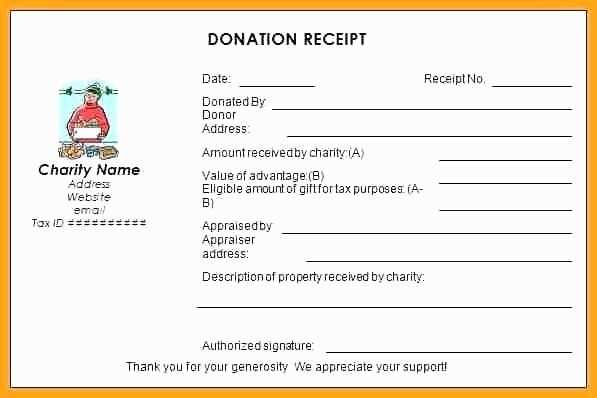

When issuing a donation receipt, it’s crucial to provide a clear and concise good faith estimate, especially for non-cash donations. A well-crafted estimate helps ensure transparency and supports both the donor and recipient with accurate information. This letter can act as both a receipt and an official acknowledgment, making it easier for donors to claim […]

Read MoreCategory: donation

Donation receipt template excel

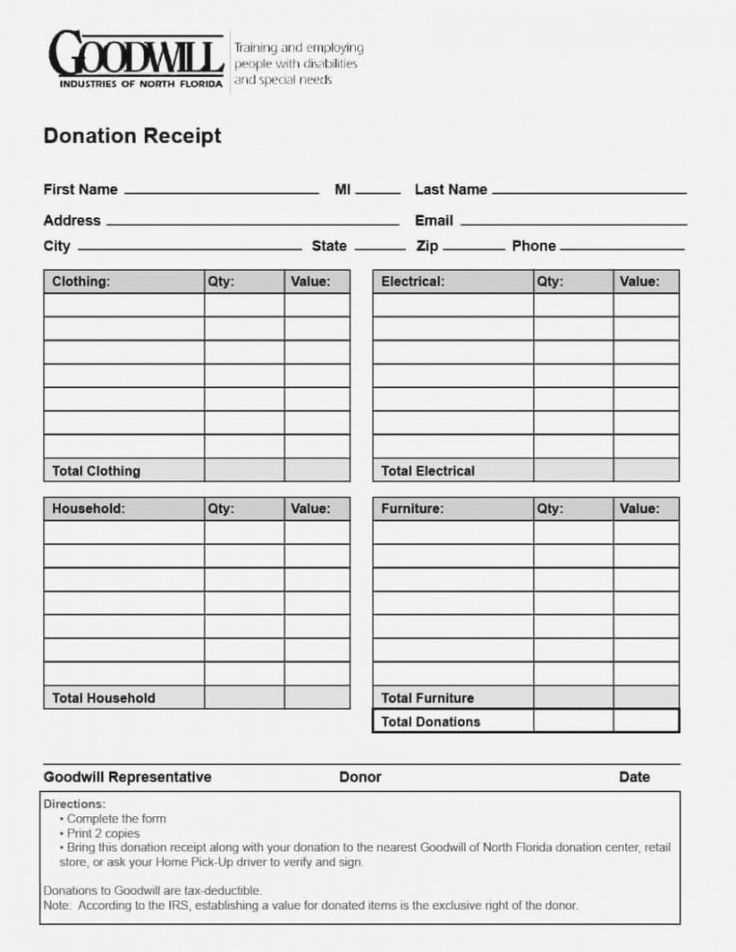

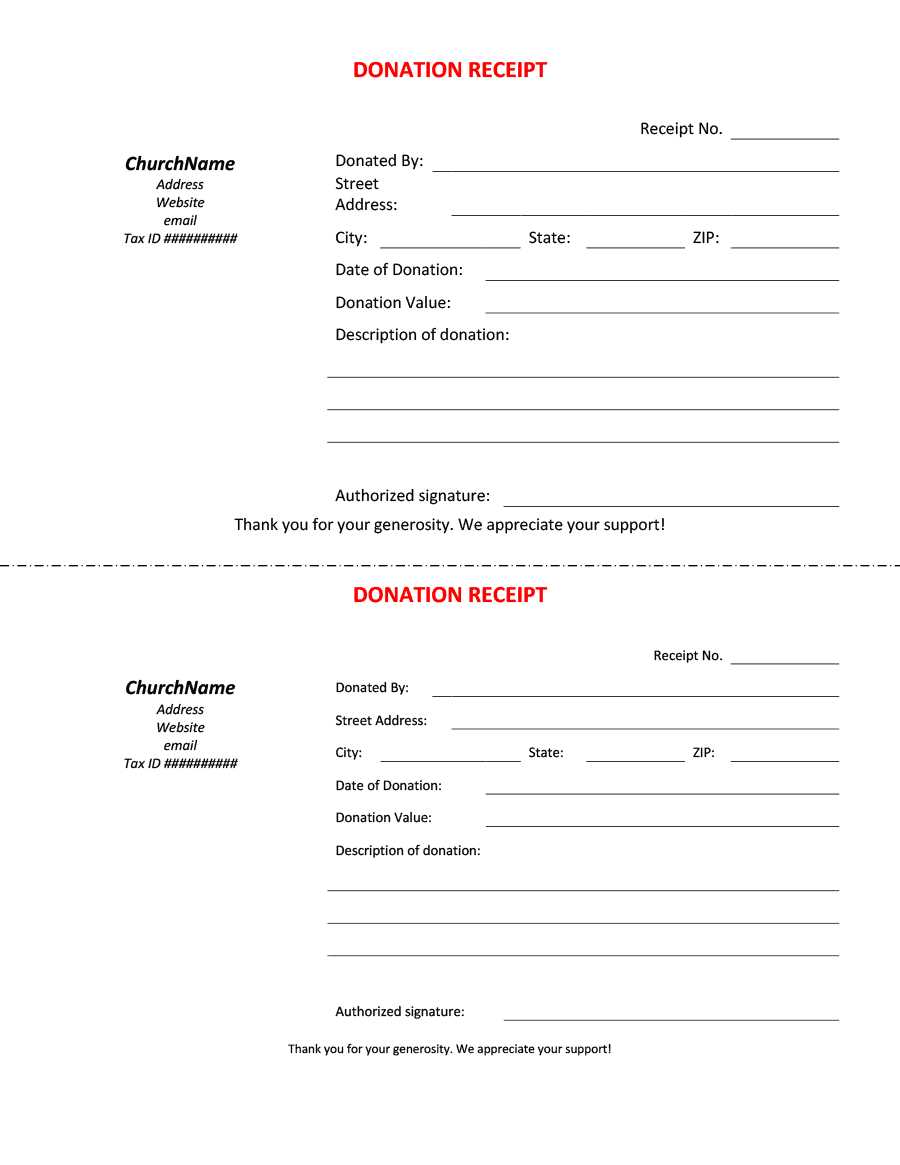

If you manage donations for a nonprofit or personal cause, creating a clear and structured donation receipt is crucial. A well-organized Excel template for donation receipts simplifies the process and ensures accuracy for both you and your donors.

