For a smooth year-end process, it’s important to provide donors with a clear and accurate donation receipt letter. This document not only helps your donors maintain proper records for tax purposes, but it also strengthens your non-profit’s relationship with them. A well-structured letter makes the process easier for both parties.

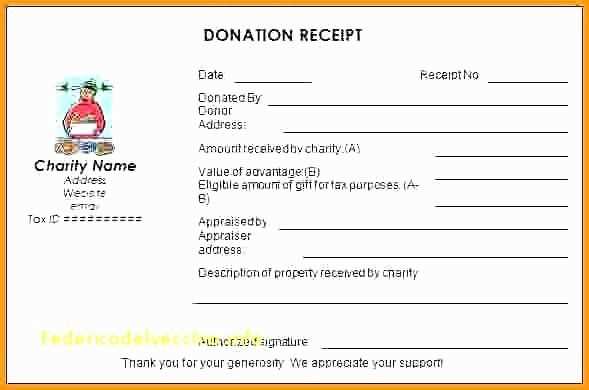

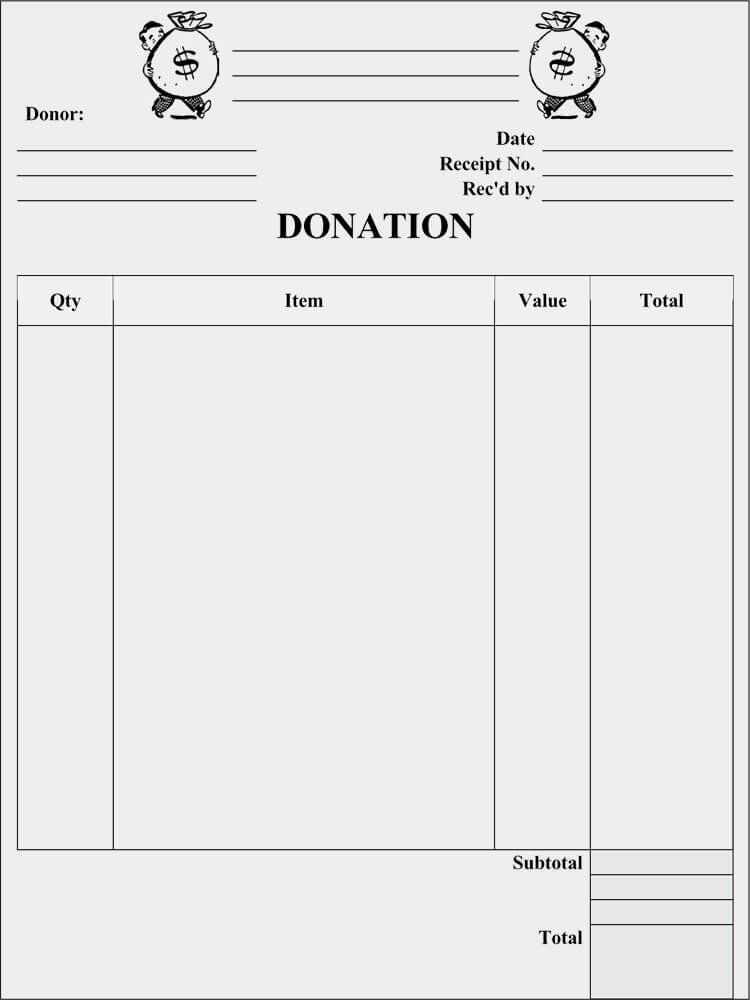

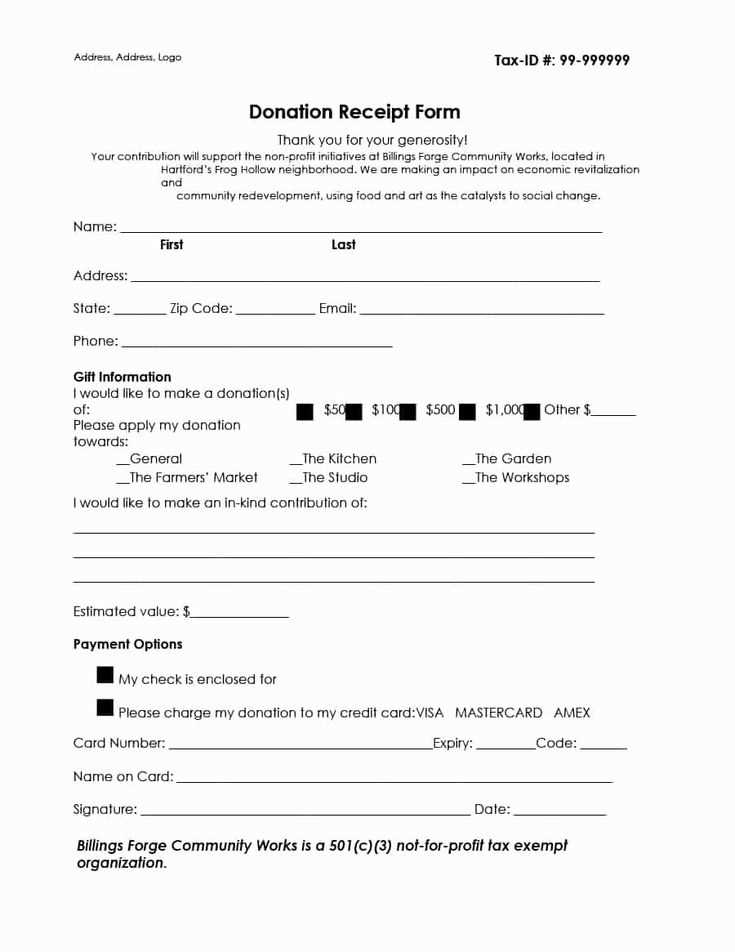

