To streamline the management of small transactions within your business, create a detailed petty cash receipt book. This simple tool ensures that every expenditure is recorded clearly, making it easier to track cash flow and maintain transparency in accounting.

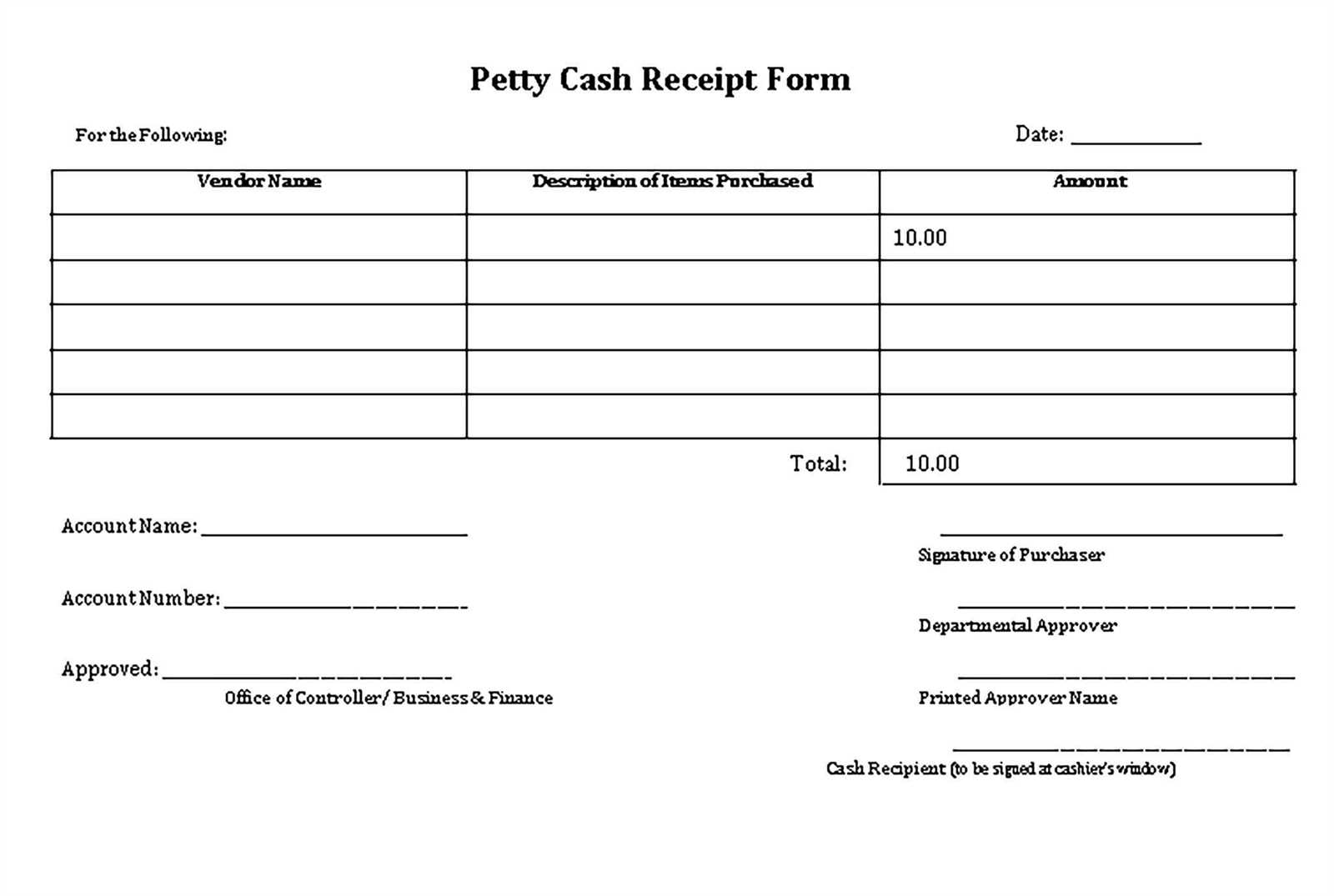

