Need a simple way to document cash transactions? A personal cash receipt template helps you track payments, avoid disputes, and maintain clear financial records. Whether you’re lending money, selling items, or receiving payments, a structured receipt ensures transparency.

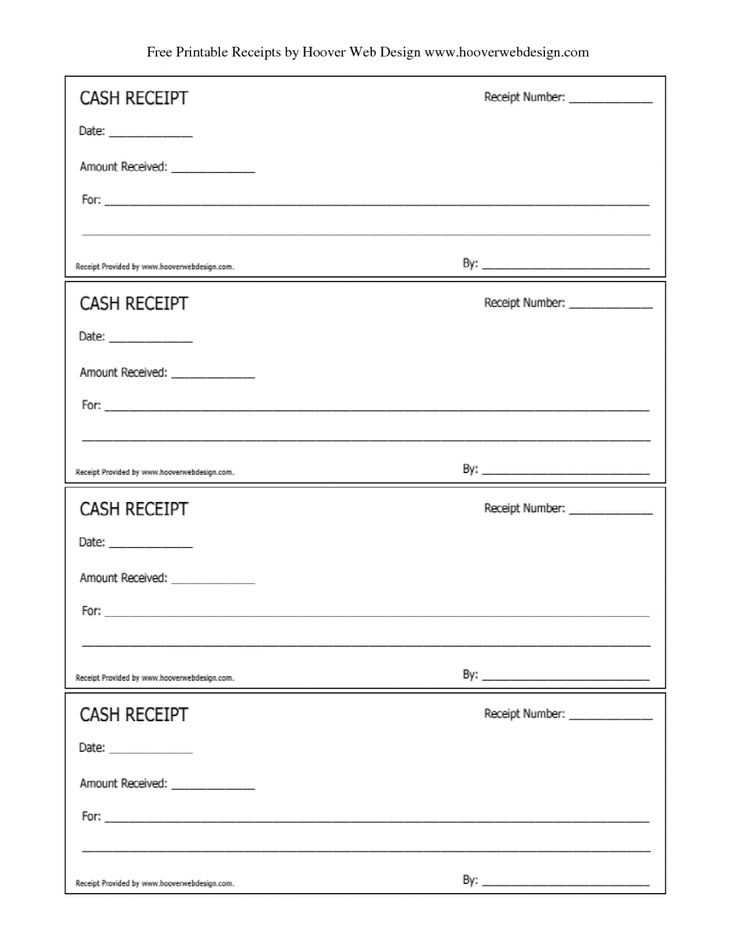

Include key details: date, amount, payer’s name, receiver’s name, and a brief description of the transaction. A handwritten or printed receipt with a signature adds authenticity. If dealing with larger sums, consider numbering receipts for easy tracking.

For digital use, create a reusable template in Google Docs or Excel. A simple table with labeled fields makes it easy to fill in details. Save completed receipts as PDFs for better organization.

A well-structured receipt protects both parties and simplifies record-keeping. Customize your template to fit your needs, and always keep copies for future reference.

Here’s a refined version of your list with reduced repetition while maintaining clarity and correctness:

Key Elements of a Personal Cash Receipt

Date: Always include the transaction date to maintain accurate records.

Payer and Payee Information: Clearly state who made and received the payment.

