Using a cash receipt template streamlines record-keeping for cash transactions. It helps to clearly document the amount received, date of payment, and the payer’s details. A well-organized receipt reduces the risk of errors and provides a reliable reference in case of discrepancies.

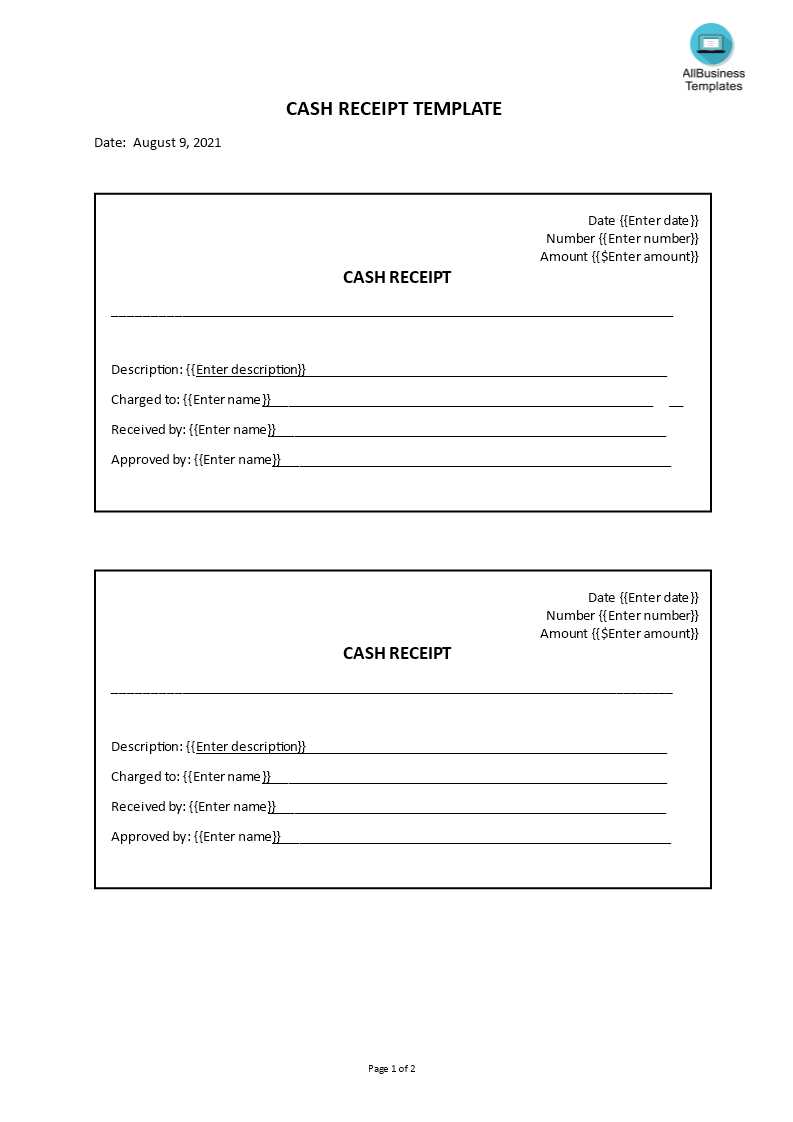

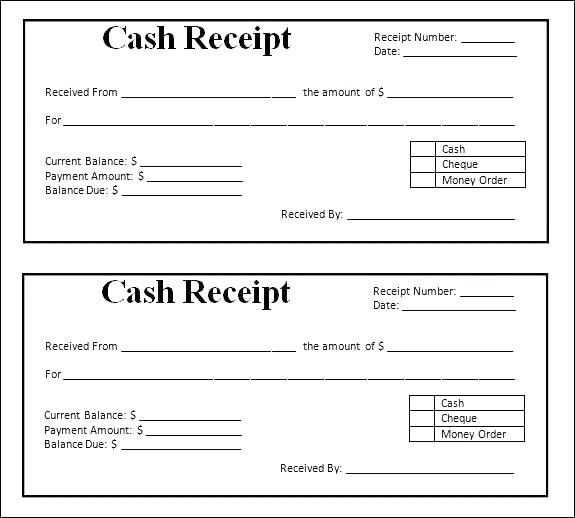

Start by including basic information like the receipt number, payer’s name, and the date of the transaction. Add a detailed description of the goods or services provided, along with the total amount paid. For clarity, ensure that both the payer and the recipient sign the receipt.

