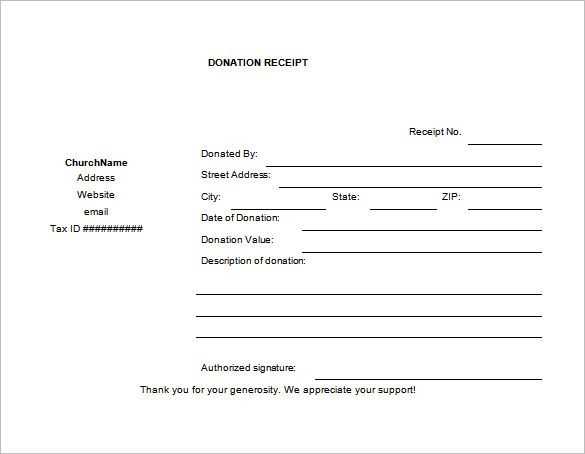

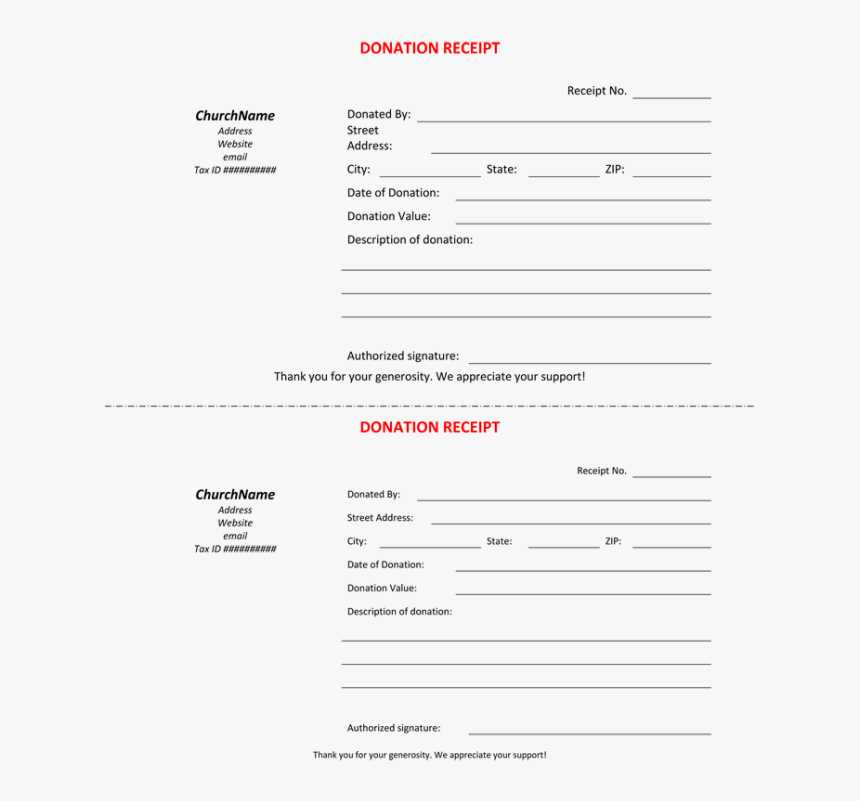

Provide your donors with a clear, professional acknowledgment of their contributions by using a donation receipt template. This template helps churches maintain accurate records while ensuring transparency with their supporters.

