To ensure clarity and accuracy, always include key details when creating a receipt for cash or check payments. A well-structured template helps both the business and the customer track the transaction with ease. Start by including the date of payment, the amount received, and the method of payment (cash or check). These elements provide clear records and prevent any confusion in the future.

For cash payments, include the total amount given and any change returned, if applicable. This will provide a transparent breakdown of the transaction. When dealing with checks, it’s important to list the check number, the bank’s name, and the payment amount. This information ensures that the payment is properly credited and avoids misunderstandings in case of future disputes.

Another important aspect is the description of the goods or services provided. A concise item list helps the customer confirm the transaction details. It’s also helpful to include your business’s contact information for future reference, as well as a unique receipt number for easy tracking and record-keeping. Make sure the format is clean and legible to avoid errors down the line.

Here’s the revised version:

For accurate record-keeping, always include specific details on your receipt for cash and check payments. This provides transparency for both the payer and the payee.

Receipt Structure

Start by listing the payer’s name or business name. Follow with the payment amount, the payment method (cash or check), and the date of the transaction. If it was a check, include the check number to avoid any confusion later. Add a brief description of the goods or services rendered for clarity.

Clear Payment Method Identification

Be explicit about the method of payment. For cash payments, simply note “Cash.” For checks, list the check number and specify that payment was made by check. This distinction ensures both parties have an accurate reference in case of disputes or clarifications later.

- Receipt Template for Cash and Check Payments

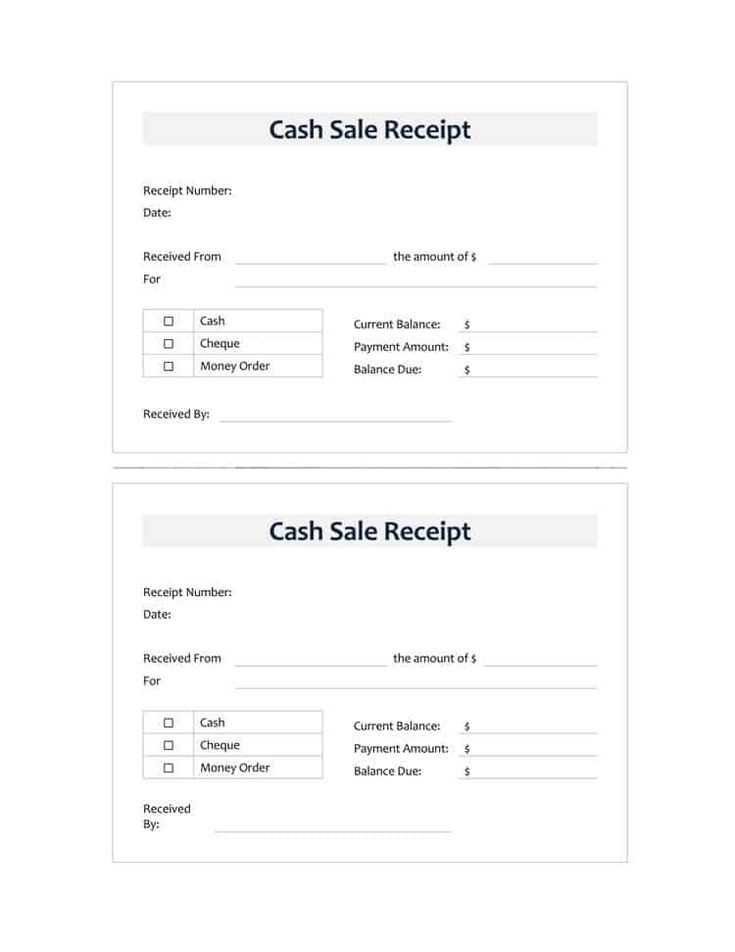

For businesses handling cash and check payments, a clear and concise receipt template ensures transparency and reduces disputes. Below is a practical template to record such transactions efficiently.

