To ensure transparency and maintain trust, it’s crucial to issue a clear and accurate cash receipt for every mental health service payment. This receipt should document all necessary transaction details, providing both the service provider and the client with a clear record. Use this template as a reference for structuring your receipts effectively.

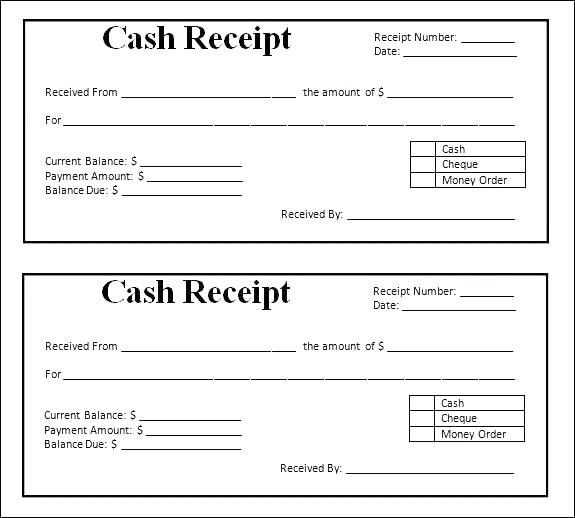

A cash receipt should include the following key elements: the date of the transaction, the amount paid, the client’s name, the provider’s information, and a description of the service provided. You should also include a unique receipt number for easy tracking. This ensures all transactions are properly accounted for in both the client’s and service provider’s records.

For added clarity, specify whether the payment is for a single session or multiple services, and if applicable, note the payment method. By including these details, you prevent any future confusion or disputes. Always ensure the receipt is signed by the service provider or an authorized representative to validate the transaction.

Here are the revised lines based on your requirements:

For mental health services, always include a clear description of the service provided, the date of service, and the client’s name on the receipt. This helps to maintain clarity and transparency in your financial records.

Specify the amount paid and whether it was in full or as a deposit. A breakdown of fees ensures clients understand the charges for each service offered, such as counseling or therapy sessions.

If the payment was made by check, credit card, or another method, include this detail to clarify the transaction type and avoid misunderstandings.

Always provide a unique receipt number for tracking purposes, which can be helpful for both the service provider and the client for future reference.

It’s beneficial to include a contact number or email address on the receipt. This makes it easy for clients to follow up or ask questions regarding their payment or services rendered.

