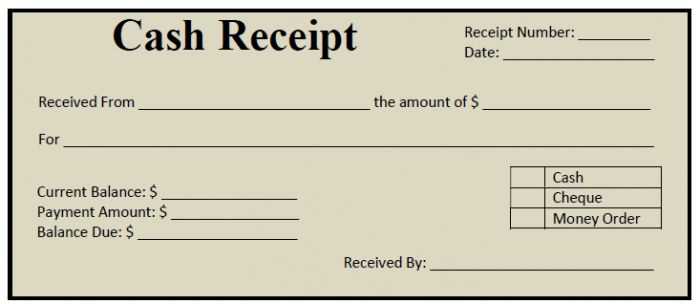

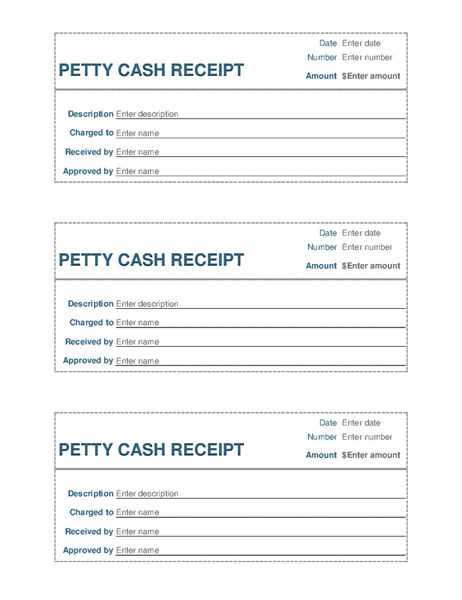

For creating a clear and functional receipt template for cash transactions, focus on simplicity and precision. Begin by including essential information: the date, the name of the seller, and the buyer’s details. Make sure to list the items or services purchased along with their corresponding prices and the total amount paid.

Use a clean layout with clearly defined sections for each piece of information. This helps in easy comprehension and reduces the chances of errors or misunderstandings. For instance, have a section for payment method, indicating cash as the method used, and ensure that the total amount is bolded for visibility.

Keep the design minimal while still providing all the necessary details. A good template will feature organized sections, including a footer for any additional notes, such as return policies or terms. A straightforward format is the most effective way to maintain a professional appearance while ensuring clarity for both parties involved in the transaction.

