Using a petty cash receipt template is a practical way to track small cash transactions in your business. A well-designed template allows you to maintain accurate records and ensure transparency when managing cash flow. Having a printable version makes it easier to keep physical copies for your records, which can be helpful during audits or when reconciling your accounts.

Choose a template that includes key details such as the date, description of the expense, amount spent, and the signature of the person making the transaction. You can find customizable templates that suit your specific needs, whether for personal use or a business environment. Keep it simple and clear, so that anyone using the template can easily fill in the necessary information without confusion.

Once you have selected your template, it’s a good idea to keep it on hand for quick printing. This can save time when you need to issue a receipt on the spot. With a standardized format, you’ll ensure that all your receipts look consistent and are easy to track in your financial system.

Here’s the revised version, where repeating words occur no more than two to three times:

Ensure clarity by using simple language in your petty cash receipt template. Avoid excessive repetition of terms, such as “amount” or “receipt.” Limit their use to two or three occurrences, as overusing them can make the template feel redundant and harder to read.

1. Structure Your Template Efficiently

The template should be easy to fill out. Focus on clear headings such as “Date,” “Amount,” and “Purpose.” These sections will ensure accuracy without unnecessary repetition. For example, use the word “Amount” only where it is needed, not in every sentence or line.

2. Streamline Your Language

Consider replacing phrases like “paid for” and “spent on” with a single, well-defined term. This keeps the template concise and user-friendly. You can use “Purpose” instead of describing what the amount was “spent on” repeatedly. This approach prevents redundancy and keeps the template professional.

| Section | Example |

|---|---|

| Date | Enter the date of the transaction |

| Amount | Specify the amount spent |

| Purpose | Describe the purpose of the payment |

By following these guidelines, you’ll create a straightforward and efficient petty cash receipt template, making it easier to track transactions with minimal repetition.