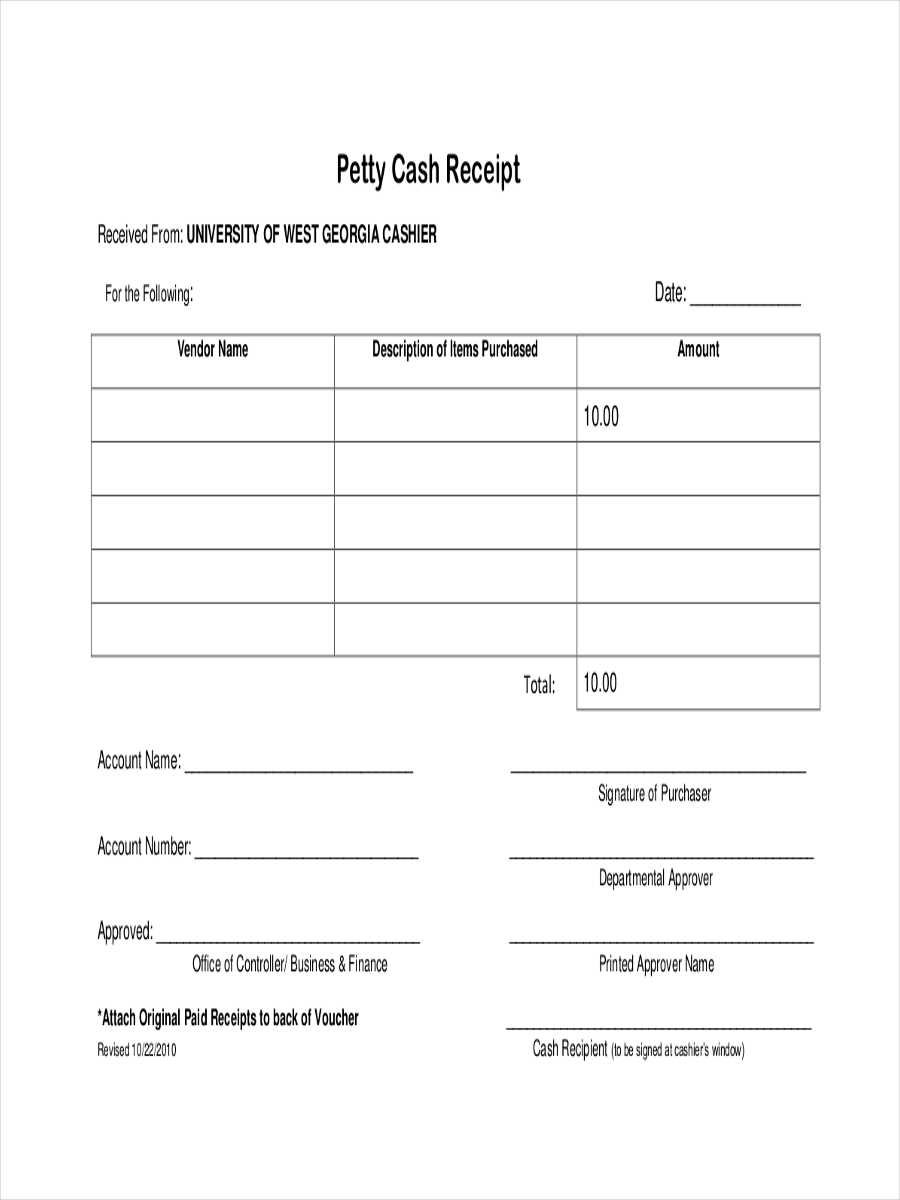

- Sample Template for Cash Receipt in Mental Health Service

A cash receipt for mental health services needs to accurately reflect the transaction details and be clear for both the provider and the client. Below is a sample template to guide you in creating one that suits your practice.

Receipt Template Structure

- Provider’s Information: Include the full name, address, and contact details of the mental health service provider.

- Client’s Information: The client’s name and contact details should be listed clearly to avoid confusion.

- Date of Payment: Specify the exact date the payment was made to track and confirm the transaction.

- Payment Amount: Clearly mention the total amount received, ensuring no ambiguity about the sum paid.

- Payment Method: Indicate whether the payment was made in cash or another form, such as check or card.

- Service Rendered: Describe the specific mental health services provided during the session, such as therapy, counseling, or consultations.

- Receipt Number: Include a unique receipt number for tracking purposes.

- Signature: Both the provider and the client should sign the receipt to confirm its accuracy and the transaction’s completion.

Sample Format

- Provider’s Name: [Provider Name]

- Address: [Provider Address]

- Phone: [Provider Phone]

- Client Name: [Client Name]

- Payment Date: [Date of Payment]

- Amount Paid: $[Amount]

- Payment Method: Cash

- Services Provided: [Description of Services]

- Receipt Number: [Receipt Number]

- Provider’s Signature: [Signature]

- Client’s Signature: [Signature]

This template ensures that all necessary information is captured clearly and systematically, making the receipt both professional and legally sound for future reference or audits.

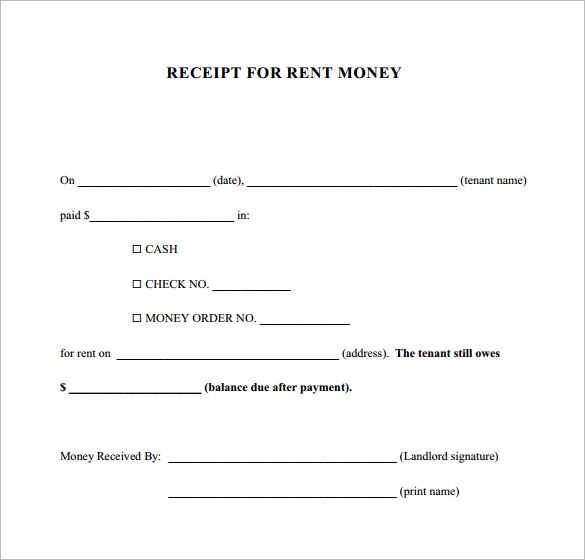

Begin by including the provider’s name, address, and contact information at the top of the receipt. This ensures that the client knows exactly who provided the service and how to reach them if needed.

