To maintain clear financial records, a petty cash receipt template is an effective way to track small expenses in your business. It ensures every transaction is documented properly, reducing errors and avoiding confusion at the end of the month. Using a template saves time and provides consistency, which is key for accurate bookkeeping.

Simply fill in the required details such as the date, the amount spent, the purpose of the expenditure, and the recipient’s signature. The template helps keep all receipts in one place, making it easier to reconcile cash flows with your accounts. It can be easily customised for your business needs, and once filled out, it’s ready for filing or submitting for approval.

For businesses in the UK, ensuring compliance with tax laws is a priority. A well-maintained petty cash log, backed by a receipt template, supports clear auditing and can help with VAT reclaim processes. Make sure to include sections for both the amount given and the balance remaining, to have a real-time overview of petty cash usage.

By using a standardised petty cash receipt, you streamline your financial processes, maintain transparency, and prevent potential discrepancies in your accounts. This simple yet practical tool is a key part of any organised finance system.

Here are the corrected lines with duplicates removed:

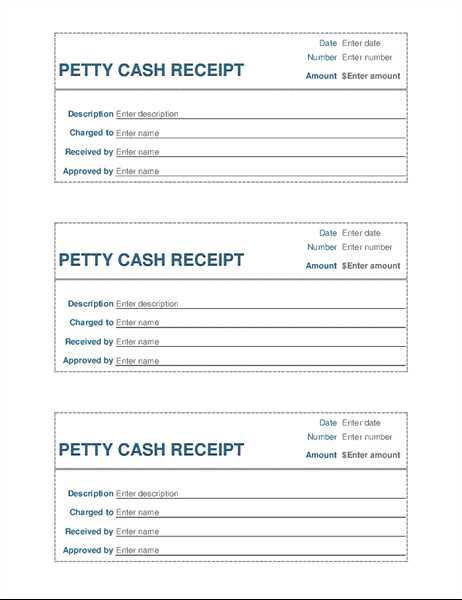

When preparing a petty cash receipt, focus on keeping the information clear and concise. Avoid repeating details such as the date, amount, and description multiple times. Here’s a corrected version of a petty cash receipt template with the unnecessary repeats removed:

| Date | Reference Number | Description | Amount (£) |

|---|---|---|---|

| 12/02/2025 | PC001 | Stationery purchase | 15.00 |

| 13/02/2025 | PC002 | Tea and coffee supplies | 8.50 |

| 14/02/2025 | PC003 | Postage costs | 5.20 |

Notice how each entry now only includes unique details. No repeated columns or information. This approach ensures your receipts are easy to read and comply with standard accounting practices.

- Petty Cash Receipt Template for UK

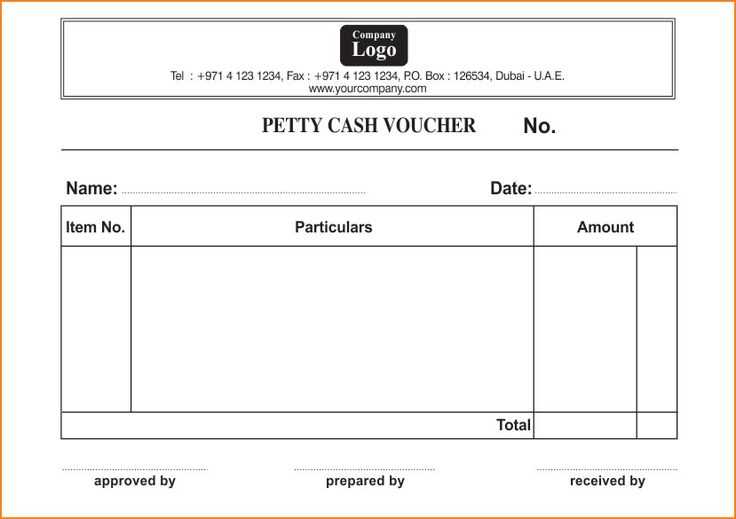

A petty cash receipt template should capture specific details to ensure transparency in cash transactions. Include the following key elements:

- Date: The date the transaction occurred.

- Amount: The total amount of money paid out from the petty cash fund.

- Purpose: A clear description of the reason for the expenditure (e.g., office supplies, parking fees).

- Receipt Number: A unique identifier for each transaction to help with record-keeping.

- Payee Information: The name of the person or department receiving the cash.

- Signature: A signature from the person who received the cash and, optionally, the person authorizing the disbursement.

- Balance Remaining: The remaining amount in the petty cash fund after the transaction.

This format allows for easy tracking and prevents misuse of petty cash. It is essential to maintain proper records for compliance with UK tax regulations and for smooth internal auditing.

