Use a cash receipt template to streamline your transaction records and avoid errors in documentation. Whether you’re receiving payments for services, goods, or other business activities, a structured template helps you stay organized and provides clarity for both parties involved.

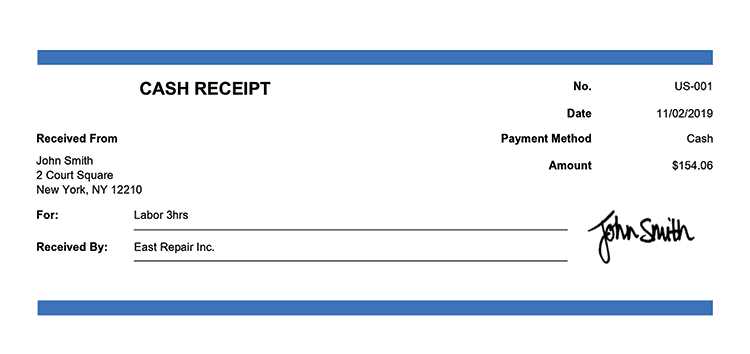

Design your template to include key details like the date of payment, payer’s name, amount received, and payment method. These components are vital for maintaining accurate financial records. Add a unique receipt number for easy tracking and referencing of transactions in the future.

Make sure to customize the template with your business logo, name, and contact details. This not only boosts professionalism but also ensures that anyone who receives the receipt knows exactly who issued it. With a few simple fields, a well-designed receipt can serve both as proof of payment and as a reliable record for accounting purposes.

Here is the corrected version with reduced word repetition:

