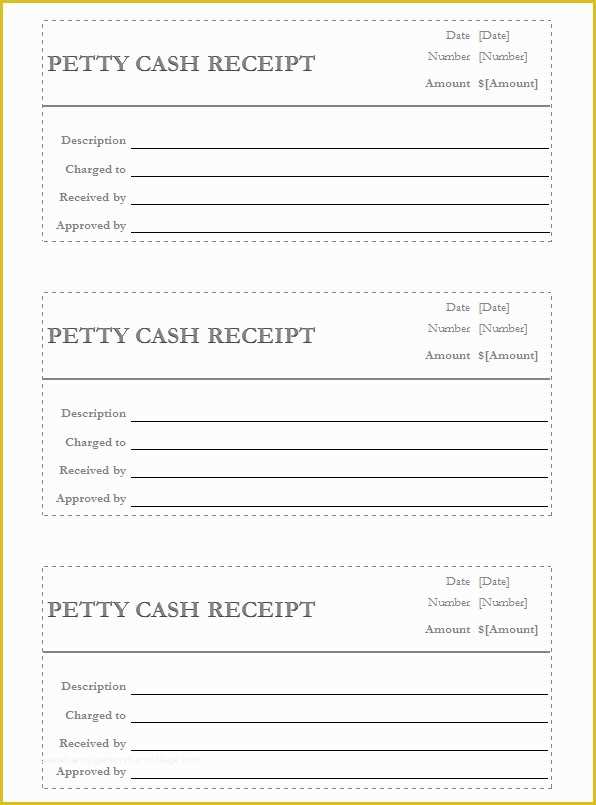

If you’re managing small cash transactions, a well-organized petty cash receipt template is a must. Excel provides an easy way to track expenditures, ensuring that every payment is accounted for accurately. A template allows you to input transaction details such as date, amount, purpose, and person responsible, keeping things clear and transparent.