- Printable Petty Cash Receipt Template

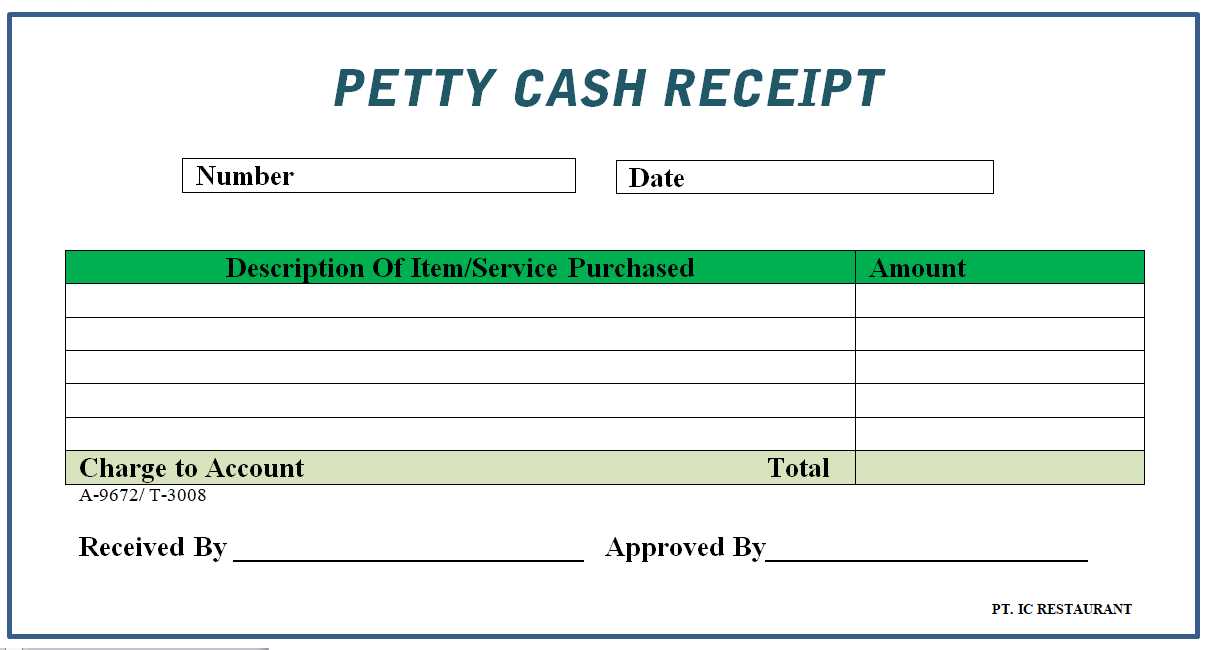

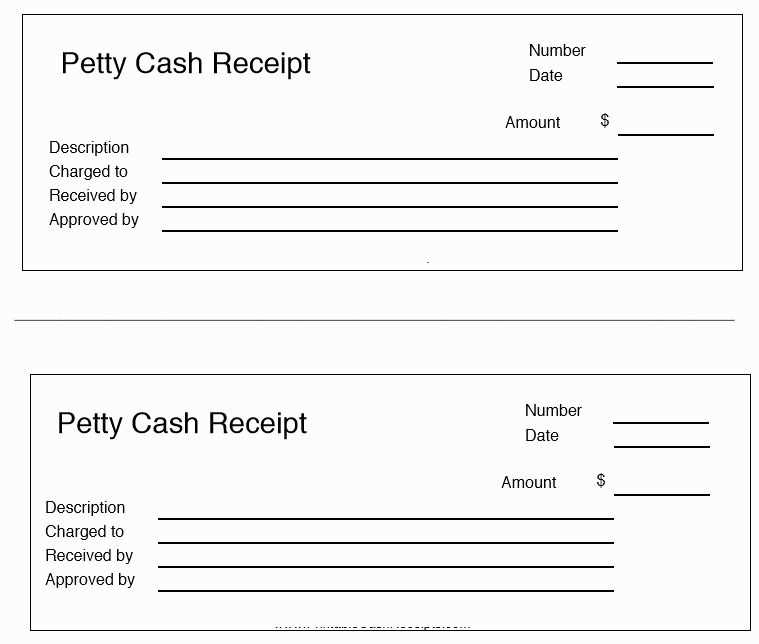

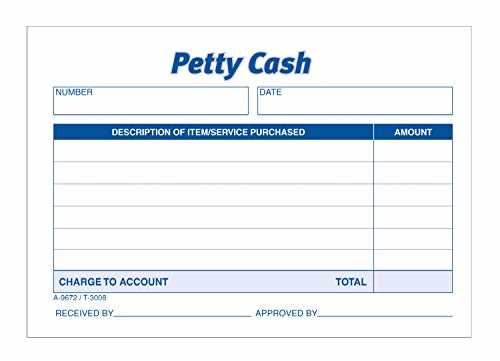

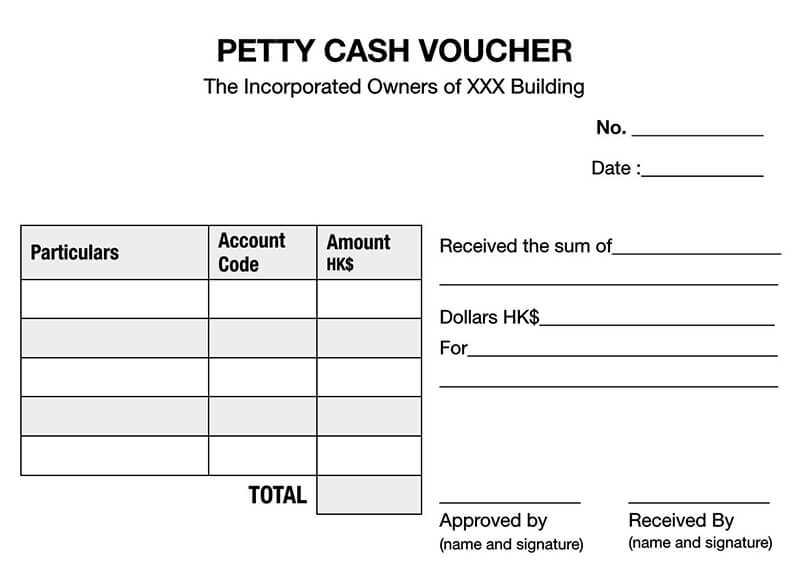

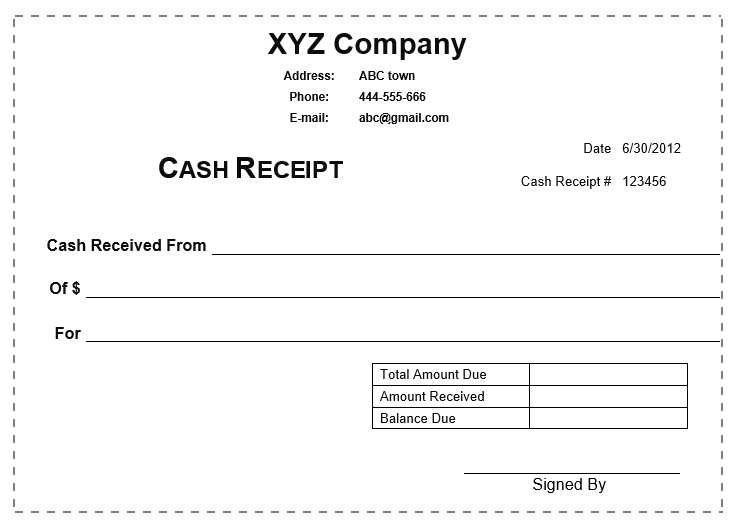

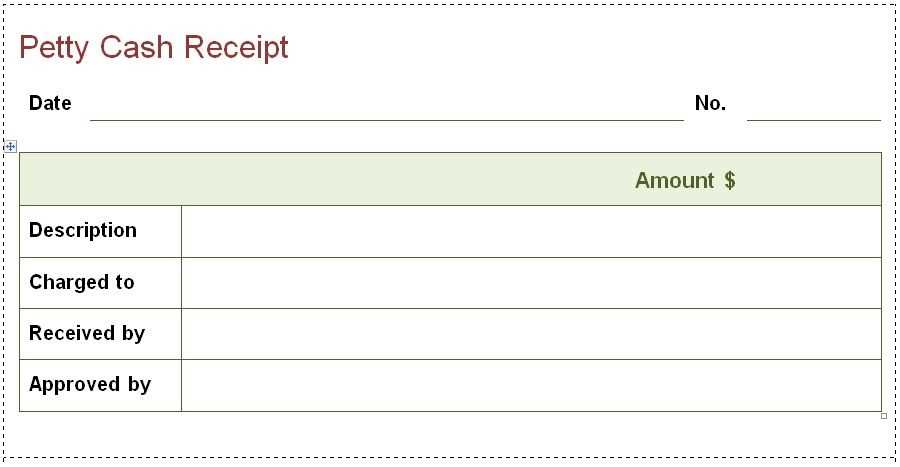

A printable petty cash receipt template should be clear and structured for easy documentation of small cash transactions. Include key fields such as the date, description of the expense, the amount, and the purpose of the cash spent. Ensure a line for the person receiving the funds to sign, as well as a signature space for the one disbursing the cash.

To ensure accuracy, organize the receipt with a designated area for the starting balance and the remaining balance. This makes it easier to track funds, especially when handling multiple small transactions. For simplicity, choose a design that accommodates all necessary details without being cluttered.

Using a well-formatted template will help keep your records organized and reduce the risk of errors when tracking petty cash usage. It’s a simple tool to help maintain transparency and accountability in everyday business operations.

To create a simple petty cash receipt template, include basic information that ensures clarity for both the issuer and the recipient of funds. Keep it concise and straightforward.

1. Add a Header

- Label the receipt clearly at the top, such as “Petty Cash Receipt.” This instantly identifies the document’s purpose.

2. Include Date and Receipt Number

- Provide a field for the date of the transaction and a unique receipt number. This helps in tracking and organizing receipts.

3. Specify Amount and Purpose

- Clearly state the amount of money disbursed. Be sure to write the amount both in figures and words.

- Describe the purpose of the expenditure (e.g., office supplies, transportation costs). This ensures accountability.