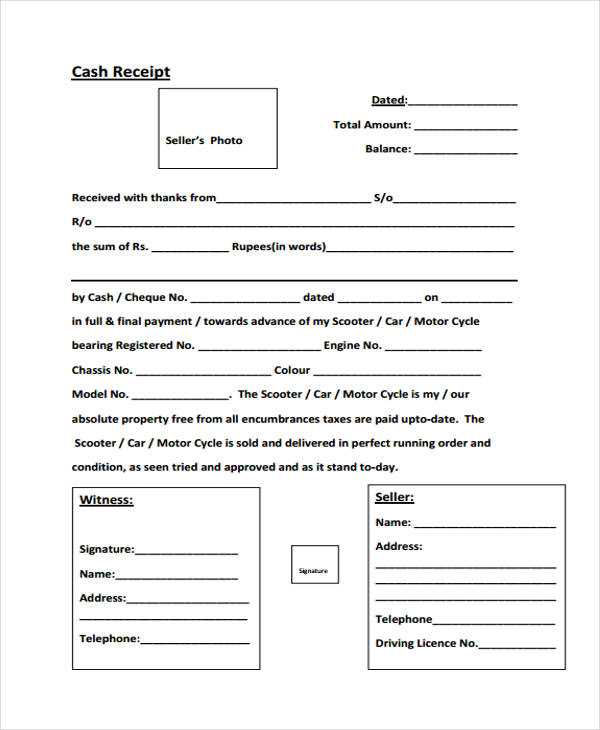

Amount Received: Specify the exact sum, both numerically and in words, to prevent discrepancies.

Payment Method: Indicate whether the transaction was completed via cash, check, or another method.

Reason for Payment: Provide a brief description, such as “Rental Payment for March” or “Consulting Fee.”

Receipt Number: Assign a unique identifier for easy tracking.

Signature: Ensure both parties sign to confirm the transaction’s authenticity.

