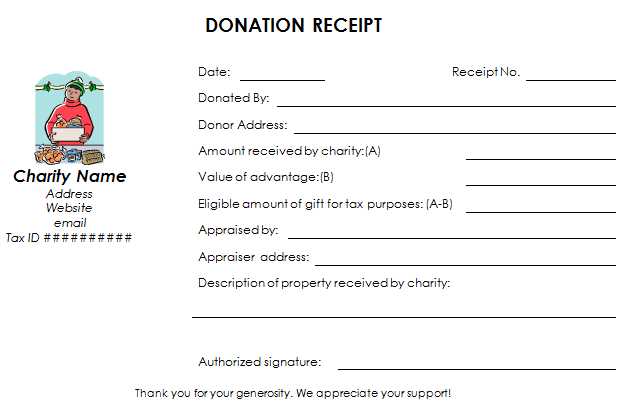

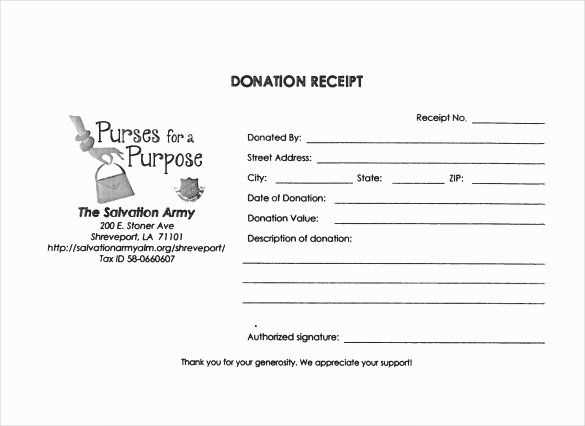

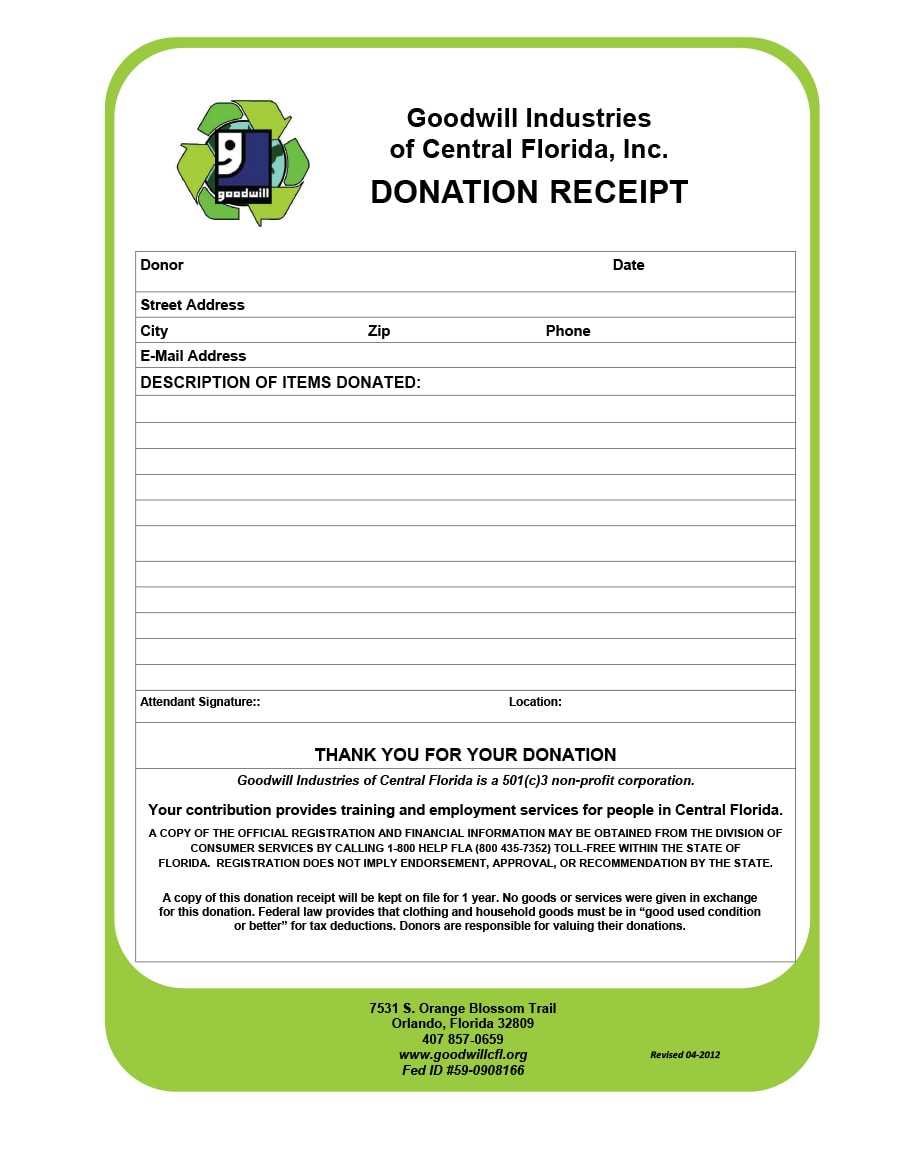

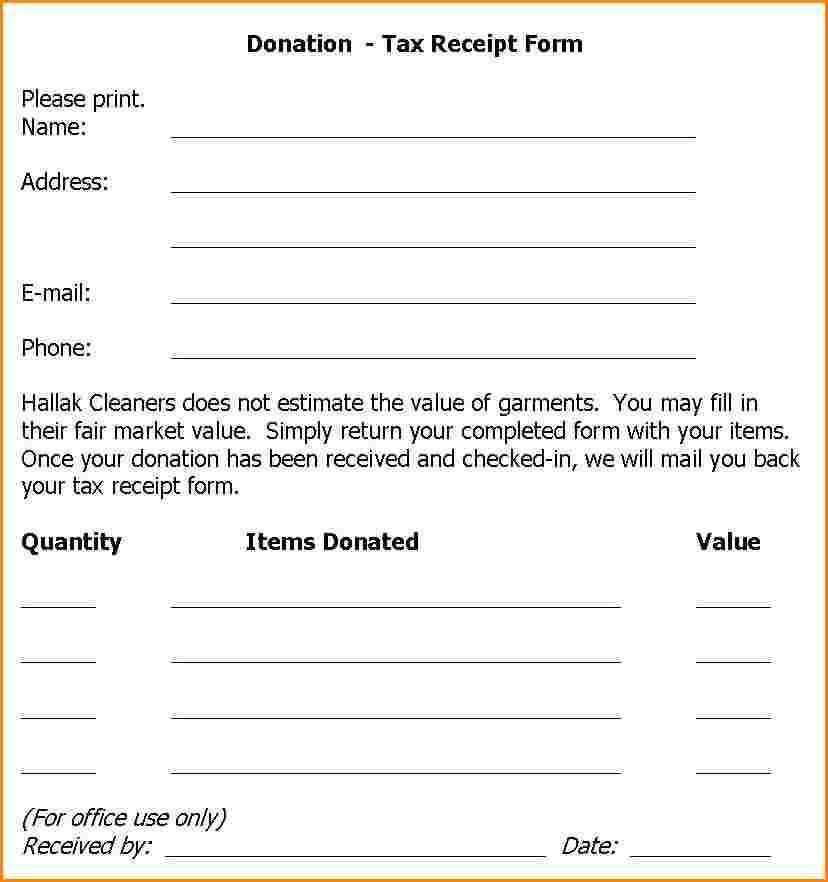

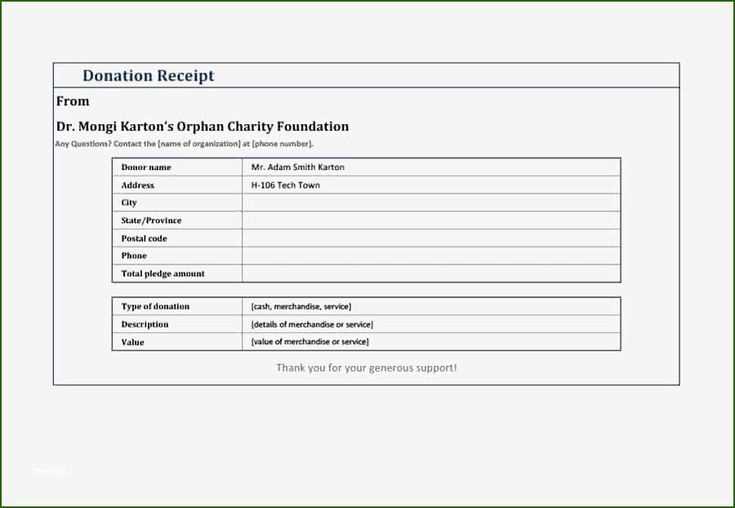

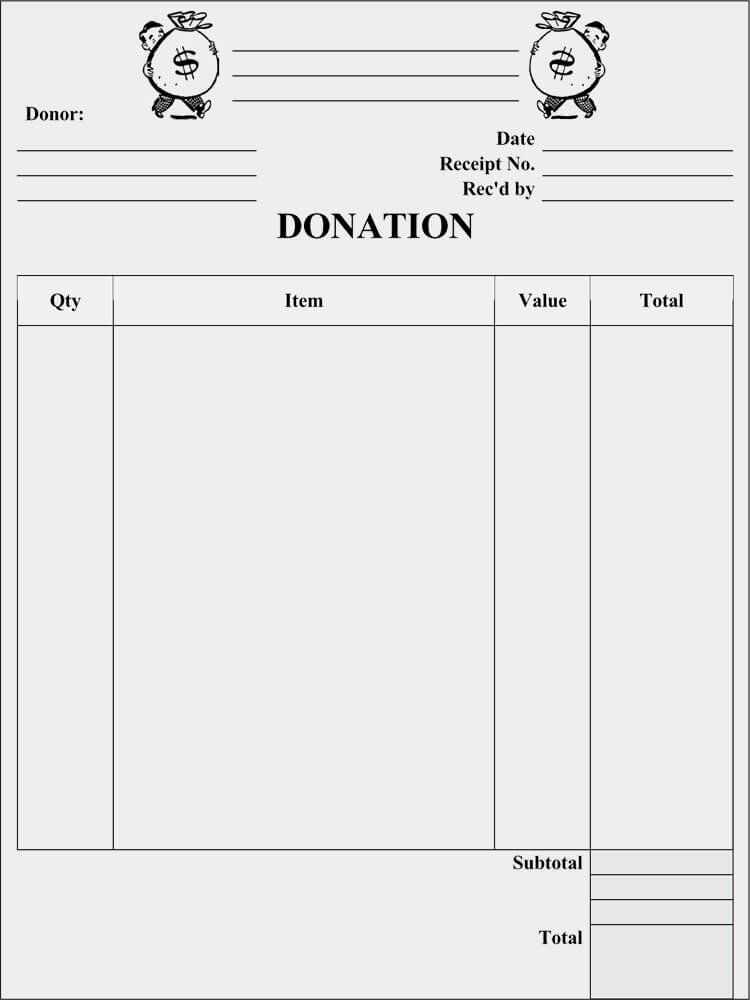

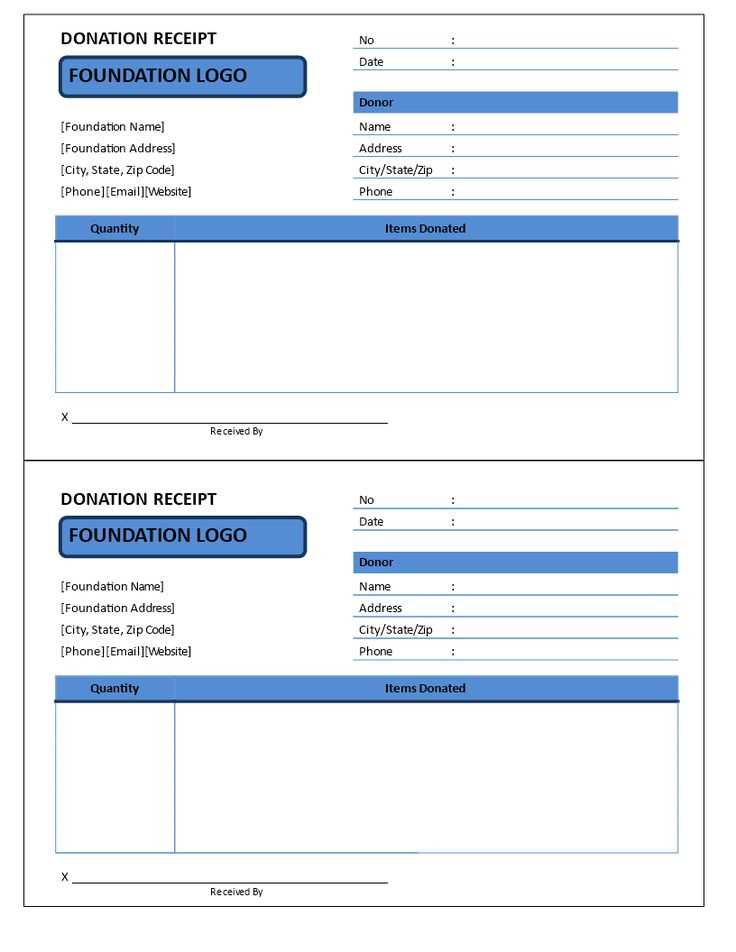

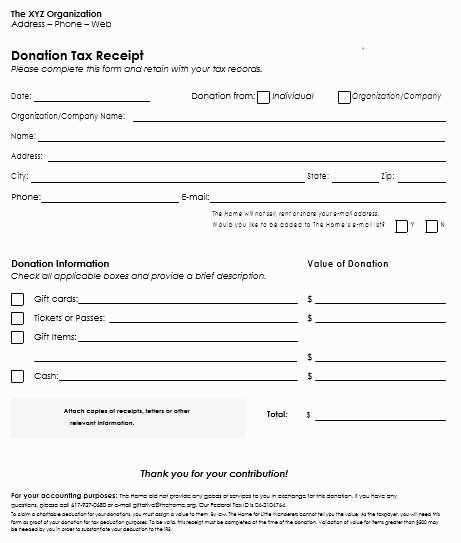

When creating a receipt for donations, focus on clarity and transparency. A template can streamline this process, making it easier for both the donor and the receiving organization to keep records accurate. Ensure that each receipt includes all necessary details: donor’s name, donation amount, date of contribution, and the purpose or cause the donation supports. […]

Read MoreCategory: donation

Printable 501c3 donation receipt template

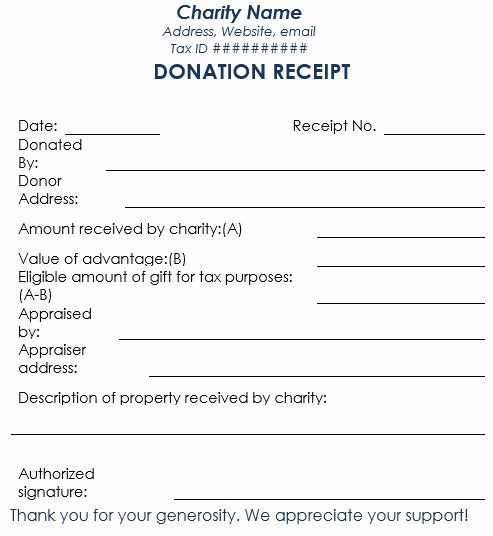