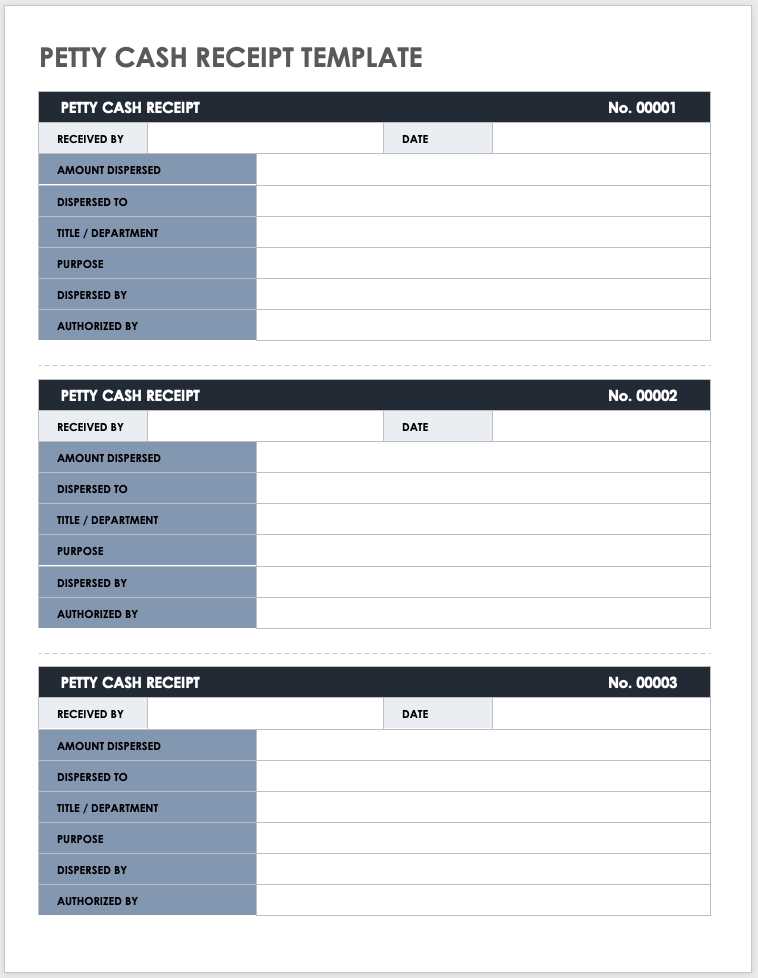

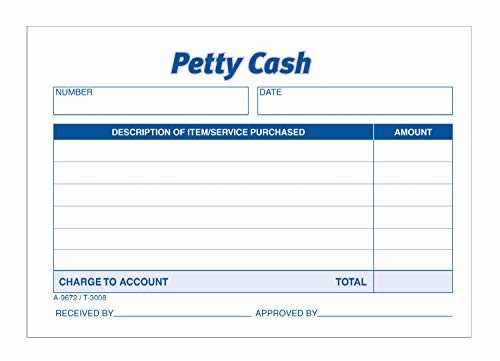

A good petty cash receipt template includes space for the date, amount, purpose, and signatures of the person authorizing and receiving the cash. It’s crucial to make sure each entry is concise and complete to avoid confusion during financial audits.