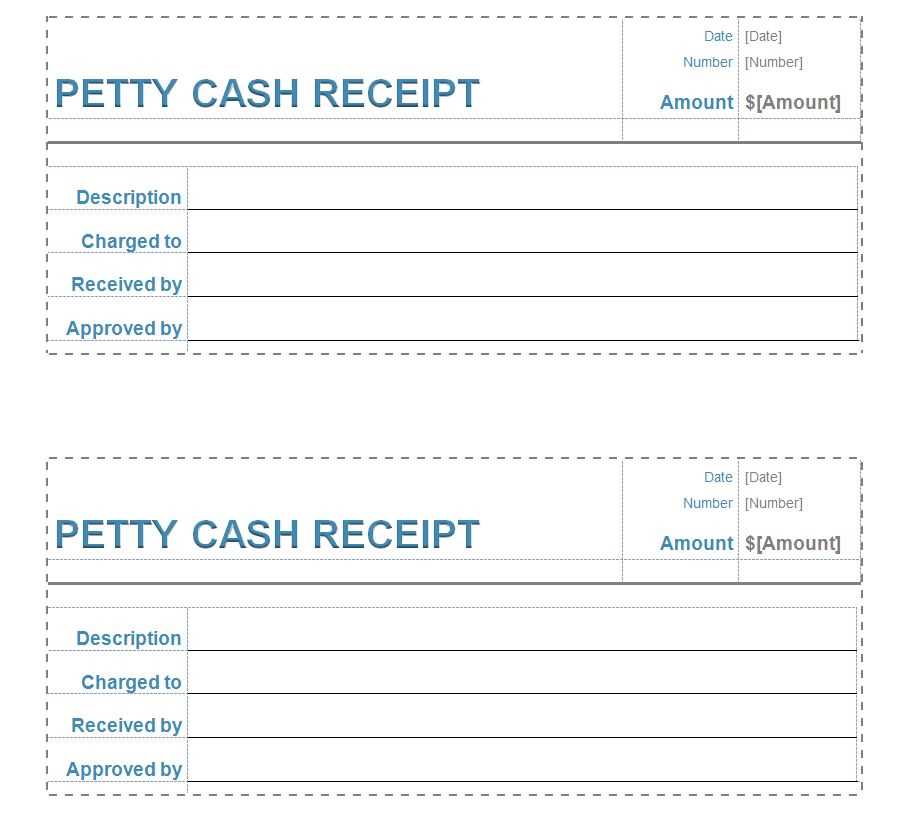

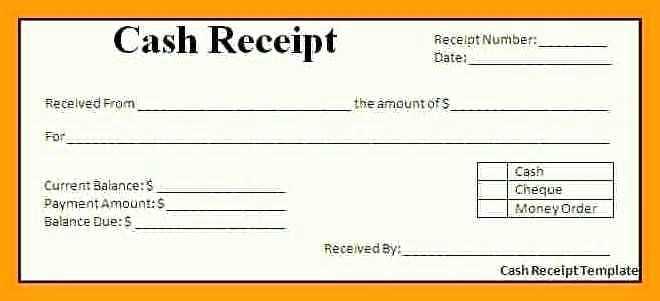

To create a well-organized cash receipt template, ensure it includes the following key elements:

- Receipt Number: Assign a unique identifier for each transaction to avoid confusion.

- Date: Specify the exact date of the transaction for record-keeping purposes.

- Payer Details: Clearly state the name and contact information of the person or entity making the payment.

- Amount Paid: Indicate the total sum paid, using both numeric and written formats for clarity.

- Payment Method: Specify how the payment was made, such as cash, check, or credit card.

- Issuer Information: Include the name, address, and contact details of the business or individual issuing the receipt.

- Signature: A signature field provides authenticity to the receipt and ensures accountability.

To improve readability and avoid excessive repetition, rephrase similar phrases and eliminate unnecessary wording. This approach enhances clarity and streamlines the document’s flow.

- Template Cash Receipt

A cash receipt template serves as a standardized form for recording cash transactions. This template is useful for businesses to ensure accuracy and consistency when documenting payments. You can tailor it to suit various business needs, such as customer payments, cash deposits, or even refunds.

Key Components of a Cash Receipt Template

At a minimum, your template should include the following details:

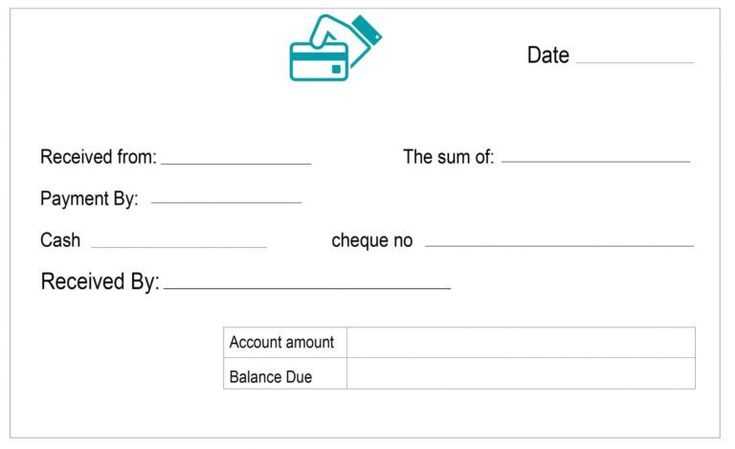

- Date: The date the payment is received.

- Receipt Number: A unique identifier for the receipt.

- Received From: The name of the payer or customer.

- Amount Received: The total sum of money received.

- Payment Method: Indicate whether the payment was made in cash, check, or another form.

- Purpose of Payment: A brief description of what the payment is for.

- Issued By: The person or department issuing the receipt.

Customizing Your Template

To meet your specific needs, consider adding fields for things like tax amounts, discounts, or notes for further clarification. Keeping the design simple but clear will make it easy to understand and use for both your business and customers.

A payment receipt template must contain a few key details to ensure clarity and accountability for both the payer and the recipient. These details create a comprehensive record of the transaction that can be referred to in the future.

Transaction Information

Include the date the payment was made. This helps both parties track when the transaction occurred. The receipt should also state the payment method used (e.g., cash, credit card, bank transfer) and any relevant reference numbers, such as transaction or authorization numbers, to help identify the payment if needed later.

Details of the Item or Service Paid For

Specify what the payment was for, including the description of the product or service, quantity, and the agreed-upon price. This section should match the terms agreed upon by both parties before the transaction took place.

Including the payer’s and recipient’s contact details ensures that both sides can easily reach each other if there are questions or issues regarding the payment. Lastly, include the total amount paid and any applicable taxes or discounts. This guarantees transparency about the total amount involved in the transaction.

