A simple cash receipts template helps you record transactions clearly and efficiently. With just a few key details, you can create a clear and professional document for your records or customers.

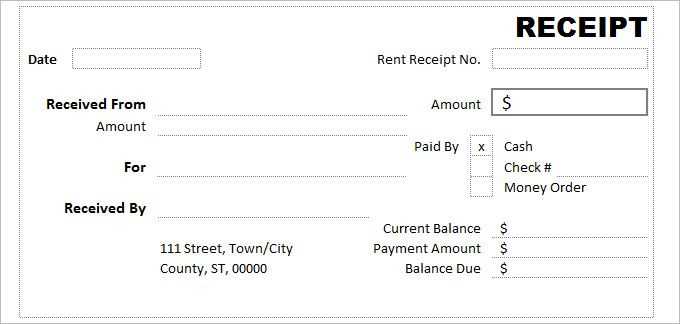

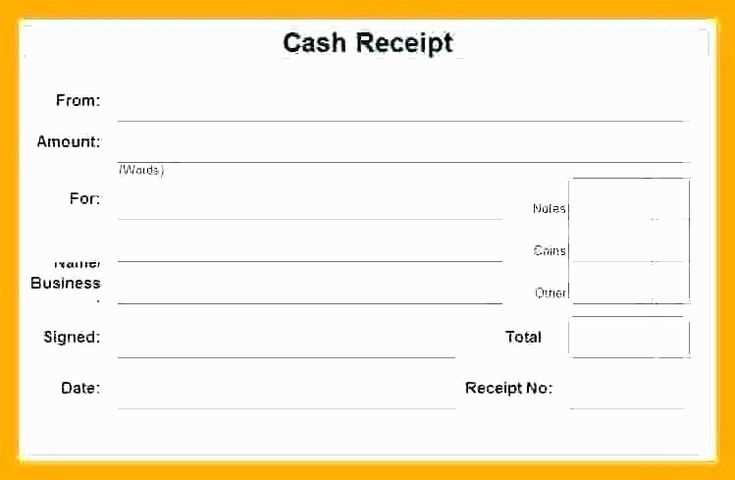

Start by including the date of the transaction and the amount received. This basic information will make tracking easier, whether for personal use or business transactions. Include a brief description of the payment, such as the goods or services exchanged, to ensure clarity.

Ensure you list the payment method, whether it is cash, check, or card. This helps verify the transaction details and adds an extra layer of transparency to your records. Finally, provide a space for signatures, both from the payer and the recipient, to confirm the validity of the transaction.

Using a simple format ensures that anyone can easily create or understand the receipt. It eliminates confusion and helps maintain an organized record system. You can customize it further to fit your needs, making it a practical tool for everyday use.

Here are the corrected lines with minimal repetition:

Use clear headings for each section of the receipt. Include fields such as “Date,” “Description,” “Amount,” and “Total.” Ensure the font size is legible and consistent throughout. For itemized receipts, list each item with its corresponding price, followed by the total sum. Add a footer with contact information, including the business name and address. Avoid unnecessary words or excessive spacing to keep the layout tidy. Finally, use a simple and intuitive design for quick readability and easy understanding of the details.