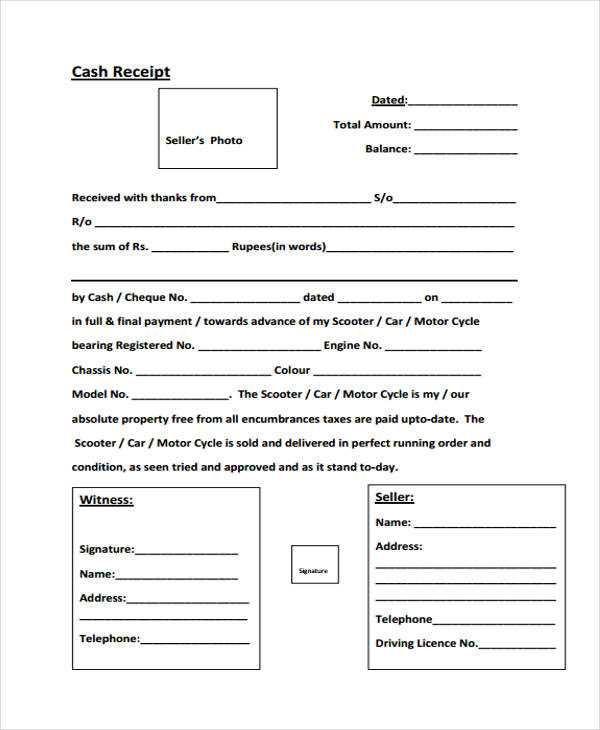

While many businesses use digital formats for receipts, having a template for manual transactions makes it easier to issue receipts quickly on the spot. You can customize a template to suit your needs, including sections for tax details or payment method, such as cash or cheque. Customize the layout to match your branding, keeping the information clear and easy to follow.

Here’s the updated version:

Use a simple and clear format to ensure that all the necessary information is included in the receipt. Start with the receipt number for tracking purposes. This helps both the recipient and the issuer stay organized. Below, you should list the date and time of the transaction to ensure accurate records.

Transaction Details

Clearly state the amount received, breaking it down if needed. Include the method of payment (cash, card, check, etc.) for future reference. It’s also helpful to note if any partial payments were made or if the full amount was settled.

Issuer Information

Include the name of the business or individual issuing the receipt. If applicable, add contact details, such as a phone number or email, for follow-up questions. This adds professionalism to the receipt and ensures transparency in communication.

Finally, make sure the receipt is signed by the authorized person or stamped, which verifies the transaction.