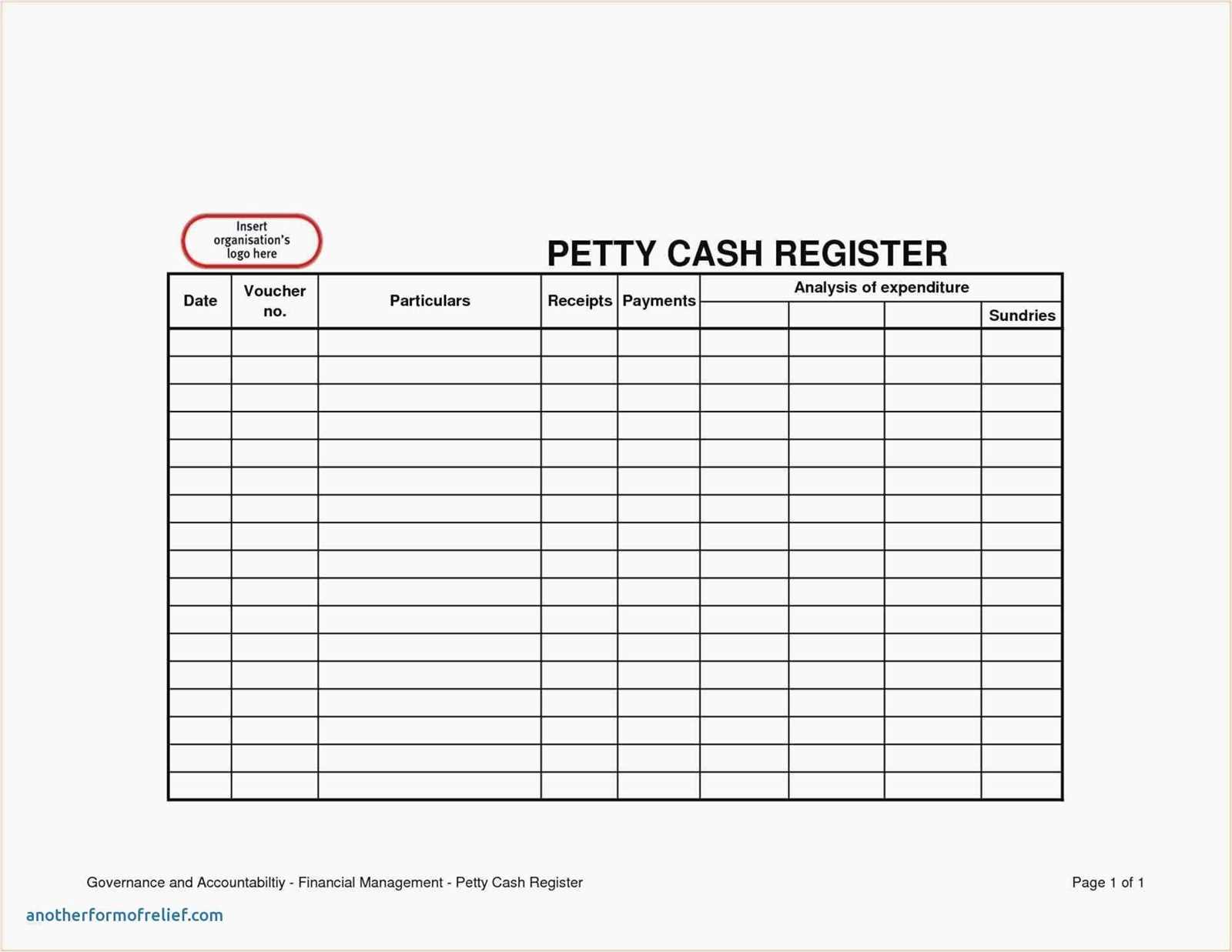

Additionally, incorporating a running balance column helps to monitor the total petty cash available at any given time. This can prevent over- or under-spending, keeping your finances organized and under control.

Sure, here’s the revised version with the repeated words minimized:

Use a simple, clear layout for your petty cash receipt book template. Start by ensuring that each entry has fields for the date, description, amount, and a unique reference number. This makes it easy to track individual transactions and reduces the chance of errors. Include space for the name of the person requesting the funds and the person authorizing the expenditure. Make sure to have a balance column to record the remaining funds after each transaction. This allows for quick updates and minimizes the risk of miscalculations. Finally, create a clear format for signatures to confirm both approval and receipt, ensuring accountability.

- How to Set Up a Cash Receipt Book

Begin by selecting a suitable receipt book with pre-numbered pages. This will help keep track of all transactions and avoid duplication. Ensure the book includes the following key sections: date, amount received, payer’s details, and reason for payment.

1. Create a Clear Format

- Reserve a specific space for each field: date, amount, payer’s name, and payment purpose.

- Use separate columns or boxes for each detail to ensure clarity and prevent mistakes.

- Ensure each receipt is numbered sequentially to maintain proper record-keeping.

2. Record Details for Every Payment

- Write the date immediately after receiving payment.

- Note the exact amount in both words and figures to avoid errors.

- Clearly record the payer’s name and any reference number for identification.

- Include a short description of why the payment was made (e.g., “payment for services rendered”).

After filling out the details, make sure to provide the payer with a copy of the receipt. This ensures transparency and a record for both parties.

Opt for a template format that fits your tracking needs. A simple format works best for small businesses or personal use, with just the basic details like date, description, and amount. If you manage a larger operation or multiple users, a more detailed template with sections for department or category tracking will provide better organization.

For accuracy, make sure the template includes space for signatures and approval stamps, especially if the book is used by more than one person. A digital template can save time by offering automatic calculations and easier record-keeping, but physical books might be more suitable for businesses that require signed receipts.

Prioritize templates that offer clear, consistent layouts to avoid confusion. Stick to formats that separate information logically, such as categorizing by date, amount, or transaction type, so that you can easily locate and review past entries.

