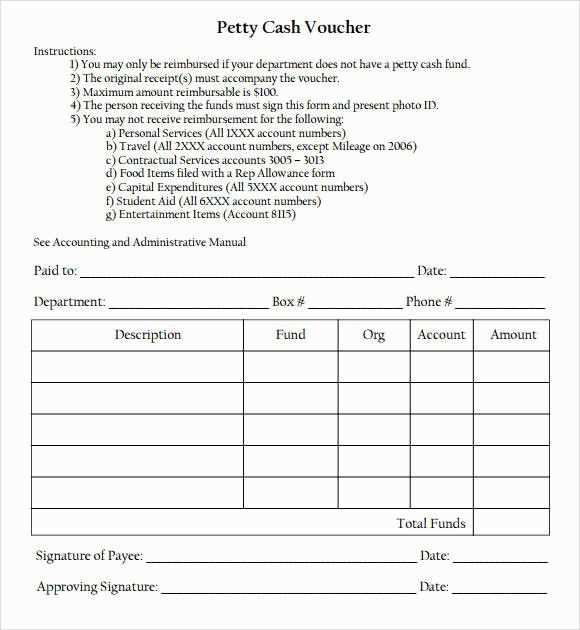

To manage small transactions effectively, use a petty cash receipt form. It allows employees to document expenses clearly and ensures accurate tracking. When filling out the form, include the date of the expense, amount spent, and a detailed description of the purchase. This transparency helps maintain accountability and reduces the risk of errors during auditing.

The template should include fields for the payee’s name, amount paid, and the purpose of the expense. Add a section for signatures to confirm the transaction, ensuring both the recipient and the person authorizing the payment are on record. You can customize the form to meet your company’s specific needs, but the key components are uniform.

In addition to maintaining financial integrity, this form can assist in reconciliation at the end of each period, helping you keep track of petty cash balances. Keep your forms organized and stored securely for easy reference during audits or financial reviews.

Here are the corrected lines:

Make sure the receipt includes the following key elements for accuracy and clarity:

- Date: Ensure the date is clearly stated. This helps in tracking the transaction timeline.

- Amount: Enter the exact amount received, broken down into the specific expenses it covers.

- Vendor/Payee Name: Include the full name of the person or company receiving the payment.

- Payment Method: Specify how the payment was made, such as cash, check, or electronic transfer.

- Purpose of Expense: Provide a short description or reference to what the payment was for.

- Signature: Include a signature from both the payer and the payee to confirm the transaction.

Always check for spelling errors, and verify that all amounts are correctly formatted. This ensures a clean and professional appearance for the receipt, making it easier to process for accounting or auditing purposes.

