with record-keeping.

Never skip the receipt number or transaction ID. These numbers are crucial for reference and tracking purposes. Without them, finding a particular transaction later can become cumbersome.

Don’t overlook the importance of signature fields. While not always legally required, including a space for both parties to sign can prevent potential challenges to the transaction’s authenticity.

Be cautious with formatting errors. Misplaced decimal points or unclear handwriting can lead to confusion or disputes. Always check that all information is legible and properly aligned.

Refrain from using informal language. A professional tone helps to reinforce the legitimacy of the transaction and minimizes any chance of confusion.

Integrating a cash receipt template with accounting software simplifies tracking and managing transactions. Begin by ensuring your accounting software supports importing or creating custom templates. Most modern systems, like QuickBooks or Xero, allow users to upload templates or create forms within the software.

Step 1: Customize Your Template

Before integration, tailor your cash receipt template to reflect necessary details such as transaction date, payer information, amount, and payment method. Ensure all relevant fields align with your software’s requirements, including invoice numbers or payment references. This avoids mismatches and keeps your records accurate.

Step 2: Import the Template

Once customized, check if your software allows direct importing of template files (such as CSV or Excel). Alternatively, use built-in tools within the software to create a similar template. Some software even provides drag-and-drop functionality to upload the template quickly.

After import, test the system by processing a dummy transaction. Check if all information from the receipt appears correctly in your financial records. If needed, adjust the mapping of fields in the software to ensure compatibility with your template’s structure.

By integrating your receipt template seamlessly, you reduce manual data entry errors and improve overall transaction accuracy.

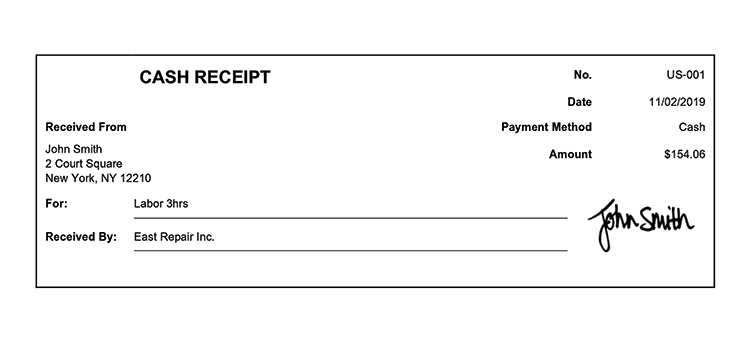

To create a clear and professional online cash receipt, ensure you include all necessary details. Start with a unique receipt number for easy tracking. Add the date of the transaction, buyer’s name, and contact information. Specify the items or services purchased with corresponding prices. Make sure to clearly indicate the total amount paid and any applicable taxes. Include a section for payment methods, such as cash, credit, or debit. Finally, always provide a space for both the seller’s signature and the buyer’s signature to validate the transaction.

Important Fields to Include

Receipt Number: This serves as an identifier for the transaction and ensures proper record-keeping.

Date: The date the transaction occurs helps track the timing of payments.

Buyer and Seller Information: Including both parties’ contact details adds transparency and accountability.

Additional Considerations

Payment Method: Specify how the payment was made (e.g., cash, credit, or debit) to avoid any confusion. This provides clarity for both parties involved in the transaction.

Signature Section: Including a signature space verifies that both parties agree to the transaction terms.