Read MoreCategory: donation

501 c 3 donation receipt template

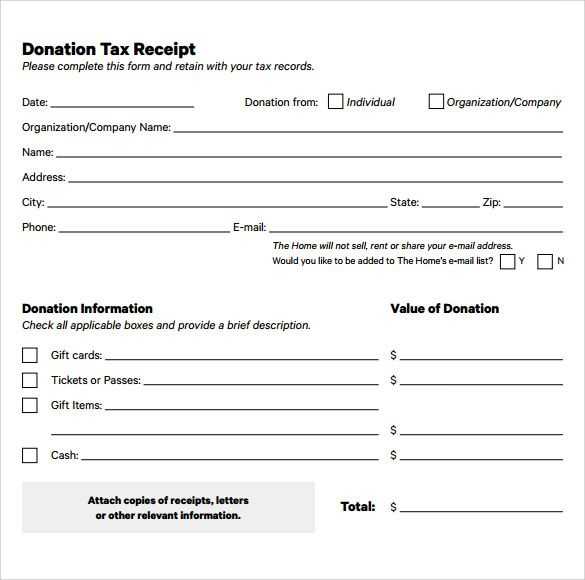

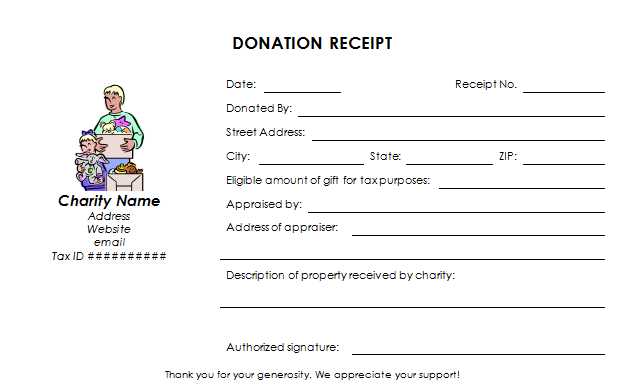

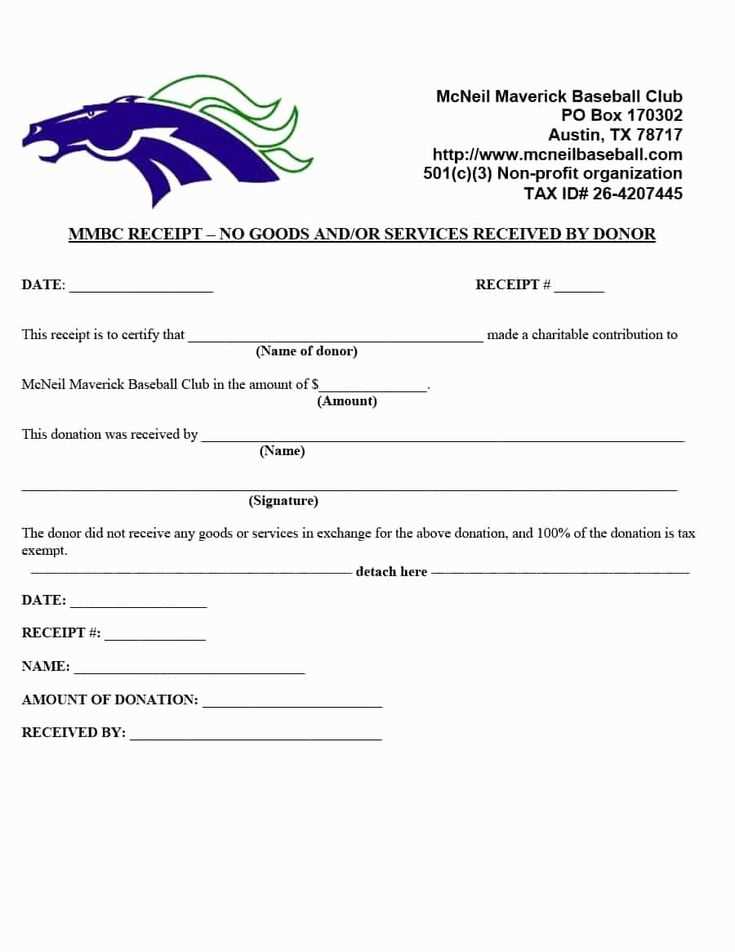

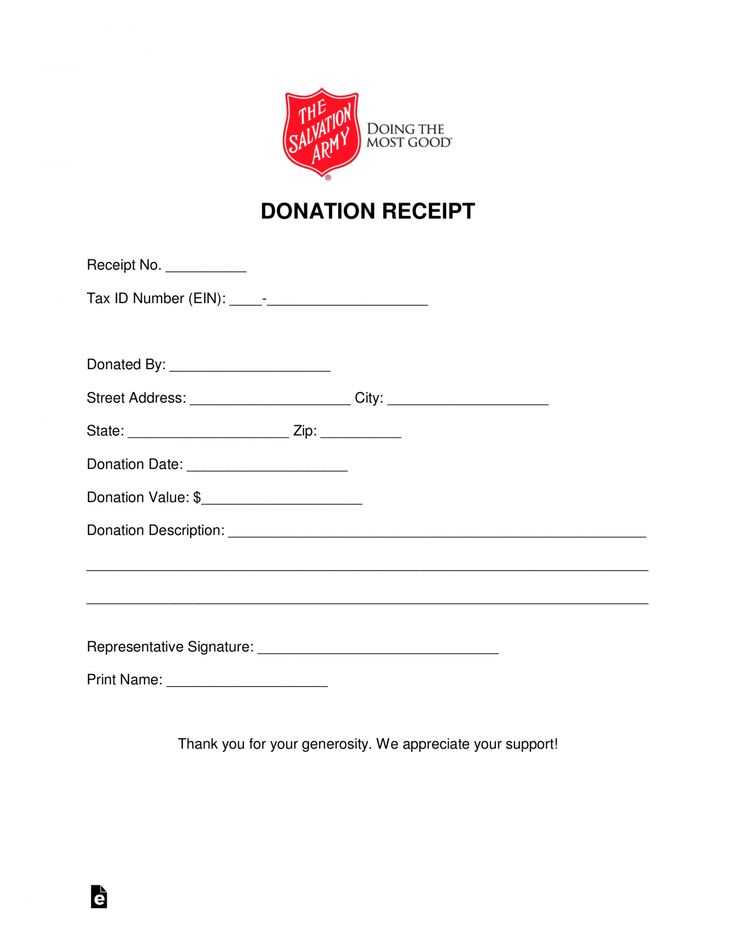

Providing a clear and accurate donation receipt is a key responsibility for 501(c)(3) organizations. This document serves as proof for donors, enabling them to claim tax deductions. The receipt should include specific details to comply with IRS regulations and ensure both parties are protected.

Read MoreNonprofit monetary donation receipt template

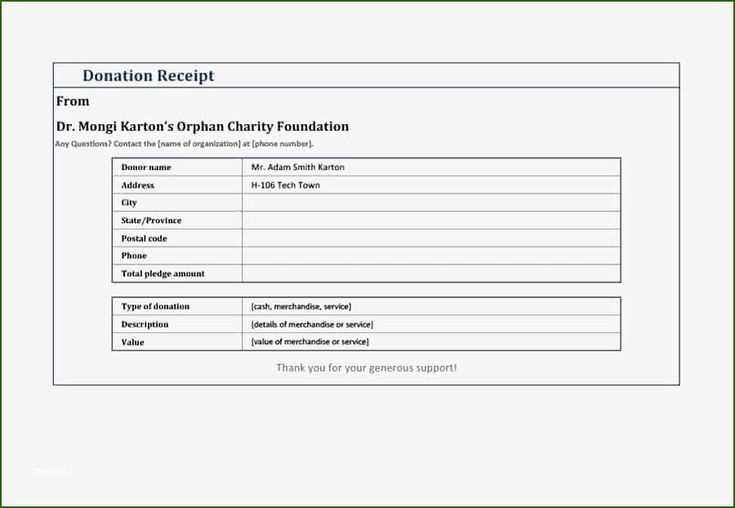

Creating a nonprofit monetary donation receipt template is straightforward and ensures transparency in donations. The template should include the donor’s name, the amount donated, and a clear statement of whether the donation is tax-deductible. A properly formatted receipt helps the donor during tax season and provides documentation for both parties involved.

