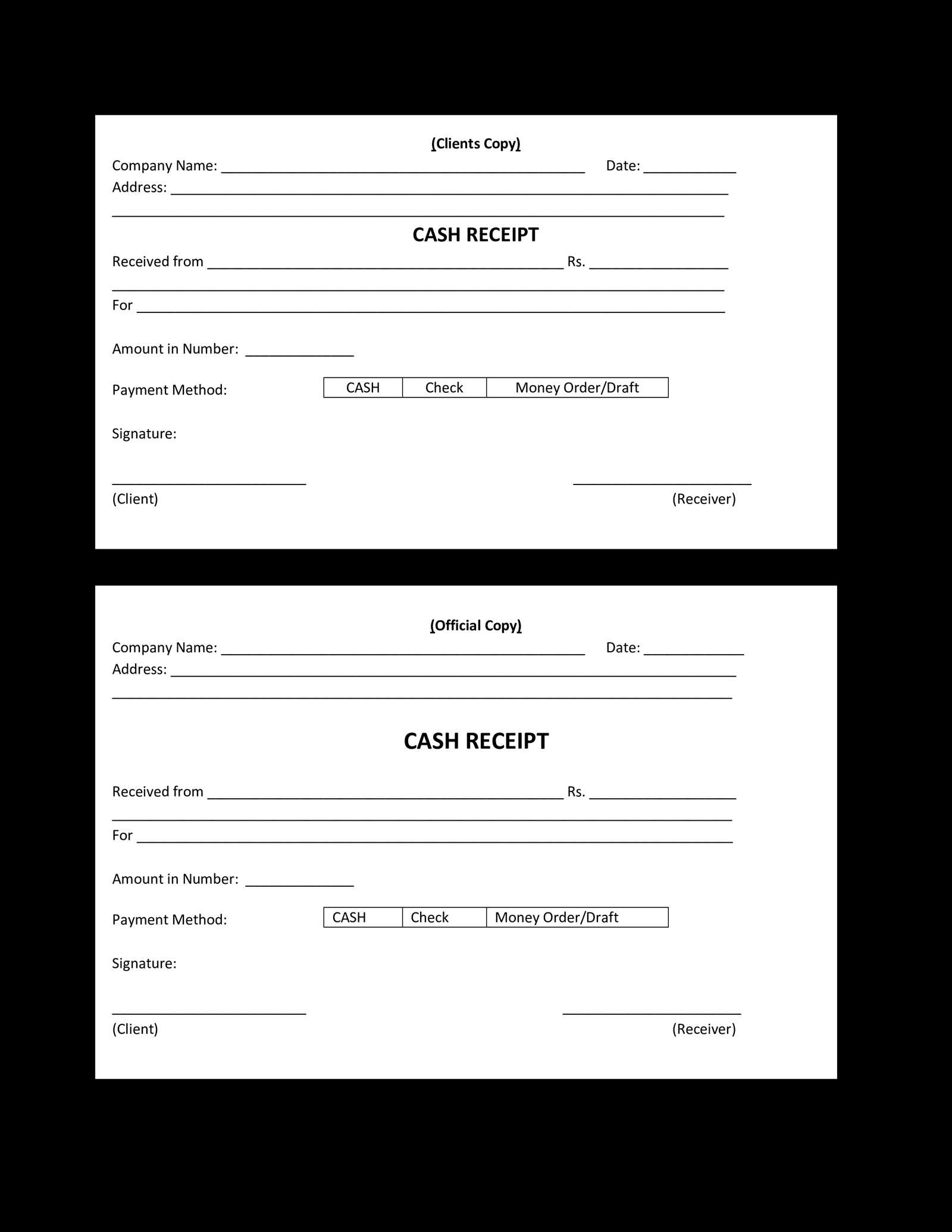

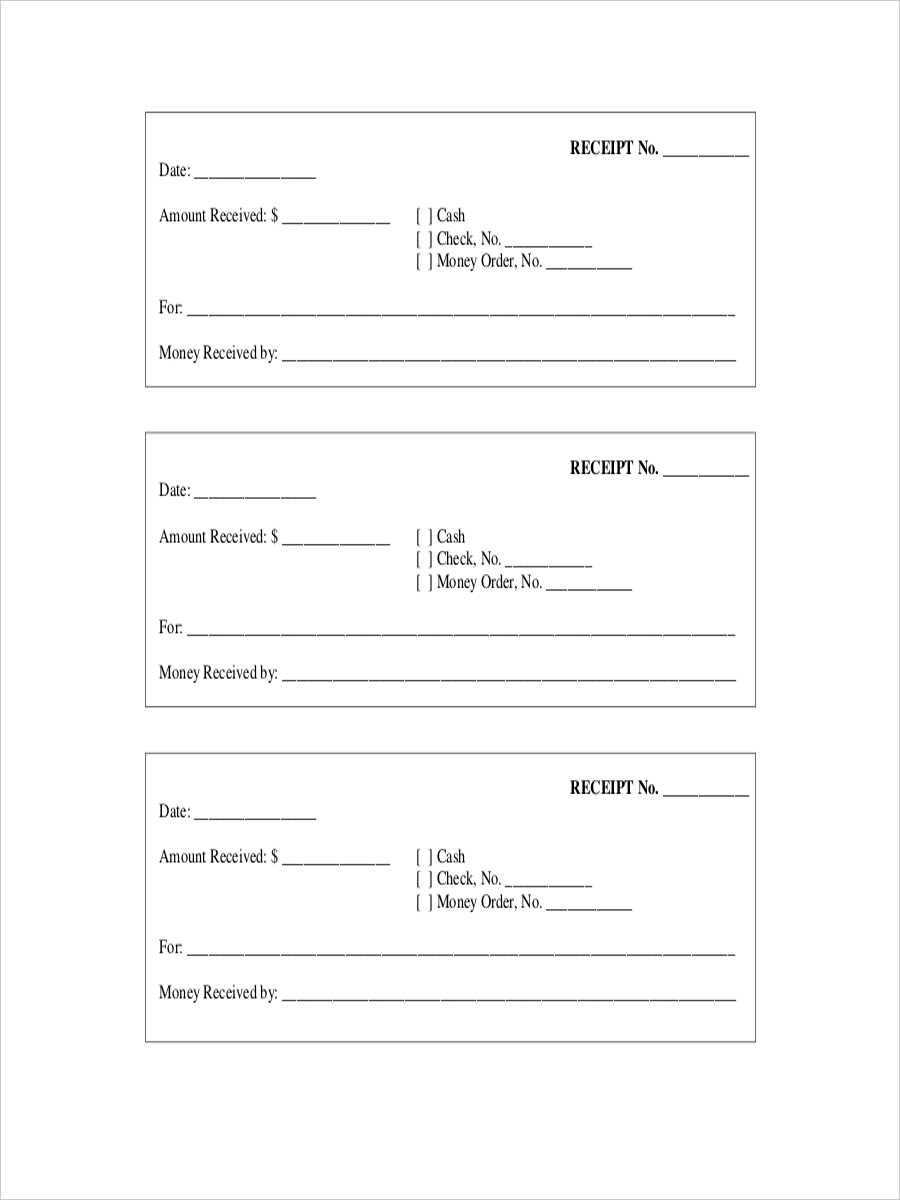

For accurate financial tracking, it’s necessary to create a clear and concise receipt whenever cash is received. A receipt template should include key details: the date of the transaction, the amount received, the name of the person or business paying, and the purpose of the payment. This provides a simple yet reliable record for both parties involved.

Customize the Template: Ensure the template is adaptable to different situations. Add fields for transaction types, payment methods, and additional notes if needed. This ensures the receipt can be used for various cash transactions, whether it’s a purchase, service, or loan repayment.

Details to Include: At a minimum, your receipt should have the following:

- Date: The exact date the cash was received.

- Amount: The total sum received in cash.

- Receiver’s Information: Include the name or business name of the person receiving the cash.

- Purpose: A brief description of what the payment is for, such as a service, goods, or debt payment.

Clarity and accuracy are key. By maintaining detailed records using a structured receipt template, you will easily avoid confusion and ensure proper financial documentation for both your business and personal transactions.

