Ensure accuracy when creating a template for cash payment receipts. A clear and straightforward format prevents misunderstandings and serves as a legal document for both the payer and recipient. Include the transaction date, payer’s name, amount paid, and the payment method. This will provide a transparent record of the exchange, reducing confusion for both parties.

Customize for your needs. The receipt template should be adaptable to various situations, whether it’s a small business transaction or a personal sale. Be sure to list the specific goods or services for which payment was made, along with any applicable taxes or discounts. Including these details makes the receipt more informative and useful for record-keeping purposes.

Maintain simplicity. While details are important, avoid overloading the template with unnecessary information. Stick to the key facts and keep the design clean and legible. This way, the receipt serves its purpose without creating clutter or confusion. A straightforward layout improves the experience for both the person receiving the payment and the one making it.

Here are the corrected lines with repetition minimized:

To streamline the payment receipt process, structure your template as follows:

- Payment Amount: Clearly state the total amount received, including the currency.

- Receipt Date: Include the exact date of the transaction.

- Payment Method: Specify the method used (cash, bank transfer, etc.).

- Recipient’s Name: Provide the name of the person or entity receiving the payment.

- Invoice Number (if applicable): Reference the associated invoice for clarity.

- Signature or Acknowledgment: Include a line for signature or acknowledgment of receipt.

By focusing on these key elements, you avoid unnecessary repetition while ensuring all important details are captured.