Read More501c3 non profit donation receipt letter template

For a 501c3 non-profit organization, providing a clear and accurate donation receipt is crucial for both the donor’s tax purposes and the organization’s record-keeping. The letter should include specific details that confirm the donation and establish its tax-deductible nature. Start by addressing the donor personally and expressing gratitude for their support.

Read MoreDonation receipts template

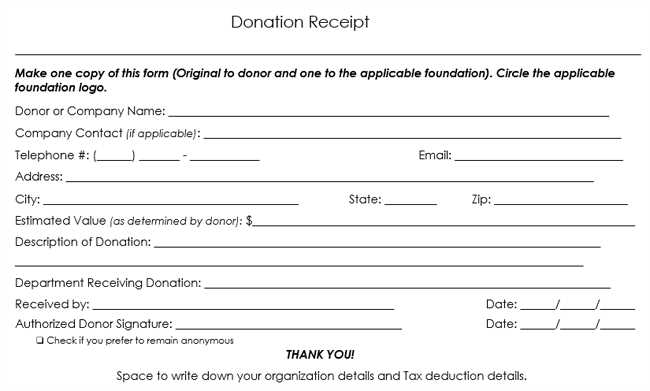

Every donation receipt should include specific details to comply with tax regulations and provide clarity for donors. At a minimum, include the donor’s name, the organization’s name, donation amount, and date. If the contribution is non-monetary, describe the donated items but avoid assigning a value–this is the donor’s responsibility.

