To streamline donation tracking, a well-structured donation receipt is key. Customize your template with essential fields such as donor’s name, amount donated, date, and the purpose of the contribution. Keep the design simple but clear, ensuring that the church’s name, contact details, and tax-exempt status are visible for transparency.

Read MoreCategory: donation

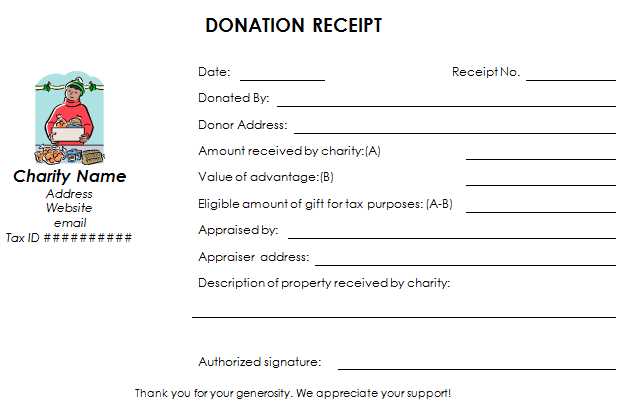

Nonprofit donation receipt template

Every nonprofit needs a clear and well-structured donation receipt to ensure proper record-keeping and compliance with tax regulations. A good receipt includes the donor’s name, donation amount, date, and a statement confirming whether any goods or services were provided in exchange.

Read MoreDonation bequest receipt template

Creating a donation bequest receipt is straightforward when you have the right template. This receipt serves as proof for both the donor and the organization, ensuring transparency and compliance with tax regulations. A clear and accurate template is key to maintaining trust and avoiding confusion later on.

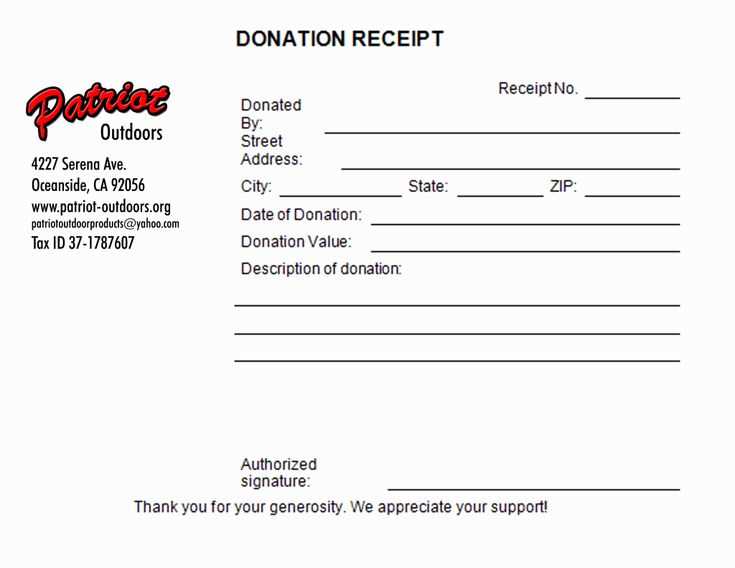

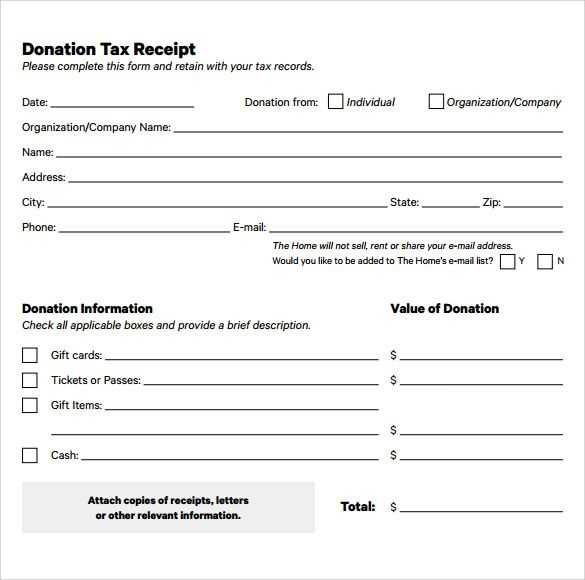

Read MoreDonation receipt form template

A donation receipt form should clearly list the details of the donation for proper record-keeping and tax purposes. Make sure to include the donor’s full name, address, and the amount of the contribution. Be specific about whether the donation was in the form of cash, goods, or services, and provide a brief description of any […]