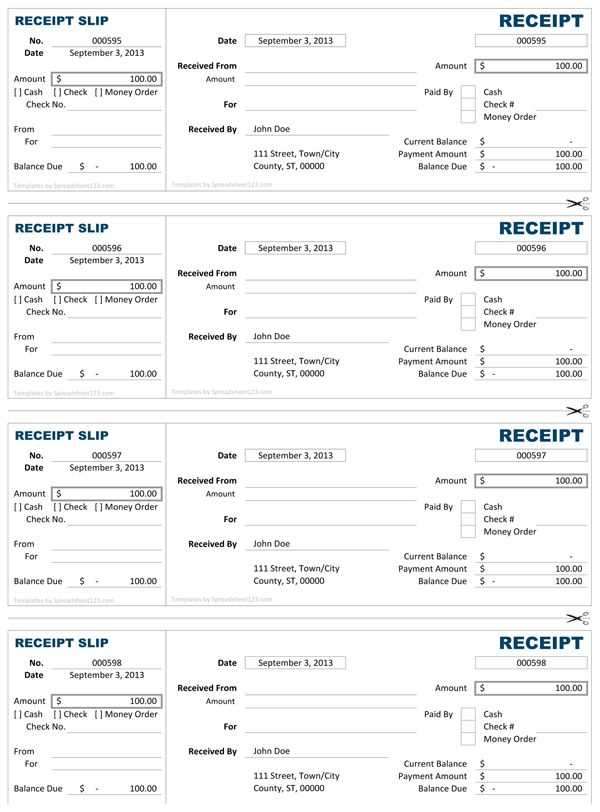

- Receipt Number: Assign a unique number for each receipt to help track transactions.

- Date: Include the exact date of the payment.

- Received From: Full name of the customer or payer.

- Amount Paid: Clearly indicate the amount in both numbers and words for clarity.

- Payment Method: Specify if the payment was made via cash or check. If check, include the check number and bank details.

- Payment Details: Include a brief description of the service or product purchased.

- Signature: Space for the signature of both the payer and the receiver to confirm the transaction.

- Balance (if applicable): If the payment is part of an installment, show the remaining balance due.

Ensure that the format is clear, the font is readable, and each section is neatly organized. This will provide both the customer and the business with a record they can refer back to if needed.