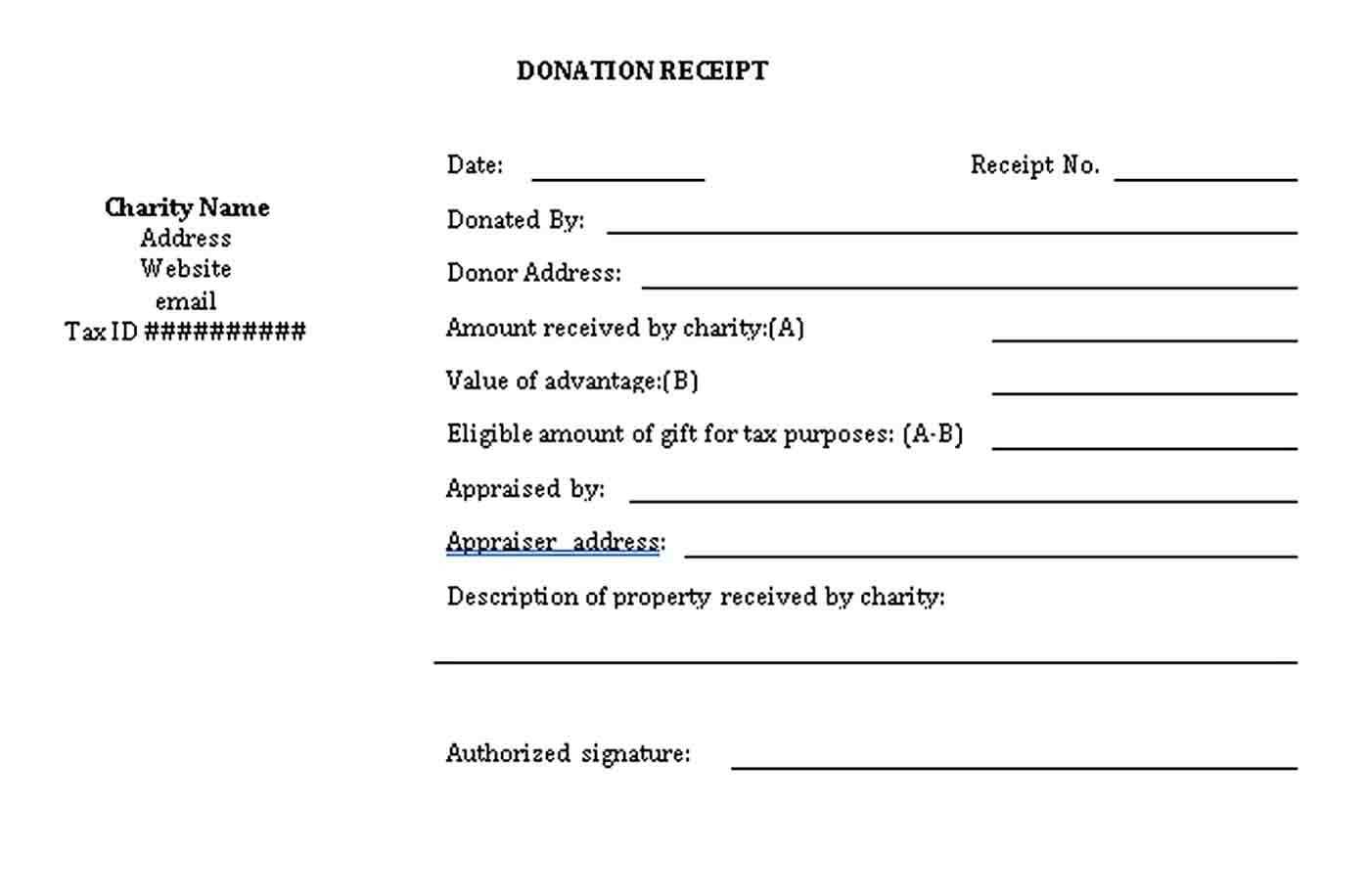

Your donation receipt should include key details such as the donor’s name, donation amount, and the date the donation was made. If applicable, specify whether the donation was in cash or goods. It’s also important to mention any goods or services provided in exchange for the donation, as this affects the deductible amount. Always ensure to avoid vague terms and include clear, factual information that will support your donor’s tax claim.