Additional Tips for Accuracy

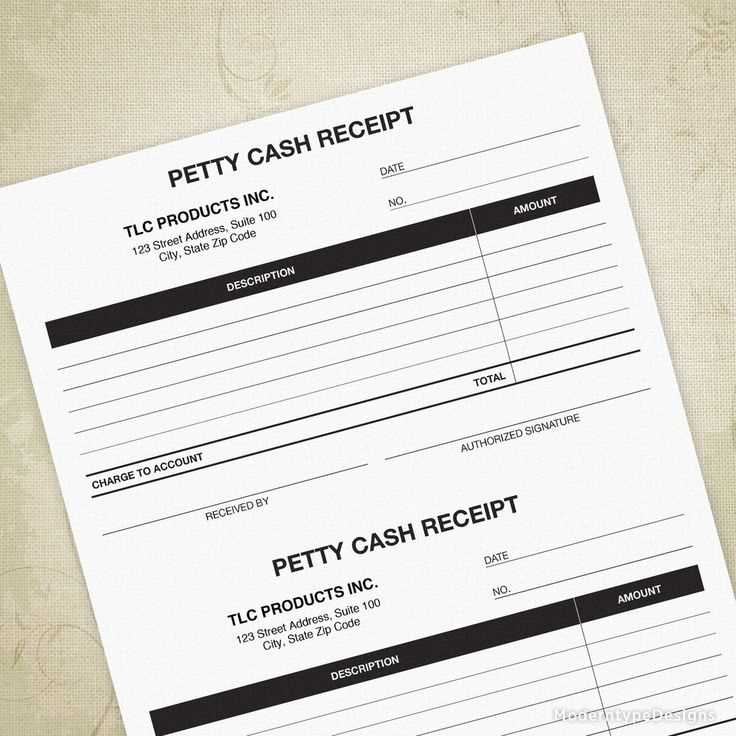

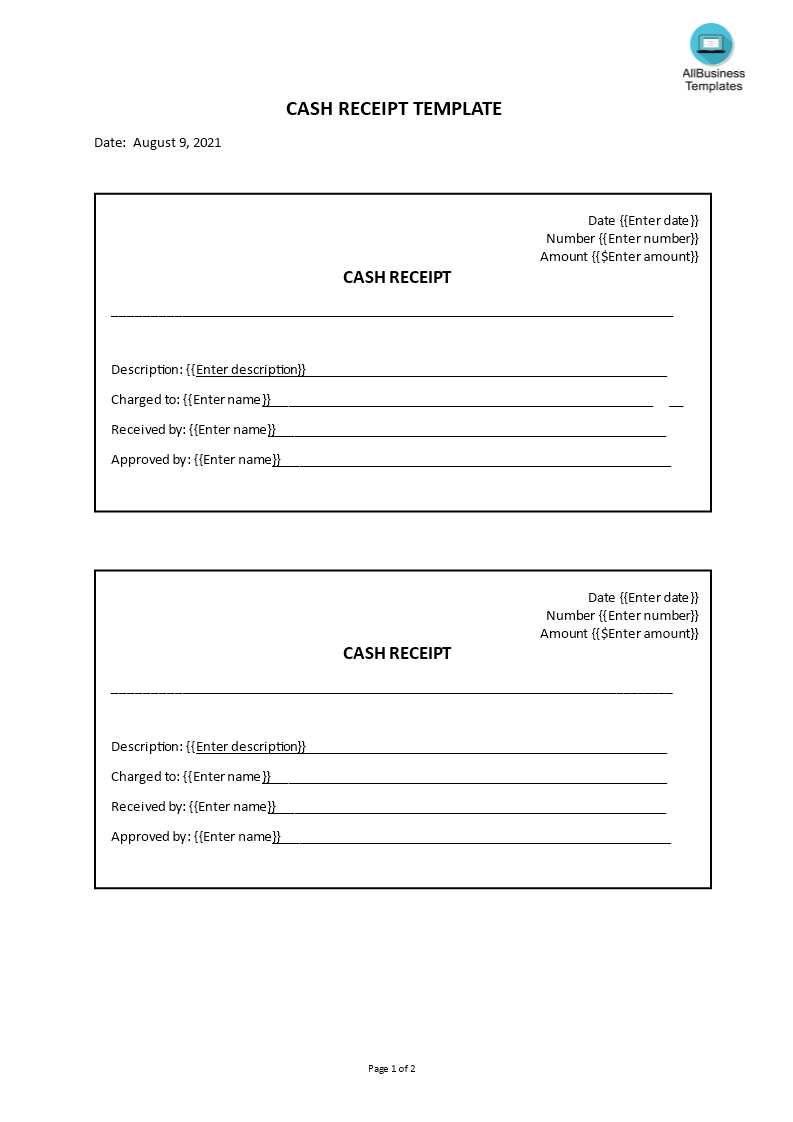

Use a Template: A standardized format prevents missing details.

Store Copies: Keep both digital and physical copies for reference.

Verify Details: Double-check all amounts and names before finalizing.

- Personal Cash Receipt Template

Use a structured personal cash receipt template to track cash transactions accurately. Include key details to ensure clarity and prevent disputes.

Essential Fields

- Receipt Number: Assign a unique number for easy reference.

- Date: Specify the transaction date.

- Payer and Payee Details: Include full names and contact information.

- Amount: Clearly state the received sum.

- Payment Method: Indicate if it was cash, check, or another method.

- Purpose: Describe the reason for the payment.

- Signature: Obtain signatures from both parties for verification.

Formatting Tips

- Use a simple table layout for readability.

- Ensure all fields are clearly labeled.

- Print copies for both the payer and the payee.

A well-structured template saves time and ensures financial transparency.

Ensure every cash receipt includes the date of the transaction. This confirms when the payment was made and helps track financial records.

Payer and Payee Information

Clearly state the payer’s name and payee’s details, including the business or individual receiving the payment. This prevents disputes and ensures proper documentation.

Payment Details

List the amount paid in both numbers and words to avoid misinterpretation. Specify the payment method (cash, check, or other forms) for accurate bookkeeping.

Include a description of the transaction, detailing what the payment covers. If applicable, note any taxes or additional fees.

Conclude with a unique receipt number for tracking and reference. If issued by a business, add a signature or stamp to validate authenticity.

Use a structured layout to make the personal cash receipt easy to read. Organize sections logically and keep the information concise.

- Header: Place the receipt title at the top in bold text to make it immediately recognizable.

- Date and Receipt Number: Align these to the right to ensure quick reference.

- Payer and Payee Details: List names and contact information clearly, using separate lines for each.

- Payment Breakdown: Use a table or bullet points to separate item descriptions, quantities, and amounts.

- Total Amount: Highlight this field by using bold text or a larger font.

- Payment Method: Indicate whether the payment was made in cash, by check, or another method.

- Signature Line: Leave space for both parties to sign, confirming the transaction.

Keep margins wide and use a readable font. Avoid excessive styling–simplicity ensures clarity.

Always include the full name and contact details of both the seller and the buyer. This ensures clarity in case of disputes or tax audits.