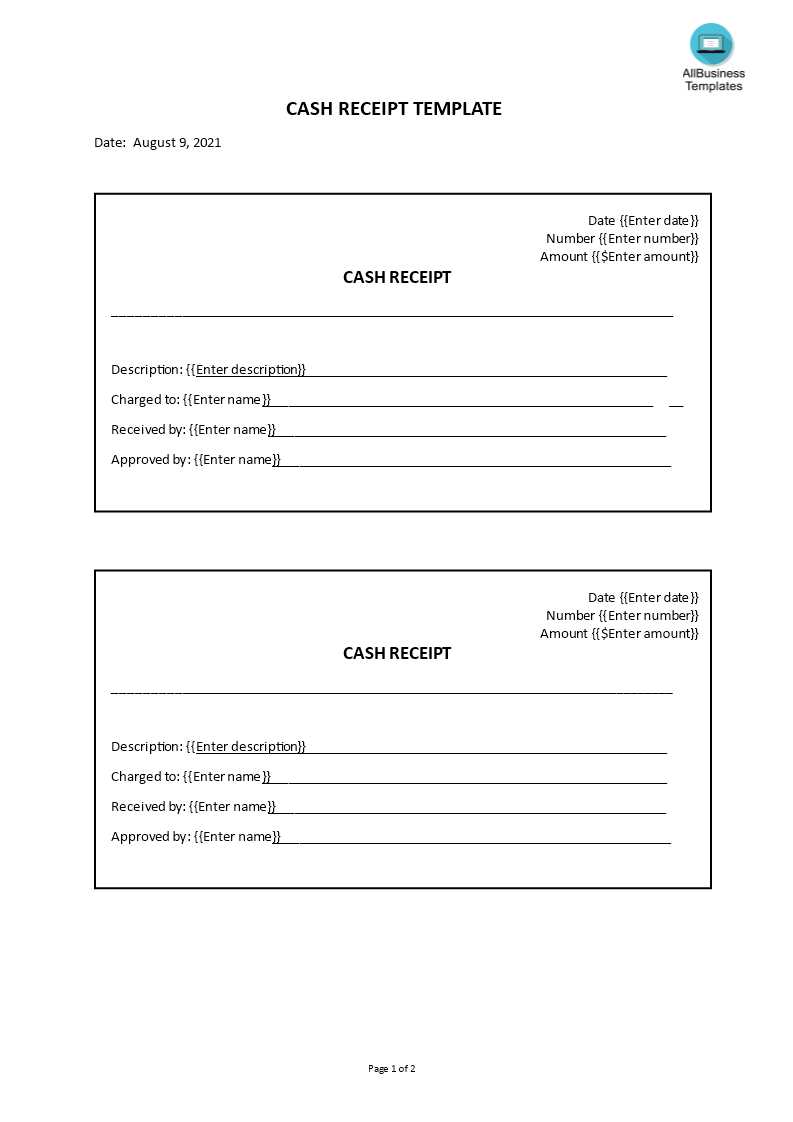

To create a clear and professional cash payment receipt, follow these steps:

1. Include Basic Details

Start with the business name and contact information at the top of the receipt. This ensures that the document is easily traceable in case of future reference. Include the business address, phone number, and email address.

2. Date and Receipt Number

Indicate the exact date of the transaction. Along with this, provide a unique receipt number. This helps with organization and tracking. If possible, use a numbering system that’s consistent across all receipts.

3. Cash Payment Information

Clearly state the amount paid in cash. Break it down if needed, such as showing the subtotal and any additional fees or taxes. Be precise to avoid confusion.

4. Describe the Goods or Services

List the items or services paid for, including their quantity and price. This detail is crucial for both the customer and the business in case of disputes or returns.

5. Payment Confirmation

Include a line confirming that the payment was made in cash. This can be a simple statement such as: “Payment received in cash.” You may also specify the denominations used if needed.

6. Signature Line

Leave a space for the cashier’s signature or a digital signature if applicable. This adds legitimacy to the receipt and serves as a point of verification.

7. Footer Details

At the bottom, include any terms or conditions regarding the payment or refund policy, if relevant. You may also want to add a thank-you message or contact details for follow-up inquiries.

By following these guidelines, you create a professional, easy-to-read cash payment receipt that protects both the customer and your business.

A well-structured check payment receipt provides clear, detailed information to both parties involved. The following elements are critical for accuracy and transparency:

| Element | Description |

|---|---|

| Date of Payment | Include the exact date the check was received. This helps both the payer and payee track payment timelines. |

| Payer’s Information | List the name and contact details of the person or business making the payment. |

| Check Number | The unique check number serves as a reference for future tracking and ensures the payment is properly recorded. |

| Bank Information | Include the name of the bank where the check was issued. This can help confirm the check’s authenticity and traceability. |

| Amount Paid | Clearly state the payment amount in both numbers and words to prevent misunderstandings. |

| Payment Purpose | Describe what the payment is for (e.g., invoice number, service provided). This ensures clarity and proper accounting. |

| Payee’s Information | Include the name of the person or business receiving the payment. It confirms who is collecting the funds. |

| Signature | A signature from the payee confirms the receipt of funds and acknowledges the transaction’s validity. |

Including these elements ensures that both parties have all the necessary details for verification and record-keeping, minimizing any potential disputes or confusion.

Tailoring receipt templates to suit different industries can streamline business operations and enhance customer experience. Customization can range from simple adjustments to more detailed modifications based on the specific needs of the industry.

Retail

Retail businesses often require templates that display product details, including names, quantities, and prices. Adding a logo and store address is common for branding purposes. For larger transactions, consider including a breakdown of taxes and discounts applied. In some regions, compliance with local tax regulations requires specific details on the receipt.

Healthcare

In healthcare, receipts typically need to include patient information, service dates, and treatment codes. Custom fields for insurance information and payment breakdowns can improve clarity. A receipt template might also incorporate sections for co-pays or outstanding balances, depending on the nature of the services provided.

Hospitality

In the hospitality industry, customization of receipts might focus on accommodation details, check-in/check-out times, and services rendered, such as meals or additional amenities. Including a tip line or VAT (Value Added Tax) breakdown can be especially useful for transparency. The template could also feature loyalty program details or a QR code for future reservations.