Next, clearly state the client’s name and the date of the service. This helps in confirming that the receipt matches the session provided.

List the type of service offered, such as individual therapy, group counseling, or psychiatric evaluation, along with the duration of the session. This level of detail helps clients verify the charges and the nature of the services rendered.

Indicate the fee for each service provided, followed by the total amount due. If applicable, include any insurance or discount information that was applied to the final amount.

Finally, include a statement confirming that payment was received. This may also include the method of payment, whether it was by credit card, check, or cash, for clarity and reference.

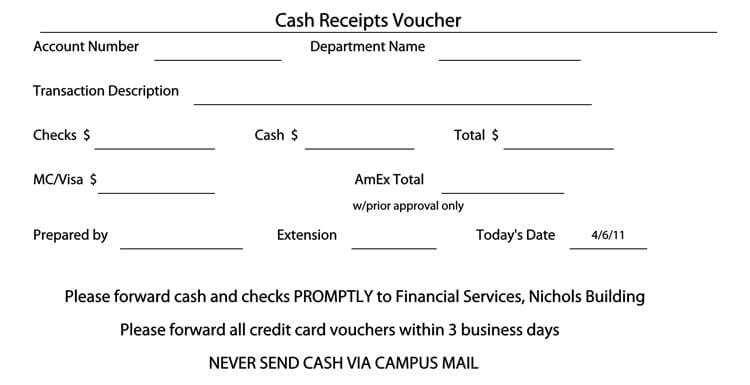

A cash receipt should clearly reflect key details of the transaction. At a minimum, it should include the following:

Receipt Number

Each receipt must have a unique number to help track and differentiate transactions. This number acts as a reference for both the payer and the provider.

Date of Transaction

The date on which the payment was made should be recorded. This is crucial for tracking and matching payments with services provided.

Payer’s Information

The name of the person or entity making the payment should be clearly noted. This ensures the payment is associated with the correct client or account.

Amount Paid

The exact amount of cash received must be stated, including any applicable taxes or fees. It provides transparency in the transaction process.

Service Description

A brief description of the service provided in exchange for the payment should be included. This helps in clarifying what the payment covers, such as a therapy session or consultation.

Provider’s Information

Details of the provider, such as the name of the mental health professional or clinic, should be included. This helps confirm where the payment was made and who received it.

Payment Method

While this is a cash receipt, it can be helpful to specify the form of payment (e.g., cash, check) for records.

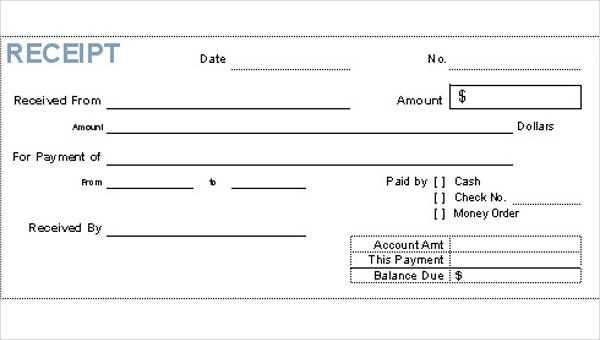

Step-by-Step Guide to Creating a Custom Receipt Template

To create a custom receipt template for mental health services, follow these steps carefully. This will help ensure clarity and professionalism while meeting your specific needs.

1. Define Key Information

Start by identifying the essential details that need to appear on the receipt. These typically include:

- Patient’s name

- Date of service

- Amount paid

- Payment method

- Provider’s contact information

- Service description

- Receipt number

2. Set the Layout

Choose a simple and clean layout that can accommodate all the details. Consider using a two-column format with one side for itemized services and the other for billing information. This will improve readability and organization.