To save time and effort, use a template that covers all necessary elements. Make sure to customize it for your specific needs, such as including your non-profit’s name and address, as well as any legal disclaimers required by your country’s tax laws. This helps ensure that your receipts are both legally sound and donor-friendly.

A clear, concise donation receipt shows appreciation for your donors’ generosity, while also helping them with tax deductions. By staying organized and ensuring you follow a structured approach, you set a professional tone and demonstrate accountability in your non-profit’s operations.

Here is the corrected version of the text:

Ensure your letter includes a clear statement of the donation amount, either in numbers or written form. Clearly indicate the type of donation, such as cash or goods, and provide any relevant details. It’s critical to include your organization’s name, address, and a statement that no goods or services were provided in exchange for the donation. If the donor has requested a receipt for tax purposes, be sure to add a line that confirms the donation was made without any reciprocal benefits.

What to Include

Don’t forget to provide the date of the donation. If the donor made multiple contributions, list each separately with the corresponding date. Keep the tone professional yet warm to reflect the impact of the donation.

Sample Text

Donation Acknowledgement: “Thank you for your generous cash donation of $250 received on December 15, 2024. No goods or services were provided in exchange for this contribution.”

Conclude the letter with a sincere thank you, emphasizing the donor’s contribution and its value to your organization. This adds a personal touch while keeping the letter professional.

- Year End Cash Nonprofit Donation Receipt Letter Template

A clear and concise year-end donation receipt is a crucial tool for both nonprofits and donors. The receipt should include specific details to ensure compliance with tax laws and provide the donor with the necessary information for filing their taxes.

Start with a professional letterhead or the organization’s name, address, and contact details. Below that, include a subject line such as “Donation Receipt for Tax Purposes.” The first paragraph should thank the donor for their contribution, mentioning the exact amount donated and the date of the donation.

In the next section, confirm that no goods or services were provided in exchange for the donation, as this is important for the donor’s tax deduction. If goods or services were exchanged, include a description and estimate of their value. It’s also essential to state whether the donation was in cash, check, or another form.

End the letter with a final note of appreciation, along with the signature of an authorized individual from the organization, such as the Executive Director or Treasurer. This will add a personal touch and show gratitude for the donor’s support.

A well-structured year-end cash receipt provides clear, accurate documentation for donors, allowing them to claim tax deductions. Begin with key donor information, including full name, address, and donation date. The amount donated should be listed clearly, followed by any relevant transaction details (e.g., check number or payment method). Include the nonprofit’s tax-exempt status and the statement that no goods or services were provided in exchange for the donation, if applicable. This statement ensures compliance with IRS regulations.

Key Elements to Include:

| Element | Description |

|---|---|

| Donor Information | Name, address, and contact details |

| Donation Amount | Exact dollar amount donated |

| Date of Donation | Specific date the donation was received |

| Nonprofit’s Information | Organization name, address, and tax ID |

| Statement of No Goods or Services | Declaration confirming no goods or services were exchanged for the donation, if true |

Best Practices:

Keep the tone professional but warm. Ensure that your receipt is sent within a reasonable timeframe after the donation is made, typically by early January. If the donation is substantial, consider providing a breakdown of how the funds will be used to support your nonprofit’s mission. This can strengthen the donor’s connection to your cause.

Include the donor’s name and address to ensure their details are correctly linked to the contribution. This serves as verification for both parties.

Specify the date of the donation. This will help the donor track when they made the contribution, which is necessary for tax purposes.

Provide a description of the donated item or cash amount. If it’s a cash donation, mention the exact dollar value. For in-kind donations, describe the donated items and their estimated value, if possible.

Clearly state that no goods or services were provided in exchange for the donation, especially for tax deduction purposes. If something was exchanged, detail the fair market value of the benefit received.

Include the nonprofit’s tax-exempt status. This confirms the organization’s ability to accept tax-deductible donations, and it can be helpful for donors when filing taxes.

Thank the donor for their support. A brief, genuine acknowledgment shows appreciation and strengthens the relationship between the donor and the nonprofit.

Provide contact information for the organization, including a phone number or email for any questions or further assistance regarding the donation.