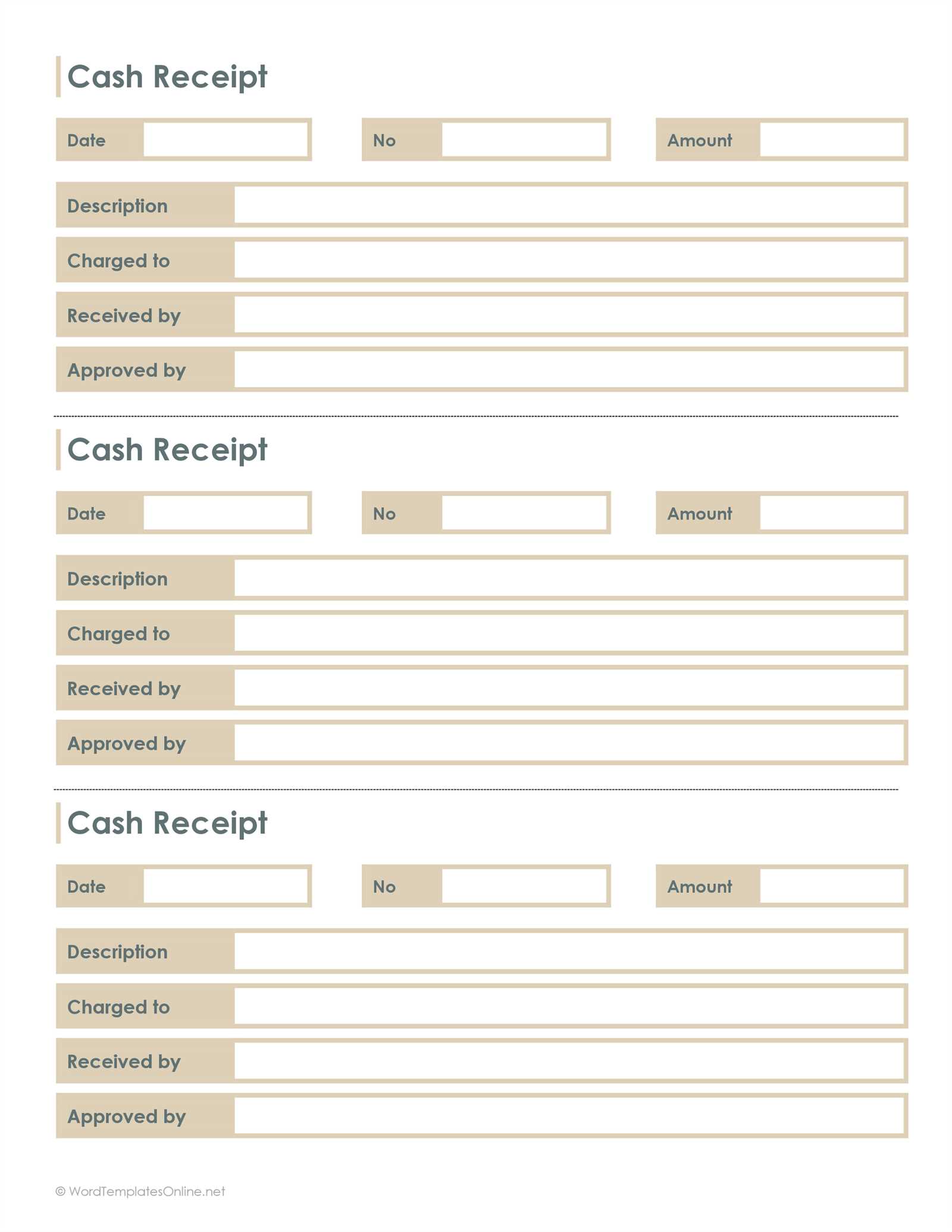

- Simple Cash Receipt Template

To create a clear and professional cash receipt template, follow these steps:

- Header Information: Include the name of the business or individual issuing the receipt, along with contact details like address, phone number, and email.

- Date of Transaction: Always include the exact date the payment was received. This ensures clarity and helps in record keeping.

- Receipt Number: Assign a unique receipt number for easy tracking of each transaction.

- Amount Received: Clearly state the amount of money received in both numeric and written form. This eliminates any ambiguity.

- Payment Method: Specify the method of payment (e.g., cash, credit card, check) to avoid confusion.

- Purpose of Payment: Include a short description of what the payment is for (e.g., service fee, product purchase).

- Signature: If applicable, include a space for the payer’s signature to confirm the transaction.

Ensure all fields are clear and easy to read. This makes it easier for both parties to verify the details of the transaction later.

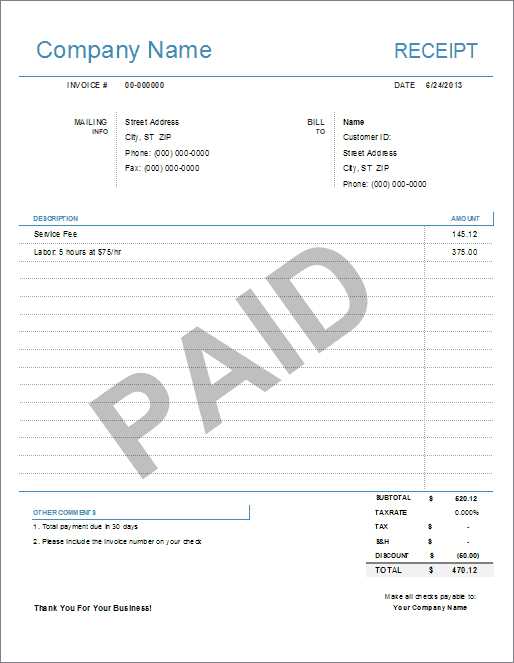

Customize your receipt template by adjusting key elements to fit your business needs. First, include your business name, address, and contact details in the header. This helps customers quickly identify your brand. Make sure to add your logo for brand consistency. You can upload it directly into the template or place it in a prominent position on the receipt.

Tailor the Receipt Layout

The layout should clearly display all the necessary transaction details: date, itemized list of products or services, prices, tax, and total amount. Use a clean and straightforward format, ensuring that each section is easy to read. Avoid unnecessary clutter, as it can confuse the customer.

Incorporate Your Business’s Unique Terms

Modify the receipt to include any specific business policies, such as return or exchange terms, warranty information, or membership discounts. This provides clarity for your customers and prevents misunderstandings down the line.

Lastly, ensure that the receipt template is compatible with your point-of-sale (POS) system. Whether you’re using a simple cash register or a more advanced system, make sure the template integrates seamlessly for accurate and quick transactions.