Here are the revised lines with minimal repetition:

Focus on using clear, concise phrasing to avoid redundancy. This approach improves clarity and readability. Below are key strategies for revising content:

- Replace long phrases with shorter alternatives, such as “received payment” instead of “payment that has been received”.

- Use active verbs to simplify the sentence structure. For example, instead of “A receipt will be issued”, write “We issue a receipt”.

- Avoid repetitive words by rephrasing the sentence. For instance, “received the payment and issued a receipt” can be condensed to “received payment and issued a receipt”.

- Be specific and direct. Instead of saying “The receipt was given to the customer”, write “We gave the receipt to the customer”.

Apply these adjustments to enhance the readability and flow of your document. Keep sentences direct and to the point, ensuring the key message stands out.

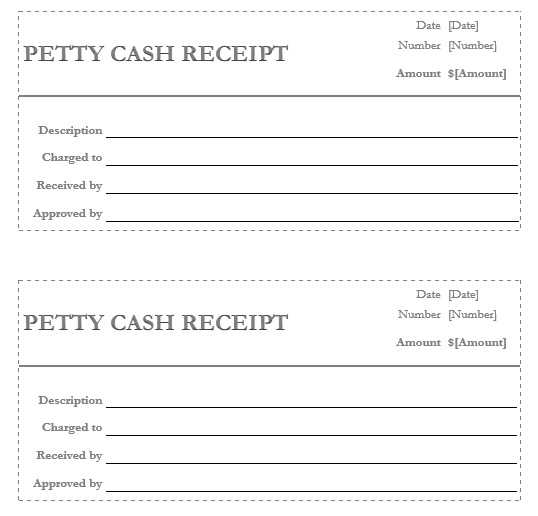

- Template for Cash Received

When documenting cash received, it’s crucial to use a straightforward template that includes all necessary details. A template helps ensure that the transaction is recorded accurately and easily referenced later. Below is a simple structure you can follow:

- Receipt Number: Assign a unique identifier for each transaction to maintain order.

- Date of Transaction: Record the exact date the payment was made.

- Payee Information: Include the name of the person or business making the payment.

- Amount Received: Specify the total amount of cash received in clear figures.

- Payment Method: Indicate if the payment was made via cash or other methods, such as cheque or transfer.

- Description of Goods/Services: Briefly note the items or services that the payment corresponds to.

- Authorized Signature: Include a space for the recipient’s signature or an authorized individual.

This template can be adjusted to suit different types of transactions, but ensuring that each of these elements is included will help streamline the record-keeping process. Adjustments might be necessary for more complex transactions, but this structure provides a solid foundation for most cash receipts.

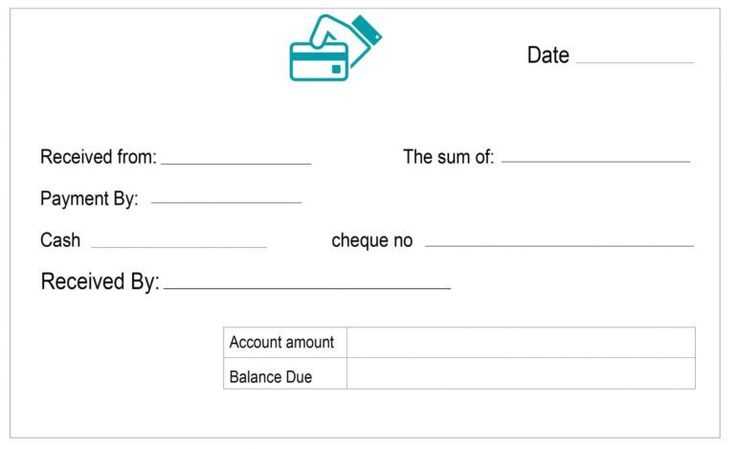

To create a simple receipt template, focus on including key details such as the name of the business, date, amount paid, payment method, and a unique receipt number for tracking. Organize the information clearly for both the issuer and the recipient to understand easily.

Step 1: Include Business Information

Start by placing the name of your business or individual issuing the receipt at the top, followed by the contact details such as address, phone number, and email. This makes it easy for the recipient to contact you if needed.