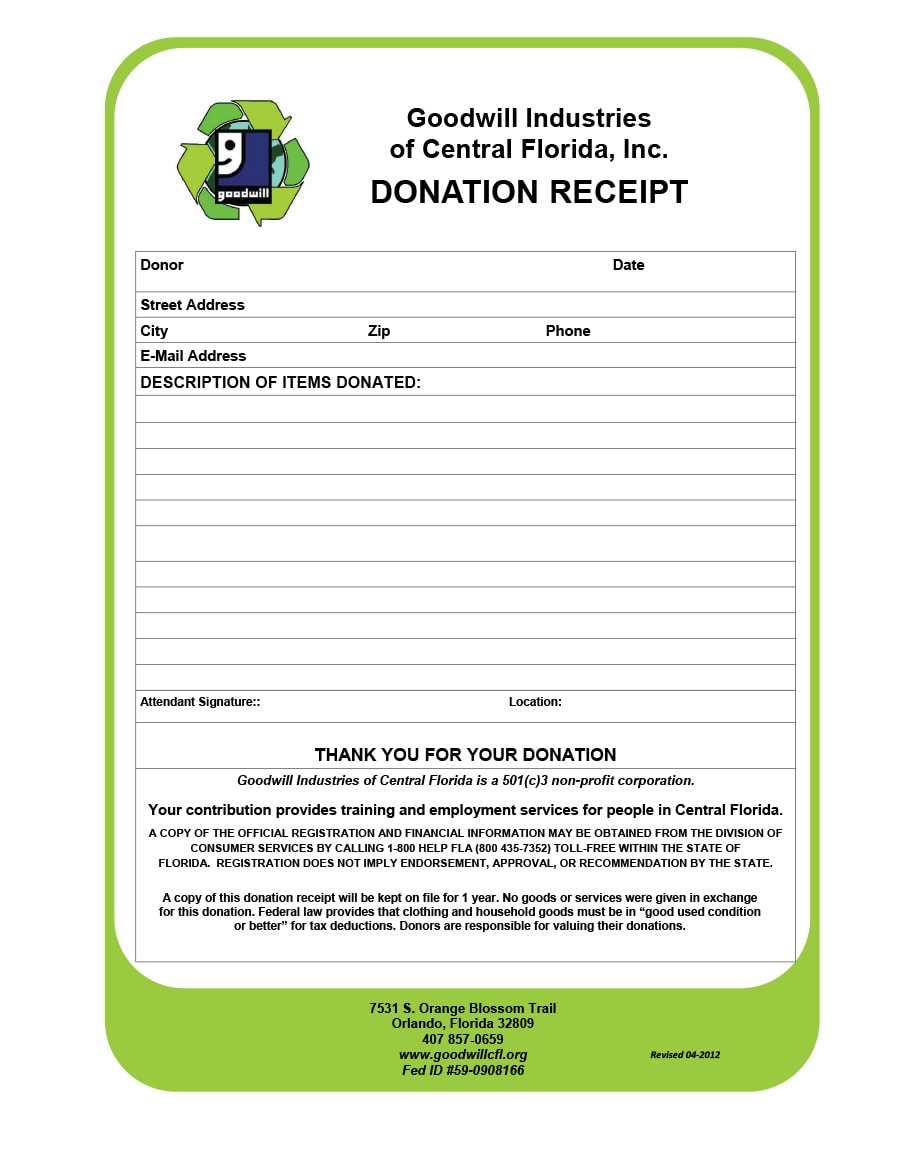

Read MoreGoodwill donation receipt builder for taxes template

Maximize your tax deductions by using a structured Goodwill donation receipt builder. The IRS requires detailed documentation for non-cash donations, including the organization’s name, donation date, item descriptions, and estimated value. Without a properly formatted receipt, you risk losing potential tax savings.

Read MoreTemplates for donation receipts

Donation ReceiptsAnswer in chat instead

Read MoreDonation receipt template 501c3

A donation receipt for a 501(c)(3) organization must include specific details to meet IRS requirements. This ensures that the donor can claim their charitable contribution on their tax return. The receipt should include the name of the organization, its tax-exempt status, the donor’s name, the amount of the donation, and the date it was received.