4. Identify the Payer and Payee

- Include fields for the name or department of the person requesting the cash and the name of the person issuing the receipt. This adds transparency to the transaction.

5. Provide Space for Signatures

- Include signature lines for both the recipient and the issuer. This formalizes the transaction and confirms that both parties agree to the details.

6. Additional Notes Section

- Optional: Add a space for any additional notes or remarks. This allows for flexibility in documenting unusual circumstances or clarifications.

By following these steps, you can create a simple, functional petty cash receipt template that ensures proper tracking and accountability in your financial processes.

Each petty cash receipt should contain specific details to ensure accuracy and transparency. Below is a list of key elements to include:

| Element | Description |

|---|---|

| Date | Include the date of the transaction to track when the money was spent. |

| Amount | Clearly state the exact amount of money disbursed. This ensures precise record-keeping. |

| Recipient Name | Record the name of the person receiving the petty cash to identify the transaction source. |

| Purpose | Note the reason for the cash disbursement (e.g., office supplies, transportation costs). |

| Approval Signature | Include a signature from the authorized person approving the petty cash expenditure. |

| Receipt Number | Assign a unique receipt number for easy reference and tracking in the petty cash log. |

By ensuring these elements are present, you’ll maintain organized and traceable petty cash records that support financial accuracy.

Pick a format that matches your workflow and keeps things simple. If you’re printing receipts by hand, a traditional paper format with clear spaces for key details like date, amount, and description is ideal. This makes it easy to complete each entry without confusion.