- Sample Cash Receipt Template

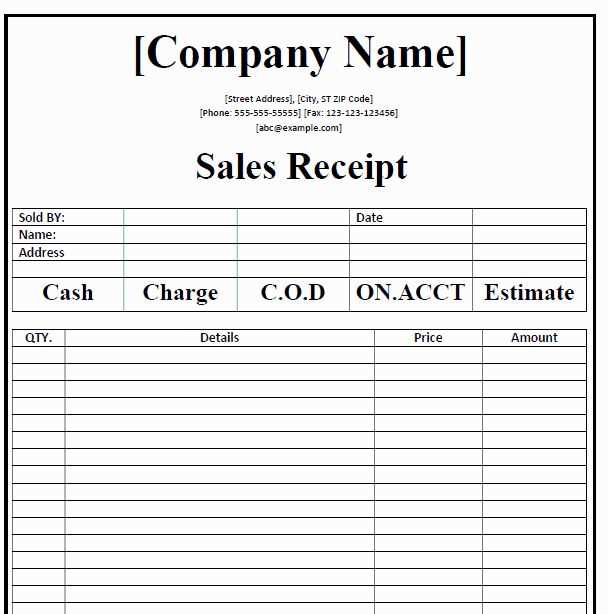

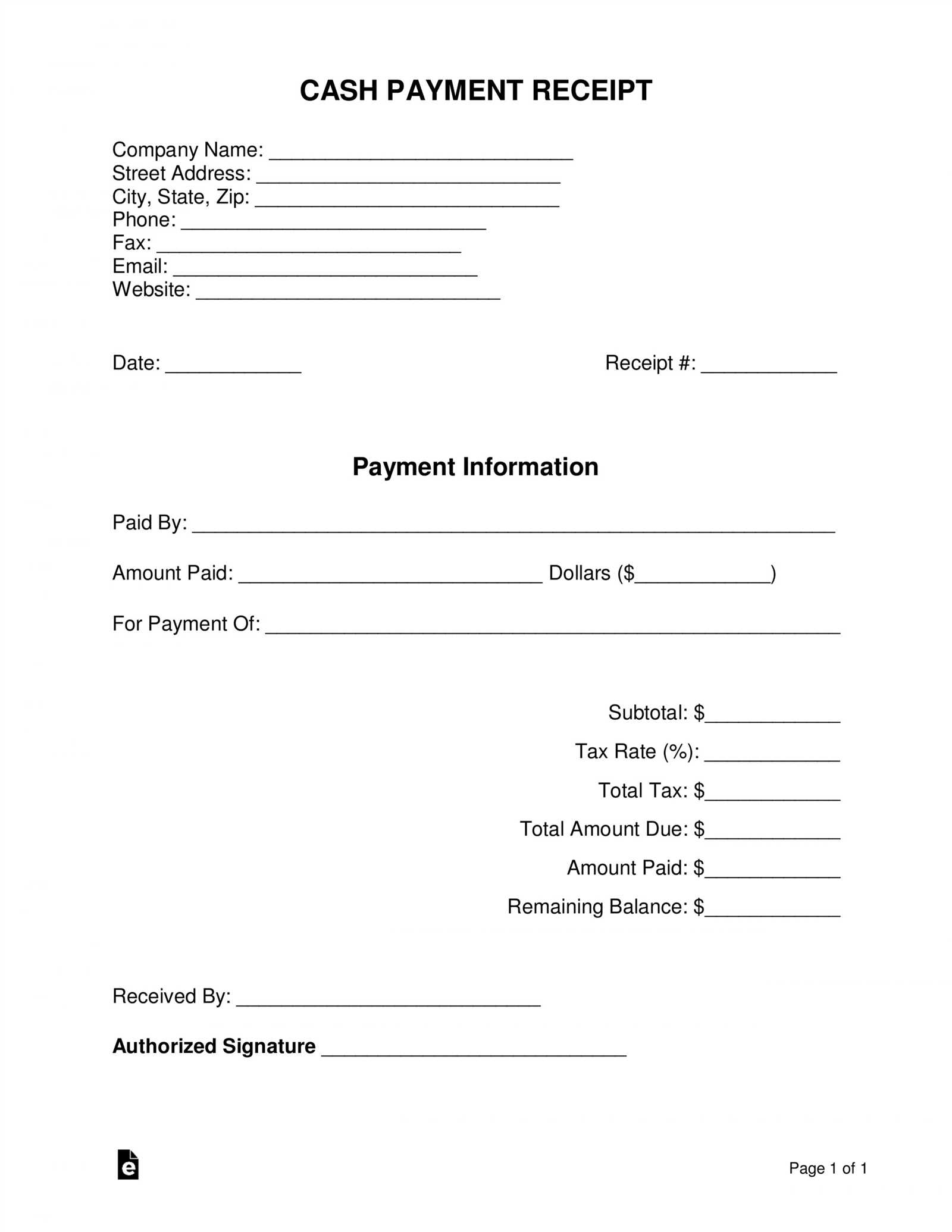

To create a cash receipt template, make sure to include the following key details: date of payment, payer’s name, amount received, and the method of payment (cash, check, etc.). A simple structure should cover all these aspects while remaining clear for both the payer and the recipient.

Start with a header that indicates the document’s purpose: “Cash Receipt.” Then, include a space for the receipt number to track the transaction. This number should be unique for each transaction to ensure proper record-keeping.

Next, include the name of the business or individual receiving the payment. Specify the date of the transaction and a detailed description of what the payment was for. For example, if it’s for a service, include the service description or invoice number associated with the payment.

Include a section for the amount paid, broken down into the correct currency and clearly labeled (e.g., “Amount Received” or “Total Payment”). If applicable, include tax and any discounts that might have been applied.

