For anyone paying employees in cash, using a clear and professional receipt template ensures both parties are on the same page. It’s important to document the transaction with accurate details for record-keeping and tax purposes.

A well-organized receipt should include the date of the payment, the amount paid, and the name of the recipient. Always provide a description of the work or service rendered to avoid confusion in the future. This is especially important if you need to refer back to these records during an audit or dispute.

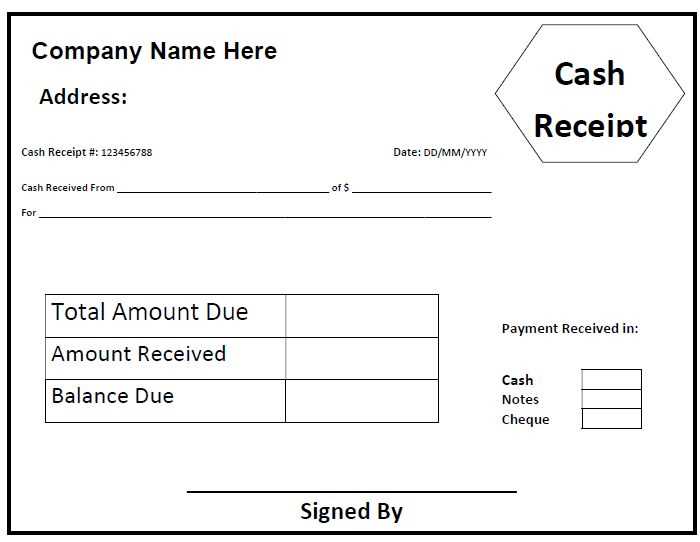

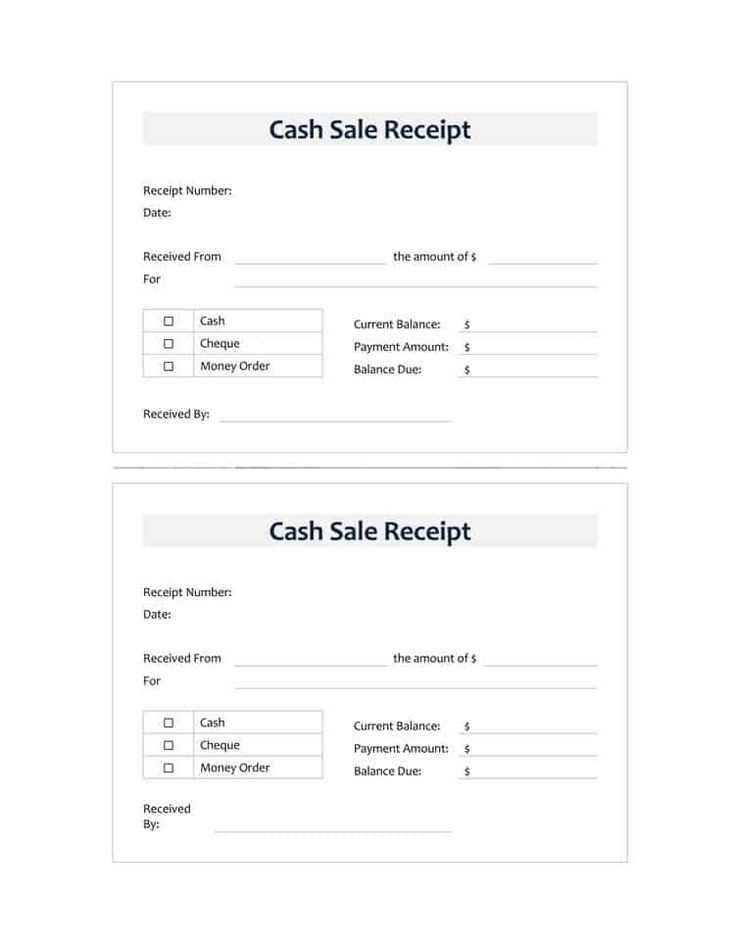

Include a payment method field to clarify whether cash was the form of payment, and don’t forget to leave space for both parties to sign. This simple step ensures that both the employer and the employee agree to the terms of the payment.

By using a receipt template, you create a transparent and accountable process for handling cash wages. It helps build trust and protects both the payer and the recipient in case of future inquiries.

Here is the corrected version based on your requirements:

Ensure the receipt includes all necessary details: the employee’s name, payment date, amount, and the wage rate. Clearly separate gross wages from deductions and net wages. List any additional payments, such as bonuses or tips. Add a section for both the employer’s and employee’s signatures to confirm agreement on the transaction.

Key Elements to Include

Provide a breakdown of the calculation, showing the number of hours worked and the hourly wage. If applicable, show deductions for taxes, insurance, or retirement contributions. Always use clear language and formatting for easy comprehension.

Additional Tips

Keep a copy of the receipt for your records, and ensure it’s dated. Providing a template can streamline the process for both parties, avoiding mistakes or confusion in the future.