3. Add Service Details

For mental health services, list the types of sessions provided, such as individual therapy, group therapy, or assessment services. Specify the duration and price for each service. Here’s an example of how to format this in your template:

| Service Description | Duration | Price |

|---|---|---|

| Individual Therapy | 50 minutes | $100 |

| Group Therapy | 60 minutes | $50 |

4. Include Payment Details

Clearly display the payment method (e.g., credit card, insurance, or cash). If applicable, include any insurance adjustments, discounts, or copays. A final total should be visible at the bottom of the receipt.

5. Design Considerations

Keep the design simple but professional. Use legible fonts and ample spacing between sections. You can also add your practice logo and colors to create a personalized touch.

Once all the elements are in place, you can generate the receipt template in a word processor or a design tool, making sure it fits your clinic’s branding and workflow.

In mental health practices, receipts must include specific information to comply with legal standards. Ensure each receipt clearly states the name of the provider, the date of service, and a detailed description of the services rendered. This transparency helps maintain accurate financial records and supports both the practice and the patient in case of audits or insurance claims.

Receipts must also include the amount paid and any applicable taxes. If payments are made by insurance, include the insurance company’s name and the amount covered by them. This prevents misunderstandings and provides clarity to both parties.

In some jurisdictions, it may be required to include the practitioner’s license number or other identifying information. Check with local and state regulations to ensure your receipts are compliant with the specific legal obligations in your area.

Records of transactions must be stored for a set period, often at least three years, depending on local laws. This ensures you can provide documentation if needed for any future legal or financial matters.

When working with minors or other sensitive cases, additional documentation may be required on receipts to meet confidentiality and privacy standards. Always be familiar with the privacy laws in your jurisdiction to avoid any potential legal issues.

Store receipts in a secure, organized manner to ensure they are easily accessible when needed. Use a consistent filing system, such as categorizing by date, client, or service type, to simplify retrieval. For physical receipts, place them in labeled folders or a dedicated filing cabinet. Keep them in a dry, cool space to avoid damage from moisture or heat.

Switch to digital receipts whenever possible. Scan or photograph paper receipts, then back them up on a cloud service or external drive. Use file names that include the date and a brief description to make searching for specific receipts more efficient. Ensure digital copies are protected with strong passwords or encryption to prevent unauthorized access.

Review and purge old receipts regularly to avoid clutter. Retain receipts for mental health services for a minimum of three years for tax or audit purposes, depending on local regulations. Dispose of outdated or unnecessary receipts securely, either by shredding physical copies or securely deleting digital files.

Leverage receipt management software to streamline the process. These tools allow you to upload, organize, and track receipts in one place, which can be especially useful for managing multiple clients or sessions. The software can also help in categorizing receipts for tax purposes and generating reports for financial tracking.

When issuing refunds or adjustments, ensure the receipt clearly reflects the updated transaction details. First, indicate the original amount and highlight the refunded or adjusted value. Specify whether it’s a full or partial refund and provide a clear breakdown of any adjustments made.

Steps for Handling Refunds

- Use a distinct refund identifier on the receipt, such as a “Refund” or “Adjustment” label.

- Include the date of the refund or adjustment to track the transaction properly.

- List the items or services refunded, showing the amount refunded next to each.

- Clearly show the new total after the refund or adjustment, ensuring it matches the amount refunded.

Steps for Handling Adjustments

- Indicate the reason for the adjustment (e.g., service change, pricing error).

- If the adjustment is due to an error, provide the correct amount along with the original charge for comparison.

- Ensure that adjustments are reflected in the total amount paid and adjust any applicable taxes if necessary.

Ensure that the receipt includes a clear breakdown of services provided. For mental health services, list the type of session (e.g., therapy, counseling), the date, and the duration. Specify the hourly rate or flat fee applied. Include the total amount charged and any payments already made. If applicable, add insurance details or coverage amounts that apply to the payment.

Detail any discounts or sliding scale rates used, if relevant. Make it easy for clients to understand what they’re paying for and how the total was determined. Clearly state the payment method–whether by check, credit card, or other means–along with the transaction reference number, if available.

If any future appointments are booked, include a note confirming this information. This helps clients keep track of both their financial and scheduling commitments. Lastly, provide contact details for questions or follow-ups regarding the receipt or services rendered.