Organizing and tracking small expenses with a petty cash receipts template can simplify financial management. Use a clear, structured format to ensure accurate documentation of every transaction. This will help maintain a transparent record of petty cash use, reducing the risk of errors and discrepancies.

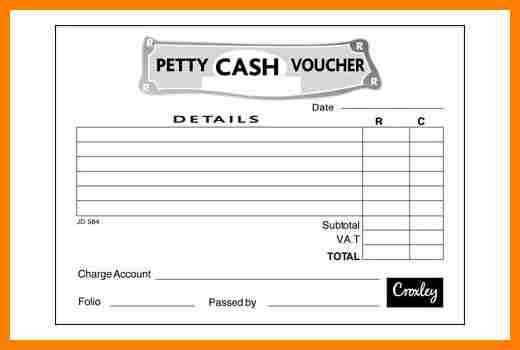

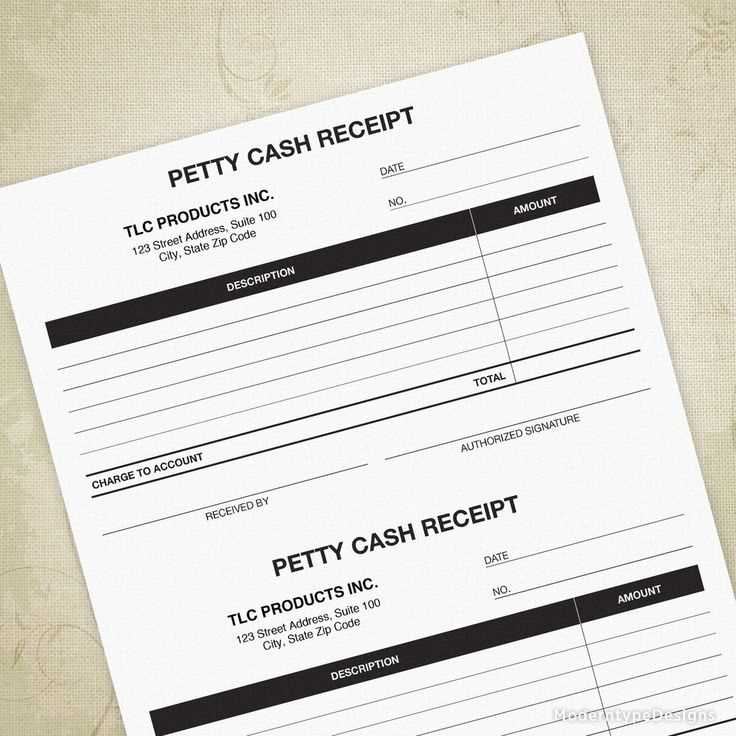

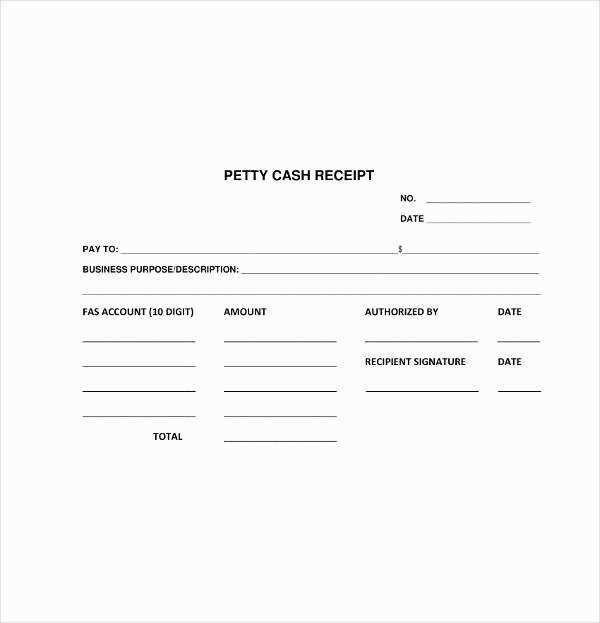

A simple template typically includes essential fields such as the date, description of the expense, amount, and the signature of the person receiving the cash. It is crucial to include the category of the expense to quickly identify its nature. This straightforward approach keeps records neat and accessible for future reference or audits.

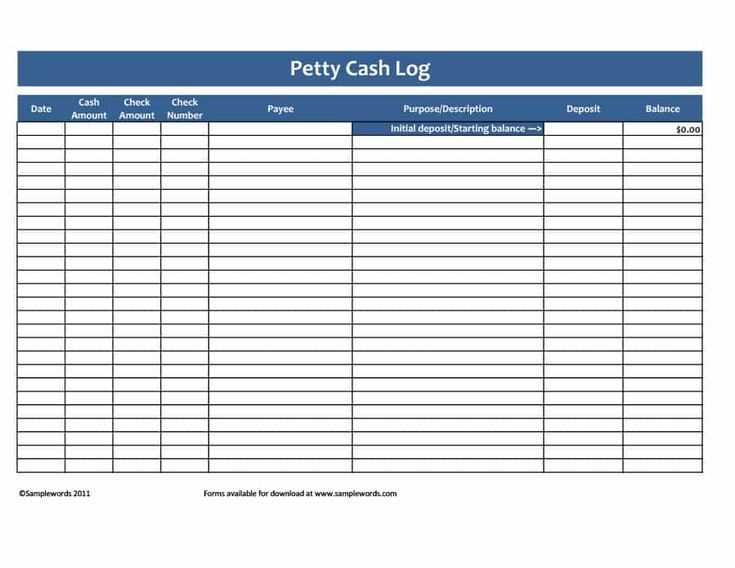

To make the template work effectively, update it regularly after each transaction. Sticking to this routine prevents accumulation of untracked expenses, ensuring that petty cash stays within the approved budget. Use columns for clarity and double-check amounts at the end of each week to maintain accuracy.