- Receipt Template for Cash Payments

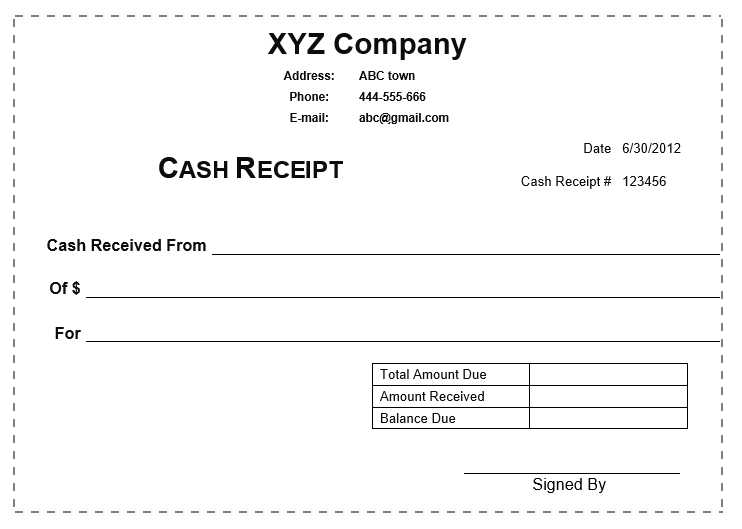

For clear documentation of cash transactions, use a simple receipt template. Include the following elements: date, recipient’s name, amount paid, payment method, purpose, and signature. This format ensures both parties have a record of the transaction.

Start with the date of the payment, followed by the name of the person or business receiving the cash. Specify the amount in both numerical and written form for clarity. Clearly state the purpose of the payment, whether it’s for services rendered or a purchase. Include a line for the payer’s signature and any notes relevant to the transaction.

Keep the template brief yet detailed enough to avoid misunderstandings. For instance, you can add a statement like, “Received from [payer’s name], the sum of [amount] for [service/product].” This ensures that all necessary information is included for both legal and accounting purposes.

To create a simple cash payment receipt, follow these clear steps:

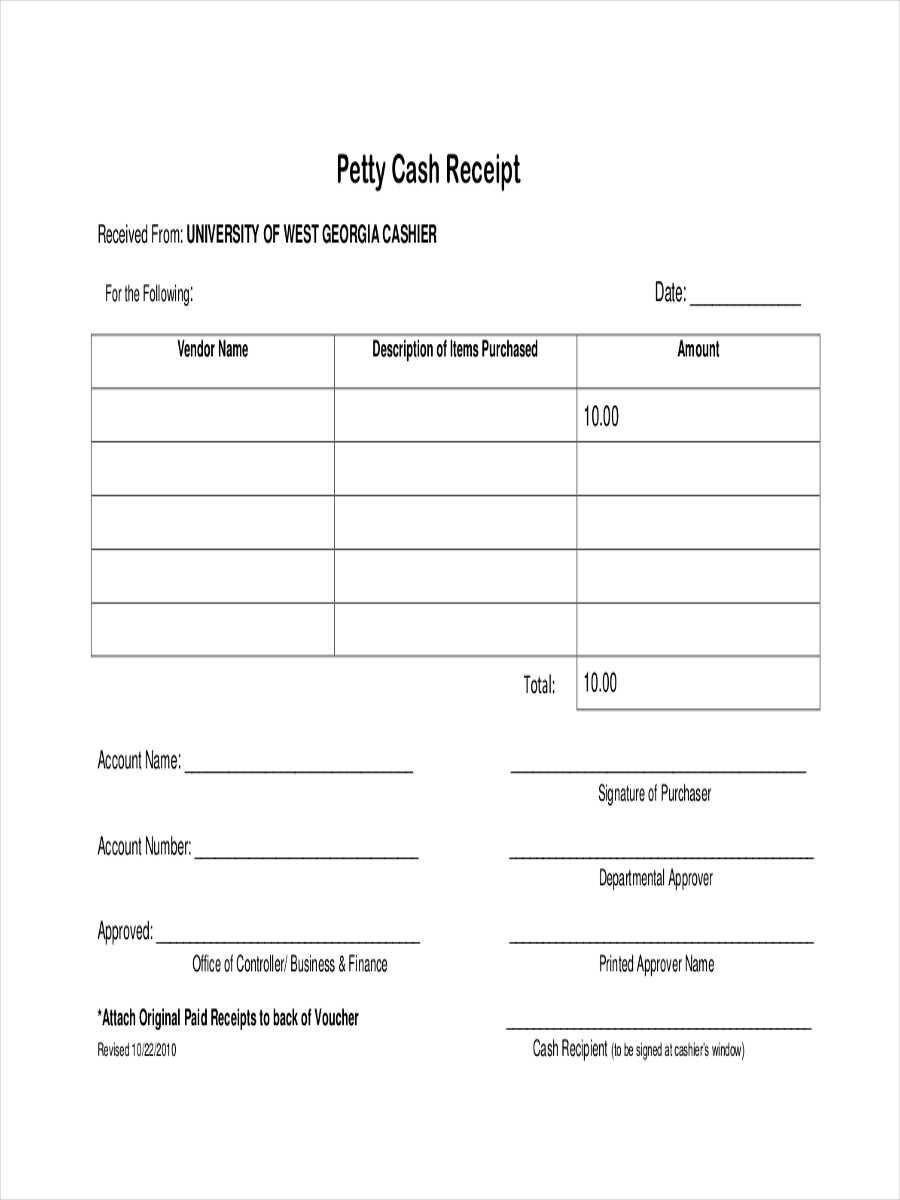

- Header Information: Begin with the title “Receipt” at the top of the document. This clearly indicates its purpose.

