To create a clear and organized donations list with receipts in Office, begin by setting up a template that aligns with your needs. Choose an Excel or Word template that allows for tracking donor information, donation amounts, and dates. Modify the template to include additional fields such as donation type or specific notes to suit […]

Read MoreCategory: donation

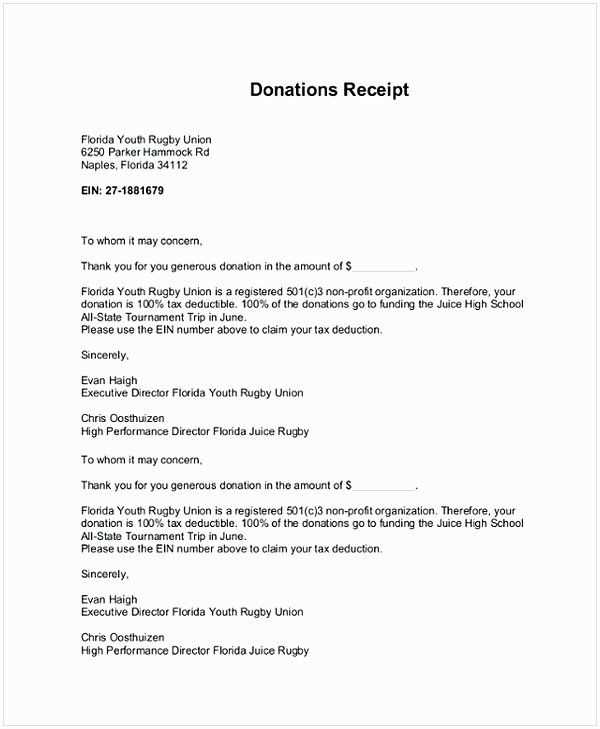

Donation receipt letter template

Use this template to create a clear and concise donation receipt for your records. It ensures the donor receives proper acknowledgment of their contribution, which is necessary for tax purposes.

Read MoreDonation receipt template vistaprint

To create a donation receipt on Vistaprint, begin by selecting the appropriate template from their collection. Ensure the template includes necessary donor details such as name, address, and donation amount. This ensures compliance with tax regulations and provides transparency for both the donor and the receiving organization.

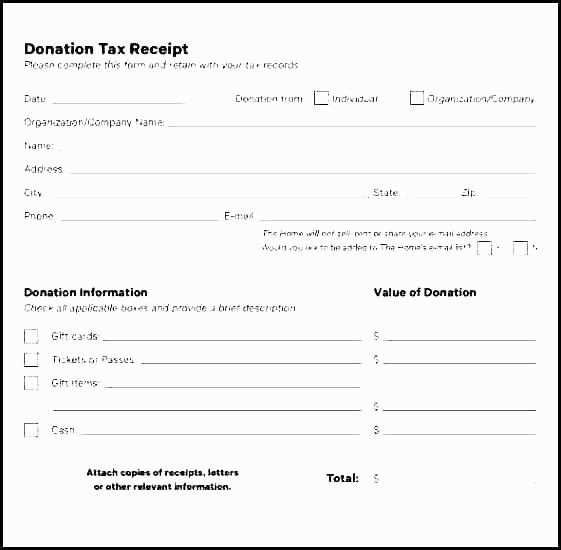

Read MoreDonation receipt for tax template

Use this donation receipt template to ensure that all charitable contributions are documented correctly for tax purposes. A well-structured receipt provides both the donor and the receiving organization with a clear record for tax deductions. This simple yet efficient format helps maintain compliance with tax regulations while offering transparency.