To customize a receipt for various transactions, focus on including transaction-specific details like product names, prices, quantities, and any applied discounts. Ensure that each receipt reflects the nature of the sale, whether it’s a product purchase, service rendered, or a subscription renewal.

1. Tailoring Receipts for Retail Transactions

For retail sales, include the itemized list of purchased goods, their individual prices, and the total amount due. If applicable, highlight taxes, discounts, or any promotions used during checkout. Make sure the receipt displays both the store’s name and location for easy reference. Optionally, add a return policy or warranty details if relevant.

2. Customizing Service Receipts

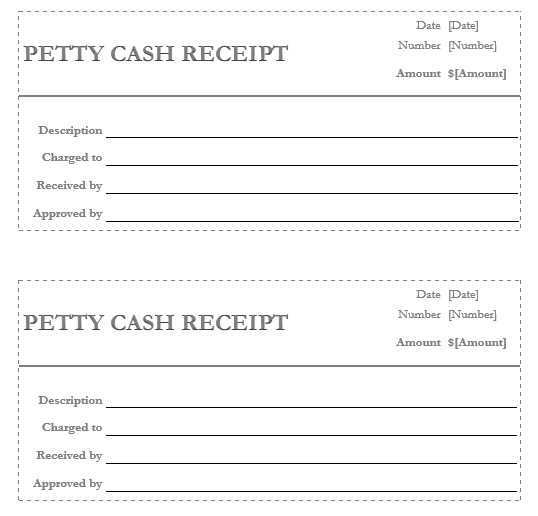

When generating receipts for services, mention the type of service provided, the duration, and the hourly or flat rate charged. If the service includes multiple steps or labor categories, list each separately. Include any additional charges for materials or travel fees. Ensure that the receipt clearly states the payment terms, such as deposit or full payment, to avoid confusion.

For subscription or membership payments, list the subscription period, renewal date, and payment amount. Add a note on the next billing cycle and provide clear contact details for any customer service inquiries.

One common mistake is failing to provide clear payment details. Ensure the template includes all necessary fields, such as the amount, date, payment method, and recipient details. Missing information can lead to confusion and delayed processing.

Another issue is overcomplicating the layout. While customization is key, keeping the template simple and easy to navigate is crucial. A cluttered design can make it difficult for users to quickly identify key information.

Inconsistent formatting can also create problems. Using varying fonts, colors, and styles throughout the template can confuse users. Stick to a clean, uniform design to maintain clarity and professionalism.

Don’t forget to include a payment reference or invoice number. Without this, it becomes challenging to track payments and resolve discrepancies.

Finally, leaving out a confirmation or receipt section is a common mistake. Always ensure there is space for a confirmation message or receipt number to reassure the payer that the transaction was processed successfully.

| Common Mistake | Impact | Solution |

|---|---|---|

| Missing payment details | Confusion, delayed processing | Include all relevant payment info (amount, date, recipient) |

| Overcomplicated layout | Hard to read, frustrating user experience | Use a simple, clean design with easy navigation |

| Inconsistent formatting | Disorganization, confusion | Maintain uniform fonts and colors |

| Missing payment reference | Difficulty tracking payments | Include reference or invoice number |

| No confirmation/receipt section | Lack of assurance for the payer | Provide confirmation message or receipt number |

Make sure the sales receipt includes specific details to ensure it complies with local regulations. Always include the date of the transaction, a description of the items or services sold, the total amount paid, and the payment method. Clearly state any taxes collected, as some jurisdictions require it. A valid receipt should also provide the seller’s full name, business address, and contact details to allow customers to reach you if needed.

Tax Compliance

Incorporate the appropriate tax rates as per local tax laws. Failure to properly document sales tax can lead to penalties, so ensure the receipt displays the tax amount separately from the total price.

Refund and Return Policy

Include your business’s return or refund policy on the receipt. This not only establishes trust with customers but also protects your business in case of disputes. Clearly outline any conditions under which a return or exchange is accepted, including time limits and requirements.

