A personal cash transaction receipt template is a straightforward tool to document cash payments, offering a simple yet effective way to keep track of financial exchanges. This template provides a clear structure to include all necessary details, ensuring that both parties have a reliable record for their personal accounting needs.

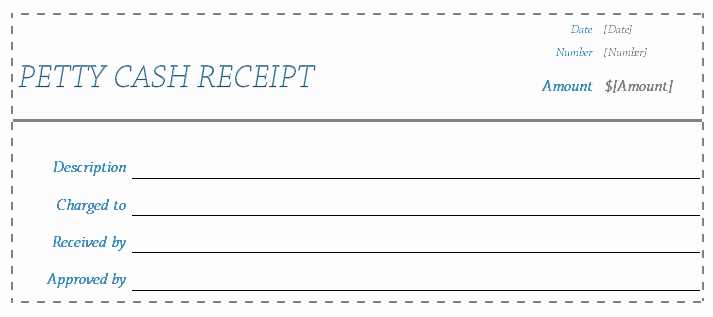

Start by including the date of the transaction. This helps in organizing receipts chronologically, making it easier to reference later. Next, write a description of the goods or services exchanged. Be specific to avoid any confusion later on. The amount should be clearly stated in both numbers and words for added clarity.

To ensure transparency, make room for both the payer’s and receiver’s names, along with any additional notes that could clarify the transaction. This might include payment methods or any agreed-upon terms. A signature line provides an extra layer of formality, confirming that both parties acknowledge the transaction took place.

Having a template at hand simplifies creating receipts on the spot, ensuring you don’t miss any critical details. It also allows for easy replication whenever necessary, saving you time while maintaining organization in your financial records.

Here’s the revised text based on your request:

To create a personal cash transaction receipt, include the following key elements:

Transaction Details

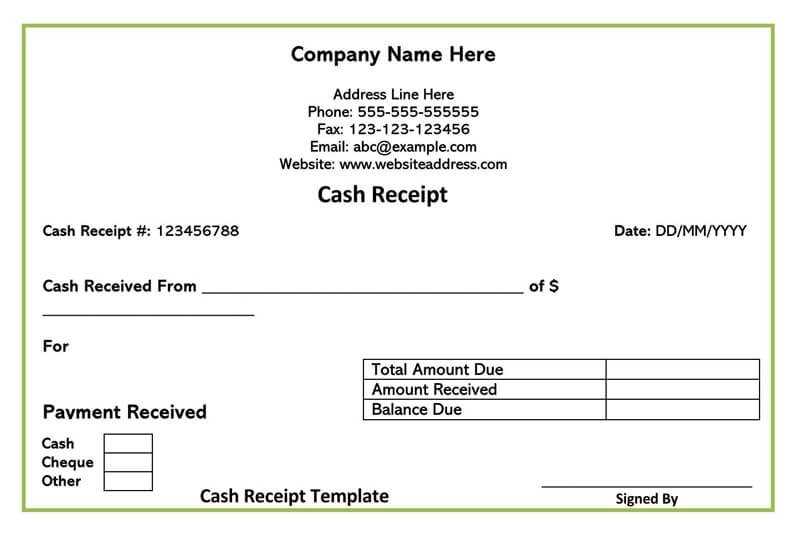

Start with the transaction amount, including both the total and any applicable taxes. Specify the currency and ensure the amount is clearly stated to avoid confusion.

Seller and Buyer Information

List the names of the seller and buyer, along with their contact details, such as phone numbers or email addresses. If the transaction involves a business, include the company name and address as well.

Ensure that both parties have access to a copy of the receipt for future reference or potential disputes.

Personal Cash Transaction Receipt Template

How to Create a Basic Cash Receipt Template

Key Information to Include in a Receipt

Customizing Your Template for Different Types of Transactions

How to Design a Receipt Template for Printing

Digital Receipts: Tools and Formats for Easy Tracking

Legal Requirements and Best Practices for Cash Receipts

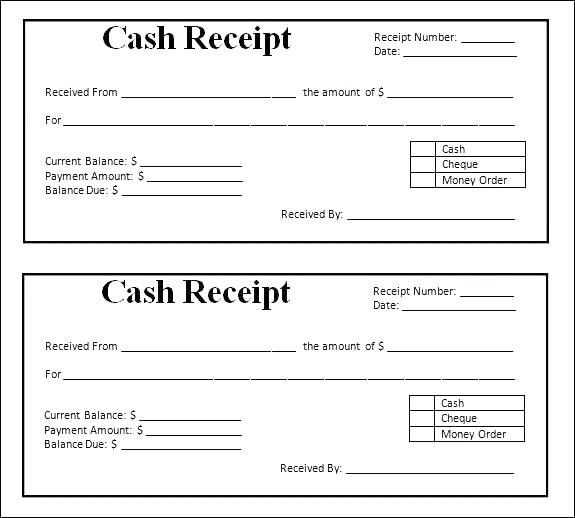

Creating a personal cash transaction receipt template involves organizing specific details for clarity and record-keeping. A basic template should include the date of the transaction, the amount received, and the method of payment. Adding space for the payer’s and recipient’s names, along with a description of the goods or services exchanged, makes the receipt clear and understandable. Be sure to include a unique transaction ID or reference number to keep track of individual transactions.

Key Information to Include in a Receipt

Each receipt must clearly outline certain details to be both valid and useful. At a minimum, you need to include the following:

- Transaction Date: Helps track when the transaction took place.

- Amount Received: The exact amount of cash paid, including currency used if necessary.

- Payer’s and Recipient’s Names: Identifies who is involved in the transaction.

- Description of Goods/Services: Explains what was paid for.

- Receipt Number: This unique identifier helps differentiate between different transactions.

Customizing Your Template for Different Types of Transactions

Depending on the type of transaction (sale of goods, payment for services, or donation), you might want to adjust the template. For example, when providing a service, include the duration or specific details of the service rendered. For goods, specify the quantity, type, and price per unit. Customization helps provide context, particularly for businesses with diverse offerings.

If you need a simple design for personal use, you can create a minimalist template, while businesses might prefer more structured layouts with space for additional tax details, business contact information, or a return policy. Flexibility in your template allows it to fit various needs.

When designing your template for printing, keep it concise yet clear. Ensure it fits on one page to avoid printing excess pages, especially when printing multiple receipts. Use legible fonts and consider including a logo or business name if applicable.

For digital receipts, use tools like spreadsheets or receipt-generator apps that allow you to track transactions efficiently. These tools often offer templates that auto-fill information based on your input and can save receipts in PDF format for easy access.

Finally, make sure your receipts comply with local legal requirements. Some regions mandate that receipts contain specific information like tax numbers or additional details for certain industries. Always verify local regulations to stay compliant and avoid issues in the future.

I removed unnecessary repetitions while maintaining meaning and structure.

Eliminate redundant information in cash transaction receipts by focusing only on necessary details. Include the date, transaction amount, payer and payee names, and a brief description of the transaction. This will provide a clear record without cluttering the document with repetitive text.

Key Elements to Include

Each receipt should list the transaction date, the amount paid, and the names of both parties involved. Optionally, you can add a unique transaction ID for future reference. Avoid adding repeated phrases or unnecessary notes that don’t contribute to the clarity or purpose of the receipt.

Simple Format for Better Clarity

A straightforward, minimal format makes it easier to track transactions. Focus on clarity and avoid adding excessive details that can confuse the reader. Use consistent wording throughout all receipts to maintain professionalism and accuracy.