A petty cash receipt voucher is a key document for managing small cash transactions within an organization. It helps track expenses and provides transparency for both the person receiving and the one authorizing the payment. By using a well-structured template, businesses can ensure proper documentation and avoid any discrepancies in their financial records.

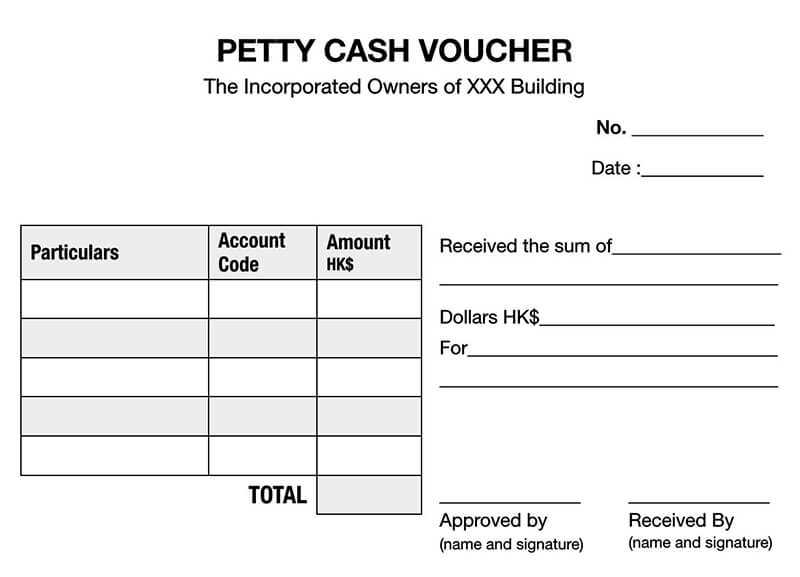

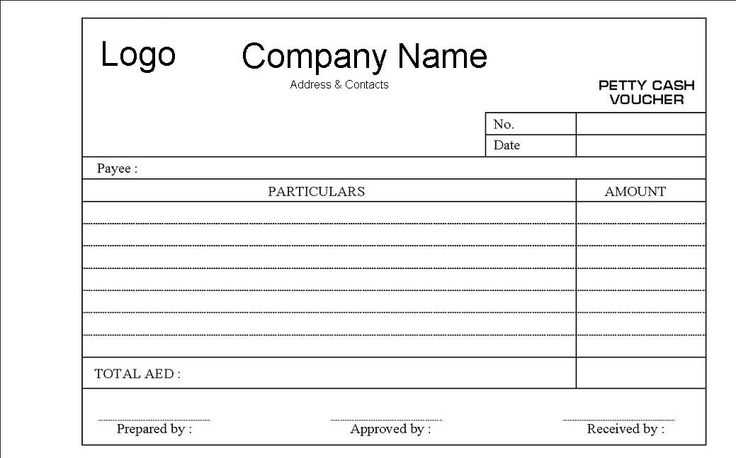

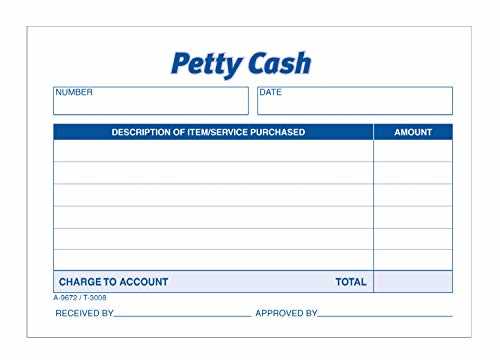

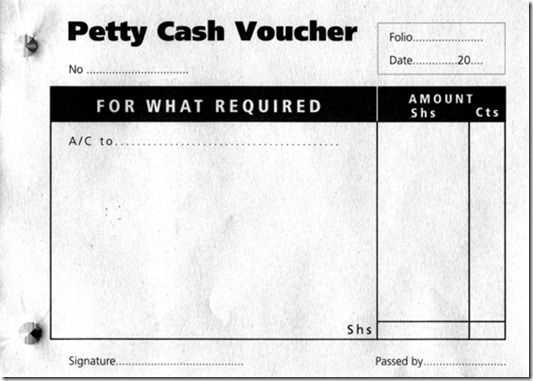

Start by including basic information such as the date, amount, purpose of the expenditure, and the name of the person receiving the cash. This will serve as the foundation for accurate record-keeping. Ensure the template also has fields for the signatures of both the person requesting the funds and the person authorizing the transaction. This adds a layer of accountability and makes it easier to cross-reference the voucher with bank statements or accounting software.

Consider incorporating a detailed breakdown of the expenses in the voucher, especially for reimbursements. This allows for clarity and ensures that every transaction is supported by specific details, making audits smoother and faster. A simple, yet effective, petty cash receipt voucher template can save time, reduce errors, and maintain proper oversight of cash flow in any organization.

Here are the revised lines with minimized word repetition:

To streamline your petty cash receipt voucher, use concise language. Begin with clear headings, such as “Date,” “Amount,” and “Description,” which can make the document more organized. Each section should only include the necessary details to reduce redundancy.

For instance, instead of repeating the word “expense” multiple times, group similar transactions under a single heading. Instead of saying “amount of money spent,” simply use “amount.” This keeps the document brief without losing important context.

Additionally, when describing the purpose of the transaction, keep it short and to the point. If a purchase is for office supplies, you could write, “Office supplies purchase,” instead of repeating phrases like “purchase of office supplies” or “office supply purchase.”