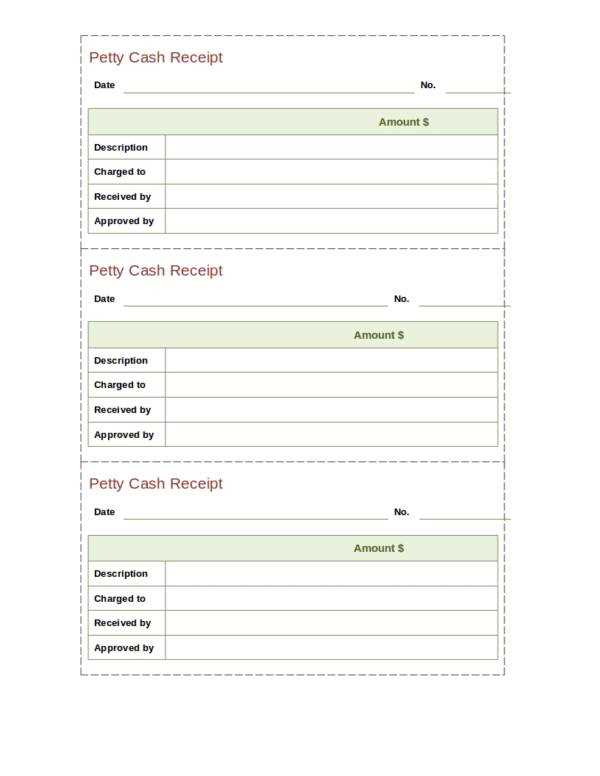

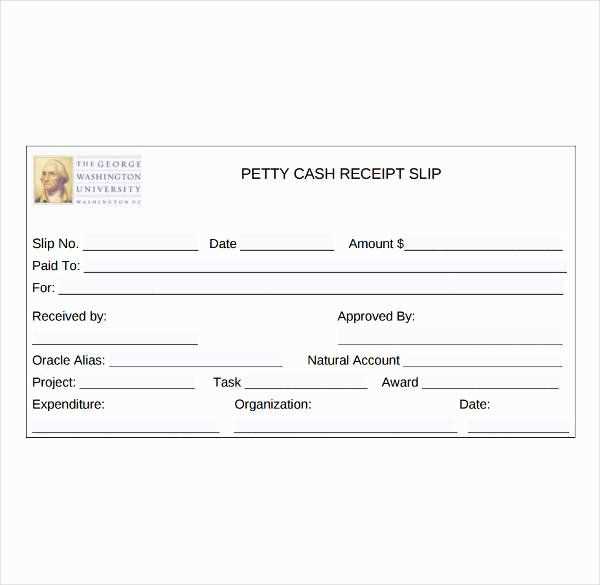

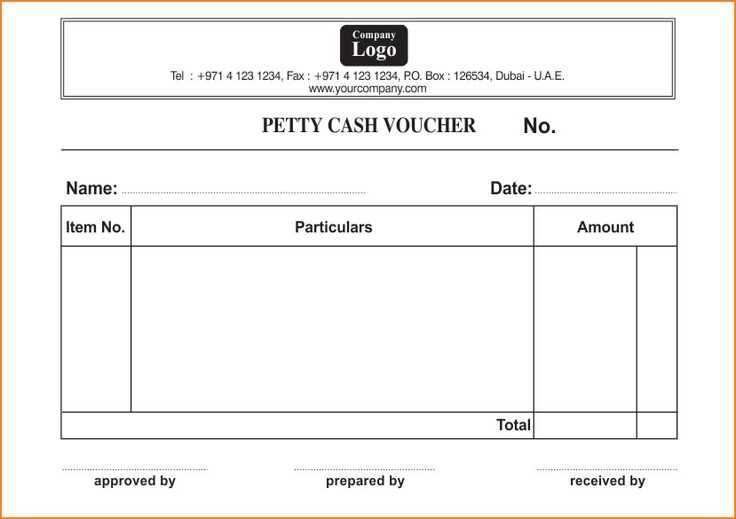

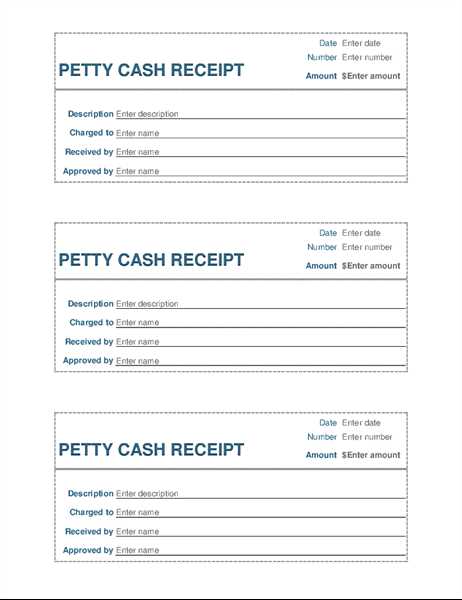

Start by creating a simple table with columns for the necessary information. Include sections for the date, description, amount spent, and a reference number. You can also add a column for signatures, confirming approval of each disbursement. This structure keeps records consistent and prevents any misunderstandings regarding cash flow.

Regularly update the spreadsheet to ensure it reflects the current state of your petty cash fund. This will make it easier to reconcile your account at the end of the month. You may also want to incorporate formulas to automatically sum totals and calculate any remaining balance, saving you time and reducing the risk of errors.

Using an Excel template also enables you to filter and sort data quickly, making it easier to track patterns and identify areas of potential improvement. This approach not only keeps your finances organized but also streamlines reporting for audits or reimbursements.

Here are the corrected lines with minimized repetitions:

Use these revised formulas for your petty cash receipt template to ensure clarity and accuracy:

- Amount Received: Enter the total amount received for the transaction.

- Amount Paid: Specify the amount paid out during the transaction.

- Remaining Balance: Calculate the remaining balance after each payment.

- Date: Record the date of the transaction for proper tracking.

- Description: Include a brief description or purpose of the transaction.

- Signature: Add a field for both parties to sign for verification.

Ensure each section is clearly labeled and the amounts are easy to read. Double-check for any redundant entries and remove unnecessary details. This keeps your petty cash records clean and organized, saving time for future audits.