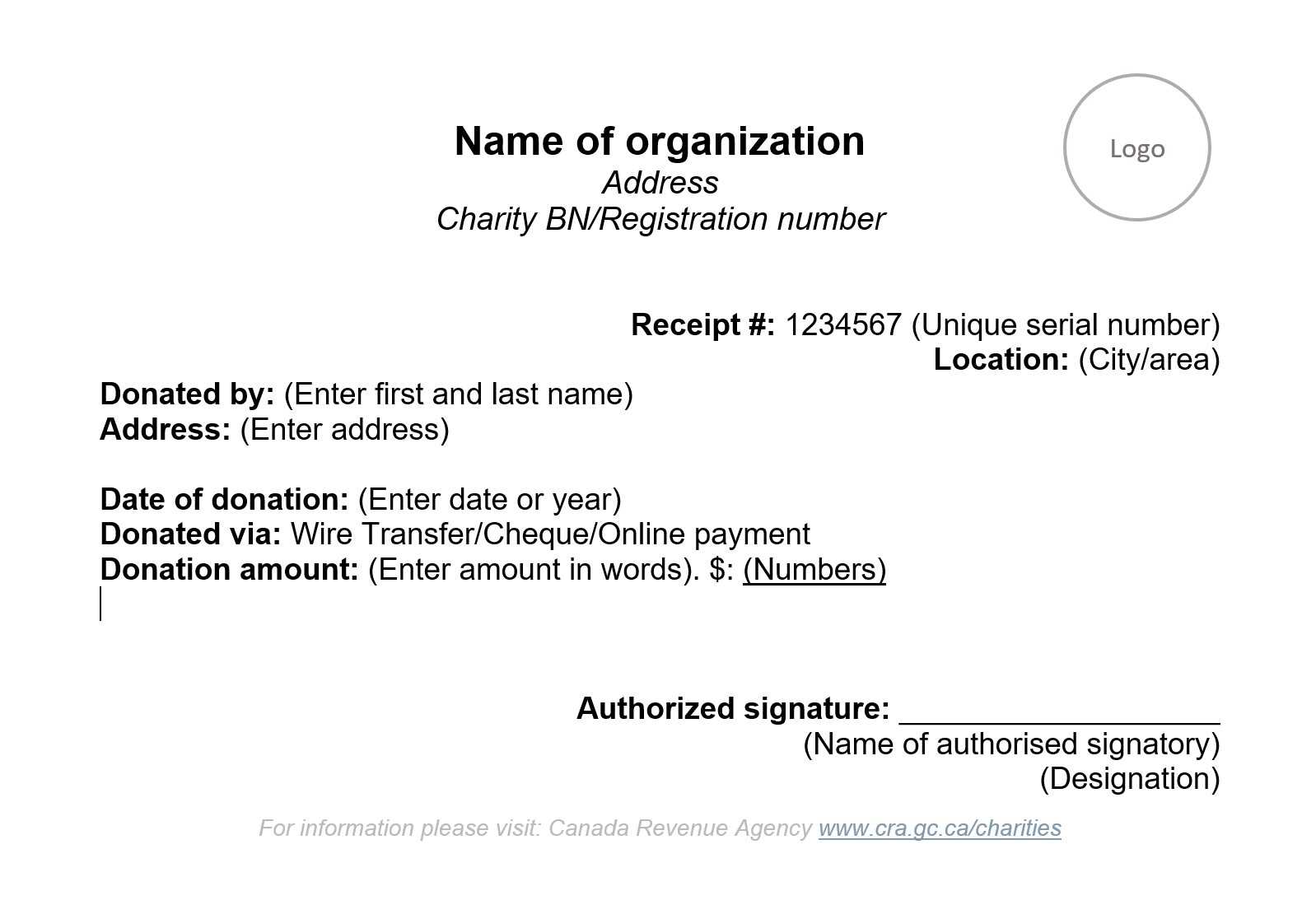

Read MoreCanadian charitable donation receipt template

To create a proper Canadian charitable donation receipt, include the donor’s full name, address, and the exact amount donated. The receipt should also state the name of the registered charity and its charitable registration number. This ensures that both the donor and the charity are in compliance with Canadian tax laws.

Read MoreFood donation receipt template az

Creating a food donation receipt is a simple but important step for both donors and recipients. It provides a clear record of the donation, helping the donor with tax deductions and offering transparency to the recipient. The format for a receipt should be clear, concise, and legally compliant with Arizona’s donation standards. A well-structured receipt […]

Read More