Creating a receipt template for cash transactions in PDF format offers simplicity and professionalism when documenting payments. By using a customizable template, businesses can quickly generate receipts that are both clear and visually appealing. This approach ensures that cash transactions are accurately recorded, providing transparency for both the payer and the recipient.

One of the key benefits of using a PDF template is its consistency and easy distribution. Once a template is set up, you can generate a receipt with minimal effort, ensuring uniformity in your documentation. PDF format guarantees that the receipt retains its formatting across different devices and platforms, making it a reliable choice for both digital and physical record-keeping.

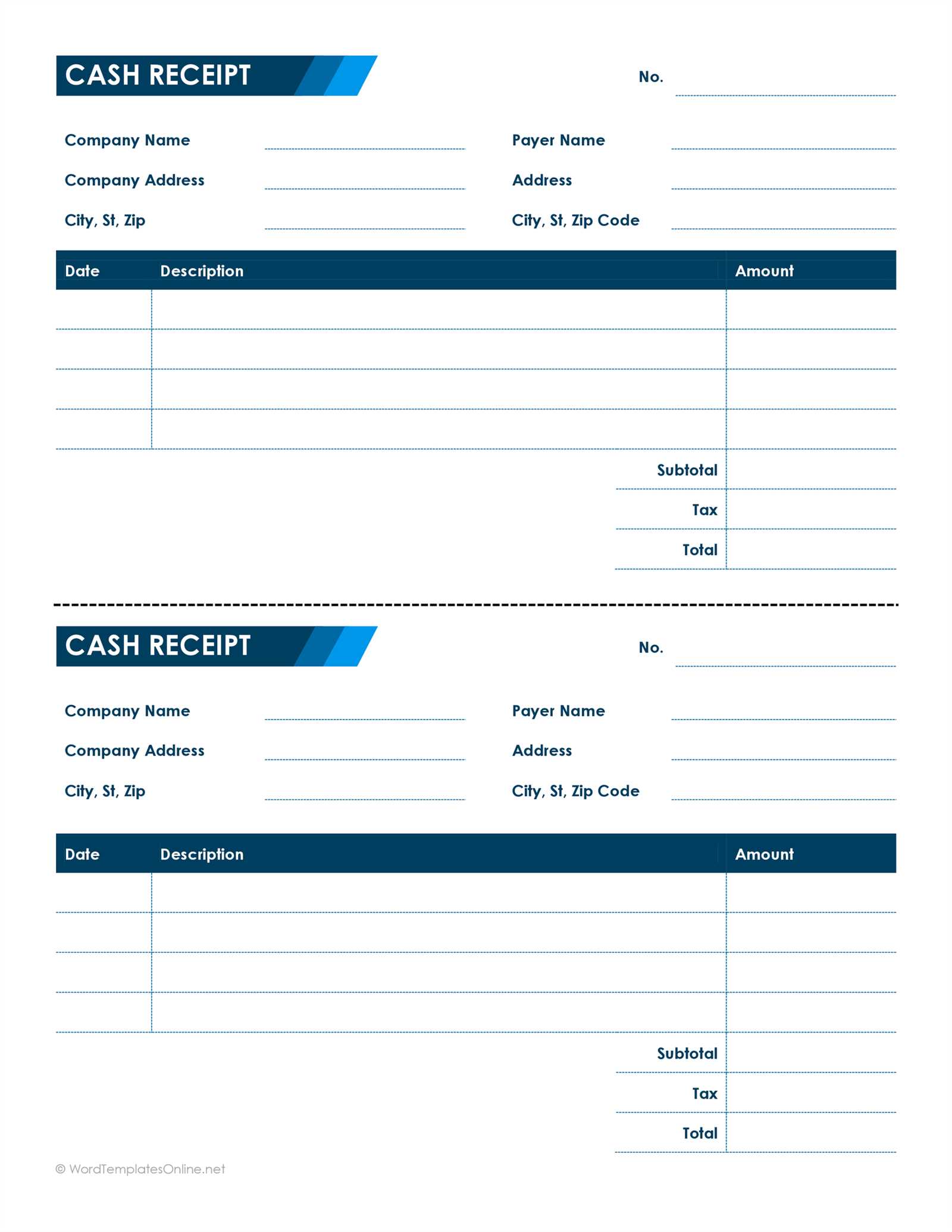

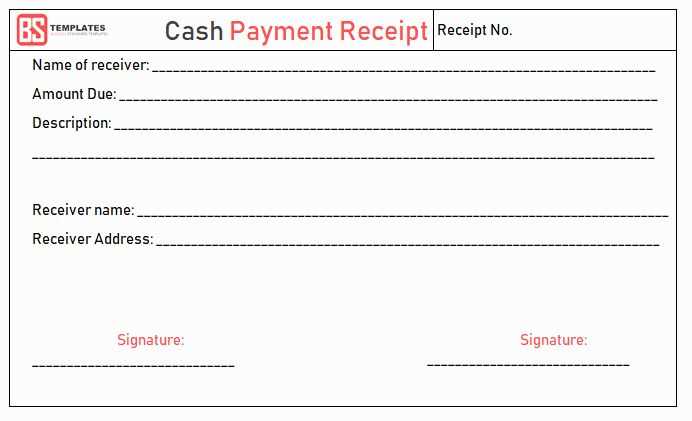

Take advantage of a cash receipt template PDF to include important details such as the transaction date, amount, payer’s name, and purpose of the payment. Customizing the template further with your business’s logo and contact details enhances brand recognition and adds a personal touch. Whether you’re running a small shop or a larger enterprise, this straightforward tool helps streamline your financial recordkeeping.

Here is the revised text where the term “Cash Receipt” is mentioned no more than two to three times:

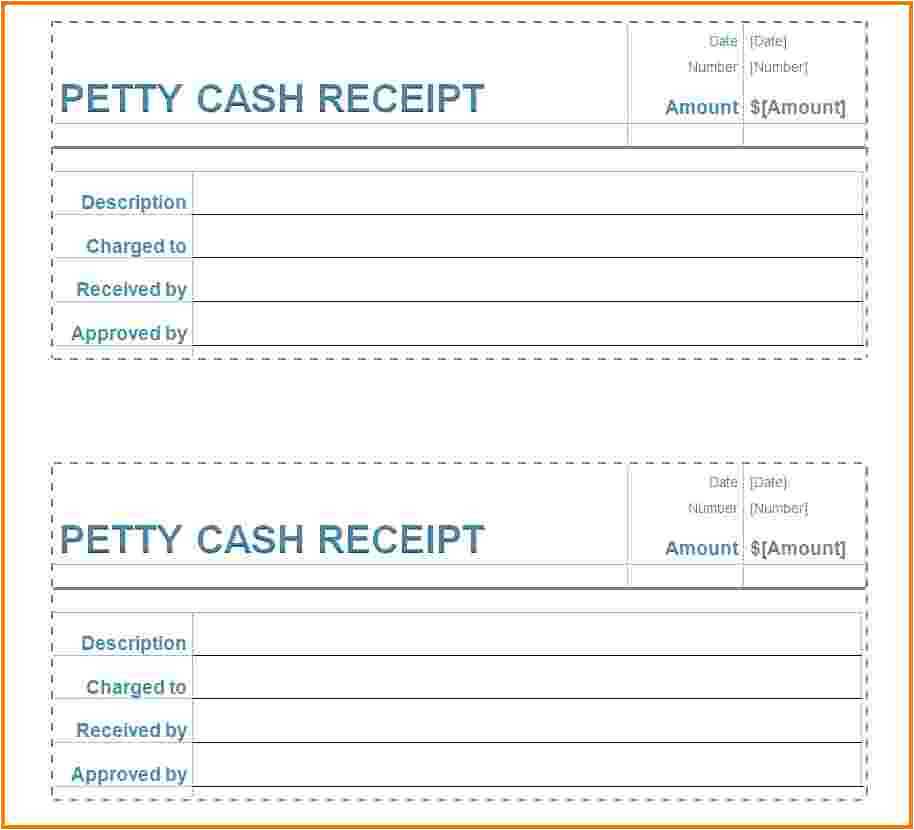

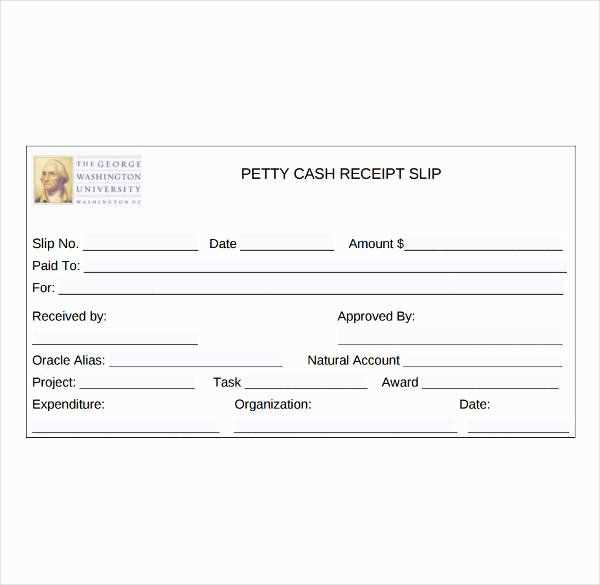

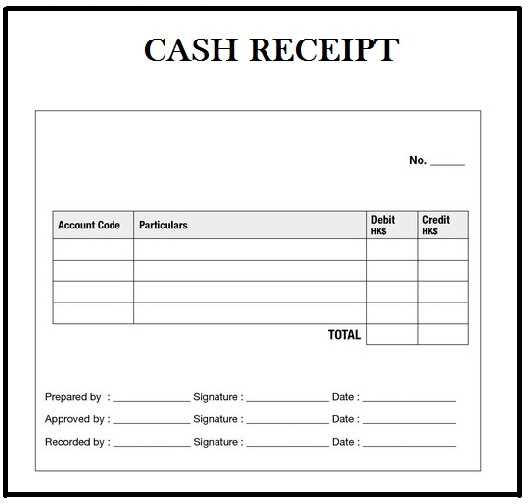

To create a professional cash receipt template, ensure clarity and precision in your layout. Use headings and sections to clearly define important details such as the amount, date, and payer information. Keep the structure simple yet organized, with key fields like the payment method and receipt number. This will make the document easy to read and reference later.

The cash receipt should include the transaction date, the payer’s name, the total amount paid, and the reason for the payment. Consider using a clean font and adequate spacing between fields to ensure all details are clearly visible.

When designing the template, include a section for the signature or confirmation to validate the transaction. A printable PDF format is ideal for this purpose, allowing for easy distribution and archiving. For added convenience, make sure that the receipt can be filled in digitally, reducing the need for manual input.

Lastly, ensure that your template is adaptable to different amounts and types of transactions. A well-designed cash receipt will save time and provide a professional touch to your financial documentation.

- Receipt Template in PDF: A Practical Guide

A PDF receipt template is an easy-to-use solution for creating professional, consistent receipts. Start by choosing a template that includes the key details of the transaction. These details typically include the date, itemized list of purchases, total amount, and payment method. It’s crucial that all information is clear and organized to avoid confusion for both the business and the customer.

Customization Tips

Tailor the template to your specific business needs. Most PDF receipt templates allow you to modify fields such as the company name, logo, address, and contact information. Adjust the layout to ensure it fits your brand and is easy to read. Make sure to include any additional fields like discounts, taxes, or serial numbers if applicable to your business model.