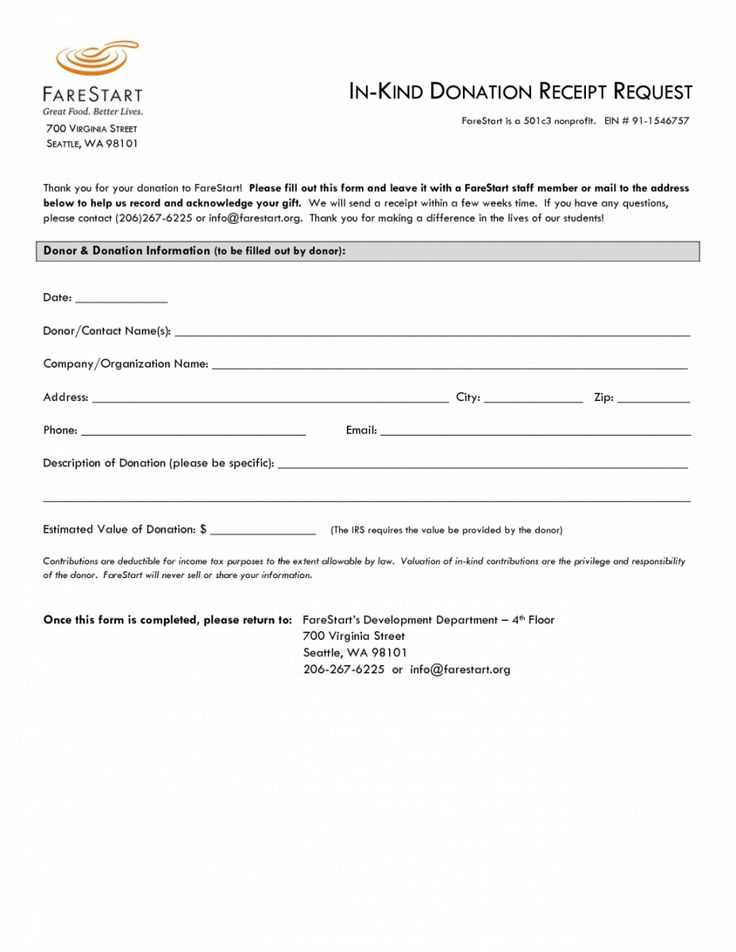

Read MoreNot for profit donation receipt template

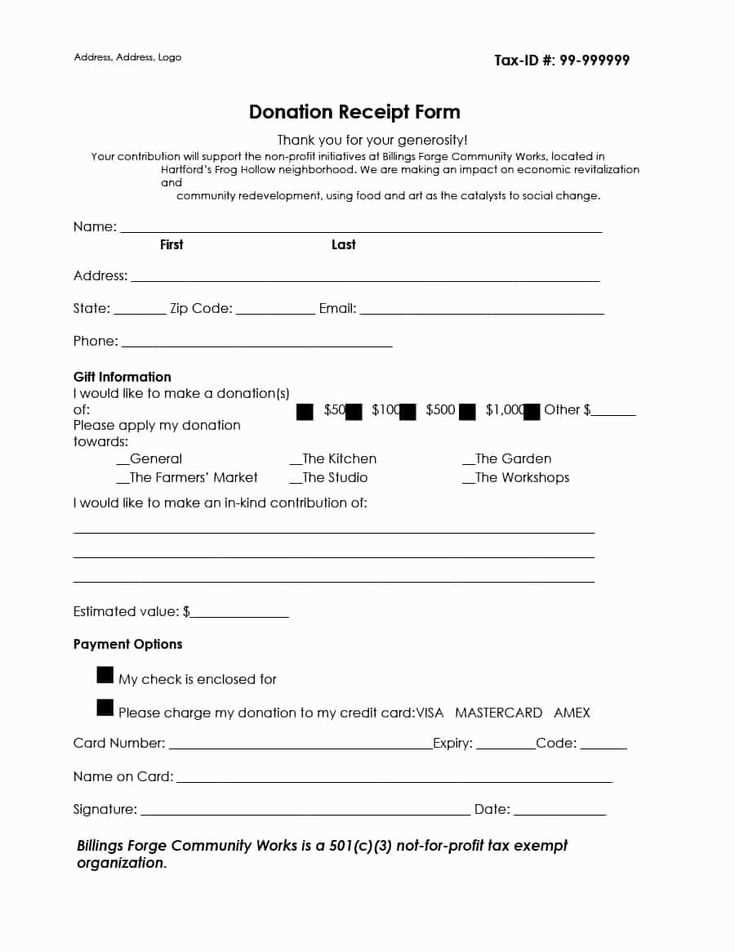

For non-profits, providing a donation receipt is not just a legal requirement, but a vital step in maintaining transparency and trust with your supporters. A simple, clear, and well-organized receipt can prevent confusion and protect both the donor and the organization. Use this template to ensure your receipts meet all necessary standards.