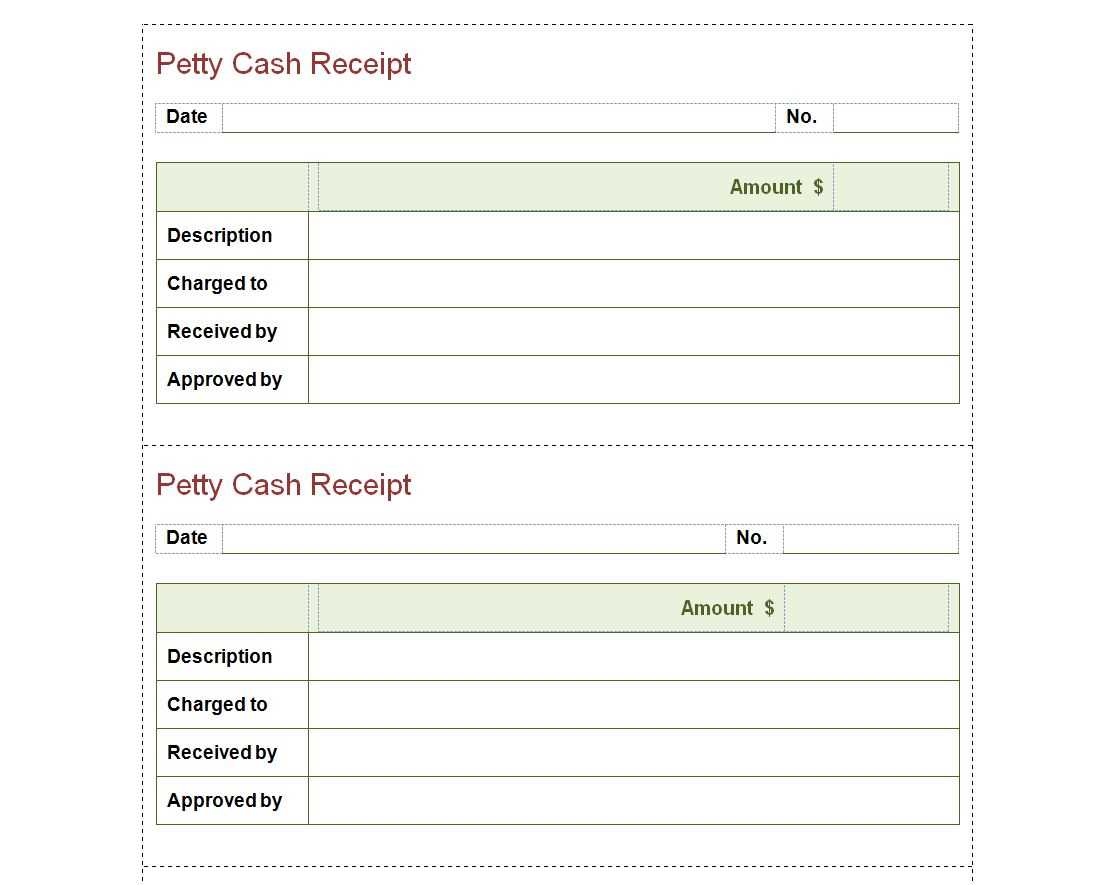

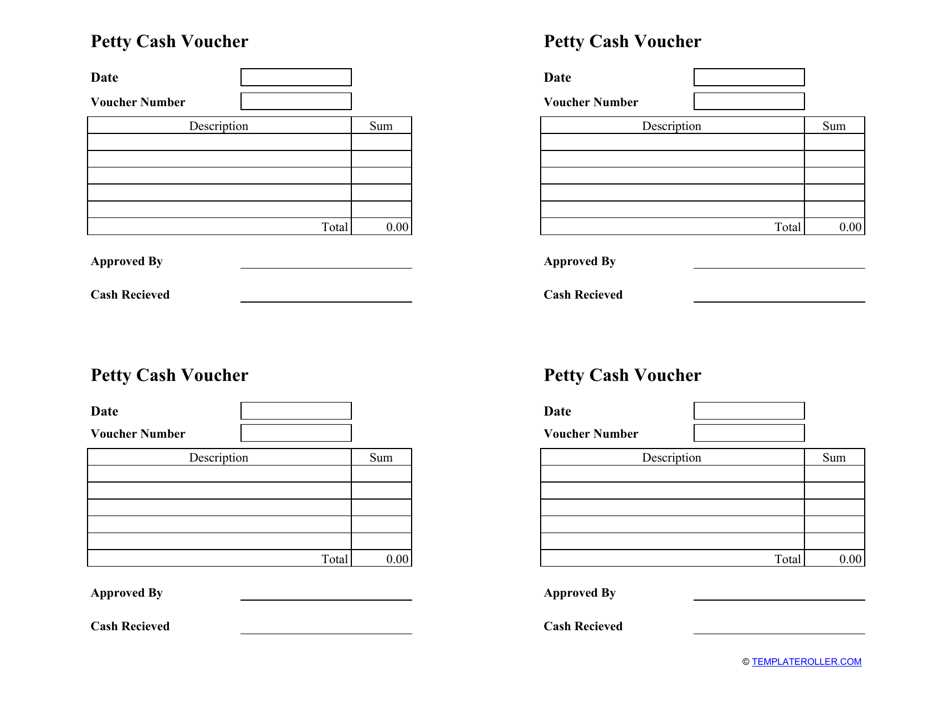

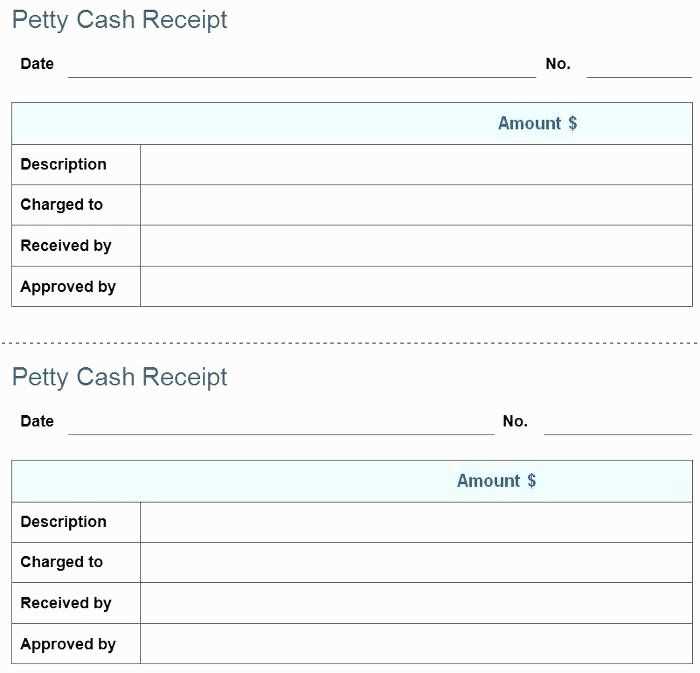

- Petty Cash Receipt Form Template

To create a straightforward petty cash receipt form, include key details such as the date of the transaction, the recipient’s name, the purpose of the cash dispensed, the amount received, and the signature of both the receiver and the cashier. Ensure clarity with clearly labeled sections to avoid confusion during audits or reconciliation.