- Petty Cash Receipt Template for Excel

Creating a petty cash receipt template in Excel can streamline your financial record-keeping and help maintain accurate cash flow tracking. Start by opening a new workbook and creating a simple layout with clearly labeled fields.

Key Fields to Include

- Date: Always include a space for the date of the transaction to ensure accuracy in financial records.

- Receipt Number: Assign each receipt a unique identifier to track cash withdrawals.

- Amount: Ensure there is a field to input the amount of petty cash being received.

- Purpose: Include a section to specify the reason for the cash expenditure to clarify its necessity.

- Authorized By: Include a field for the signature or name of the person approving the release of cash.

Formatting Tips

- Use Excel’s gridlines to create a clean, easy-to-read format that distinguishes different sections.

- Consider color-coding key fields, such as amounts and dates, for better visibility and organization.

- Enable data validation on fields like “Amount” to prevent errors in data entry.

Once you’ve designed the template, save it as a reusable file. This setup will make it easy to track petty cash usage and provide a reliable paper trail for future audits.

Begin by opening a new Excel sheet. Adjust the column widths to ensure there’s enough space to enter all relevant information, such as the receipt number, date, description of the expense, amount, and total.

Label the columns clearly with headings like Receipt Number, Date, Expense Description, Amount, and Total. These labels will make it easier to fill out the template each time.

Next, set up the rows. For each receipt, a new row will be added. You can add a Subtotal row at the bottom to automatically calculate the total amount based on the amounts entered in the Amount column.

To automate calculations, use Excel’s SUM function in the Total row. This will ensure the total updates automatically whenever an amount is added or modified in the Amount column.

For better tracking, consider adding a Notes column to include additional details or payment methods. You can also format the template by adding borders and shading to differentiate sections, making it easier to read.

Save the template with a clear and simple name so you can reuse it for future petty cash transactions. When you need to create a receipt, simply open the template and fill in the required information.

Clearly itemizing the transaction details ensures transparency and accurate record-keeping. Start with the date of the transaction, followed by the name of the person receiving the petty cash. This helps track when and who received the funds. Next, include the purpose of the expense. Specify the reason for which the petty cash was spent to avoid confusion later on.

Breakdown of Amounts

Include a detailed list of the items or services purchased. List each item or service, along with the corresponding cost, to ensure that the total amount adds up correctly. This breakdown is important for auditing purposes and ensures every penny is accounted for.

Payment Method and Approval

Indicate how the petty cash was disbursed, such as cash or a petty cash check. Also, include space for the signature of the individual authorizing the release of funds, as well as the person receiving the petty cash. This serves as proof that both parties agreed to the transaction terms.

Including these key components in your receipt will make it easier to manage your petty cash and provide a reliable record for future reference.

Set up formulas in Excel to automatically calculate totals, balances, and cash flow. Use the SUM function to add up your expenses and income columns, ensuring the calculations are done instantly. For a more detailed analysis, consider using the IF function to track when expenses exceed budget limits. This will highlight any discrepancies without manually checking each entry.

Incorporate conditional formatting to track cash flow. For example, you can set it to turn negative numbers red, making it easier to spot cash shortages. Link your expense categories to a master balance sheet for real-time updates. Use Excel’s built-in templates for cash flow reports to speed up the setup process, then customize them to suit your needs.

Ensure that all receipts are categorized correctly and add a unique identifier, like an expense type or code, to streamline sorting and reporting. This system reduces the risk of errors and allows for easy tracking of cash flow over time.

For efficient tracking and managing petty cash, create a simple Excel template. This method helps avoid confusion and provides an organized system for monitoring cash flow.

Key Features of a Petty Cash Template

Design a table with the following columns:

| Date | Description | Amount | Balance |

|---|---|---|---|

| MM/DD/YYYY | Expense description | Amount spent | Remaining balance |

Fill in these details whenever a petty cash transaction occurs. Update the balance after each entry to reflect the remaining cash available.

Tips for Efficient Use

Regularly update the record. Use simple formulas to calculate the balance automatically after each entry. This method minimizes errors and keeps tracking accurate.