Read MoreDonation receipt of funds template

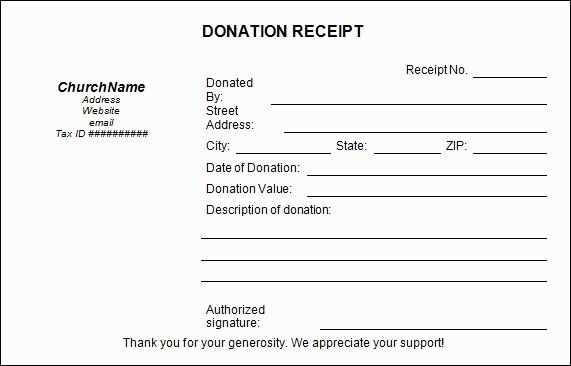

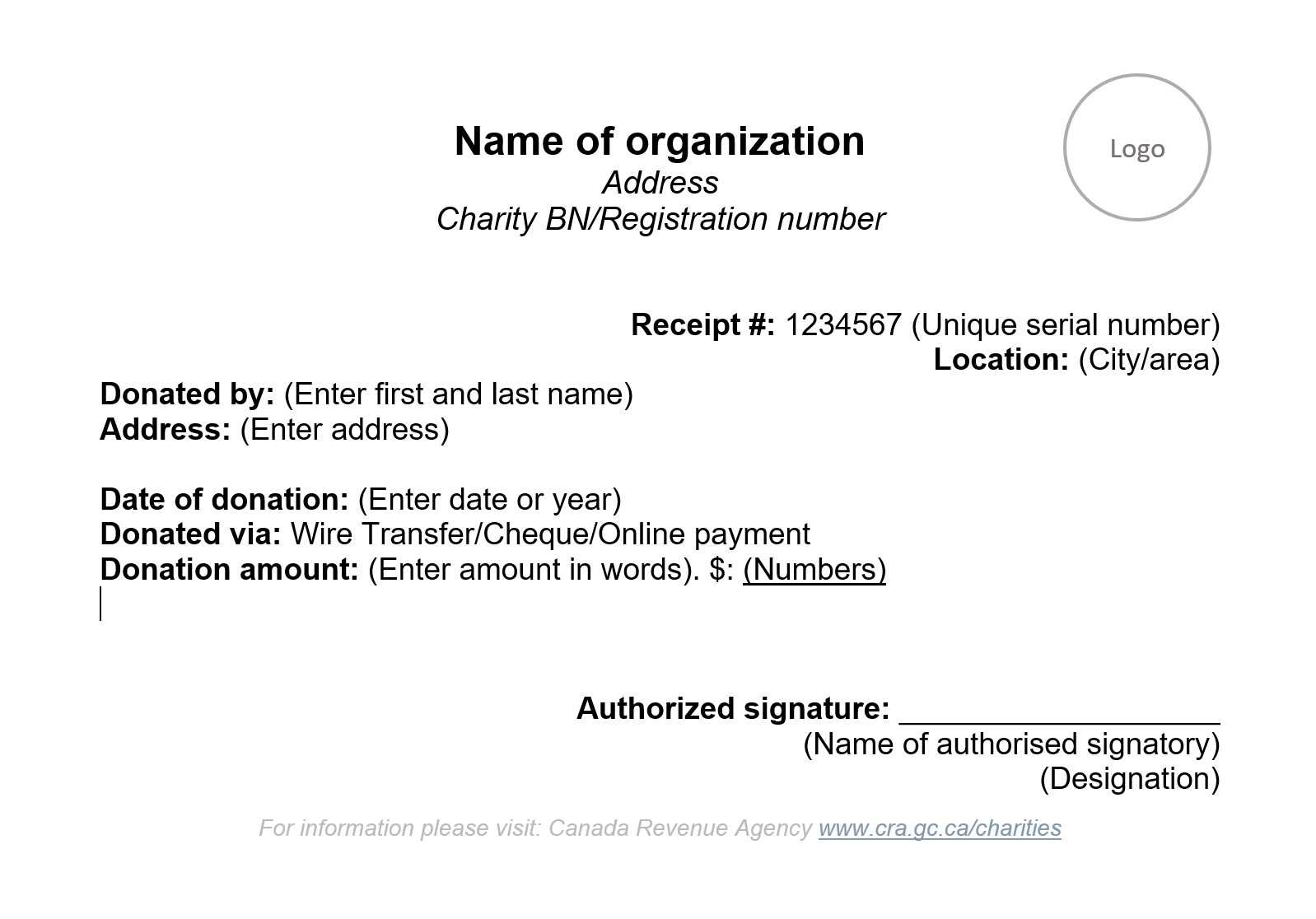

Creating a clear and professional donation receipt is an important step for both the donor and the recipient organization. It provides the necessary documentation for tax purposes and ensures transparency in the donation process. A well-designed receipt can help build trust and encourage future contributions. Use the template below to streamline the process of generating […]

Read MoreFundraising event donation receipt template

For non-profit organizations, providing donors with a donation receipt is a critical part of maintaining transparency and ensuring compliance with tax regulations. A well-structured donation receipt not only acknowledges the contribution but also provides the donor with the necessary information to claim tax deductions.

Read More501c3 vehicle donation receipt template

Required Information for a Valid Receipt A proper donation receipt must include specific details to comply with IRS regulations. Ensure the document contains the following:

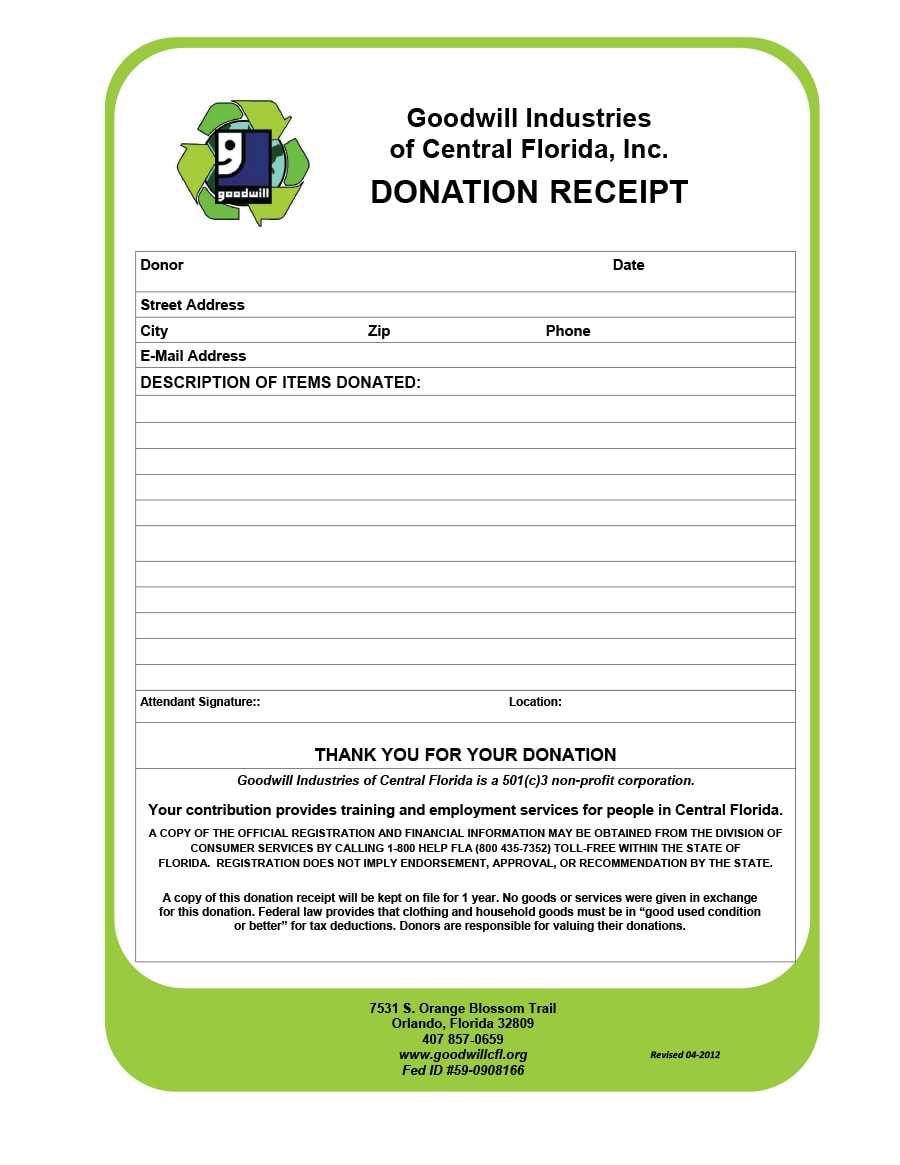

Read MoreNon profit charitable donation receipt template

Key Components of a Donation Receipt

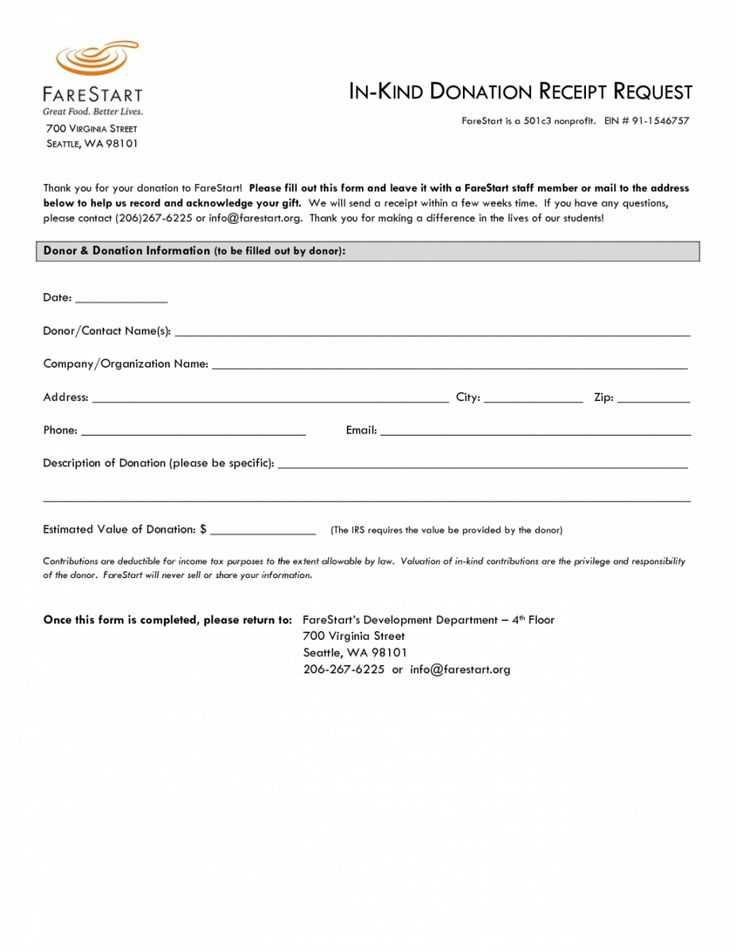

Read MoreIn kind donation receipt template

To acknowledge in-kind donations properly, create a clear and detailed receipt that outlines the gift’s value, description, and donor’s details. This helps ensure transparency for both the donor and the recipient organization, serving as proof of the donation for tax purposes.

Read MorePrintable 501c3 donation receipt template -eforms

Key Elements of a 501c3 Donation Receipt A proper donation receipt must include specific details to meet IRS requirements. Missing information can lead to compliance issues, so ensure each receipt contains the following:

Read MorePlanning center donation receipt template

Creating a donation receipt template in Planning Center can streamline your processes and ensure that donors receive the accurate documentation they need for tax purposes. Start by customizing your template with key details such as the donor’s name, donation date, and the amount contributed. This allows for a quick and professional response to each donation.

Read More