Lastly, when finalizing the voucher, ensure each line item provides enough information but avoids excessive descriptions. For example, instead of writing “received payment for office supplies on January 1st, amount spent on these items,” simply state “office supplies, January 1st, $50.” This eliminates unnecessary repetition while maintaining clarity.

- Petty Cash Receipt Voucher Template: A Practical Guide

A petty cash receipt voucher template is a simple yet effective tool for tracking small cash transactions within a business. It serves as a written record for each disbursement, ensuring accountability and transparency in handling petty cash funds. Using a template ensures consistency and prevents errors or omissions. Here’s a practical approach to creating and using a petty cash receipt voucher template.

Key Elements of a Petty Cash Receipt Voucher

Each petty cash receipt voucher should include the following key details:

| Field | Description |

|---|---|

| Voucher Number | A unique identifier for each voucher to avoid duplication. |

| Date | The exact date of the transaction. |

| Payee Name | The name of the person or entity receiving the cash. |

| Amount | The exact amount of cash dispensed. |

| Purpose | A brief description of the reason for the expenditure. |

| Signature | The signature of the person receiving the cash, confirming receipt. |

How to Use the Template

Start by filling in each section of the voucher accurately. Assign a unique number to each voucher to avoid confusion and ensure easy tracking. Clearly note the date, amount, and purpose of the transaction. After the payee signs, retain a copy for your records and give one to the individual receiving the cash. Regularly update the petty cash ledger with these vouchers to maintain clear financial records.

Design a petty cash voucher template with the following key elements to ensure clarity and accuracy:

1. Include Essential Information

- Date of Transaction: Make sure the date is clearly visible for record-keeping.

- Voucher Number: Assign a unique voucher number to each entry to avoid confusion and help with tracking.

- Payee Details: Specify who is receiving the funds. Include the name, department, and contact information.

- Amount: Clearly state the amount being reimbursed or paid out.

- Purpose of Expense: Include a brief description or reference for the reason the petty cash is being used.

2. Add Proper Approval and Authorization Fields

- Authorized Signatures: Include spaces for signatures from the person requesting the cash and the person approving it. This provides accountability.

- Approval Date: Include a field for the approval date to maintain a timeline of when the expense was authorized.

3. Keep It Simple and Easy to Fill Out

- Clear Layout: Ensure the template is easy to read with clear sections for each data point.

- Simple Fields: Limit the number of fields to the necessary information to avoid clutter.

4. Incorporate a Section for Receipts or Documentation

- Attach Receipts: Include space to attach receipts or other supporting documents for verification purposes.

- Reference Number: Add a field for the receipt number or any relevant reference to tie the voucher to the documentation.

By following these steps, you can create a practical and easy-to-use petty cash voucher template that streamlines your financial tracking process.

Include the date of the transaction at the top of each receipt. This helps track expenses over time and avoids confusion when reconciling petty cash. Ensure the description clearly explains the purpose of the expenditure–whether for office supplies, transport, or meals–to give context to the entry.

Record the amount spent in both numeric and written form to eliminate any ambiguity. Always attach the original receipt to the voucher for verification, ensuring it matches the amount stated. If no receipt is available, a written note or alternative documentation should be provided.

Include the name of the person who made the purchase and any other relevant details, such as the department or project for which the funds were used. This ensures accountability and assists in tracking who spent the money.

Have a field for the approving authority’s signature or initials. This confirms that the expense was reviewed and authorized before being recorded in the petty cash system.

Finally, maintain a running balance on each voucher. This prevents discrepancies and ensures that the remaining petty cash is easily visible for future reference.

Ensure all fields are correctly filled. Missing or incorrect details, such as the date or amount, can lead to discrepancies in your financial records.

Avoid using unclear descriptions for the payment or expense. Provide specific information to ensure clarity for both accounting and auditing purposes.

Don’t forget to include both the payment method and any associated transaction numbers. This creates a clear trail of the payment, making future reference or verification simpler.

Always match the receipt voucher to the actual expense. If a voucher doesn’t correspond to a real transaction or payment, it can lead to confusion or even audits later on.

Be mindful of duplicate entries. It’s easy to accidentally issue multiple vouchers for the same transaction. Regularly check your records to avoid this mistake.

Ensure the voucher is signed by the appropriate authority. A missing signature can undermine the validity of the voucher, especially during audits or internal reviews.

Pay attention to the formatting. A cluttered or difficult-to-read template can cause misunderstandings. Keep it simple and organized, with clearly defined sections for easy review.

Review the template’s compliance with your organization’s policies. Templates that don’t align with internal controls or accounting procedures could cause delays or issues down the line.

Use a structured layout to simplify the tracking of petty cash transactions. Include clear headings like “Date,” “Amount,” “Description,” and “Authorized By” to provide essential details for each entry. Ensure that the receipt voucher is easy to fill out, with enough space for both printed and handwritten information.

For accuracy, add a “Total” section at the bottom to summarize all entries. This helps to quickly reconcile the petty cash balance. Always double-check that the amounts are correctly totaled before closing the voucher.

Make the template accessible by offering both digital and printable versions. This allows for easy integration with accounting software or physical record-keeping systems. Keep the template simple yet organized to avoid confusion during audits or reviews.

Finally, create a clear signature line for approval. Having a designated person sign off on each transaction ensures accountability and prevents misuse of petty cash funds.