Form Structure and Key Fields

The form should include the following fields for accurate tracking:

- Date: Record the exact date when the transaction took place.

- Received By: Include the name of the individual receiving the funds.

- Amount: Specify the exact amount of petty cash dispensed.

- Purpose: Describe the reason for the cash withdrawal (e.g., office supplies, travel expenses).

- Signature of Recipient: Ensure the recipient signs to confirm they received the amount.

- Signature of Cashier: The cashier or authorized personnel should sign to confirm the transaction.

Template Design Tips

To simplify use, structure the form with a table layout for easy entry of details. Include a running balance section at the bottom to track remaining petty cash. It’s useful to integrate a unique receipt number for each transaction for better record-keeping. Keep the form visually clean and easy to read with sufficient spacing between fields.

Begin by creating a clean, organized layout that prioritizes clarity. Include the company name, address, and contact details at the top, followed by a title like “Petty Cash Receipt” for easy identification. This ensures the document is instantly recognizable to anyone reviewing it.

Include a date field where the transaction can be recorded. This helps in tracking when each disbursement occurred and facilitates later reference or audits. It’s also helpful to provide a unique receipt number for each transaction, ensuring better recordkeeping and avoiding confusion with multiple receipts.

Next, create a section for the amount of money disbursed. Clearly label this with “Amount Paid” or “Amount Disbursed” and specify the currency to avoid any misunderstanding. This part of the receipt should be large enough to ensure it’s not overlooked. Additionally, include a brief description or purpose of the cash usage, such as “office supplies” or “travel expenses,” to give context to each expense.

Below the amount, include fields for both the name of the recipient and the approving party. This step ensures that the disbursement is authorized and traceable. Including signatures can also enhance accountability. Add a “Signature of Recipient” and “Authorized by” lines to give the document an official touch.

Finally, provide a space for additional notes if needed. This could be used for any comments or clarifications, helping to keep records complete and transparent. Keep the overall design minimal to avoid clutter, but ensure all essential fields are included to maintain accuracy.

Include a section for the transaction date to establish a clear timeline. Assign a unique receipt number for better tracking and reference. Record the exact amount paid and use both numerical and written forms. Specify the payment’s purpose or description to avoid ambiguity. Add the payee’s name and signature for verification. The payer’s name should also be listed to confirm the source of funds. Include a brief description of the goods or services purchased. Clearly state the method of payment, whether it’s cash, cheque, or card. Finally, leave space for both the payee and payer to sign, confirming the transaction details.

Ensure all petty cash transactions are documented with a receipt. Each receipt should contain specific details such as the amount, date, and purpose of the expense to maintain a clear audit trail.

Track Every Transaction

Record all petty cash withdrawals in a ledger. For each withdrawal, note the date, recipient, amount, and reason for the expenditure. This creates transparency and ensures accountability for every transaction.

Establish a Clear Approval System

Designate one or two people to approve petty cash requests. Ensure that all transactions go through them before any cash is dispersed. This helps avoid unauthorized spending and keeps track of available funds.

Limit Access to Cash to a few trusted individuals. Keeping the number of people who have access to petty cash reduces the risk of mismanagement and misuse.

Reconcile Petty Cash Regularly by matching receipts with the cash balance. This should be done at least monthly to ensure there are no discrepancies. If any differences are found, address them immediately.

Digitize receipts to minimize physical storage. You can scan or take pictures of receipts, storing them in an organized digital format. This reduces paper clutter and makes receipts easily accessible for review.

To streamline the petty cash process, ensure your form includes fields for clear documentation. A detailed breakdown helps prevent misunderstandings and inaccuracies. Include sections for the date, amount, purpose of the expenditure, and the individual responsible. This will ensure accountability and transparency in all petty cash transactions.

Recommended Fields

| Field | Description |

|---|---|

| Date | The date of the transaction should be noted for accurate record-keeping. |

| Amount | Include both the total spent and any remaining balance. |

| Purpose | A brief description of the reason for the expense. |

| Authorized By | Identify the person approving the transaction for validation purposes. |

Tracking and Reconciliation

Ensure that all receipts are attached to the form for verification. Keep a running total to reconcile petty cash balances regularly. This practice keeps cash management accurate and reduces errors in accounting records.