How to Use a Receipt Template in PDF

After selecting and customizing the template, save it as a PDF file. This format ensures the receipt remains consistent across devices, preventing any misalignment or font changes. PDF files are universally accessible, so both you and your customers can view them on virtually any platform without issues. When a sale is made, simply fill in the relevant details and generate the receipt. Having a PDF receipt template ready speeds up the process, helping you maintain a professional workflow.

To create a customizable receipt template in PDF, use a reliable tool like Adobe Acrobat or any online PDF editor. These platforms allow you to design templates with fields that can be filled out dynamically, making the process more versatile for different uses.

1. Select a PDF Editor

- Adobe Acrobat Pro: Offers advanced features for creating forms, adding fields, and exporting templates in PDF format.

- Online Editors: Free tools such as PDFescape or Jotform also let you create customizable PDF templates without installation.

2. Design Your Template Layout

- Include standard sections: header (company name, address), body (itemized list), and footer (total, payment method, terms).

- Decide which fields will be dynamic, such as the customer’s name, date, item details, or amount.

- Leave placeholders for custom data entry fields like text boxes or dropdowns.

3. Add Interactive Fields

- Text Fields: For customer details, items, and total amounts.

- Check Boxes: If applicable, for services or terms and conditions.

- Drop-down Menus: For selecting predefined options like payment methods or item categories.

4. Save and Test the Template

- After creating the template, save it as a fillable PDF and test by entering different data into the fields.

- Ensure that the fields adjust correctly and the form layout remains intact.

Several reliable tools stand out for creating PDF receipts with ease. Whether you’re a small business owner or a freelancer, these platforms provide a smooth process for generating clear, professional receipts. Here’s a quick guide to some of the most effective options available:

1. Zoho Invoice

Zoho Invoice offers a simple interface and customizable templates for creating detailed receipts. With this tool, you can easily add transaction details, logo, and tax information. The ability to save and send receipts directly as PDFs adds a layer of convenience. It integrates with payment gateways and supports multiple currencies.

2. Wave Accounting

Wave Accounting is ideal for entrepreneurs looking for a free solution. This tool automatically generates receipts after payments are processed, which you can then download as PDFs. You can customize the layout and include business branding. Wave also tracks payments, making it useful for managing finances beyond receipts.

3. Invoice Simple

Invoice Simple offers a fast, no-frills approach to receipt generation. Create and send invoices and receipts in minutes, and download them as PDFs. This tool is intuitive and allows users to personalize receipts with their company details and logos. It’s a great option for those seeking simplicity.

4. PayPal

PayPal generates automated receipts for all transactions conducted through its platform. While it primarily focuses on payment processing, it also provides downloadable PDF receipts that you can share with clients or customers. This tool is particularly useful for businesses that frequently use PayPal for transactions.

5. QuickBooks Online

QuickBooks Online allows businesses to create and manage receipts alongside their accounting data. It offers customization options and generates PDF receipts that are automatically updated with client details and taxes. The integration with various payment systems makes it a powerful tool for business owners with diverse payment methods.

These tools allow you to easily manage receipts without unnecessary complexity, ensuring that you can focus on your business while handling transactions efficiently.

Include the date of the transaction. This helps both the customer and the business track when the payment occurred. It’s particularly useful for accounting and returns.

Add the name of your business or organization. Clearly display the business name along with the contact details, such as an address, phone number, or email. This allows customers to reach you in case they need assistance or have questions about the transaction.

List the items or services purchased, with a description and price for each. This ensures transparency and provides customers with a clear record of what they paid for. If applicable, include any discounts or promotional codes applied.

Provide the total amount paid, including taxes and any extra charges. This should be clearly marked to avoid confusion. Make sure the breakdown of the subtotal, taxes, and total is easy to read.

Include the payment method used. Whether it’s credit card, cash, or another method, knowing how the transaction was completed can help resolve issues later.

