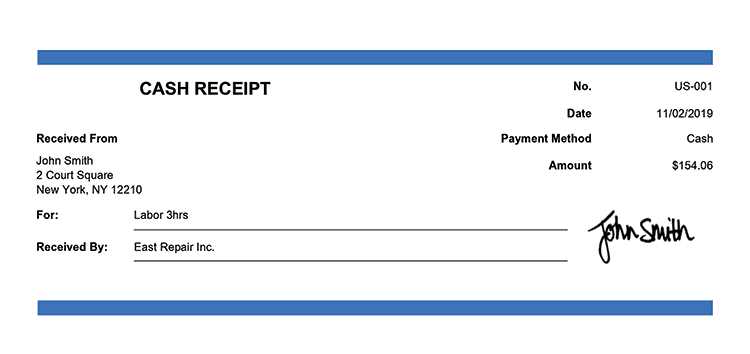

If you have paid in cash for goods or services and need a tax receipt, you can create a simple template to meet your needs. A tax receipt provides proof of payment and helps you maintain accurate financial records for tax purposes. You can easily customize the template with the required details, such as the amount paid, date of payment, and the name of the service provider or vendor.

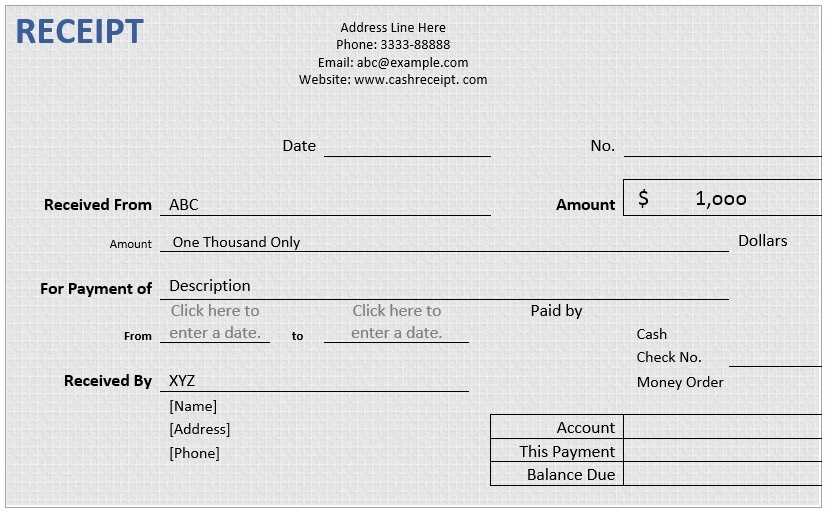

Start by including the name and contact information of the vendor, followed by the transaction details. Clearly state the amount paid in cash, any applicable taxes, and a description of the service or goods purchased. Be sure to include a signature or stamp to validate the receipt. This will ensure the document holds legal weight in case of any audits or inquiries.

By using this template, you can easily track your payments and be prepared for tax filing. It also ensures you comply with any local regulations regarding payment documentation and receipts. Simply adjust the template to suit your specific transaction details for a clean and accurate record.

Here’s a version with minimized repetition:

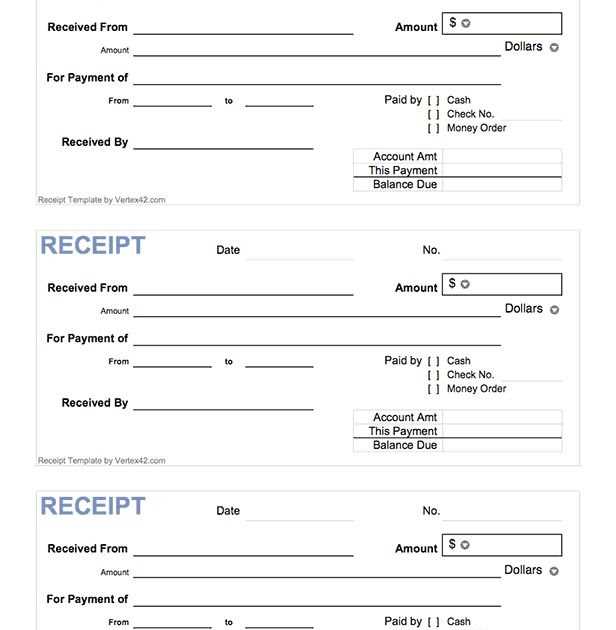

To create a tax receipt template for cash payments, include the following key elements:

| Element | Description |

|---|---|

| Date of Payment | Clearly state the date when the payment was made. |

| Amount Paid | Indicate the exact amount paid in cash. |

| Recipient’s Name | Provide the name of the person or business receiving the payment. |

| Payment Method | Specify that the payment was made in cash. |

| Transaction Description | Briefly explain the purpose of the payment (e.g., service, goods purchased). |

| Signatures | Include spaces for both the payer and recipient to sign. |

Ensure all fields are completed correctly to avoid any confusion. A simple format will suffice, but make sure all necessary details are included.

