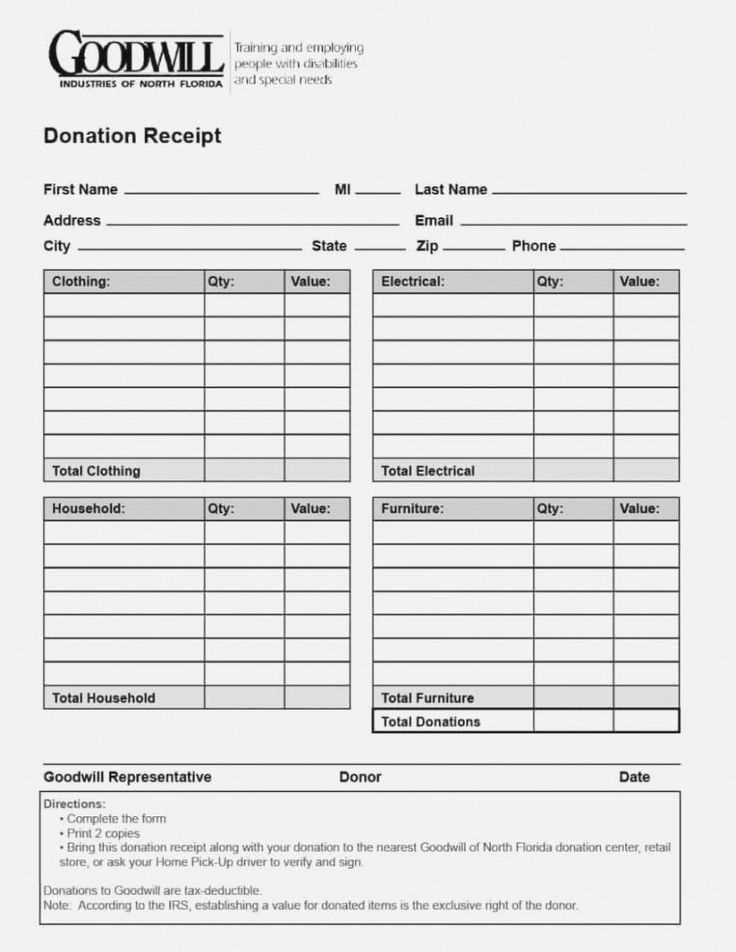

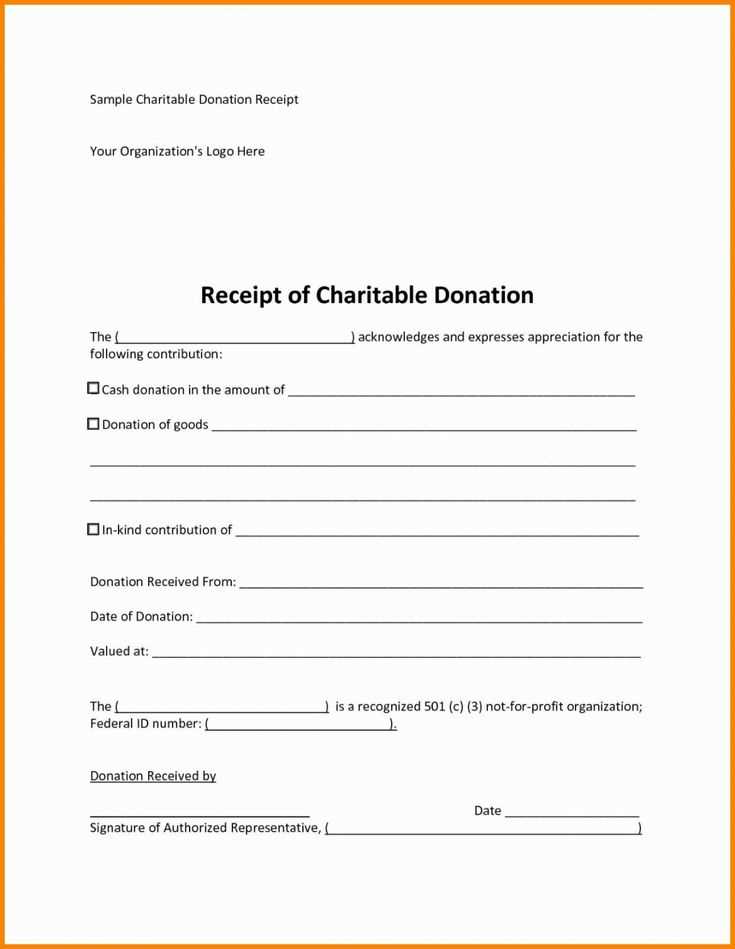

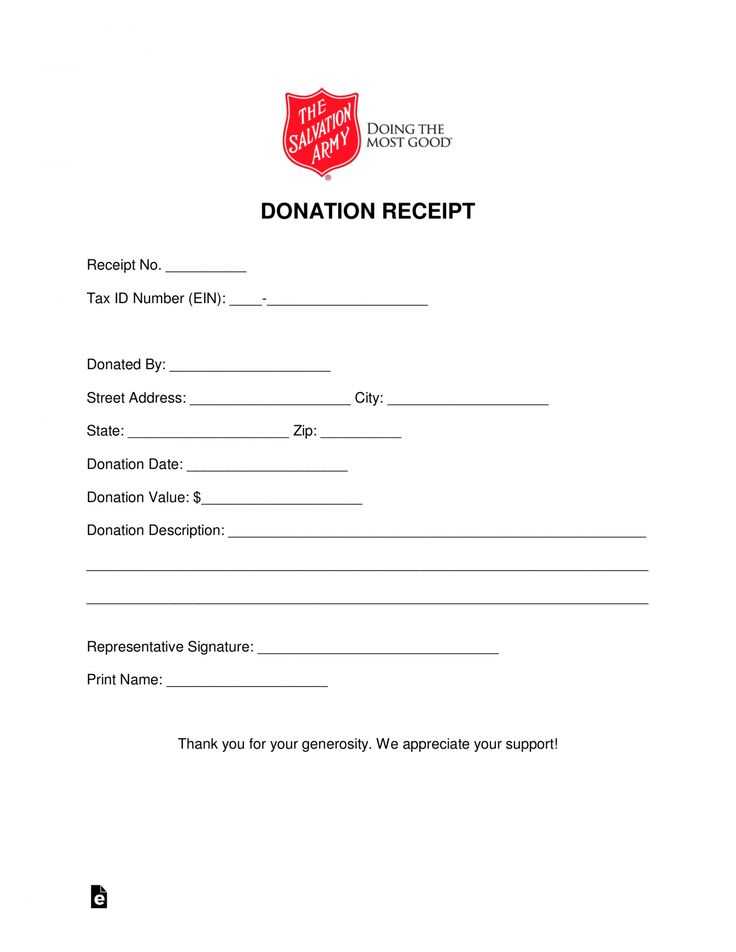

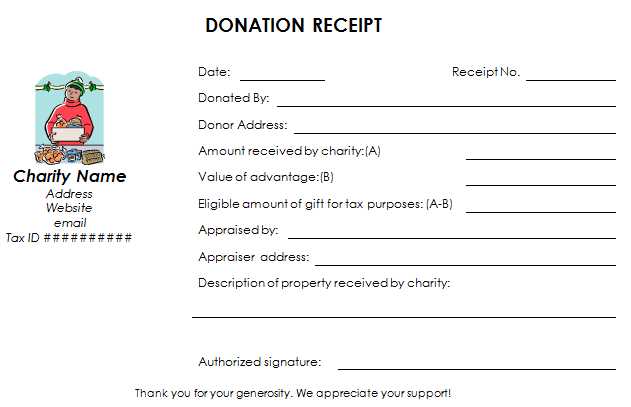

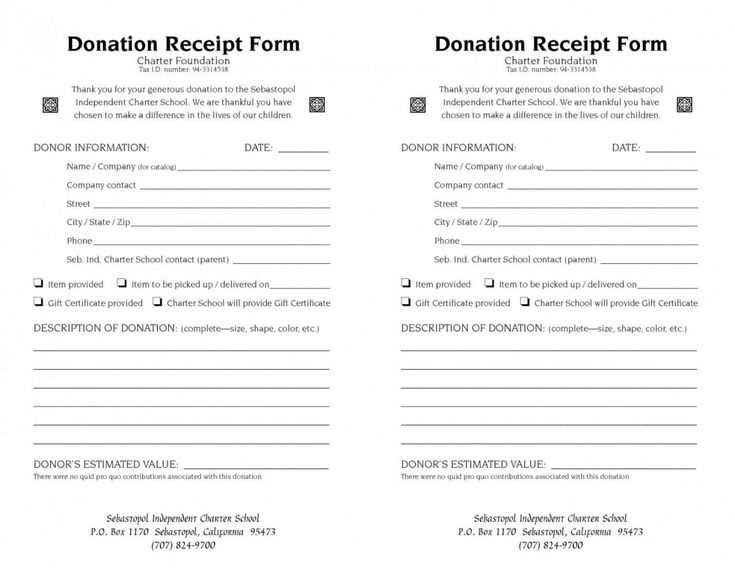

Creating a donation tax deduction receipt is straightforward when you include the necessary details. The template should clearly state the donor’s name, the charity’s name, and the amount donated. Make sure to include the date of the donation and any description of the items donated, if applicable. A receipt can only be used for tax […]

Read MoreCategory: donation

Pta donation receipt template

Designing a PTA donation receipt template ensures a smooth process for acknowledging donations and maintaining accurate records. Keep the format simple, clear, and professional, with all necessary details for tax and documentation purposes.