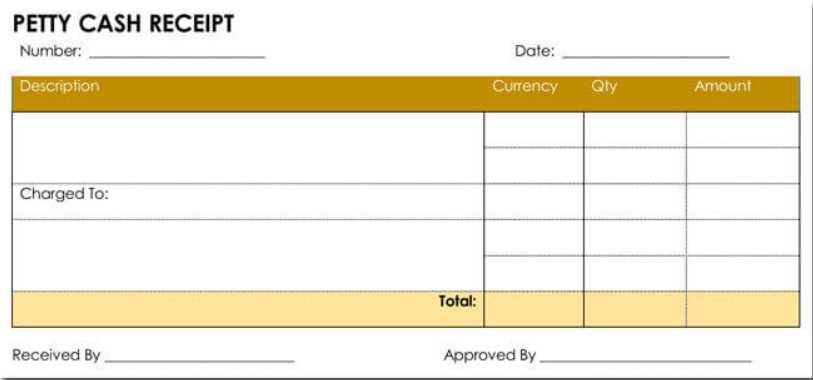

To create a petty cash receipt, begin by clearly stating the details of the transaction. Include the date of the expense and the name of the person making the payment. Make sure the amount spent is clearly written in both figures and words.

Next, include a brief description of what the money was spent on. This helps provide clarity for both the person receiving the funds and anyone reviewing the receipt later. If applicable, note the department or project the expense is linked to, ensuring proper allocation of funds.

Record the remaining petty cash balance after the transaction. This step helps you keep track of cash flow and ensures accountability for the cash on hand.

Don’t forget to include a unique receipt number for easy reference. This ensures you can track receipts efficiently, especially when managing multiple transactions.

Finally, have the person who made the payment sign the receipt to confirm the transaction. This signature serves as proof of the expense and can help resolve any future disputes or questions about the transaction.

To comply with UK laws regarding petty cash, businesses must follow strict guidelines on record-keeping, tax reporting, and accountability. Failure to meet these obligations can result in fines or penalties. Here’s how to ensure compliance:

1. Record Keeping

Maintain a clear and accurate record of all petty cash transactions. This includes receipts, vouchers, and notes that show the purpose of the expenditure. The records must be detailed and available for review by HMRC if requested. You should keep records for at least 6 years.

2. VAT Considerations

When making purchases using petty cash, the VAT status of the item must be tracked. If the purchase includes VAT, businesses can reclaim it, but only if the purchase is related to the business activities. Be sure to keep VAT receipts and document claims accordingly.

3. Personal Use Restrictions

Petty cash should only be used for business-related expenses. Any use of petty cash for personal expenses could result in penalties or tax issues. It’s important to set clear policies about what constitutes an acceptable petty cash transaction.

4. Setting and Monitoring Petty Cash Limits

Establish a fixed limit for petty cash and regularly monitor expenditures. This helps ensure the amount remains manageable and reduces the risk of misuse. Regular audits of petty cash can identify discrepancies early on.

5. Tax Reporting

Ensure that petty cash expenses are accurately reported in your business’s tax filings. Petty cash transactions must be included in your records of income and expenses for the purpose of calculating taxable profits. Misreporting can lead to issues during HMRC audits.

6. Reimbursement Process

When reimbursing petty cash, keep a log of the reimbursement process. All reimbursements should be properly documented with receipts and a clear record of the amount reimbursed. This helps in maintaining transparent and auditable financial records.

Adjust your petty cash receipt to reflect the specifics of each expense category. Different costs, such as office supplies, travel, or refreshments, require distinct fields to track details accurately.

Adjust Categories and Descriptions

Modify the “Description” section to clearly specify the purpose of each expense. For example, use “Printer Ink” for supplies or “Taxi Fare” for travel. This ensures clarity when reviewing receipts later.

Include Relevant Dates and Times

For time-sensitive expenses, like transportation, add fields for the date and time of the transaction. This helps verify that the expense falls within the appropriate period, especially for recurring purchases like monthly subscriptions.

Ensure your receipt template includes sections for both the total amount and VAT if applicable. This is particularly important when handling business-related purchases that require VAT reporting.

Tailor the receipt layout to match the complexity of the expense. For simple purchases, a brief description may be enough. For larger or more detailed transactions, include itemized lists or additional fields to clarify each cost.

For a straightforward petty cash receipt template in the UK, ensure the following details are included:

Key Information to Include

- Receipt Number – Assign a unique number for each transaction to track and reference easily.

- Date – Record the exact date of the transaction for clarity.

- Payee Details – Include the name of the individual or company receiving the funds.

- Amount – Clearly state the amount being paid out in both figures and words.

- Purpose of Payment – Briefly describe the reason for the payment (e.g., office supplies, transport).

- Authorized Signatures – Have a space for signatures from both the payee and the person approving the payment.

- VAT (if applicable) – Include VAT details if the transaction requires VAT accounting.

Additional Tips

- Keep It Simple – Avoid overcomplicating the format. Use clear headings and lines for easy filling.

- Track Payments Regularly – Regularly update and review petty cash records to maintain accurate accounts.

- Use Digital Templates – Consider using a digital template to simplify storage and retrieval of receipts.