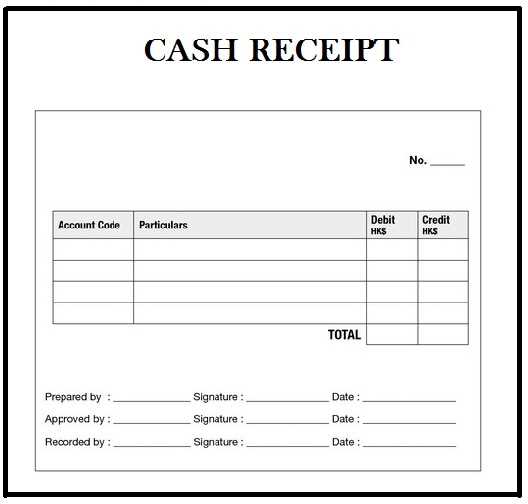

Ensure that each cash receipt includes these critical fields to maintain clarity and accuracy in transactions:

Date

Recording the date of the transaction helps track payment timelines and ensures that both parties agree on when the payment was made. This is key for auditing purposes and for resolving any disputes regarding timing.

Payer Information

List the name or business of the payer. This provides clear identification of who made the payment and prevents any confusion in future reference checks.

Amount Received

The payment amount should be specified clearly. This field helps verify that the correct amount was received and acts as a reference for any refund or balance adjustments.

Payment Method

Indicating whether the payment was made via cash, check, or other methods prevents misunderstandings and aids in financial record keeping.

Receipt Number

Assigning a unique receipt number to each transaction simplifies tracking and retrieval, and is an effective tool for maintaining organized financial records.

Description of Goods/Services

Provide details about the items or services purchased. This ensures both the buyer and seller are on the same page regarding the transaction, and supports transparency in the case of returns or disputes.

Seller Information

The name and contact details of the seller should be listed. This helps the payer reach out for inquiries and acts as an official record of the business involved in the transaction.

Signatures

Both the payer and the seller should sign the receipt. This serves as an acknowledgment from both parties that the transaction has been completed.

| Field | Description |

|---|---|

| Date | Tracks the transaction date for record-keeping and reference. |

| Payer Information | Identifies the individual or entity making the payment. |

| Amount Received | Confirms the exact amount paid. |

| Payment Method | Specifies how the payment was made (cash, check, etc.). |

| Receipt Number | Unique identifier for each transaction. |

| Description of Goods/Services | Lists the items or services for which payment was made. |

| Seller Information | Provides the contact information for the seller. |

| Signatures | Confirms the agreement of both parties on the transaction. |

Each field is crucial in ensuring that both parties have a clear understanding of the transaction details and that records are kept for future reference or any potential audits.

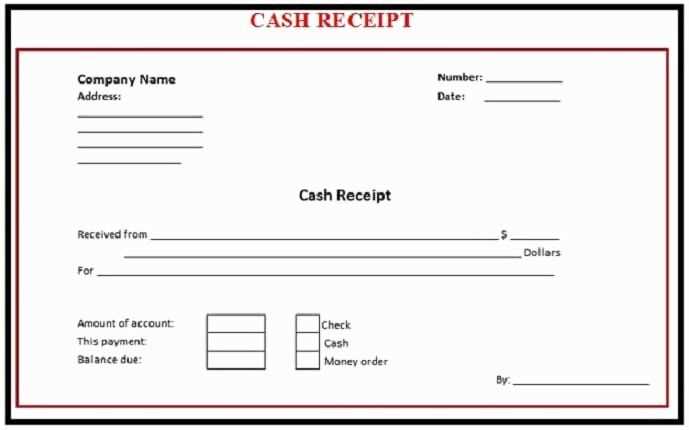

To track cash transactions accurately, start by clearly recording the date, amount, and purpose of the transaction. Use a consistent format for every receipt, ensuring that all essential details are visible. This will make future reference easier and more organized.

Step 1: Write Clear Descriptions

Each receipt should include a short description of the transaction. Specify whether it’s a sale, refund, or payment. This clarity helps prevent confusion later on. If needed, add the customer’s name or ID for more precise tracking.

Step 2: Use a Receipt Template

Templates simplify the recording process. Set up a basic template that includes fields for the date, item description, amount, and payment method. This ensures that no important detail is overlooked. If using software, many offer customizable templates to suit your business needs.

Step 3: Record in Your Cash Ledger

After issuing a receipt, immediately log the transaction into your cash ledger. This can be done manually or digitally, depending on your preference. Regular updates ensure accuracy and provide a real-time picture of your cash flow.

Step 4: Verify with Reconciliation

Regularly reconcile your receipts with the cash on hand. Check if the amounts match and investigate any discrepancies right away. Reconciliation should happen at least once a day to catch errors early and avoid larger issues down the line.

Optimizing Receipt Entries in Simple Cash Templates

Limit the use of the term “Receipt” to two or three times to maintain clarity and conciseness. Instead of repeating the word, consider using variations such as “payment confirmation” or “transaction record” to convey the same meaning. This helps avoid redundancy while keeping the structure of the document straightforward and easy to follow.