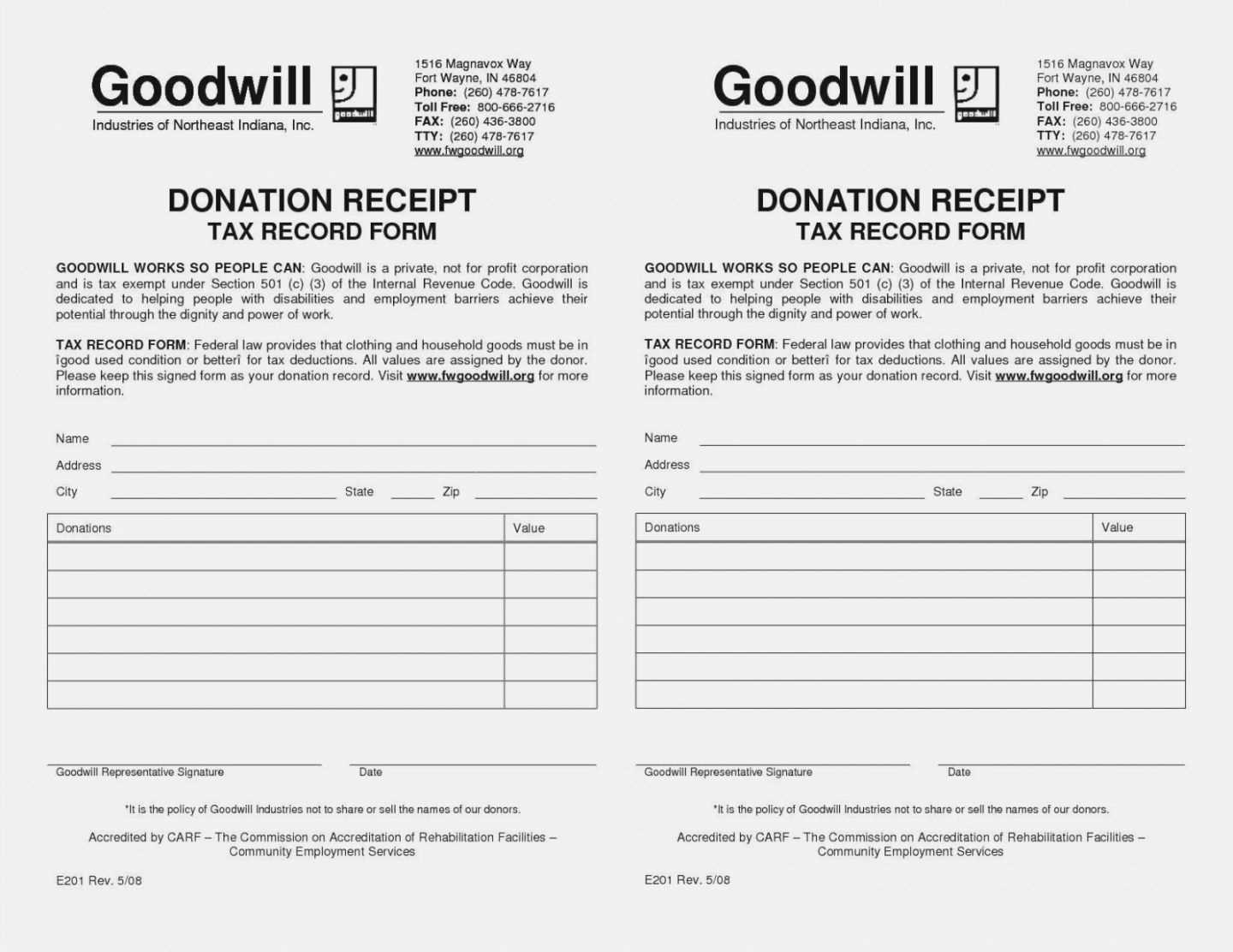

Read MoreTemplates for a receipt of donation to a non-profit organization

For a non-profit organization, providing a clear and professional receipt for donations is not just a legal requirement, but also a way to build trust with your supporters. A receipt template should include all the necessary details to validate the donation and make it easy for donors to use for tax purposes. Keep it concise […]

Read MoreDonation receipt template uk

If you are looking to create a donation receipt for your UK-based charity or organization, use a clear and simple template to ensure that all required information is included. The receipt should outline the donor’s details, the donation amount, the charity’s information, and the date of the donation. This helps maintain transparency and serves as […]

