For businesses and individuals handling cash transactions, having a standardized cash payment receipt template simplifies record-keeping and ensures clarity. A well-structured receipt provides both the payer and recipient with necessary details, making it easier to track payments and resolve any potential discrepancies.

The template should include key information such as the date of the transaction, the amount paid, the payer’s name, and the purpose of the payment. Ensure that a clear description of the goods or services provided is included, along with the name and contact information of the party receiving the payment. This not only fosters transparency but also serves as an official proof of the transaction.

By using a standard format, you reduce the chance of errors and provide a professional approach to cash transactions. A good receipt also supports accounting and tax reporting, offering a straightforward way to maintain accurate financial records.

Here are the revised lines with reduced repetition of words:

Ensure that the payment receipt template clearly lists the transaction amount and details. Avoid redundant phrases by keeping the wording concise. Use straightforward language to describe the method of payment, highlighting key aspects like the payment method and the recipient.

Each section of the receipt should be well-organized, with sections such as date, amount, and recipient clearly defined. Avoid overloading the document with unnecessary details that don’t add value to the transaction record. Keep instructions brief and to the point, focusing on what the user needs to know.

To improve readability, separate different payment types or notes with simple headings. Ensure that the format remains consistent throughout the document, making it easy to scan and understand at a glance.

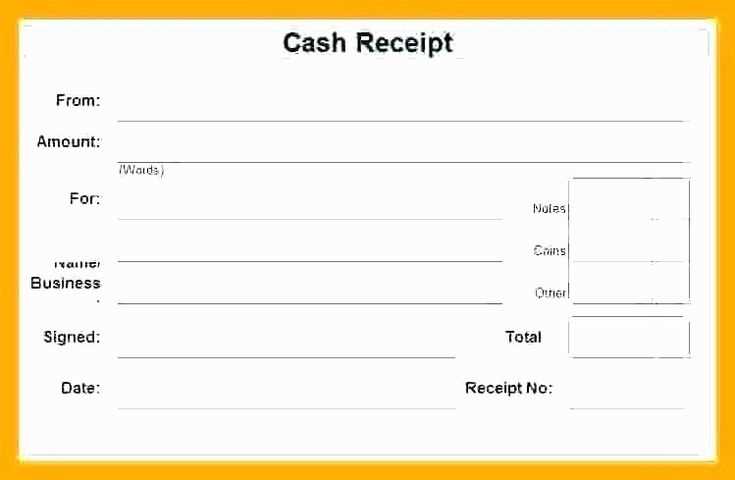

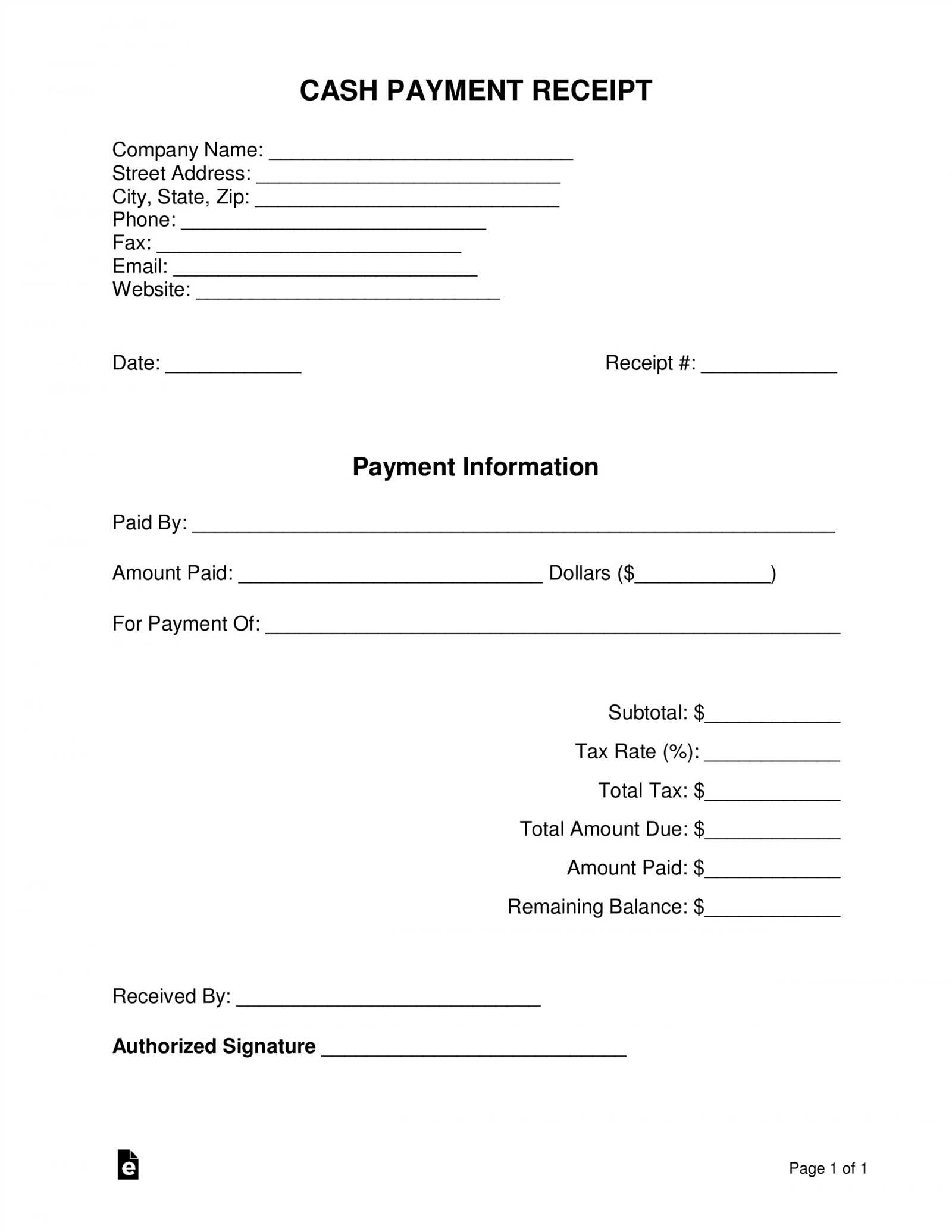