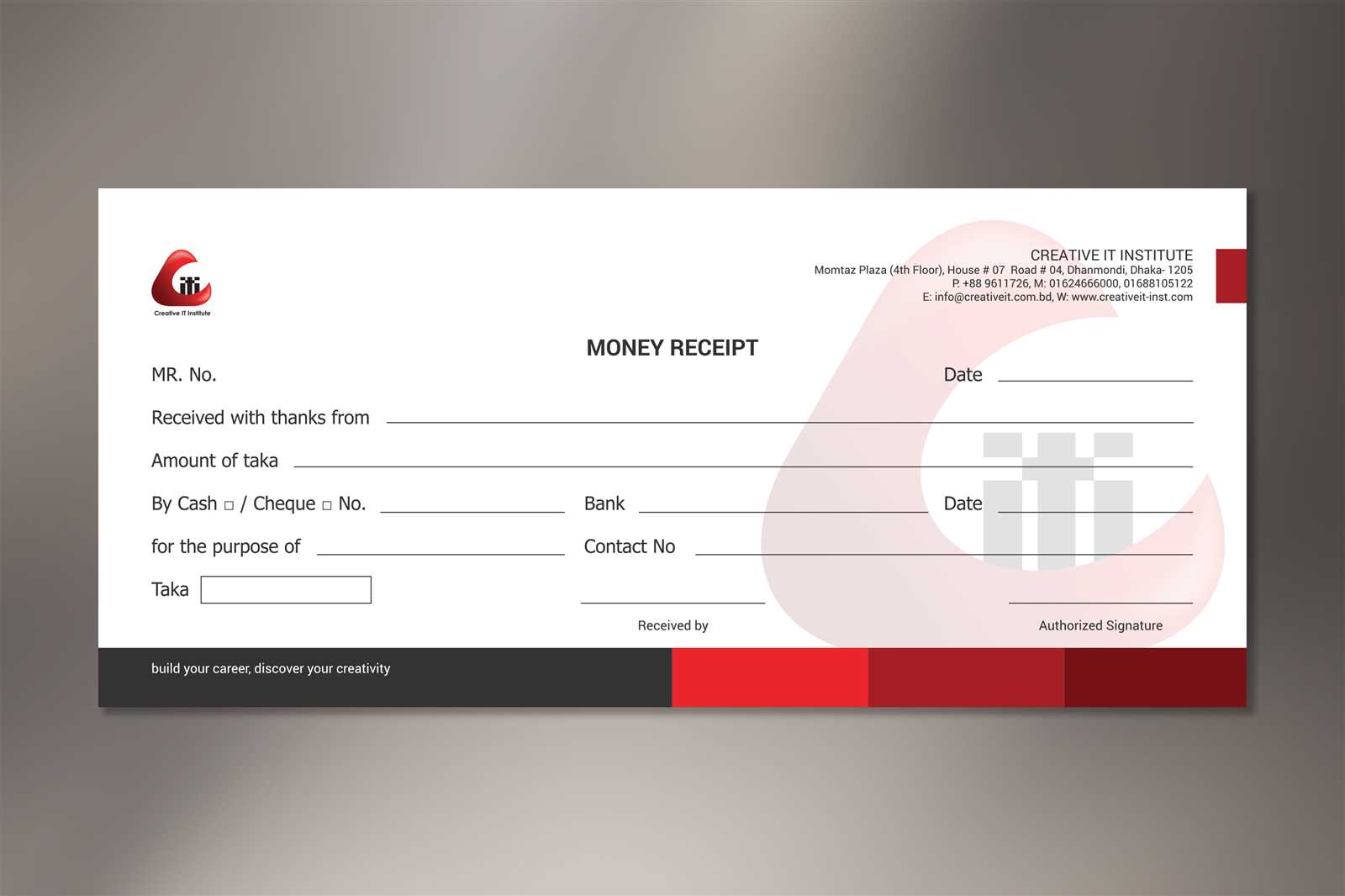

Read MoreMonetary donation receipt template

Use a clear and simple template for your monetary donation receipts to ensure transparency and ease for both donors and recipients. A well-structured receipt provides the necessary details, including the donor’s name, donation amount, and the organization receiving the funds. This prevents confusion and ensures accurate record-keeping for tax and legal purposes.

Read MoreReceipt of donation template

To create a donation receipt, make sure to include specific details that confirm the donor’s contribution. The template should include the donor’s name, the date of the donation, and the exact amount or value of the donation. If the donation is non-monetary, a clear description of the item(s) received is necessary.