Read MoreCharity donation receipt template

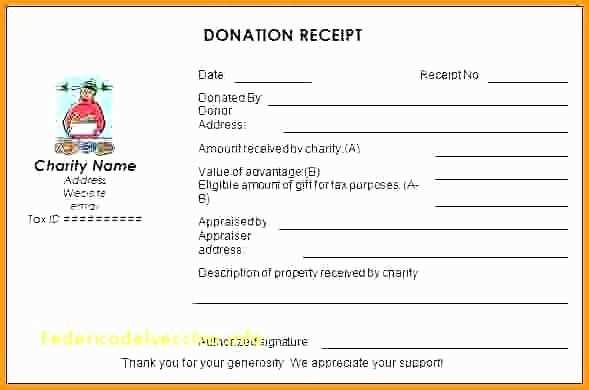

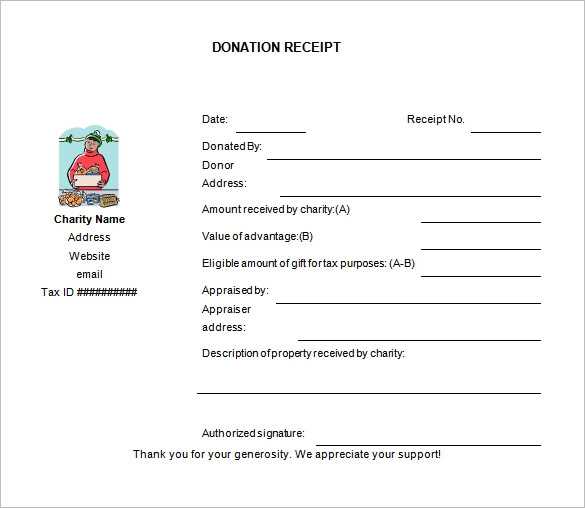

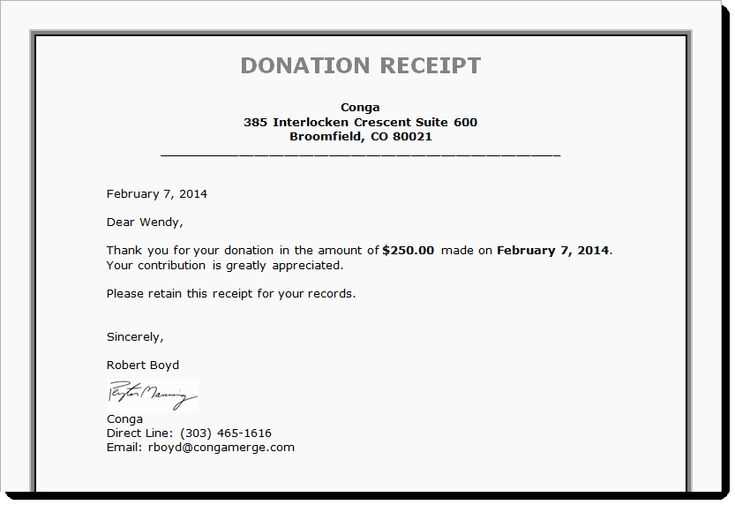

A charity donation receipt serves as an official record of a donor’s contribution. It’s a simple yet significant document that confirms the amount donated and can be used for tax purposes. If you’re a charity organization or an individual handling donations, having a well-structured receipt template is key to keeping records clear and accurate.

Read MoreElectronic donation receipt template

A well-structured electronic donation receipt simplifies record-keeping for donors and ensures compliance with tax regulations. The key elements include the donor’s name, donation amount, date of contribution, and a statement confirming no goods or services were received in exchange. Adding an organization’s tax ID and digital signature enhances credibility.

Read MoreNon profit donation tax receipt template

Provide a clear and concise donation tax receipt to your donors using a simple, well-structured template. This not only helps build trust but also ensures compliance with tax laws. The receipt should include essential details such as the donor’s name, donation amount, date of the donation, and the organization’s tax-exempt status.

Read MoreTax donation receipt template

Provide a clear and concise donation receipt for each contribution to maintain transparency and ensure tax compliance. A donation receipt template helps simplify this process by outlining all necessary details, including the donor’s information, the donated amount, and the charity’s credentials.

Read MoreFake blood donation receipt template

When creating a fake blood donation receipt, accuracy is key. It should closely mimic the formatting and details typically found on legitimate receipts, including donor information, donation date, and organization name. Use a professional tone while making sure the document clearly indicates the type of donation. Remember to include a unique receipt number, which adds […]

Read MoreDonation tax credit form receipt template

Hey! How’s it going?

Read More