A 501c3 donation receipt template provides a convenient and reliable way for nonprofits to issue tax-deductible donation receipts. It helps donors keep track of their charitable contributions while ensuring that your organization remains compliant with IRS guidelines. When selecting a template, make sure it includes all required details, such as the donor’s name, donation date, […]

Read MoreTemplate for charitable donation receipt

Use the following template to create a clear and concise charitable donation receipt. This ensures transparency for both the donor and the organization, complying with tax reporting requirements.

Read MoreNon profit donation receipts template

Key Elements of a Donation Receipt A well-structured donation receipt ensures compliance with tax regulations and builds donor trust. Include the following:

Read MorePolitical donation receipt template

To ensure transparency and comply with legal requirements, it’s vital to provide donors with a proper receipt for political contributions. A well-structured receipt not only confirms the donation but also serves as an official document for tax purposes. Use clear language and include all necessary details to avoid confusion and ensure compliance.

Read MoreTemplate for charity donation receipt

To create a charity donation receipt, include the donor’s full name, donation amount, and the date of the contribution. Clearly state that the donation is tax-deductible, if applicable, and provide the charity’s name, address, and contact details. This ensures transparency and gives the donor the necessary information for their records.

Read MoreDonation receipt template australia

To create a donation receipt template for use in Australia, start by ensuring it complies with the Australian Taxation Office (ATO) requirements. The receipt must include specific information to make the donation tax-deductible for the donor, such as the donor’s name, the donation amount, and the date of the donation.

Read MoreTemplate for a donation receipt

Providing a donation receipt that complies with legal standards helps ensure transparency and trust between donors and organizations. A well-crafted receipt includes all the necessary details to confirm the donor’s contribution and assist with tax purposes. If you’re managing a nonprofit or charity, having a standardized template for donation receipts is an effective way to […]

Read MoreTemplate for donation receipts

Key Elements of a Donation Receipt

Read MoreYear end church donation tax receipt template

For a smooth year-end tax filing, providing a clear and organized donation receipt is a must. A well-structured template helps donors track their charitable contributions, ensuring that they can claim the appropriate tax deductions. Make sure to include the donor’s name, the amount donated, the date, and the church’s tax-exempt status. A simple layout can […]

Read More