Finally, leave space for signatures. The payer and the recipient should both sign the receipt to verify the transaction. A place for additional notes may also be helpful, particularly if there are specific terms or agreements related to the payment.

By using this straightforward template, you create a professional document that helps prevent disputes and ensures all payment details are properly recorded.

To customize a cash receipt template, begin by adding your business logo and contact details. This makes the receipt look professional and adds an extra layer of branding. Ensure the template includes the full name of your business, address, phone number, email, and website URL if applicable.

Include Necessary Transaction Information

Customize the template by clearly displaying key transaction data such as the date, receipt number, and payment method. This helps keep records organized and ensures clarity for both the customer and your accounting team. Always specify whether the payment was made by cash, check, or credit card.

Customize the Payment Details

- Amount Paid: Display the total amount in both numerical and written form for easy verification.

- Description of Goods or Services: Include a brief list or description of the items or services purchased, along with the corresponding prices.

- Tax Breakdown: If applicable, ensure that tax calculations are visible, with each tax rate and the total tax amount clearly marked.

Next, add your return or refund policy. This can help avoid confusion later on and set clear expectations. You might also consider including a field for customer comments, which can be useful for tracking feedback or special instructions related to the transaction.

Finally, make sure that all fonts are legible and the layout is clean. This will ensure the receipt is easy to read and understand at a glance. Save your customized template for reuse and be ready to generate receipts that reflect your business’s identity and streamline your payment process.

Double-check all the details before issuing a receipt. Ensure the recipient’s name, transaction amount, and date are accurately recorded. Missing or incorrect information can lead to confusion and make the receipt invalid.

Don’t overlook the importance of clear item descriptions. Avoid vague or incomplete entries, as they can raise questions during audits or when referencing the transaction in the future.

Make sure to update the receipt template to reflect any changes in your business. Using outdated templates can cause issues with compliance and mislead your customers.

Be mindful of the formatting. Keep it simple and clear. A cluttered or overly complex template can confuse both you and your customers, making it difficult to read the necessary details quickly.

Don’t forget to include your business details, like address and contact information. This helps customers reach out if needed and adds a professional touch to your receipts.

Check for missing tax information. Always include the correct tax rates and total amounts, ensuring your receipts comply with tax regulations. Mistakes here can lead to legal complications.

Scan receipts as soon as you get them. Use your smartphone or a dedicated scanner to create digital versions. Apps like Expensify or Receipt Bank can help automate this process and store the files in a cloud system for easy access later. Make sure each receipt is clearly legible to avoid misinterpretation.

Organize your receipts by categories. You can set up folders or tags for different expense types, such as business, personal, travel, or groceries. Many receipt management apps allow you to add categories while scanning, which simplifies the process. This helps you quickly locate any receipt you need without searching through piles of paper.

Label each receipt with a date, vendor, and amount before storing it. Most apps automatically capture this information, but double-check the details. Accurate labeling ensures you won’t waste time searching for specific receipts later, especially when preparing for taxes or audits.

Regularly back up your digital receipts. Cloud storage services like Google Drive, Dropbox, or OneDrive offer secure options for saving files. This prevents the risk of losing receipts due to device failure or accidental deletion.

Utilize receipt management software to generate reports. Many digital systems can automatically generate expense reports based on the data from your receipts. This can save time and make financial reviews simpler.

Set a reminder to periodically check and categorize receipts. This keeps your records up to date and avoids accumulation of unorganized files. Even a quick weekly check ensures everything is neatly organized and ready when needed.

Streamlining Your Cash Receipt Template

Remove unnecessary repetitions to enhance clarity and readability without losing meaning. Focus on maintaining the structure and key points while avoiding redundant words. For example, instead of saying “The customer has made a payment, and the payment has been received,” simply state, “The payment has been received from the customer.” This keeps the message concise and clear.

Use bullet points or tables to organize the details of each transaction effectively. A table provides a clear overview of the necessary information such as date, amount, and payment method. Here is an example:

| Date | Amount | Payment Method |

|---|---|---|

| 2025-02-13 | $250 | Credit Card |

| 2025-02-14 | $150 | Cash |

Ensure your template provides a straightforward breakdown of essential details without overcomplicating the format. Focus on what is necessary to make the receipt easily understandable and organized.