- Template for Cash Payment Receipt

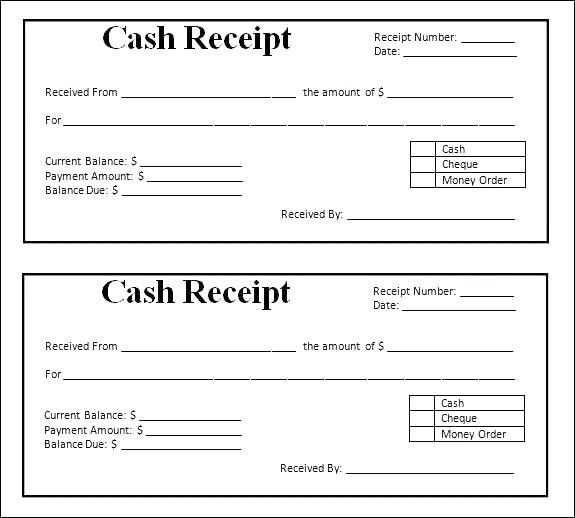

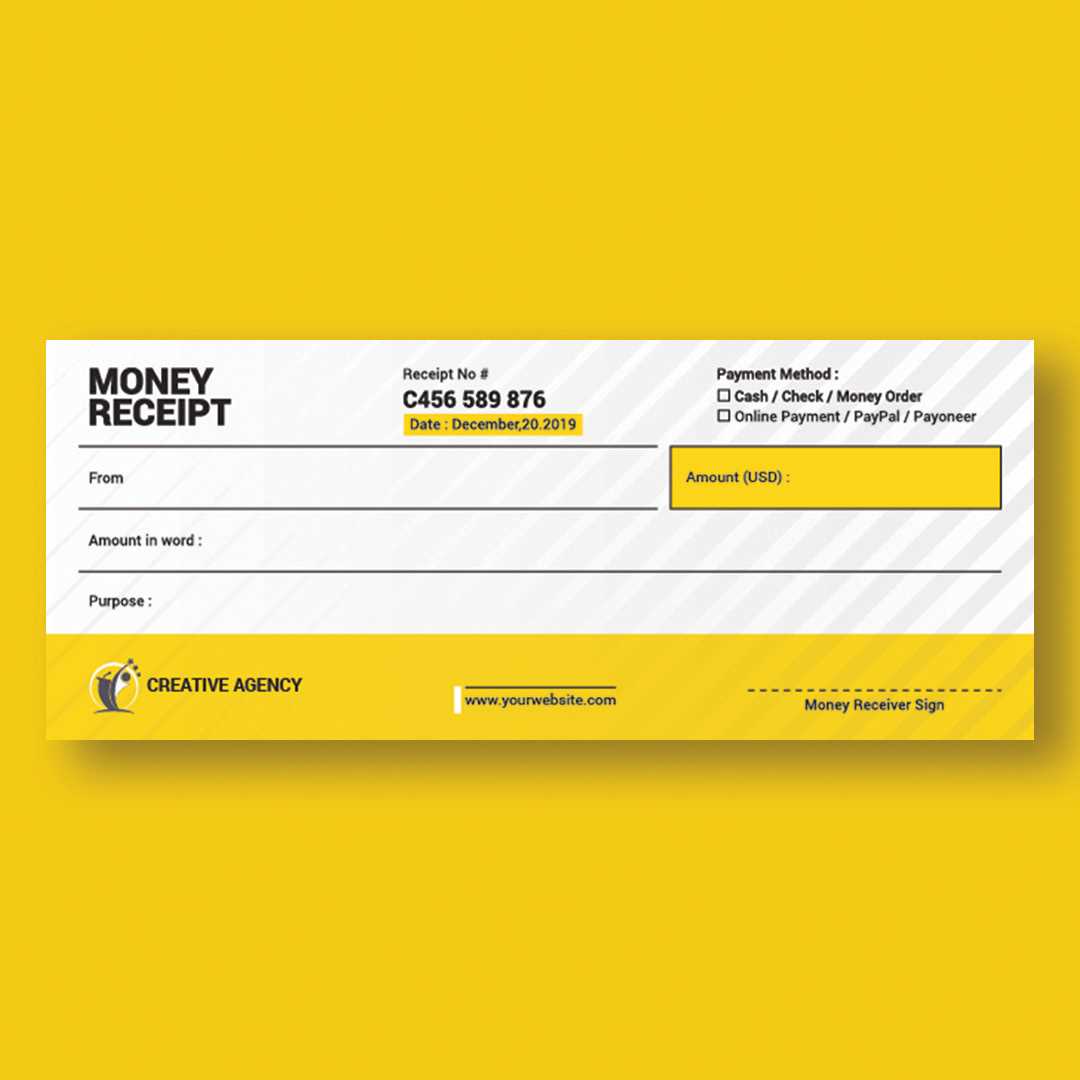

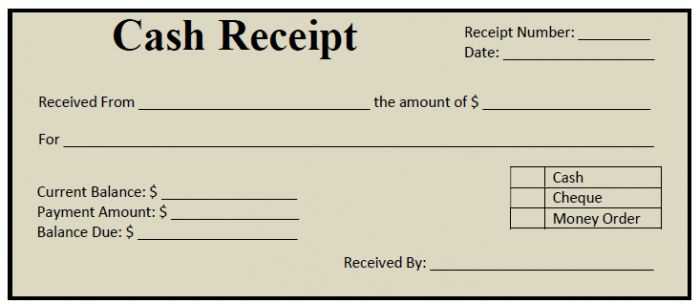

A cash payment receipt template should clearly display all relevant payment details. Begin with the header, including the name of your business and contact information. Then, specify the receipt number and the date of the transaction. Clearly state the amount paid, the purpose of the payment, and the method of payment, emphasizing that it was made in cash.

Next, include a breakdown of items or services purchased, including quantities and individual prices. Ensure the total amount matches the sum of the individual entries. Additionally, provide space for both the payer’s and receiver’s signatures, which help confirm the transaction was completed. The template should also feature a statement that the payment has been received in full.

Lastly, consider adding a footer with any applicable terms or policies regarding refunds or exchanges. This keeps both parties informed and ensures transparency in the transaction.

Begin with a clear record of the transaction date. This should be placed at the top of the receipt for easy reference, ensuring it aligns with accounting systems. Immediately following, list the payer’s name, which helps identify the individual or entity making the payment. If applicable, include their contact details for future communication.

Next, specify the payment method used, whether it’s cash, cheque, credit card, or bank transfer. This distinction is necessary for accurate record-keeping and auditing. Include the amount received in both numeric and written form to avoid any ambiguity. Double-check the figures to prevent discrepancies.

A brief description of the purpose of the payment provides context. For instance, “payment for invoice #1234” or “advance on services rendered.” This enables quick identification of the payment’s nature, should questions arise later.

Finally, ensure there’s a section for signatures–either from the payer or an authorized representative. This formalizes the transaction and can serve as proof if disputes occur. Keep the layout simple yet detailed, and ensure all components are visible and legible.

| Component | Description |

|---|---|

| Transaction Date | Record the date of payment for reference |

| Payer Information | Include name and contact details |

| Payment Method | Specify the method used, e.g., cash, cheque, etc. |

| Amount | Write both numeric and word forms of the amount |

| Description | Clarify the purpose of the payment |

| Signatures | Include signatures for verification |

Include relevant legal and tax details in your payment template to ensure compliance and avoid potential issues. Start by adding your company’s registered name and address. This helps establish the legitimacy of the transaction. You should also mention your tax identification number (TIN) to confirm tax obligations.

Clearly outline the applicable tax rates for the transaction, such as sales tax or VAT, if required by your jurisdiction. Indicate the total amount, including tax, to ensure transparency. If your country requires issuing invoices with tax breakdowns, make sure to provide that information clearly, listing both net and gross amounts.

Specify any legal disclaimers or terms of service that apply to the payment. This can include refund policies or the terms of use of the service or product. Providing these details in the payment template prevents misunderstandings and clarifies both parties’ responsibilities.

Finally, keep in mind the date of the transaction and the method of payment. Including this information helps track payments and ensures accuracy for both you and the customer.

To maintain accuracy and meet compliance standards, cash payments must be recorded immediately after each transaction. This ensures that every amount paid is documented without delay, reducing the risk of errors or discrepancies. Set up a systematic process where receipts are generated for each cash payment and filed appropriately in your records.

Standardize Recordkeeping Procedures

Adopt a clear, consistent approach for entering transaction details into your records. Include specifics such as the date, amount, payer, and reason for payment. This structure minimizes confusion and supports auditing and verification processes. Make sure to follow local regulations for storing and presenting these records when needed.

Conduct Regular Reconciliation

Perform regular reconciliation of cash records with actual cash on hand. This can be done daily, weekly, or as needed, depending on transaction volume. Discrepancies should be immediately investigated and resolved to prevent financial misstatements. Regular checks also ensure compliance with both internal controls and external regulations.

Ensure that the receipt template includes clear details such as the amount paid, the date of payment, and the method used (e.g., cash, credit, or debit). This information helps both parties confirm the transaction without confusion.

Labeling: Use concise, understandable terms for each section of the receipt. A simple label like “Payment Amount” is more effective than a generic one like “Total”. It makes reading quicker and more direct.

Details to Include: Specify the purpose of the payment. For example, a label like “Payment for Invoice #12345” helps with identifying the transaction in future references.

Receipt Number: Assign each receipt a unique number. This helps track individual transactions, especially in case of disputes or refunds.

Signatures: Both parties should sign the receipt if required by the transaction’s nature. A signature confirms that both the payer and the receiver have agreed to the transaction terms.

Printing Considerations: Ensure that the receipt template is printer-friendly. Use a clear, readable font, and structure the layout for easy scanning. Avoid excessive design elements that might clutter the document.