For creating payment templates, choosing the right file format is crucial for smooth handling, storage, and sharing. The best formats offer a balance between compatibility, ease of use, and customization. Below are the top formats to consider:

1. PDF

PDF is a widely used format due to its universal compatibility across devices and operating systems. It ensures your payment template maintains its formatting and is easy to share via email or print. PDF templates can also be secured with passwords, offering an extra layer of protection for sensitive financial data.

2. Excel (XLSX)

Excel allows for dynamic payment templates with built-in formulas and the ability to automate calculations. It is ideal for templates that require frequent updates or customization based on different payment scenarios. Excel files are commonly used for tracking payments and performing data analysis.

3. Word (DOCX)

Word offers a user-friendly environment for creating and editing payment templates. While not as dynamic as Excel, it is great for simple payment receipts or invoices that don’t require calculations. Word documents can be customized with different styles and fonts to match your business branding.

4. Google Sheets

Google Sheets is a cloud-based alternative to Excel. It allows real-time collaboration, making it perfect for teams that need to work on payment templates together. Google Sheets also offers the convenience of automatic updates and easy sharing across devices.

5. CSV

CSV is useful for storing and exporting payment information in a simple, text-based format. It’s lightweight and compatible with many applications, making it a great option for transferring large amounts of payment data between systems.

6. HTML

For web-based payment templates, HTML offers flexibility and integration with online payment systems. HTML templates are ideal for e-commerce websites where users can directly download or print receipts after making payments. They can also be customized to match your website’s design.

You can find ready-made receipt templates on several platforms offering both free and paid options. These templates are ideal for quickly generating professional receipts without having to start from scratch.

1. Microsoft Office Templates

Microsoft offers a range of customizable receipt templates for Word and Excel. You can download them directly from the Office website. These templates are easy to personalize, making them perfect for businesses of all sizes.

2. Template Websites

There are dedicated websites like Template.net and TemplateLab that specialize in various types of templates, including receipts. They provide both free and premium templates suitable for different industries.

For more variety, check out sites like Canva and Adobe Spark. These platforms allow you to design receipts from scratch or modify existing templates with ease. Their drag-and-drop interface simplifies the process.

Additionally, online marketplaces like Etsy often feature receipt templates for sale, designed by graphic designers. These templates are ideal for users who want something unique or creative.

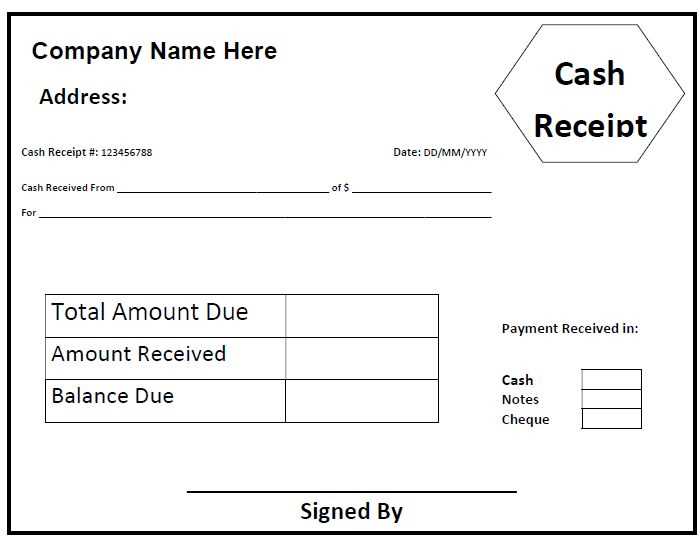

To create a well-structured cash receipt template, it’s key to organize the information clearly. The structure should include essential data such as the payer’s details, amount, date, and transaction type. Begin with a clean header that displays your business name and contact information for easy reference. Below that, list the receipt number, as each transaction needs a unique identifier for tracking purposes.

Key Elements

Each line item should include a description of the product or service provided, along with the corresponding amount. Ensure that you have a subtotal section to clearly outline the sum of the items before taxes. Include any applicable taxes in a separate line for clarity. The total amount section should be prominently placed at the end, followed by the method of payment used, such as cash, credit, or check.

Footer Information

Finally, add a footer section that includes your business’s return policy or other relevant terms, like the payment terms or a thank-you note. This adds a professional touch and can assist with customer relations. It’s also important to leave space for signatures or additional notes if needed.