If you need a simple and reliable template for documenting cash transactions, a receipt template is your go-to tool. Creating a cash receipt can save time and avoid misunderstandings, ensuring both parties have clear records of the exchange. With the right structure, you can include all necessary details, such as the payer’s name, amount paid, payment date, and description of the transaction.

Start by using a format that is easy to fill in and update. Include fields for both the payer’s and the receiver’s information, as well as a breakdown of the payment. Be sure to note the method of payment and include a unique receipt number for tracking purposes. If applicable, add the reason for the transaction or services rendered for better clarity.

Once the template is ready, personalize it to fit your business or personal needs. Whether you’re running a small business or making a one-time personal transaction, having a standard cash receipt template will keep you organized and provide documentation that both parties can reference later.

It’s a quick process that requires minimal setup. The template can be used repeatedly, saving you time on paperwork and providing peace of mind for both parties involved in the transaction.

Here’s the revised version:

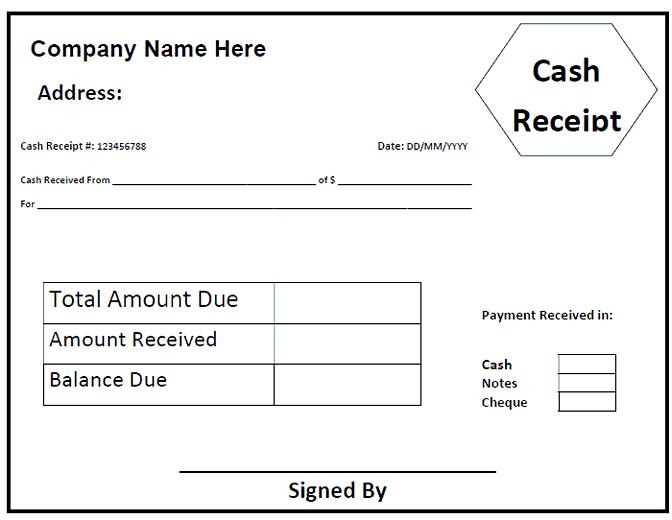

To create a clear and professional cash receipt, ensure the document contains the following key elements:

1. Date and Transaction Details

Include the date the payment was received. Specify the transaction purpose, such as “payment for services rendered” or “sale of goods.” This clarifies the reason for the cash exchange.

2. Payer and Payee Information

List the name of the individual or business making the payment (payer) and the recipient (payee). It’s essential for proper record-keeping and verification.

For ease of reference, provide space for both parties to sign. Ensure the amount is written both in numbers and words, avoiding confusion or errors.

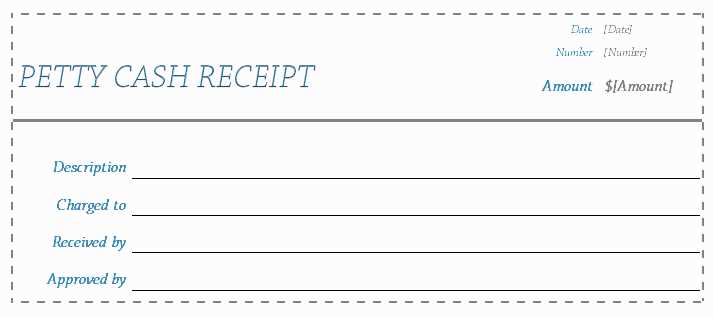

- Receipt of Cash Template

A clear and accurate receipt of cash template is necessary for any transaction involving cash. This document provides both the payer and the recipient with proof of payment, which is useful for record-keeping and resolving any disputes. Below is a simple structure for a receipt of cash template:

Basic Elements of a Receipt of Cash

The receipt should include the following details:

- Receipt Number: A unique identifier for each receipt.

- Date: The date of the transaction.

- Amount Paid: The exact amount of cash received, written both in numbers and words.

- Paid By: The name or business of the payer.

- Received By: The name or title of the individual or company receiving the payment.

- Payment Description: A brief description of what the payment is for.

- Signature: The signature of the person receiving the payment to validate the transaction.

Additional Tips for Creating the Template

Make sure the template is easy to read and can be customized to fit various transaction types. Use a clean and professional font, and ensure the fields are clear so that they can be easily filled out by hand or digitally. Always double-check the amounts and signatures to ensure accuracy before finalizing the document. Keep a copy for both parties for reference.

Focus on including all necessary details clearly and concisely. Start with the date the payment is received. This establishes the transaction timeline and ensures clarity.

Next, list the payer’s information. Include their name, address, and contact details. This helps in tracking who made the payment and facilitates communication if needed.