- Payment Details: Include the date the transaction occurred and the total amount paid in cash. Ensure the amount is written both in numbers and words for clarity.

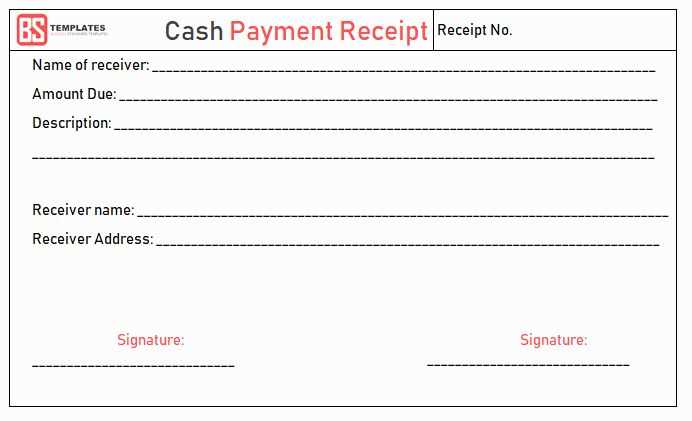

- Recipient Information: List the name of the person or business receiving the payment. This ensures transparency in the transaction.

- Payment Description: Provide a brief explanation of the service or product being paid for. This helps identify the purpose of the payment.

- Signatures: Include a space for both the payer and recipient to sign, confirming the transaction.

- Receipt Number: Add a unique receipt number for record-keeping and future reference.

Ensure all details are clear and accurate, keeping the document simple yet informative.

The wage receipt should clearly state the employee’s full name and address. Include the employer’s details, such as the business name, address, and contact information.

Clearly mention the date of payment and the pay period it covers. This ensures transparency regarding when the wages were earned and paid.

Specify the gross wage amount, followed by any deductions. Break down the deductions, such as taxes or retirement contributions, so the employee can see how their net pay is calculated.

List any additional payments like bonuses, overtime, or commissions separately. This gives a detailed account of how the final amount is reached.

Include the method of payment (e.g., cash, cheque, bank transfer) and the actual net pay amount after deductions.

Provide details of the employee’s tax code and any other applicable legal information, ensuring compliance with tax laws and employment regulations.

Adjust your wage receipt template to suit specific purposes by including or omitting certain details. Whether it’s for tax reporting, employee records, or personal tracking, each use case requires different information. Make sure to tailor your format accordingly to avoid confusion and meet your specific needs.

For Tax Reporting

When preparing wage receipts for tax purposes, accuracy is key. Include the total wages, deductions (such as tax withholdings, social security, and other applicable deductions), and net pay. These items are necessary for both the employee’s records and tax filing. You should also add your employer identification number (EIN) and specify the tax period covered by the receipt.

For Employee Recordkeeping

For internal employee records, wage receipts should focus on consistency and clarity. Include the employee’s full name, job title, payment period, and a detailed breakdown of hours worked. Ensure that any additional payments like overtime or bonuses are clearly listed, with totals for each category. This helps maintain organized records for future reference, such as performance reviews or salary adjustments.

| Category | Details |

|---|---|

| Employee Name | [Employee Name] |

| Job Title | [Job Title] |

| Payment Period | [Start Date] to [End Date] |

| Regular Hours | [Regular Hours Worked] |

| Overtime Hours | [Overtime Hours Worked] |

| Bonus | [Bonus Amount] |

| Gross Pay | [Gross Pay] |

| Deductions | [List of Deductions] |

| Net Pay | [Net Pay] |

Ensure your wage receipt is clean and easy to read, with clearly separated sections for each category. This approach avoids confusion and provides a professional document for both employee and employer records.

Receipt Template for Cash Wages

Make sure to include the date of payment at the top of the receipt. This helps both the employer and the employee keep accurate records of transactions. Include the full name of the employee, their position, and the amount paid in cash. Specify whether the payment is for regular wages or an additional bonus.

Include a breakdown of hours worked and the rate per hour if applicable. This gives clarity on how the total amount was calculated. Also, provide space for any deductions, such as taxes or other withholdings, ensuring both parties are aware of the net amount received.

Leave a section for the employer’s name, signature, and contact details, which can be useful for reference or verification purposes. Be sure to provide space for the employee’s signature as well, confirming that the payment has been received.