Here are the corrected lines:

Ensure the date is entered accurately on each receipt to avoid discrepancies. Always match the payment amount to the exact total listed in the ledger. Adjust the categories for each expense to reflect the purpose of the transaction precisely.

Correct Date Format

Use the standard MM/DD/YYYY format for consistency. Double-check the date on each entry to prevent errors when reconciling receipts later.

Accurate Payment Amount

Always verify that the payment amount aligns exactly with the recorded total. Even minor differences can lead to accounting issues.

- Petty Cash Receipts Template

A good petty cash receipts template includes key elements for clarity and tracking:

Receipt Number

Assign a unique number to each receipt for better organization and easier reference. This will help quickly trace any transaction in the future.

Amount and Payment Method

Specify the exact amount given and the method of payment (cash, check, etc.). This provides a clear record of how the funds were dispensed.

Always include a space for both the recipient’s name and signature. This ensures that the receipt is validated and creates accountability for the disbursement.

First, focus on the key details that should appear on your receipt. Include fields for the date of the transaction, a brief description of the expense, and the amount spent. Make sure to add a section for the signature of the person authorizing the payment as well as the person receiving the funds. This ensures accountability and traceability for all petty cash disbursements.

Ensure your template includes a unique receipt number for better record-keeping and tracking. A sequential numbering system helps maintain order and prevents duplication. Consider adding your business logo at the top for a professional appearance, along with your contact details in case of any inquiries.

Design the layout to be clear and easy to read. Group similar information together, using a simple table format. This will help anyone reviewing the receipts understand the transaction at a glance. Leave enough space for any additional notes, especially if the transaction involves multiple items or complex explanations.

Lastly, offer a space for the balance of the petty cash fund at the bottom of the template. This keeps a running total of the funds available and ensures your records align with actual cash on hand. With these elements, your petty cash receipt template will help streamline record-keeping and improve financial tracking for your business.

Date – Always include the exact date of the transaction. This helps to clearly track financial activities and prevents confusion during audits or reconciliations.

Transaction Amount – Clearly list the total amount spent or received. Break down any taxes, discounts, or additional charges to ensure transparency.

Receipt Number – Assign a unique identifier to each receipt. This makes it easier to track and reference specific transactions within the record system.

Payee Information – Include details such as the name or business name of the person or organization receiving the funds. This ensures accuracy in identifying all parties involved.

Description of the Expense – Provide a concise description of what the payment was for. Whether it’s office supplies, service fees, or any other expense, a clear description helps categorize expenses accurately.

Method of Payment – Specify how the transaction was made (e.g., cash, card, bank transfer). This assists in verifying the payment source during audits.

Signatures – If required, include the signature of the person making the transaction or the person approving the receipt. This adds legitimacy and accountability to the document.

Tax Information – If applicable, ensure that tax rates and totals are clearly stated. This is especially useful for VAT or sales tax tracking.

Amount in Words – Always include the amount written out in words to avoid confusion or fraudulent alterations.

Double-checking data entries is a must. Avoid entering inaccurate amounts or missing transaction details. Small mistakes can lead to discrepancies that take time to resolve later. Make sure the correct date, amount, and description are always included for every receipt.

Leaving out the payer’s information can create confusion, especially if there are multiple transactions. Always ensure that the name or reference of the payer is properly noted. This will help in tracking and reconciling funds correctly.

Don’t forget to categorize receipts correctly. Without proper categorization, it becomes challenging to analyze where cash is coming from and going. Stick to the predefined categories or add new ones only when necessary.

Refrain from skipping signatures or initials when required. Some templates ask for authorized signatures or other approval markings to confirm the legitimacy of the receipt. Failing to include this information can result in unverified or unapproved entries.

Ensure you’re using the template consistently across all transactions. Adapting or modifying it without a clear reason can lead to inconsistencies, making tracking difficult. Stick with one format throughout to maintain uniformity.

| Common Mistake | Solution |

|---|---|

| Incorrect amounts or missing data | Double-check all entries for accuracy |

| Failure to include payer details | Always include payer information or references |

| Inconsistent categorization | Stick to established categories or create a clear system |

| Skipping signatures/initials | Ensure all required approvals are included |

| Inconsistent template usage | Use the same template format for all receipts |

Ensure each receipt includes clear details such as the date, amount, and purpose of the expense. This allows for quick tracking and accountability.

- Record the name of the person making the purchase or receiving the payment.

- Include a brief description of the goods or services acquired.

- Use a consistent format for all entries to simplify tracking and reporting.

- Always keep receipts attached or referenced to the transaction for future auditing purposes.

- Designate a responsible person for managing and reviewing petty cash transactions regularly.

Having a clear template ensures accurate tracking and smooth reconciliation during audits.