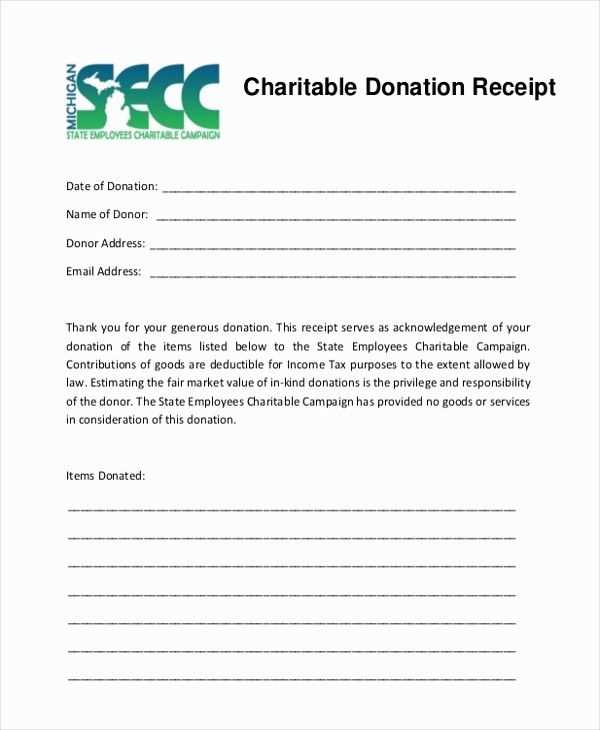

Read MoreCharitable donations receipt template

For organizations managing charitable donations, a well-structured receipt template is a must. It serves as an official record for donors and simplifies tax deductions. Create a receipt that includes the donor’s name, address, date, and amount donated, along with a description of the gift. This provides transparency and ensures that both parties are on the […]

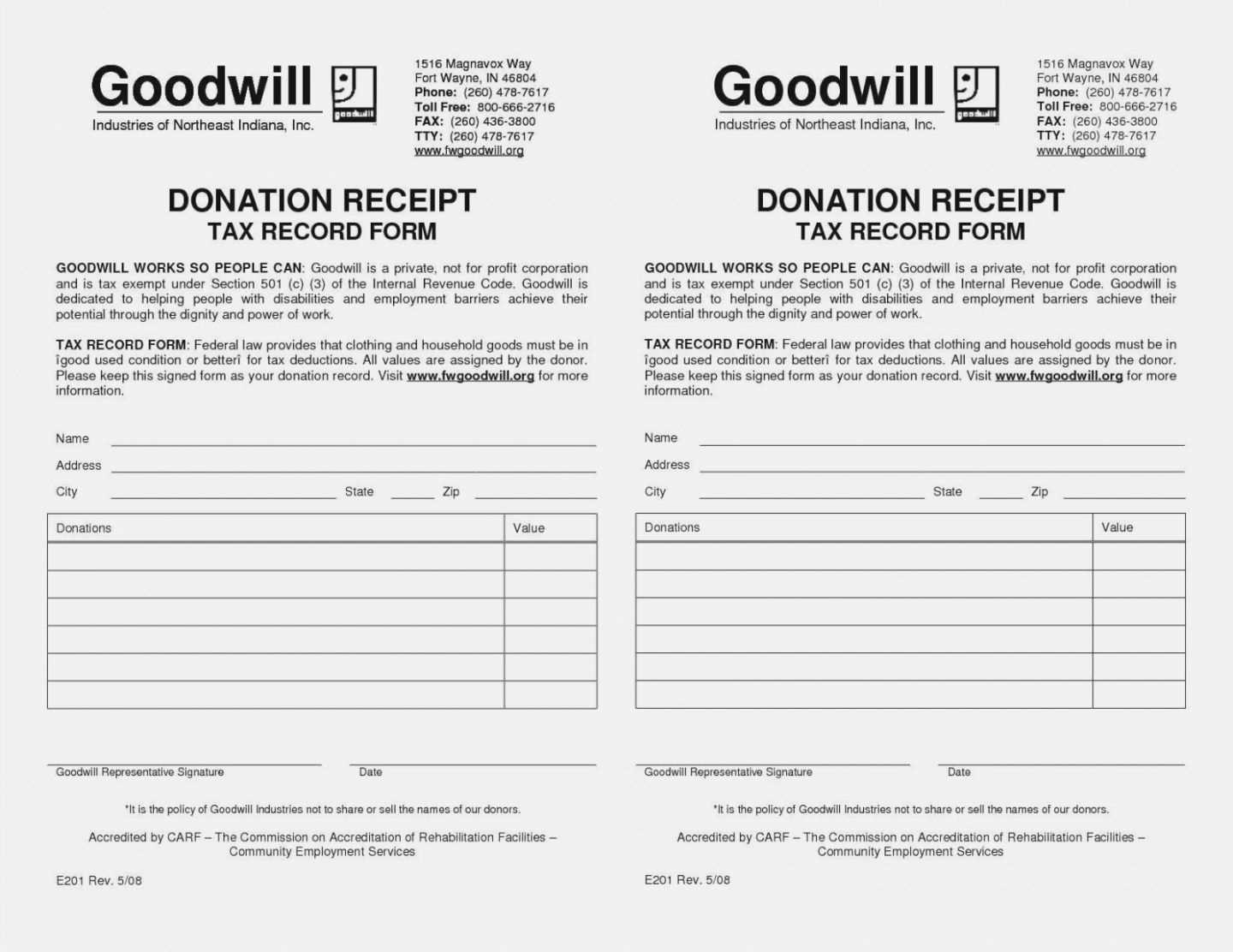

Read MoreDonation receipt letter template california goodwill

To comply with California’s tax regulations, providing donors with a detailed and accurate receipt is a must. A donation receipt letter serves as proof of a charitable contribution for tax deductions. Goodwill, as a 501(c)(3) nonprofit, follows a specific format to ensure donations are properly documented for the donor’s benefit.