Mandatory Information

| Requirement | Details |

|---|---|

| Date of Transaction | Specify the exact date when the payment was made. |

| Unique Receipt Number | Use a sequential numbering system to track transactions. |

| Payment Method | Indicate whether the payment was made in cash, by card, or another method. |

| Amount Paid | Write the total amount in both numerical and written form. |

| Description of Goods/Services | Provide a clear breakdown of what was purchased. |

Compliance with Tax Regulations

Ensure the receipt aligns with local tax laws. If required, include VAT or sales tax details. For businesses, maintaining copies for a set period (e.g., five years) helps meet legal obligations.

Digital receipts must meet the same standards as paper copies. Electronic storage should follow data protection laws to prevent unauthorized access.

Signatures or digital stamps may be necessary for legal validity in some regions. Always verify local requirements to avoid compliance issues.

Digital receipts offer greater convenience for organizing and storing transactions. They eliminate the need for physical storage, making it easier to access and review purchases from any device. Additionally, many digital receipts automatically integrate with accounting or expense management software, streamlining record-keeping processes.

Benefits of Digital Receipts

One of the key advantages of digital receipts is their environmental impact. By reducing paper usage, you contribute to sustainability efforts. Furthermore, digital receipts can be easily backed up, reducing the risk of loss due to accidental damage or misplacement. Many retailers also send digital receipts via email or apps, allowing for immediate access and tracking of purchases.

Challenges of Paper-Based Receipts

Paper receipts often fade over time and may become unreadable, especially in the case of thermal printing. They can also accumulate quickly, cluttering physical spaces. Unlike digital receipts, paper receipts do not offer the same level of convenience for searching or organizing. In addition, there is always the risk of losing them, which can be problematic for returns or warranty claims.

Choosing between digital and paper receipts depends on personal preference and organizational needs. For better organization and eco-friendly practices, digital receipts are the recommended option, while paper receipts still serve as a reliable fallback in situations where digital options are unavailable.

Adjust your receipt template to match specific transaction types. For cash payments, include a section for exact change. For credit card transactions, add a line for card type and authorization code. If offering discounts, create a field to show the amount or percentage discounted. For refunds, include details about the original purchase to ensure clarity. Tailor each receipt to provide all necessary information relevant to the transaction, helping customers understand the breakdown of costs. Use a modular template that can easily be updated for different types of sales or returns. Make sure the receipt always reflects the transaction clearly and accurately, avoiding confusion and ensuring proper documentation for both parties.

Focus on providing clear and accurate information in the receipt. Ensure that the total amount is correct and clearly visible. Double-check the spelling of the buyer’s name and other details to avoid any confusion. Missing these small but important elements can lead to misunderstandings or disputes.

Don’t forget to include all necessary transaction details, such as payment method and item description. Omitting any information may cause issues in the future if the receipt is ever needed for proof of purchase or warranty claims.

Avoid using ambiguous or unclear formatting. A cluttered or difficult-to-read receipt will cause frustration for both the buyer and seller. Use clear fonts, proper spacing, and make sure the important details stand out.

Ensure the date and time of the transaction are listed correctly. Inaccurate or missing timestamps can lead to complications when the receipt is used for returns or tax purposes.

Lastly, don’t forget to personalize the receipt with your business’s name, logo, and contact information. This not only makes the receipt look more professional but also helps with any customer inquiries or follow-up.

Streamlining the Personal Cash Receipt Template

To maintain clarity and avoid unnecessary repetition, consider simplifying the structure of your personal cash receipt template. Start with essential details like the date, amount, and the payer’s information. Incorporate a brief description of the transaction, ensuring that the document serves its purpose without redundancy. Keep the language direct, emphasizing the payment method and any specifics about the goods or services exchanged.

Structure the Template for Simplicity

A straightforward approach helps prevent confusion. Use labels such as “Amount Received” and “Transaction Description” rather than repeating the term “Cash Receipt” multiple times. This approach enhances readability and minimizes clutter.

Practical Tips for Clear Documentation

Always ensure that the amount is clearly stated, possibly with both numbers and words, to avoid errors. If you’re including a receipt number, place it at the top for easy reference. Keep the tone neutral, focusing on accuracy and clarity without unnecessary flourishes.