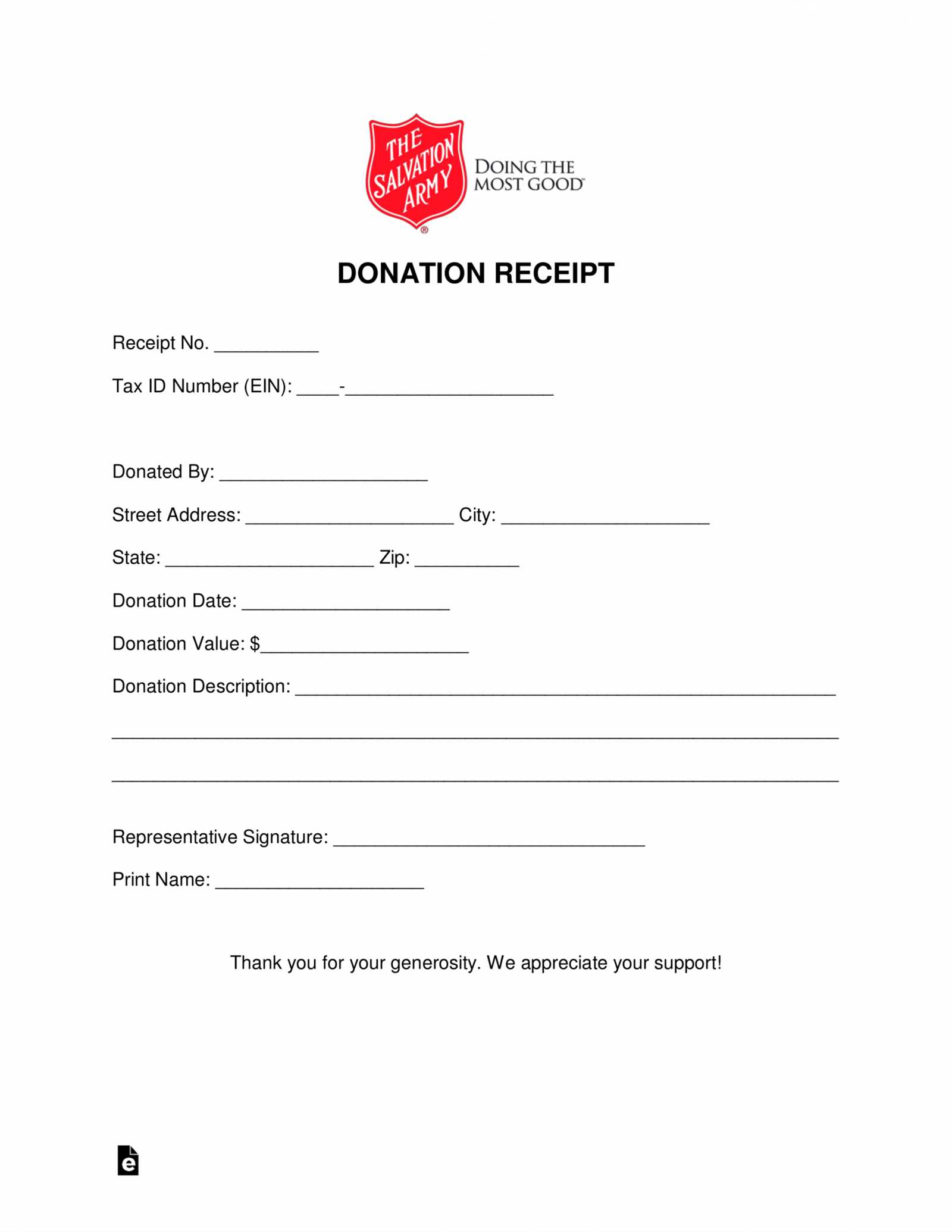

Read MoreSalvation army donation receipt template

For a smooth donation process, it’s important to have a clear and concise receipt template for the Salvation Army. A well-designed template helps ensure that both donors and the organization stay organized and transparent. It provides necessary details such as the date, donor’s name, item description, and estimated value, which can be used for tax […]

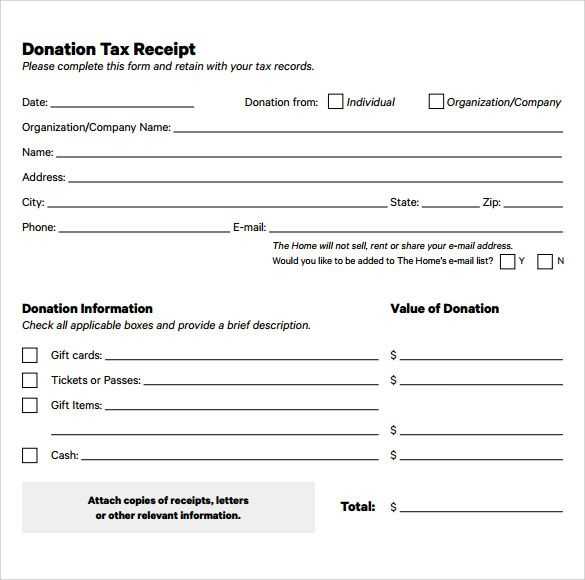

Read MoreTemplate tax donation receipt

To create a proper tax donation receipt, ensure it contains all the necessary details to comply with IRS regulations. Begin with the donor’s name, address, and the donation amount or description of the items donated. Make sure to specify whether the donation is monetary or non-monetary. If it is property, include an accurate description.

Read MoreTax deductible donations receipt template

A tax-deductible donation receipt is a necessary document for both donors and charitable organizations. It ensures that donors can claim their contributions as deductions on their tax returns while providing the organization with a clear record of the donation. Here’s a template you can use to create a valid receipt quickly and easily.

Read MoreTax exempt donation receipt template

Provide donors with a tax-exempt donation receipt to ensure they can claim their contributions for tax deductions. A well-structured template should include key details like the donor’s name, the donation amount, the date of the donation, and a statement confirming the organization’s tax-exempt status. These elements help streamline the receipt process for both the donor […]

Read More