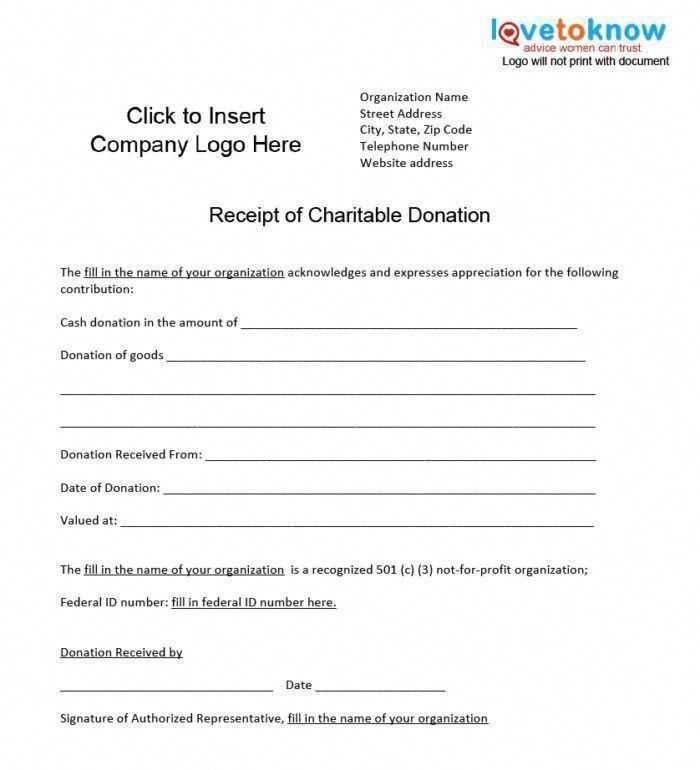

Read MoreTax receipt for charitable donations template

Creating a tax receipt for charitable donations can simplify the process of claiming deductions. Use a clear and concise template that includes key details about the donation. Make sure to include the donor’s name, donation amount, and the charity’s registered tax number. This will help both the donor and charity maintain accurate records for tax […]

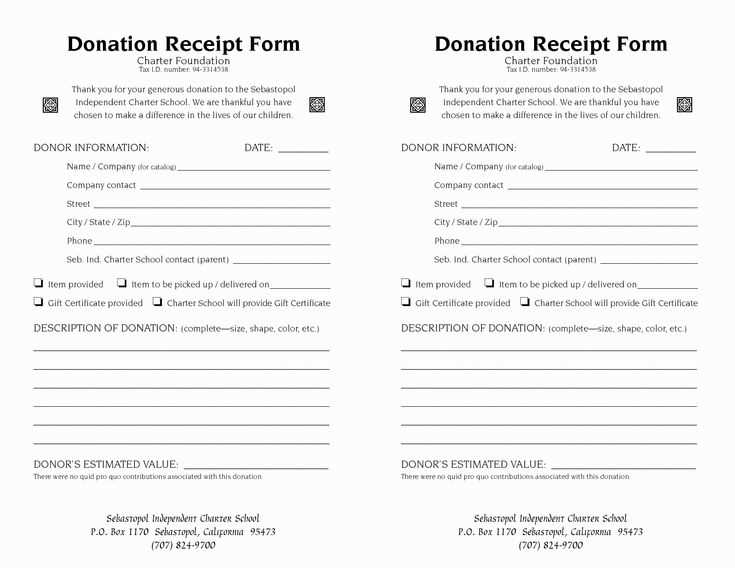

Read MoreIn-kind tax donation receipt template

If you’re making or receiving in-kind donations, it’s crucial to have a clear, accurate receipt to document the contribution for tax purposes. This receipt ensures that both parties are protected and can substantiate the value of the donated items for tax reporting. A well-crafted in-kind donation receipt will include all necessary details to meet IRS […]