- On the Receipt: Formatting Tips for Clear and Professional Invoices

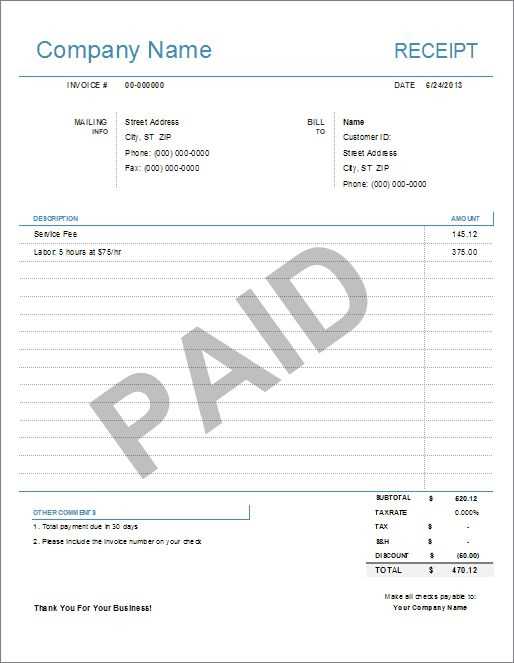

Ensure the receipt contains a clear, consistent format. Start with your business name and contact details at the top, followed by the date of transaction. This helps in easily identifying the document and its context.

Include a unique invoice number. This prevents confusion and makes it easy to track payments. Organize the items or services in a clear table format, listing the description, quantity, price, and any taxes separately.

Clearly state the total amount due, ensuring it is easily distinguishable from other figures on the receipt. Avoid clutter by leaving sufficient spacing between sections.

Lastly, always use legible fonts and avoid excessive use of colors. This keeps the focus on the important information and maintains a professional appearance.

Provide a receipt immediately after receiving cash payments. This shows transparency and protects both the payer and the payee in case of disputes.

Key Moments to Issue a Proof of Payment

- After the full payment is made, whether for goods or services.

- Whenever a customer requests a record of the transaction for their own reference.

- In cases where there is a formal agreement or requirement to provide a payment record.

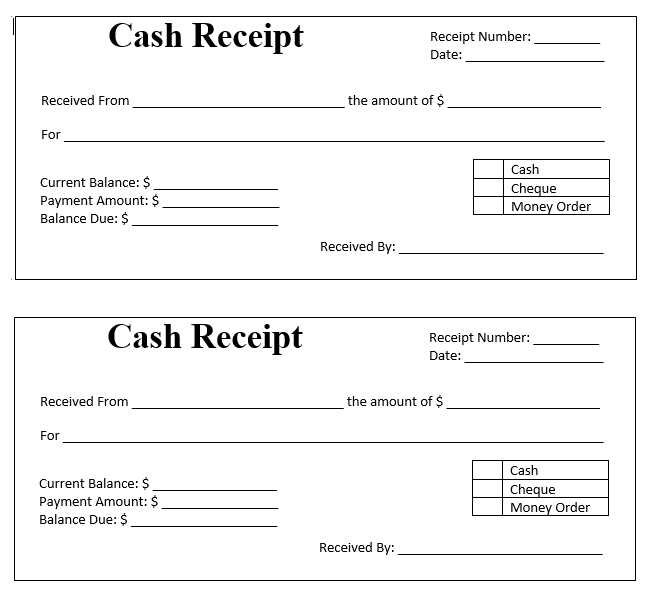

How to Format the Proof of Payment

- Include the date and amount paid.

- Clearly mention the purpose of the payment, whether it’s for a product, service, or deposit.

- Provide the details of both the payer and the payee (names, addresses, or business identifiers).

- Ensure the document is signed, especially in the case of larger transactions.

Ensure your tax receipt meets all legal requirements by including specific details that confirm the transaction. These elements protect both you and your customer from potential tax issues.

Required Elements

- Business name, address, and tax identification number

- Receipt issue date

- Clear breakdown of items or services purchased

- Amount paid, including taxes, if applicable

- Method of payment

- Signature or name of the issuing party

Check Local Laws

Verify that your receipt template adheres to specific tax laws in your jurisdiction. Different regions have distinct regulations regarding what information is necessary for legal compliance. Double-check your template against local rules to avoid issues later.

Keep receipts in a well-organized system that makes retrieval easy when needed. Consider sorting receipts by category, such as purchases, services, or charitable donations. This way, it’s faster to find specific receipts when tax season arrives or for any expense tracking purpose.

Use Digital Tools

Scan paper receipts and store them in a cloud service or dedicated receipt-management app. This reduces physical clutter and ensures easy access from any device. Always label files with relevant details like the purchase date, amount, and vendor name.

Physical Storage Solutions

If you prefer keeping paper receipts, use a filing system with labeled folders or envelopes. You can categorize them by month, vendor, or type of expense. Make sure the storage location is dry and cool to prevent wear and tear.

To create a tax receipt for cash payments, make sure it includes key information such as the date of the transaction, the amount paid, the names of both parties involved, and a description of the goods or services exchanged. This will provide clear documentation for tax purposes.

What to Include

Clearly state the payment method as cash and include the exact amount paid. Add a unique receipt number for easy tracking. If applicable, specify the tax rate and the amount of tax charged on the transaction. Always sign the receipt to confirm its authenticity.

Why It Matters

Providing a detailed receipt protects both the payer and the recipient in case of disputes and ensures that all transactions are properly recorded for tax filing. This documentation can help prevent any misunderstandings and simplify financial audits.