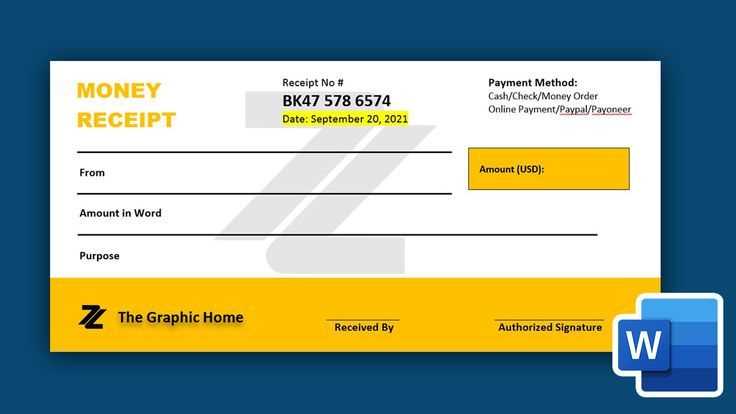

Use a clear and structured template to keep track of cash payments. Start by including the date and transaction details for accurate record-keeping. Include the total amount paid and break it down by item or service, if applicable. This ensures both parties are on the same page regarding the transaction.

Make sure to add a section for the payer’s name and recipient’s name, providing clarity on who is involved. It’s also helpful to include a unique reference number to easily identify the receipt later on. Lastly, a signature field is optional but can add an extra layer of verification to the payment.

A simple yet detailed template minimizes confusion and guarantees transparency between the buyer and seller. Keep your receipts neat and standardized, ensuring they meet any legal or business requirements relevant to cash transactions.

Receipt Template for Cash Payment

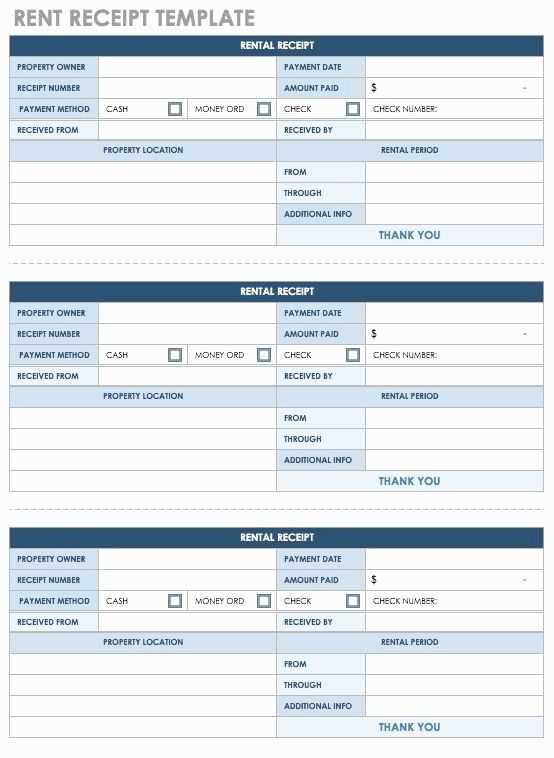

A cash receipt template should include the date of the transaction, the amount received, and the details of the transaction. Start by listing the buyer’s and seller’s information, such as names and addresses. Specify the payment amount and method clearly, including any applicable taxes. Include a unique receipt number for tracking purposes and space for the cashier’s signature or initials. Finally, ensure the template is simple, clear, and easy to understand, with appropriate spacing for each element.

For a detailed cash receipt, include a line-item breakdown of products or services purchased. This helps both parties understand the specific nature of the payment. Additionally, consider including terms regarding refunds or exchanges if necessary.

Make sure to leave enough space for both the customer and the business to sign, confirming the transaction details. This ensures a smooth record-keeping process for future reference.