- Standard Cash Payment Receipt Template

A standard cash payment receipt template should be clear and concise to ensure both the payer and receiver have a record of the transaction. The template must include several key elements for accuracy and legality.

Key Components of a Receipt

- Receipt Number: A unique identifier for the transaction.

- Date: The exact date when the payment was made.

- Payer’s Information: The full name or business name of the person making the payment.

- Amount Paid: The exact amount of money received, listed in figures and words.

- Payment Method: A clear mention that the payment was made in cash.

- Purpose of Payment: A brief description of what the payment was for (e.g., goods, services).

- Receiver’s Information: The full name or business name of the recipient.

- Signature: The signature of the person receiving the payment, confirming the transaction.

Creating Your Template

Ensure the template is formatted neatly, with sections for each component to avoid confusion. Include spaces for both parties’ details and leave room for additional notes or terms if needed. This approach guarantees that all necessary information is clearly visible and properly documented.

Begin with a clean format. Clearly display the title “Payment Receipt” at the top of the document. Below the title, include the transaction date and receipt number for easy reference.

List the payer’s information, such as their name and contact details, followed by the amount paid. Be specific about the payment method–whether cash, card, or online transfer–and include any relevant payment identifiers.

Provide a brief description of the service or goods exchanged, and clearly state the total amount. If applicable, break down the price into individual items or services to provide transparency. Make sure the subtotal and any taxes or fees are shown separately before the final total.