Receipt Template for Cash World

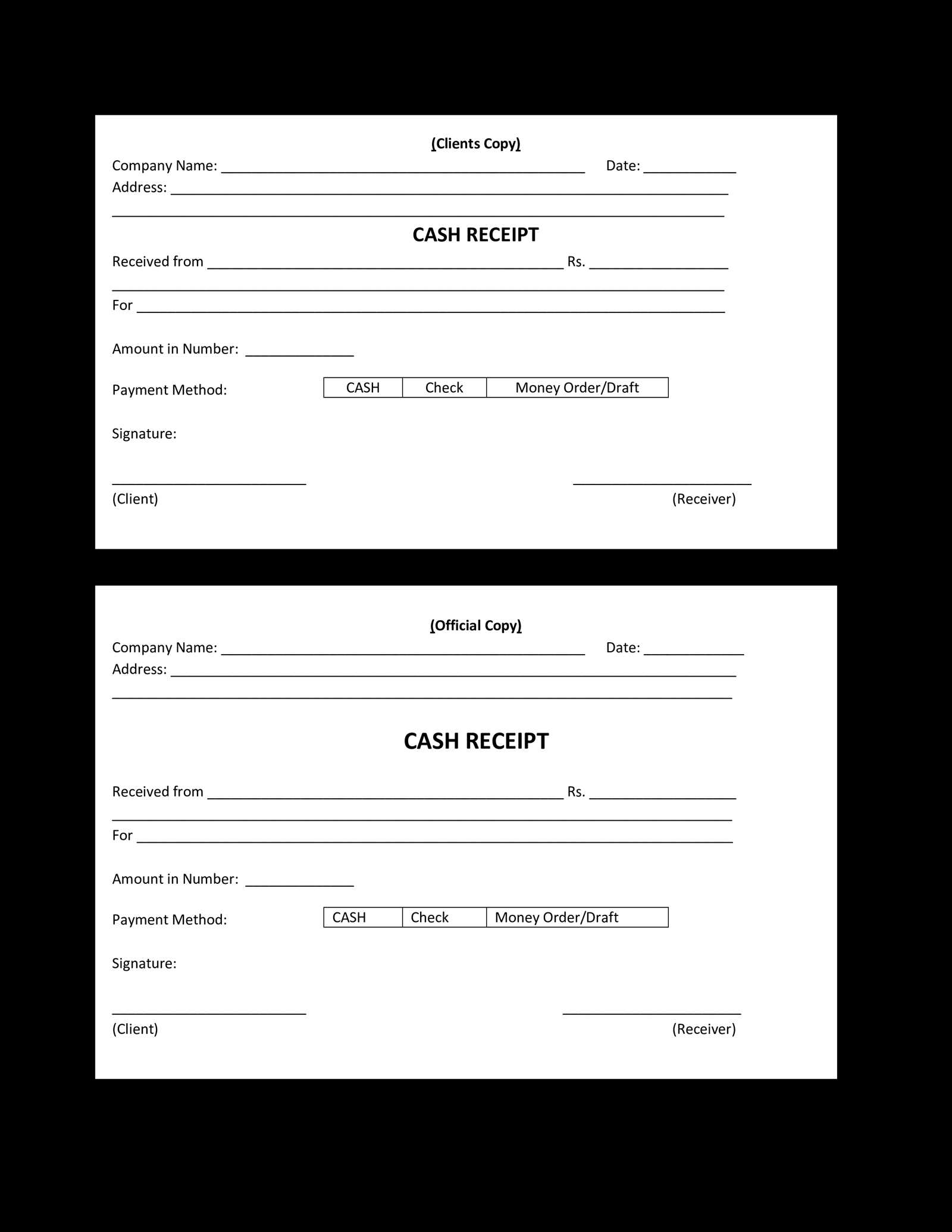

To create a functional receipt template for Cash World, focus on including specific details such as the transaction date, customer information, itemized list of products or services, and the total amount. Each section should be clearly marked, ensuring ease of understanding for both the customer and the business. Make sure to include a unique transaction number for tracking purposes.

Transaction Details

The template must feature a space for the transaction number, date, and time. It’s crucial to specify the method of payment–whether it’s cash, credit card, or another form of payment. This will provide clear documentation for financial purposes.

Itemized List

Ensure the receipt includes a detailed list of the purchased items or services. For each item, display the quantity, description, and price. At the bottom, clearly state the subtotal, taxes, and the final total. This will guarantee transparency in the transaction and avoid any confusion during a potential dispute or return.

Designing a Simple Receipt Layout

Keep the layout clear with a few basic elements that make it easy to read and understand. Start with the company name at the top, followed by contact information like phone number and website, if necessary. This provides immediate access to the business’s identity for the customer.

- Itemized List: Clearly list each product or service, including the quantity, price, and total. Use a simple table format to align the text for better clarity.

- Subtotal: Provide a subtotal for all items before any discounts or taxes.

- Discounts and Taxes: Clearly separate any discounts, taxes, or additional fees, and display them prominently for transparency.

- Total Amount: Highlight the final total at the bottom of the receipt. It should stand out to ensure customers know the exact amount they are being charged.

Incorporate spacing between sections for readability. Ensure that the font is legible and consistent throughout the receipt. Use bold text for key numbers like the total price or tax amounts.

Finally, leave space at the bottom for any additional information such as a thank you message or return policy. Keep it brief, so the focus stays on the transaction details.

Customizing Fields for Specific Transactions

Adjusting fields for specific transactions ensures that your receipt template matches your business needs and simplifies the process for customers. Begin by identifying the type of transaction–whether it’s a sale, refund, or exchange–then tailor the fields accordingly. For example, include specific data fields like discount percentages, payment methods, or product condition for returns.

Adjusting Data Fields

For retail transactions, you can add fields such as “Item Description,” “Quantity,” and “Unit Price.” In case of a refund, include “Refund Reason” and “Original Transaction Date.” This customization provides clarity and ensures that every relevant detail is captured for reporting and auditing purposes.

Incorporating Transaction-Specific Information

If you offer multiple payment methods, integrate a “Payment Method” field. For exchanges, a field to track the “Exchange Item” and “Original Item” may be helpful. Adjusting your fields based on transaction type reduces manual data entry and prevents errors. Customize labels to match your business language, keeping the process straightforward for both your team and customers.

Integrating Payment Methods and Tax Calculations

For smooth processing, link payment methods directly to tax calculation functions in your receipt template. This ensures automatic tax adjustments based on the payment method and total transaction amount.

Payment Method Setup

Start by setting up payment gateways to handle various methods like credit cards, PayPal, and cash. Ensure each method provides clear data about the payment amount and method type. Once integrated, map each payment type to its corresponding tax rate.

Tax Calculation Integration

Use formulas within the receipt template to calculate taxes based on the subtotal. For example, set a function to calculate sales tax by multiplying the total by the current tax rate. This rate can be adjusted according to the payment method or geographic location, if necessary.

For simplicity, include an option to display tax-exempt transactions or special rates for specific products. This adds flexibility to your template, making it adaptable to different business models.

Lastly, validate that your tax calculations are correct by testing with various transaction amounts and payment methods. Adjust your formulas as needed to ensure accuracy.