Step 2: Add Payment Details

Include the date of the transaction, the total amount received, and specify the payment method (e.g., cash, credit card). Ensure the receipt number is unique for each transaction, so you can track payments accurately.

Begin with a clear title at the top of the receipt, such as “Receipt” or “Payment Confirmation.” This ensures immediate recognition of the document’s purpose. Include the date and time of the transaction; this will help identify the receipt in case of future reference or disputes.

Transaction Details

Provide a brief description of the items or services purchased, including quantities and unit prices. It is helpful to show both the subtotal and any applicable taxes separately. This allows the recipient to easily understand the breakdown of charges.

Payment Information

Clearly state the total amount paid. Include the payment method (e.g., cash, credit card, check) to confirm how the payment was made. If applicable, include transaction or authorization numbers for online or card payments.

Ensure the receipt contains the name and contact details of the business issuing it. This adds transparency and offers a point of contact in case of inquiries. Finally, include any necessary terms or return policies that apply to the transaction, keeping the information concise.

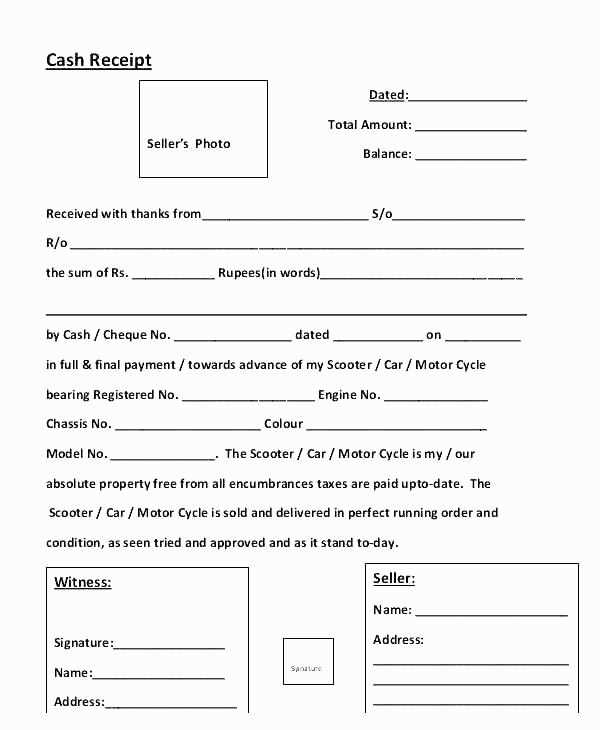

Adjust your receipt template based on the transaction type. This ensures clarity and avoids confusion for both you and your customers. For example, customize templates for retail sales, services, or donations to reflect specific information related to each scenario.

Retail Transactions

For retail purchases, include product details such as name, price, and quantity. A breakdown of applicable taxes and discounts should be clearly displayed. This allows customers to see how the final price was determined.

Service Transactions

For services, highlight the type of service rendered, the hourly rate or fixed cost, and any service-related taxes. A payment method section will help keep track of the transaction’s completion status.

| Item | Price | Quantity | Total |

|---|---|---|---|

| Consultation | $50 | 1 hour | $50 |

| Service Fee | $20 | 1 | $20 |

| Tax | $7 | 1 | $7 |

For donations, include donor details, donation amount, and the applicable tax deduction (if any). Customize the receipt to reflect nonprofit status and any tax-exempt information as needed.

Provide a clear breakdown of cash transactions. Detail the amount received, date, and purpose of the payment. This ensures transparency and helps maintain accurate records. Be sure to include both the payer’s and recipient’s names, along with any relevant references or invoice numbers.

Receipt Template Structure

Begin with the total amount received and the currency type. Follow with a brief description of what the payment was for, such as a service or product. Include the method of payment (e.g., cash, cheque). Make sure to mention any applicable taxes or additional charges in a separate line for clarity.

Legal Considerations

Incorporate any legal requirements based on local regulations. For instance, you might need to state whether VAT was included in the total amount. Keep the receipt brief but comprehensive enough for future reference or any potential audits.