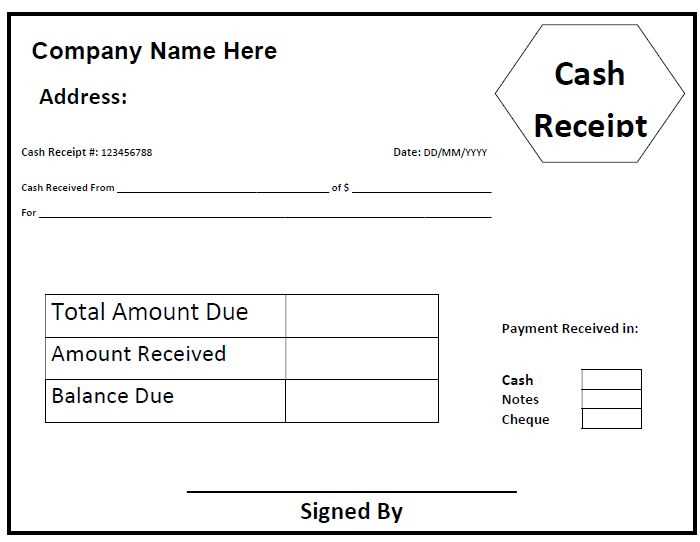

How to Structure a Cash Payment Receipt Template

Begin with a clear header that includes the receipt title and your business name. This immediately informs the recipient about the document’s purpose.

- Receipt Title: Use a bold “Cash Payment Receipt” label at the top.

- Business Information: Include your business name, address, phone number, and email address. This helps in identifying the source of the receipt.

Next, list the transaction details. Clearly break down the relevant financial information to avoid confusion.

- Date of Payment: Specify the exact date the transaction occurred.

- Transaction ID or Receipt Number: Assign a unique reference number for record-keeping and tracking.

- Amount Paid: Display the total amount received in both numerical and written formats to reduce errors.

- Paid By: Include the name of the individual or entity making the payment.

Finally, provide a brief summary of the purpose of the payment. This clarifies the reason behind the transaction.

- Purpose of Payment: A short description like “Payment for goods” or “Service fee for consulting” adds transparency.

Finish with a thank-you note or any additional instructions, such as refund policies or contact details for inquiries. This adds professionalism to the receipt and ensures clarity for future reference.

- Signature: If applicable, a signature line for both the payer and recipient to acknowledge the payment.

Key Information to Include in a Cash Payment Receipt

Include the transaction date at the top of the receipt. This helps both the payer and the payee track the payment history. It’s a good practice to use the full date (day, month, and year) to avoid any confusion later on.

Transaction Details

Clearly state the amount paid, along with the currency used. This removes any ambiguity regarding the payment amount. If partial payments are made, indicate the balance remaining and ensure this is updated after each transaction.

Buyer and Seller Information

Include the name and contact information of both the buyer and the seller. This is especially useful in cases where follow-up is required. For businesses, include the company name, address, and any relevant registration number.

Record the method of payment (in this case, cash), and specify whether any receipts or invoices were issued as part of the transaction. Lastly, don’t forget to include a unique receipt number for future reference, which makes it easier to track payments in case of disputes or refunds.

Customizing the Template for Different Transaction Scenarios

Adjust the receipt template to include transaction-specific details. For cash payments, ensure that the payment method is clearly stated, including the amount tendered and any change given. Add a section to specify the purpose of the payment, such as product purchase, service fee, or deposit. For transactions involving multiple items, list each item separately with its price, quantity, and total cost, ensuring easy readability for the customer.

In the case of refunds or partial payments, include fields to capture the original transaction details, the refund amount, and the reason for the adjustment. This helps in tracking and reconciling payments accurately. If discounts or promotions apply, make space to highlight the discount applied and the final amount due, ensuring transparency in the transaction.

Consider adding a section for transaction notes or special instructions. This can include delivery details, customer preferences, or custom requests that may affect the transaction. Tailor the format to suit both simple and complex transactions, offering flexibility while maintaining clarity in the information presented on the receipt.