Include Payment Information

Clearly state the amount received in both numerical and written form. This eliminates any confusion regarding the exact payment. Specify the payment method used (cash, check, bank transfer, etc.). Include any relevant reference numbers if available.

Provide a Breakdown of Goods or Services

If applicable, include a detailed description of the items or services paid for. This helps both parties understand what the payment is for and avoids disputes later.

Conclude the form with the issuer’s name, signature, and contact information. This adds legitimacy and accountability to the receipt.

Keep the design simple and well-organized. Use a readable font and avoid clutter. A straightforward layout enhances the form’s usability and reduces mistakes.

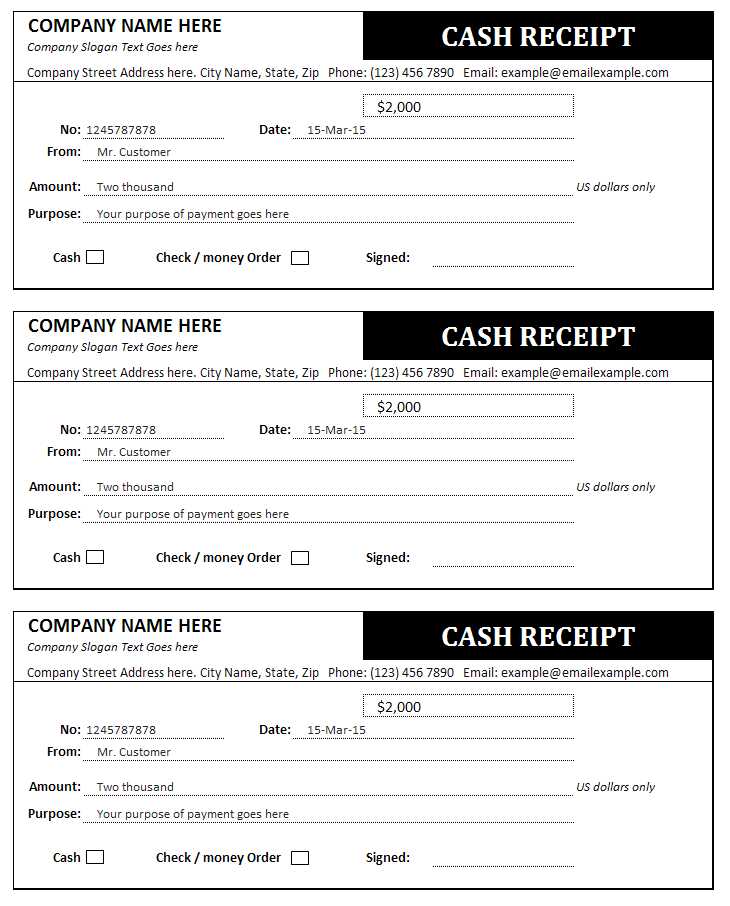

To create a clear and accurate cash receipt, include the following details:

- Date of Transaction: Record the exact date when the payment was made to ensure proper tracking and reference.

- Amount Received: Specify the exact amount of cash received, clearly noting the currency used, especially if it differs from the local currency.

- Payment Method: Indicate that the payment was made in cash to avoid confusion with other methods like credit cards or checks.

- Issuer’s Name or Business Name: Identify the person or business that received the payment. This provides a point of reference for future queries or disputes.

- Recipient’s Name (if applicable): Include the name of the individual or entity making the payment if the receipt is issued on their behalf.

- Receipt Number: Assign a unique number to each receipt for easy tracking and record-keeping.

- Description of Goods or Services: Provide a brief description of the goods or services paid for, including any relevant details like quantities or model numbers.

- Signature (if required): Some receipts may need a signature from either the issuer or the recipient to verify the transaction.

- Tax Information (if applicable): If the transaction involves sales tax, clearly indicate the tax rate and amount included in the total sum.

Including all these details ensures that the receipt serves as a reliable record for both parties involved. Keep the information concise and accurate to prevent any misunderstandings later on.

Keep the receipt layout clean and clear, focusing on what’s necessary. Use legible fonts and a layout that flows logically. Begin with the store or service name, followed by the transaction date and time. Ensure this information is easy to find at the top.

Next, list the items or services provided. Keep descriptions short, and include quantities, prices, and any applicable taxes. Use columns for clarity, with product names on the left and their corresponding prices on the right.

Place the total amount due at the bottom, clearly separated from other details. If there are any discounts or promotions applied, highlight these amounts right above the total for transparency.

Consider including contact information or a simple return policy at the bottom, but don’t clutter the receipt with unnecessary details. Aim for a balance between informative and concise.

