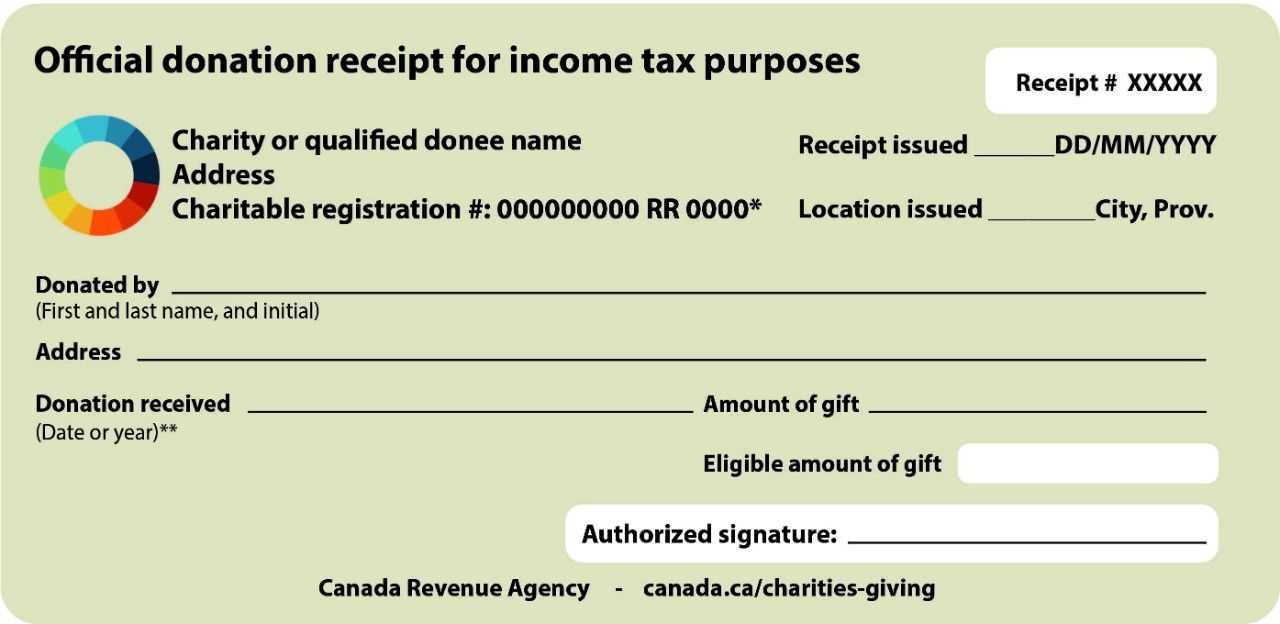

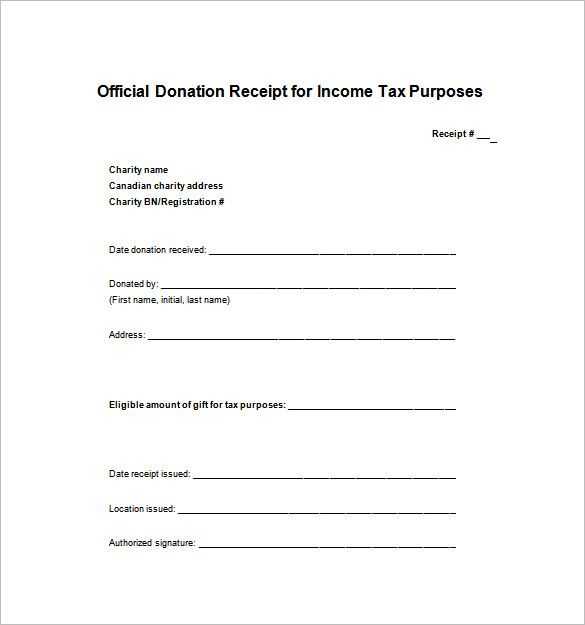

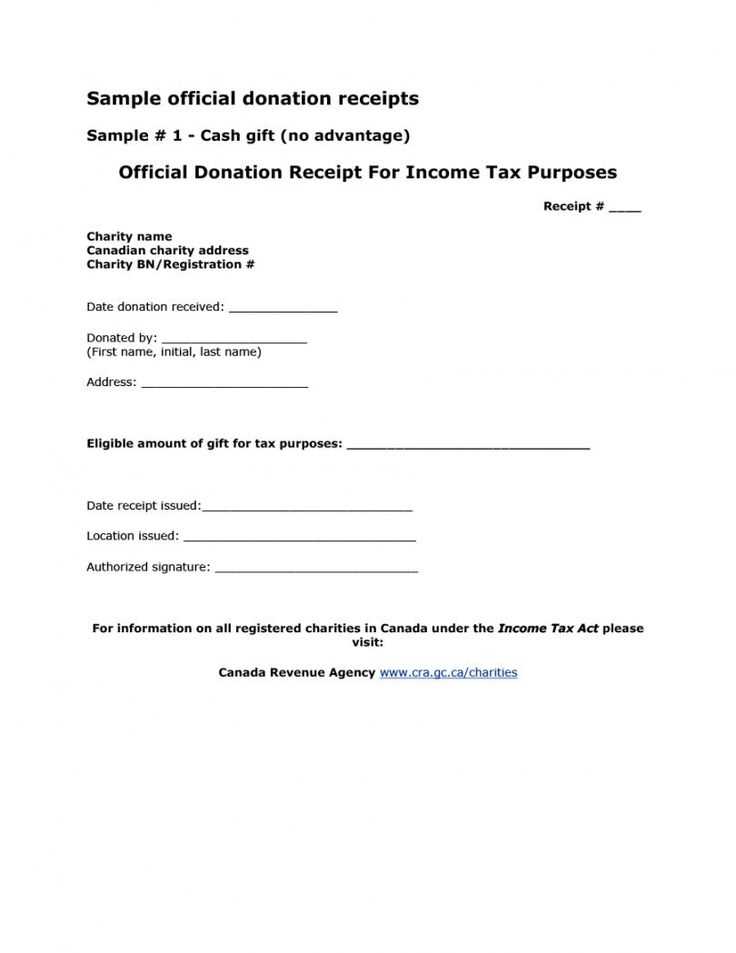

When issuing a tax receipt for a donation in Canada, make sure to include specific details to ensure compliance with the Canada Revenue Agency (CRA) guidelines. The donation receipt template should include the charity’s legal name, registration number, and the date of the donation.

Read MoreCategory: donation

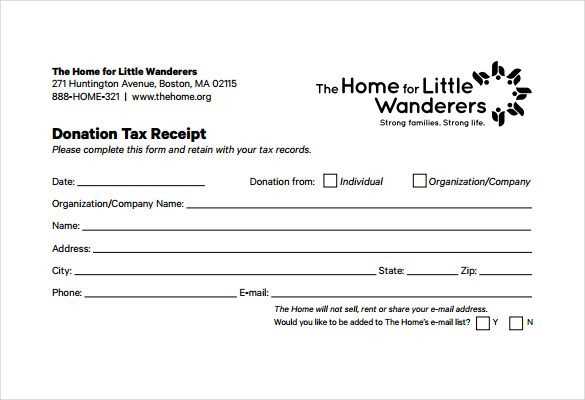

Donation receipt letter for tax purposes template

Creating a donation receipt for tax purposes requires clear documentation of both the donor’s contribution and the organization’s details. The letter should include the date of the donation, a description of the donated items or funds, and a statement that no goods or services were provided in exchange for the donation.

Read MoreDonation receipt template cra

To create a donation receipt that complies with the Canada Revenue Agency (CRA) requirements, ensure it includes all necessary details for both the donor and the organization. A proper template should contain the donor’s name, address, and donation amount, along with a clear statement of the charity’s name and registration number.