For digital receipts, choose a format that allows you to customize fields quickly. PDFs are widely accepted for their reliability and compatibility across devices. However, Excel or Google Sheets offer flexibility, especially if you need to track and calculate totals automatically.

Consider your audience as well. If receipts are handed over to clients, a clean, professional-looking template with a logo or business name might be beneficial. For internal use, simplicity and clarity should be your main focus, without unnecessary details.

Lastly, ensure that your template can be printed clearly. Test it with different printers and paper sizes to avoid cutting off crucial information. The right format enhances both the utility and presentation of your receipts.

Begin by adjusting the header to include your company’s name, logo, and contact details. This ensures that the receipt is clearly identified and easy to trace back to your business.

Next, ensure the date and time fields are visible for easy reference. Including these details helps track when the transaction occurred.

Add a field for the description of the petty cash expense. Clearly define what the funds were used for, whether it’s office supplies, transportation costs, or any other item. This keeps the records transparent and accurate.

Include space for the amount spent, both in numbers and words, to avoid any confusion or discrepancies. It’s a standard practice to ensure clarity in the total spent.

Designate a section for the signature of the person approving the expense. This serves as an authorization step and provides an accountability check.

Finally, ensure there is room for the receipt’s serial number or reference number. This unique identifier makes it easier to organize and retrieve the receipt when needed.

- Ensure your font is legible and professional.

- Make the layout clean with adequate spacing for each section.

- Include a “Thank you” message at the bottom to keep it polite and professional.

Customize the template to fit your specific needs, but always maintain clear and accurate details for record-keeping purposes. With these simple adjustments, your petty cash receipts will be well-organized and professional.

A printable petty cash receipt provides businesses with an easy and reliable way to track small cash transactions. By using this receipt template, you can ensure transparency in financial operations and avoid any misunderstandings related to petty cash expenses.

It helps establish a clear record of every transaction, making it easier to reconcile accounts at the end of the month. This transparency also reduces the risk of fraud or misuse of company funds. Employees are less likely to misuse petty cash when they are required to provide a receipt for each transaction.

Additionally, having physical receipts on hand simplifies auditing processes. In case of any discrepancies or audits, you can quickly present a well-organized and accurate record of petty cash expenditures. This minimizes the time and resources spent on resolving financial issues.

Another key benefit is that it saves time during bookkeeping. Instead of manually inputting every petty cash transaction into a digital system, a printable receipt can serve as a quick reference, which can later be easily digitized or filed for future use. This can streamline your accounting processes and ensure all petty cash records are kept in order.

Using a printable petty cash receipt also encourages a structured and professional approach to cash handling, enhancing financial discipline within your organization. This simple tool adds clarity and organization to otherwise chaotic cash transactions.

To quickly get a free printable petty cash receipt template, you can visit several online platforms offering customizable and ready-to-use templates. Websites like Template.net provide a variety of options, ranging from basic to more detailed formats. These templates are often downloadable in multiple file types, such as PDF and Word, making them easy to print or edit as needed.

Online Template Repositories

For a broader selection, try Smartsheet, which offers a range of printable receipt templates designed for both small businesses and personal use. Another popular option is Microsoft Office Templates, where you’ll find templates for Excel and Word. These templates can be customized and tailored to match specific needs.

Free Template Websites

Free receipt templates are also available on platforms like Vertex42 and Canva, which let you create and print receipts quickly. Some sites offer templates that you can fill out online and then print, saving you the hassle of manual editing.

Redundant repetitions are eliminated while maintaining the meaning of each sentence.

To streamline a petty cash receipt template and remove unnecessary repetition, focus on clarity and precision. Replace redundant phrases with concise wording that still conveys the intended message. For instance, instead of repeatedly stating the amount of money, use “total amount” once and refer to it simply in other parts of the receipt.

Key Recommendations:

- Avoid repeating the same information multiple times. Once you state the purpose, use placeholders or clear headings to refer to it again.

- Group related data together for better organization, like payment amount and purpose, under one heading to avoid redundant explanations.

- Use simple, direct sentences. If an explanation doesn’t add value, remove it.

This approach keeps the content clear and easy to read, while also making sure all essential details are covered without excess.

Examples of Improvement:

- Original: “The amount of cash given was $50. The $50 was given as a payment for office supplies.”

Improved: “A payment of $50 was made for office supplies.” - Original: “This receipt acknowledges the payment. It acknowledges that the cash payment was made.”

Improved: “This receipt acknowledges the cash payment.”

Following these guidelines will create a receipt template that is concise, functional, and free from unnecessary repetition.