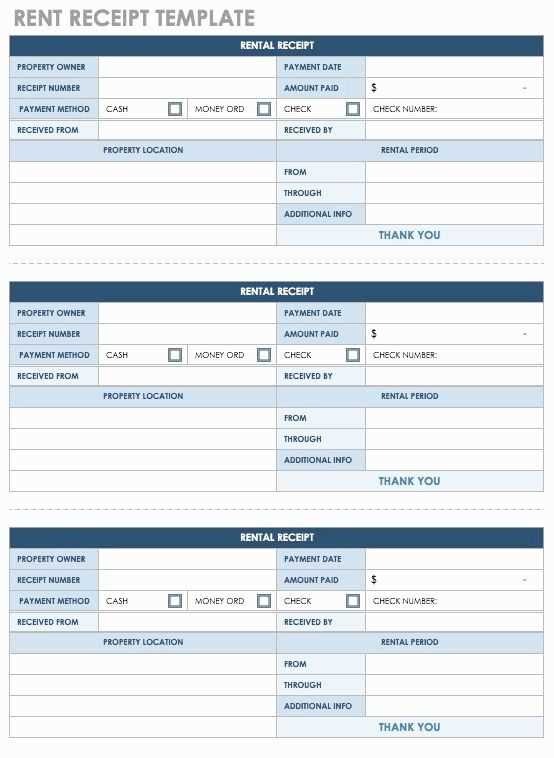

Real Estate

For real estate transactions, receipts generally require fields for property addresses, rental terms, and security deposits. Templates should also include payment due dates and rental period details. Customizing the receipt to show agent details and commission breakdowns can help both the landlord and tenant keep track of the financial details.

Education

Educational institutions often customize receipts to reflect tuition fees, course materials, and other school-related expenses. Adding fields for student identification numbers and payment plans can improve organization and accountability. Including a receipt number or transaction ID can also be valuable for future reference and reporting purposes.

Freelancers and Contractors

Freelancers or contractors can create receipts that break down services provided, hours worked, and the rate charged. Custom fields for project names or invoice numbers help maintain clarity for both the service provider and the client. Templates may also include a reminder for the client to make the payment by a certain due date.

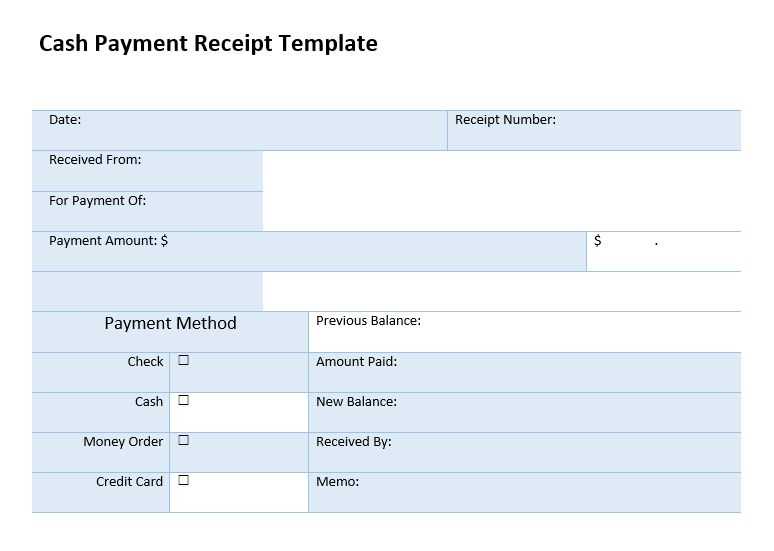

Ensure your receipt template includes a clear breakdown of the payment method. If the payment is by cash, list the total amount received, including any change provided. For check payments, include the check number and the issuing bank to verify the transaction.

Cash Payment Example

For cash transactions, specify the total amount tendered and the change returned to the customer. For instance: “Total: $50.00 | Change: $10.00.” This helps both parties confirm the amount exchanged.

Check Payment Example

For checks, include the check number and the issuing bank to validate the payment. Example: “Check No: 123456 | Issuing Bank: Bank of America.” This ensures transparency and allows for easy reference in case of disputes.

Always keep the layout simple and organized, making it easy for both you and the customer to review the transaction quickly.