To create a clear and organized cash receipt for a woodworking item, follow this straightforward template. This ensures both parties involved have all the necessary details for reference.

Receipt Header Information

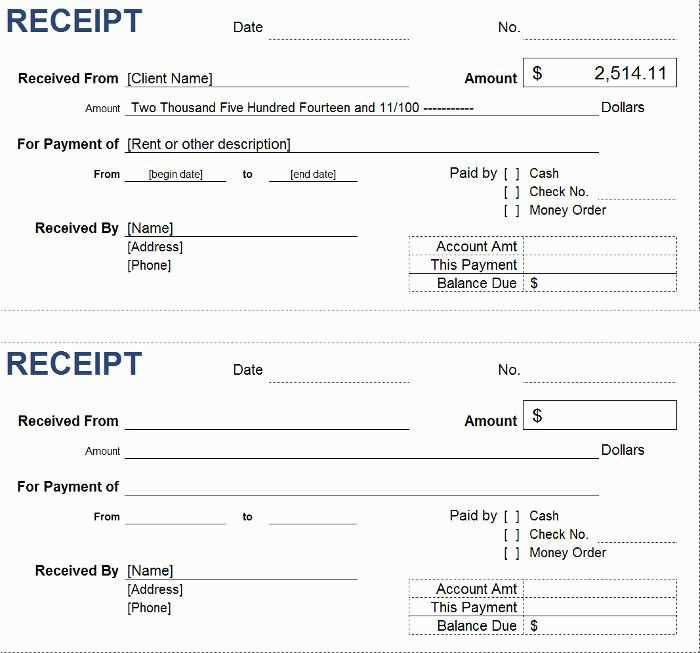

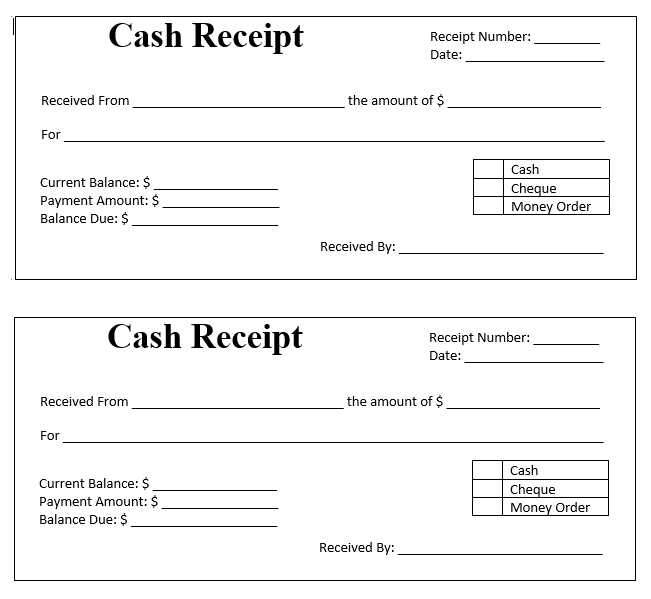

- Receipt Title: “Cash Receipt for Payment” or simply “Receipt”

- Date: Include the exact date of the transaction

- Receipt Number: Assign a unique number for record-keeping

Seller and Buyer Details

- Seller’s Name or Business Name: Full legal name or company name

- Seller’s Contact Information: Address, phone number, and/or email

- Buyer’s Name: Full name of the customer

- Buyer’s Contact Information: Address, phone number, and/or email

Transaction Details

- Item Description: Specify the woodworking item sold (e.g., custom table, chair, cabinet)

- Quantity: Number of items purchased

- Unit Price: Cost per item

- Total Amount: Total payment received (quantity x unit price)

Payment Information

- Payment Method: Cash, check, bank transfer, etc.

- Amount Received: Exact cash received or total payment

- Change Given: If any change was provided, state the amount

Signature Section

Seller’s Signature: Space for the seller to sign the receipt

Buyer’s Signature: Space for the buyer to sign the receipt (optional, but recommended for acknowledgment)

Additional Notes

If any special conditions or warranties apply to the item, briefly include them here. Make sure both parties are aware of all agreements surrounding the transaction.

Template for a Payment Receipt for Woodworking Item

Creating a Basic Receipt Template

Key Fields to Include in the Receipt

Formatting Tips for Clear Information

Common Errors to Avoid in Receipt Templates

Adapting the Template for Various Payment Methods

Legal Aspects When Issuing a Receipt

For a woodworking item payment receipt, begin with a simple structure that includes clear, essential information. The receipt should indicate the date, the buyer’s and seller’s details, a description of the item, the amount paid, and payment method. Ensure that the buyer’s name and contact information are accurately recorded, alongside the seller’s business name, address, and phone number.

Key fields to include:

- Date of transaction: Essential for both record-keeping and legal purposes.

- Buyer and seller information: Name, address, and contact details.

- Description of the woodworking item: Specify the type, dimensions, material, and other relevant details.

- Payment amount: Clearly show the total cost.

- Payment method: Include cash, credit, or another payment option.

- Transaction ID (if applicable): Helps with tracking payments.

- Signature: If necessary, include space for both parties’ signatures.

Formatting tips:

Make the document easy to read by keeping it uncluttered. Use clear headings for each section. Bold key points such as payment amount and item description. Ensure sufficient spacing between sections to prevent confusion. Consider aligning the payment details and item description for a neat appearance. Tables can help organize the receipt, especially for larger transactions.

Common errors to avoid:

- Omitting key details like the transaction date or item description.

- Incorrect spelling of names or numbers.

- Providing unclear payment method information, especially with multiple payment options.

- Forgetting to include a signature when required.

Adapting the template for various payment methods:

Tailor the receipt depending on the payment method. For cash payments, include the exact amount received. For credit or debit card payments, provide the last four digits of the card number and the payment processor’s name. If payments are made through a digital platform, include the transaction ID and platform name.

Legal aspects:

When issuing a receipt, be mindful of local regulations. Some regions may require certain information, such as tax details, to be included. Ensure your receipt complies with legal standards regarding business transactions. If you are in a tax-regulated industry, such as selling woodworking products, including your tax identification number might be necessary. Always keep a copy of the receipt for your records.