Nonprofit organizations must comply with specific legal requirements when issuing year-end cash receipts for donations. A key requirement is ensuring that receipts for donations of $250 or more include specific information outlined by the IRS, such as the amount donated, a statement regarding whether the organization provided any goods or services in exchange for the donation, and a description of any such goods or services.

IRS Guidelines

Under IRS rules, any donor giving $250 or more must receive a written acknowledgment. The acknowledgment must include a clear description of the cash donation and the organization’s details. If the donor received goods or services, the receipt must also state whether those items are tax-deductible, and if so, the fair market value of the goods or services provided.

Timing of the Receipt

The IRS requires that receipts be sent out to donors before the filing deadline for the organization’s tax return, which is typically by the 15th day of the 5th month after the end of the organization’s fiscal year. For most nonprofits with a calendar-year fiscal year, this means receipts must be sent by May 15th.

Organizations should ensure that their receipts are clear, accurate, and meet these IRS standards to avoid complications with tax-exempt status or donor tax deductions. Maintaining proper documentation can prevent legal issues and help donors claim the correct deductions on their tax returns.

Tailor your receipt letter based on the donor’s profile and contribution type. For example, for major donors, include personalized messages that reflect the impact of their support. Address their past involvement, such as attending events or long-term support, to show appreciation for their continued commitment.

For Individual Donors

Keep the tone warm and personal. Use their first name and briefly highlight how their specific donation will contribute to your mission. If they made a recurring donation, mention how their ongoing support is making a difference over time. This personal touch reinforces the connection and encourages future contributions.

For Corporate Donors

For businesses or organizations, emphasize the partnership and the visibility they’ve gained from their involvement. Acknowledge any promotional efforts, such as sponsoring events or matching donations, and how it aligns with their corporate values. This approach helps to foster a lasting relationship with corporate partners.

By customizing the letter, you make each donor feel valued, showing that their contribution is unique and appreciated in the context of your mission.

Use a reliable system to track donations. Whether it’s software or spreadsheets, choose a method that aligns with your organization’s needs and is easy to maintain. Make sure each donation is logged with key details such as the donor’s name, donation amount, and date. This helps ensure no donation is overlooked or misreported.

Regularly Update Donation Records

Update your records regularly to avoid any backlog. Record donations as soon as they are received, and take time to review and correct any discrepancies. Regular updates help keep your financial statements accurate and prevent confusion during audits.

Organize Receipts and Documentation

Ensure each donation is linked to a corresponding receipt or acknowledgment letter. Retain copies of all receipts, along with any notes about the donation purpose or restrictions. This helps protect both your organization and donors in case of future inquiries or audits.

Keep records organized and backed up. This will streamline year-end reporting and tax preparation, making the process smoother and more transparent for both the organization and your supporters.

To efficiently send year-end donation receipts to your donors, begin by gathering all the donation data. Ensure your records are up-to-date and include accurate donation amounts, dates, and donor details. This step avoids any confusion later and helps maintain transparency.

1. Personalize the Receipt

Personalization adds a human touch. Address each donor by name, and reference their specific contribution. Make sure the letter is formatted to reflect your nonprofit’s branding, with your logo and contact information clearly displayed.

2. Include the Necessary Information

Your receipt must contain the following key details:

- Donor’s name and address

- Date and amount of the donation

- Statement that no goods or services were provided in exchange for the gift, if applicable

- Your nonprofit’s name, EIN (Employer Identification Number), and contact info

- Signature from an authorized individual (if required)

3. Choose the Delivery Method

Consider whether you want to send physical receipts via mail or digital versions via email. Email can be quicker and more environmentally friendly, but physical receipts may feel more personal to some donors. Both options should be equally professional and clear.

4. Set Deadlines

Send receipts promptly after the donation is made, and ensure all donors receive them by the end of the year. This timing helps donors claim deductions in time for tax season.

5. Automate the Process

If you have a large donor base, use software to automate receipt generation. Many donation platforms allow automatic year-end receipt creation and delivery, saving time and reducing errors.

To create a clear and functional year-end cash donation receipt letter, keep the content straightforward and focused on the donor’s contribution. Use a clean, easy-to-read format to avoid confusion.

- Start with the non-profit organization’s name, address, and tax-exempt status clearly visible at the top.

- Include the donor’s name and address as well as the donation amount and date.

- State the purpose of the donation (if applicable) and confirm that no goods or services were exchanged in return for the gift.

- Incorporate a statement verifying the donation was made in cash and include the amount. If the donation includes other items, list them separately.

- Ensure the letter is signed by a representative of the non-profit, confirming the receipt.

Incorporating these key elements will ensure the donation receipt is professional, legally compliant, and easily understood.