Include the name and contact information of your business or organization. If relevant, add terms regarding refunds or other conditions tied to the payment. Close with a thank you note or message expressing appreciation for the transaction.

Lastly, ensure the document is easy to read. Use legible fonts, and avoid overcrowding the space with unnecessary details. This creates a straightforward, professional receipt that’s useful for both parties.

A payment receipt should clearly display specific details for both the payer and payee. This ensures the transaction is properly documented and easy to reference later. Here are the key elements to include:

1. Date of Payment

The receipt should include the exact date the payment was made. This provides a clear timeline of the transaction and helps in tracking payments for future reference.

2. Payment Amount

State the total amount paid, clearly indicating the currency. This is fundamental to avoid any confusion regarding the payment’s value.

3. Payment Method

Specify the payment method used, whether it’s cash, credit card, bank transfer, or another form. This helps clarify how the payment was processed.

4. Payer’s Information

Include the payer’s name or organization details, if applicable. This identifies who made the payment and ties the receipt to the payer.

5. Payee’s Information

Provide the name or business name of the recipient. This ensures the correct party is credited with the payment.

6. Receipt Number

Assign a unique number to each receipt. This is crucial for tracking and organizing receipts, especially for businesses that handle multiple transactions.

7. Transaction Description

A brief description of what the payment was for should be included. This can be a service, product, or fee being paid, offering clarity about the nature of the transaction.

8. Signature (if applicable)

If relevant, a signature can be added to validate the receipt. This is especially important for high-value transactions or legal purposes.

9. Tax Information (if applicable)

If taxes were applied to the payment, provide the tax amount and rate. This ensures compliance with tax regulations and makes the receipt more detailed for accounting purposes.

Example Table

| Information | Details |

|---|---|

| Date of Payment | February 14, 2025 |

| Payment Amount | $200.00 |

| Payment Method | Credit Card |

| Payer’s Name | John Doe |

| Payee’s Name | XYZ Company |

| Receipt Number | 12345 |

| Transaction Description | Consulting Service |

| Tax Information | 5% Tax Applied |

Double-check the date. A common mistake is forgetting to include the correct date or entering the wrong one. This can lead to confusion about when the transaction occurred.

Ensure accurate item descriptions. Avoid vague terms and be specific about what was sold. This will help clarify what the customer paid for and prevent disputes later.

Provide clear payment details. Always specify the exact amount paid, the method of payment (cash, card, etc.), and any additional charges, such as taxes or shipping fees.

Avoid using abbreviations or shorthand that might confuse the recipient. Write out full terms for clarity, such as “Payment received in full” instead of using “Paid” or “Complete”.

Be careful with the receipt number. If you’re using a numbering system, ensure each receipt has a unique number. Duplicates or skipped numbers can cause tracking issues.

Ensure the business name and contact information are clearly stated. Missing details like a company’s name or address can make it difficult for the customer to reach out for inquiries or returns.

Additional Tips

- Include both the seller’s and buyer’s names, when applicable.

- Review any discounts or promotions applied to the transaction.

- Ensure that the currency and any applicable taxes are clearly listed.

Avoid using generic templates that might leave out important details or are too vague for a specific transaction. Tailor your receipts to the nature of the sale to ensure completeness.

Creating a Standard Cash Payment Receipt Template

For simplicity and clarity, ensure your cash receipt template includes the following key elements: transaction date, business name, and the total amount received. Add the recipient’s details, including name and address if applicable. Make sure the description of goods or services is concise yet clear, showing the item or service provided along with its cost.

Necessary Components

The receipt should feature an easily identifiable receipt number. This number helps track transactions and is important for accounting purposes. Including the payment method ensures transparency, specifying if cash or other methods were used.

Formatting Tips

Ensure the receipt is easy to read. Use a simple layout with clear, bold labels for each section. Group related information logically: date, recipient, amount, payment method, and description of the transaction. For printed receipts, choose a font size that’s readable at a glance.