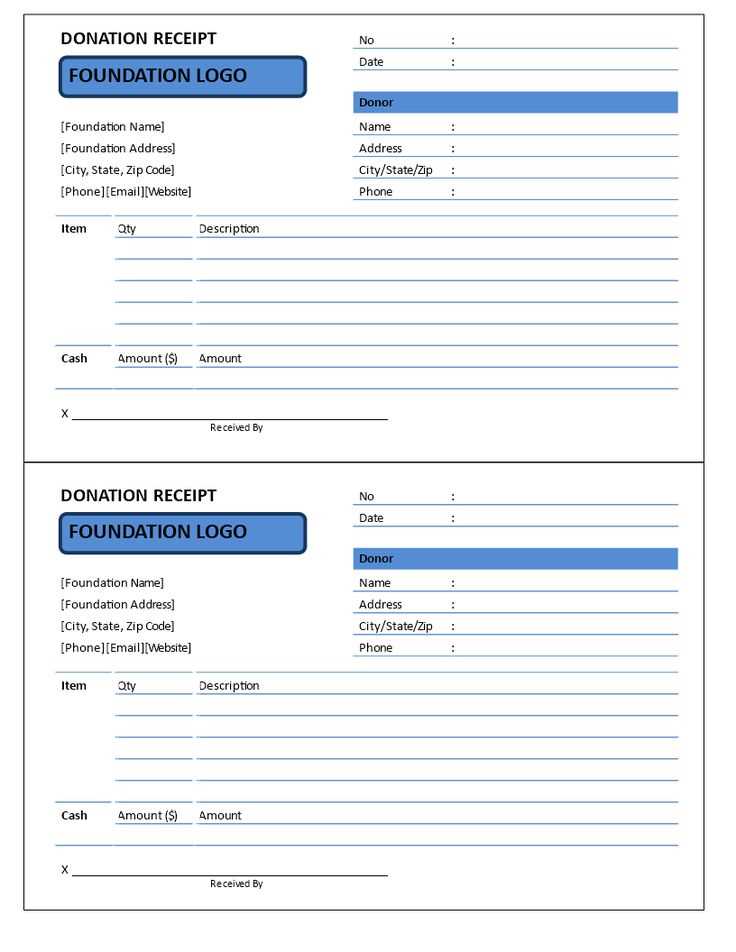

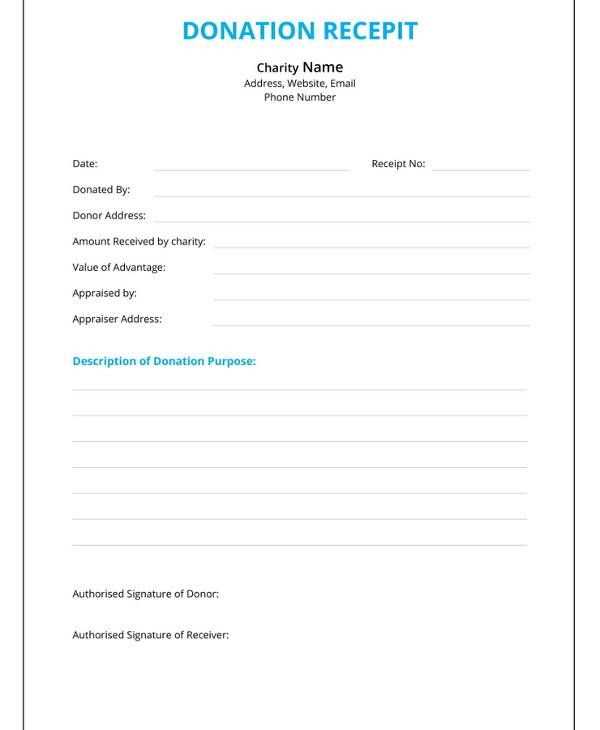

Read MoreNon profit donation receipt template

Make your donation receipts clear and simple. Provide your donors with a receipt that includes necessary information for tax purposes and proves their contribution. The key elements to include are the name of the nonprofit, the donation amount, the date, and a statement about whether the donation was made in cash or in-kind.

Read MoreTemplate for receipt of donation to nonprofit

Provide a clear and concise receipt to donors. A donation receipt should include the nonprofit’s name, address, and tax identification number, as well as the donor’s name and the amount donated. Be sure to specify the date of the donation and whether the contribution was in cash, goods, or services.

Read More