Finally, leave some white space to make the receipt feel less crowded and more visually appealing. A straightforward design that doesn’t overwhelm the customer will ensure your receipt is both functional and easy to understand.

Group receipts by category to stay organized. Separate receipts for business, personal expenses, and any other relevant categories to reduce confusion. This will make it easier to track spending and find specific receipts when needed. Use envelopes, folders, or digital folders to categorize physical and digital receipts accordingly.

Make use of receipt scanning apps. These apps can digitize your receipts and organize them automatically by date, category, or vendor. It saves time and reduces the risk of losing paper receipts. Some apps even allow you to store receipts in the cloud for easy access across devices.

Set a routine for organizing receipts. Create a habit of scanning or filing receipts regularly, whether daily or weekly. This helps you avoid accumulating a stack of receipts that can become overwhelming to sort later. Establish a deadline for filing or scanning receipts after each purchase to stay on top of your records.

Tag or label receipts with keywords. Whether digital or paper, add tags such as “tax deductible” or “reimbursable” to important receipts. This way, you can quickly filter through them when preparing for tax season or submitting expense reports.

Back up your digital receipts. Don’t rely on one storage method. Use cloud storage and local backups to ensure you have a secure copy of all receipts. This minimizes the risk of losing valuable financial data if one method fails.

Review your receipts regularly. Periodically check your receipts to verify that all transactions are correct and that there are no duplicate or unaccounted purchases. Keeping receipts up to date helps you avoid errors that could affect your financial records or budgeting efforts.

Cash receipt documentation must meet several legal standards to ensure validity and protect both parties involved. Below are key legal requirements that businesses must adhere to:

- Accuracy of Details: Each receipt should clearly state the amount received, the date of the transaction, and the parties involved (payer and payee). This prevents disputes and ensures transparency.

- Signature or Acknowledgment: Receipts should include a signature or some form of acknowledgment from the recipient to verify the transaction. This could be a physical signature or an electronic confirmation in case of digital receipts.

- Legal Compliance with Tax Regulations: Receipts must comply with local tax laws, which may require including specific information like tax ID numbers or VAT details for businesses subject to tax regulations.

- Clear Payment Description: The purpose of the payment should be explicitly stated, whether it’s for goods, services, or a deposit. This helps in future audits and dispute resolutions.

- Retention Period: Cash receipt records should be retained for a legally specified period, typically ranging from 3 to 7 years depending on jurisdiction, for tax and audit purposes.

- Format and Language: Ensure that the receipt is in a clear, readable format. In some jurisdictions, certain languages may be required on receipts for them to be legally binding.

Fulfilling these requirements helps avoid potential legal issues and provides clear, accountable documentation of financial transactions.

Tailor your receipt template to match your business identity by including key details that matter to your customers and your operations. Begin by adding your business name, logo, and contact details at the top. This gives the receipt a professional touch and allows customers to easily reach you if needed. Ensure that the receipt’s design is clean, simple, and aligned with your brand style. Using colors or fonts that reflect your branding can help enhance the customer experience.

Key Information to Include

Include fields that specifically relate to your business. For example, if you run a retail store, add itemized product descriptions, quantities, and individual prices. For services, consider providing more detailed service descriptions and the hourly rate if applicable. Don’t forget the date and time of the transaction. This makes tracking and referencing receipts more efficient for both your team and the customer.

Adding Customizable Elements

Depending on your business model, you may need to add specific notes or disclaimers on receipts. For example, if you offer warranties, include a section detailing the terms. Some businesses may want to add a feedback or promotional message to encourage repeat business. Customize these sections to serve both practical and marketing purposes, ensuring they are concise but informative.

Lastly, make sure the template is flexible enough to accommodate different transaction types. This way, you can easily adapt it for various payment methods, refunds, or discounts without overhauling the template each time. Keeping the design versatile ensures long-term usability.

Removing Redundant Word Repetitions While Retaining Meaning

To make your receipts clear and concise, remove unnecessary word repetitions. If certain phrases are used multiple times without adding value, simplify the sentence structure without losing key information.

Tips for Reducing Word Repetition

Review your template for any phrases where the same concept is repeated, such as “cash payment received” and “received cash payment.” Replace these with more straightforward expressions, such as “cash received,” to keep the message clear and to the point.

| Redundant Phrase | Optimized Version |

|---|---|

| “Cash payment received” and “payment made in cash” | “Cash received” |

| “Amount of money received in full” and “full payment received” | “Full payment received” |

| “Total amount of the transaction” and “transaction total” | “Transaction total” |

These small adjustments ensure the receipt is both professional and easy to understand, without over-complicating the message.