Display a unique transaction or receipt number for reference. This number will help you and the customer identify the specific transaction, especially if there are multiple receipts involved.

If the receipt involves a return or refund policy, include a brief statement or a link to the full policy. This sets expectations and informs the customer about their rights regarding returns or exchanges.

Lastly, include any terms or conditions that might apply to the transaction. This includes any warranties, limitations of liability, or other legal disclaimers that might affect the customer’s experience.

First, scan or take a high-quality photo of the receipt. Ensure that the entire document is visible and readable in the image. Use a smartphone or scanner with a high resolution to avoid blurry details.

Next, open a PDF creation tool. Popular apps like Adobe Acrobat or free tools such as Smallpdf or PDF24 will work. Select the “Create PDF” or “Convert to PDF” option in the software or app.

Upload the image of the receipt into the tool. Ensure the image is in the correct orientation. Most tools will automatically rotate the image if needed, but double-check for accuracy.

Once uploaded, adjust the file size, margins, and quality settings. Many PDF tools allow you to crop the image or adjust the resolution. Make sure the content of the receipt remains clear and legible.

Click on the “Convert” button to initiate the PDF creation. The software will process the image and turn it into a PDF document.

Finally, save the newly created PDF to your device. Choose a location on your computer or cloud storage to easily access it later. You can now share, store, or print your receipt as a PDF with ease.

PDFs guarantee that your receipts will look the same across all devices, preserving the layout and content. This format is universally supported, making it easy for customers to view, store, and print receipts without issues. Additionally, PDF files are compact, reducing the file size compared to other formats like images or Word documents, which can be important for storage or email attachments.

Security is another reason to opt for PDFs. PDFs can be encrypted and password-protected, ensuring that sensitive information remains safe. You can also add digital signatures to verify the authenticity of the receipt.

The searchable text feature in PDFs makes it simple to locate specific details quickly. This can be especially useful when managing large volumes of receipts or performing audits. Plus, PDFs retain the exact formatting you set up, reducing the risk of misinterpretation or loss of detail in receipts.

With PDFs, you also gain flexibility in how you share receipts. You can email them directly, store them in the cloud, or save them for offline use. This convenience saves time and effort for both businesses and customers.

To modify a receipt PDF on a desktop, start by using a reliable PDF editor like Adobe Acrobat or an online tool like PDFescape. These platforms let you add or change text, adjust font size, and update date or amount details. Simply open the PDF file, choose the “Edit” option, and make the necessary changes. Save your work when finished.

Editing on Windows and macOS

If you’re using Windows or macOS, Adobe Acrobat Pro remains a top choice for comprehensive editing. For a free solution, consider using PDF-XChange Editor on Windows or Preview on macOS, which both support basic text edits and annotations. After editing, you can export the file in your desired format or simply save it as a PDF.

Editing on Mobile Devices

On mobile devices, apps like PDFelement or Adobe Acrobat Reader are highly recommended for both Android and iOS. These apps allow you to fill in forms, add comments, or insert text and images. They provide a user-friendly interface, enabling quick adjustments without needing a desktop. Once your changes are made, you can easily save or share the updated PDF.

To create a clean and user-friendly receipt template for cash transactions in PDF format, focus on clarity and consistency. Begin by organizing essential transaction details such as the date, items purchased, total amount, and payment method.

Structure your template with well-defined sections for each of these details. Use tables for easy readability, ensuring that each column aligns properly with its corresponding information.

| Item | Quantity | Price | Total |

|---|---|---|---|

| Item 1 | 1 | $10.00 | $10.00 |

| Item 2 | 2 | $5.00 | $10.00 |

Make sure the total is clearly visible at the bottom of the table. Including a “thank you” note or business contact information can personalize the receipt.

For PDF creation, use simple tools like Microsoft Word or online PDF generators to convert the template to PDF format. Once finalized, save it in a template file for reuse, ensuring a streamlined process for future transactions.