Receipts should be clear, detailed, and include specific information to maintain proper records. Here’s a breakdown of what needs to be included:

Transaction Details

Include the date of the transaction, the name of the vendor or payer, and a brief description of the goods or services provided. This ensures that the receipt can be easily identified and cross-referenced in financial records.

Amounts and Payment Methods

Clearly list the total amount paid, including any taxes or discounts. Specify the payment method used, whether cash, card, or any other form of payment, to ensure transparency and traceability.

| Key Information | Description |

|---|---|

| Date | Exact date of the transaction |

| Vendor Name | Name of the seller or service provider |

| Description of Goods/Services | Brief summary of what was purchased or serviced |

| Amount | Total sum paid, including taxes |

| Payment Method | Cash, card, or other payment types |

Including these details ensures accurate financial records and can help with refunds, audits, or disputes. Keep receipts legible and easy to reference, using clear fonts and logical layout to avoid confusion.

Assign a designated person to manage petty cash. This ensures accountability and a clear point of reference for any questions or discrepancies.

Set a Defined Limit

Establish a clear cash limit for petty expenses. This prevents overspending and simplifies tracking. Regularly review and adjust the limit based on the needs of your organization.

Keep Detailed Records

Record every transaction immediately in your petty cash book. Include the date, amount, purpose, and who received the money. This will help maintain transparency and avoid confusion during audits.

Implement regular reconciliations. Match receipts with the entries in your petty cash log at least once a week to ensure everything aligns. This can help catch errors early.

Keep all entries clear and accurate, noting each transaction promptly. Ensure to record the date, description, amount, and reason for each cash movement. Double-check the amounts to minimize errors and discrepancies.

Regular Reconciliation

Reconcile your cash log frequently. Compare the recorded entries with the actual cash available to ensure consistency. This prevents errors from accumulating over time and allows you to identify any discrepancies early.

Maintain Separate Sections

Separate personal and business transactions. If the cash log is used for both purposes, ensure clear divisions between personal and business expenses. This helps to maintain transparency and accountability.

| Date | Description | Amount | Reason |

|---|---|---|---|

| 02/07/2025 | Office supplies purchase | $50 | Business expense |

| 02/07/2025 | Reimbursement for parking | $10 | Personal expense |

Track any changes in your cash flow, noting the context and reason for withdrawals or additions. This helps to ensure that the cash log accurately reflects the state of finances at any given time.

Ensure all entries in the receipt book are clearly written. Illegible handwriting can lead to misunderstandings, making tracking difficult later. Use legible fonts or clear handwriting to keep everything readable.

1. Forgetting to Number Receipts

Always number receipts sequentially. Skipping numbers or failing to number receipts can cause confusion and make it hard to verify records. Keep track of each transaction with a unique number for easier reference.

2. Not Providing Complete Details

Every receipt should include the full name of the payer, the amount, the date, and the reason for the payment. Missing details can lead to confusion and issues with record-keeping or accounting later on.

Maintain accuracy and consistency throughout the receipt book. Double-check every entry for correctness to avoid errors that could affect financial tracking.

Use clear and specific titles for each section of the petty cash receipt book. This ensures each part serves a defined purpose and avoids confusion. Each header should align with a specific task or aspect of managing petty cash.

- Receipt Numbering System: Assign sequential numbers to each receipt. This allows for easy tracking and reference during audits.

- Transaction Description: Include a brief but detailed description of the expense. Avoid general terms like “miscellaneous”; be specific about what the funds were used for.

- Amount Involved: Clearly state the exact amount for each transaction. This prevents ambiguity and simplifies financial tracking.

- Date of Transaction: Always record the date when the expense occurred. This helps establish a clear timeline for all transactions.

- Purpose of Expense: Include a short explanation of why the money was spent. This gives context and helps justify each expenditure.

Practical Tips

- Ensure consistency in formatting for each entry.

- Review the completed receipt book regularly to spot discrepancies early.

This version reduces repetition while keeping the meaning clear.

Use concise wording in each entry to make your records more manageable. When describing a transaction, avoid redundant details. Focus on the date, amount, and purpose of the expense to maintain clarity.

Always include specific information about the person or department that made the payment, ensuring the record is complete without unnecessary elaboration. This keeps the bookkeeping streamlined and easy to follow.

Keep totals at the bottom to avoid cluttering individual entries. This layout minimizes errors by separating summaries from transaction details.

Ensure each entry is numbered sequentially to maintain organization. Using bullet points or clear labels further enhances readability.