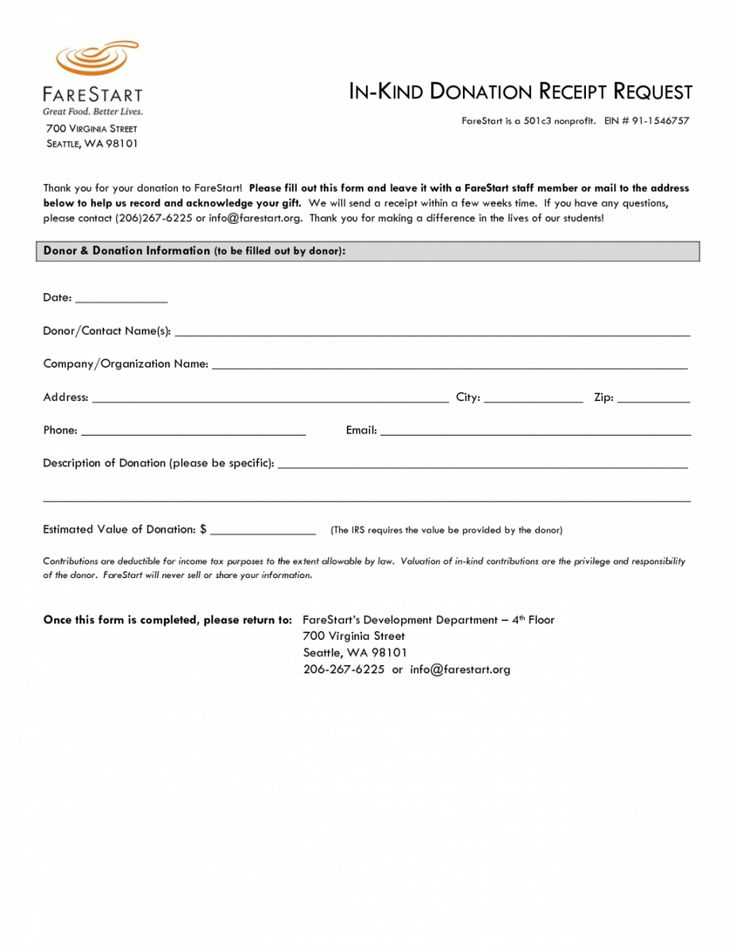

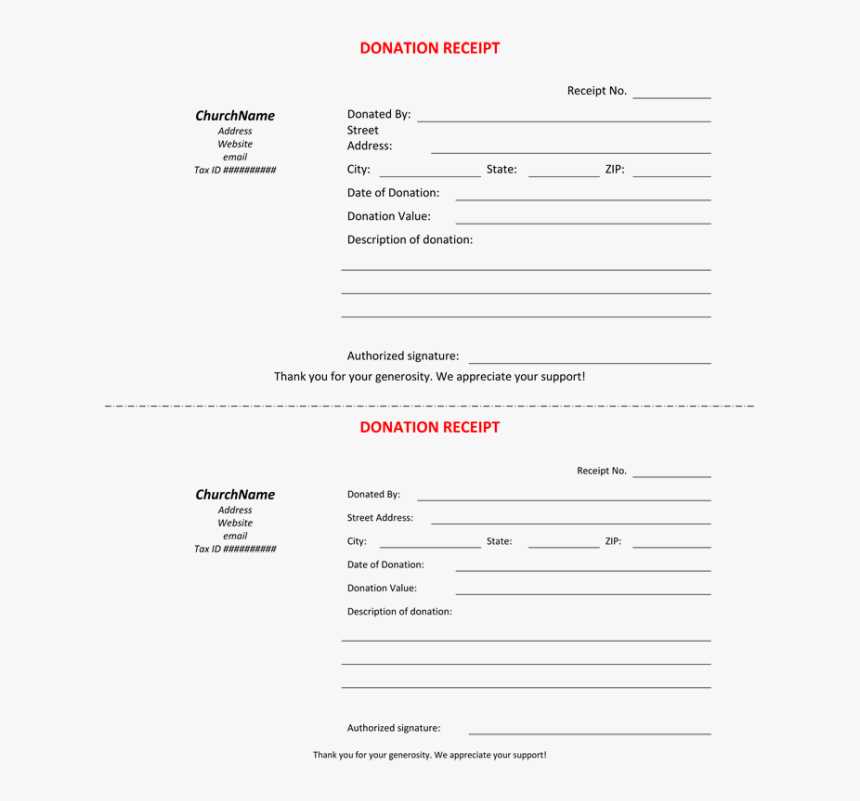

Read MoreDonation receipts for nonprofits template

Creating a donation receipt template for your nonprofit is a straightforward way to show appreciation to donors while keeping your financial records organized. A well-designed receipt ensures compliance with tax laws and provides a transparent record for both your organization and the donor. You can customize the template to suit the needs of your nonprofit, […]

Read MoreEnd of year donation receipt template

Ensure your donors receive accurate and organized year-end receipts by using a clear and straightforward donation receipt template. This template will provide all necessary details for tax deductions, keeping both your organization and donors in compliance with tax regulations.

Read MoreDonation receipt email template

For a smooth donor experience, create a simple and clear donation receipt email. Use a direct approach and make sure to acknowledge the donor’s contribution while providing key details such as the donation amount, date, and your organization’s tax information.

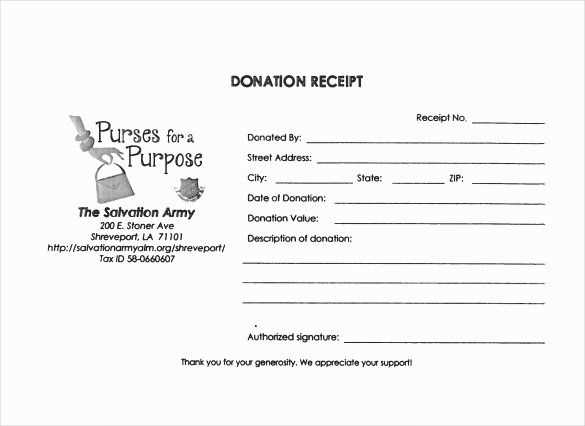

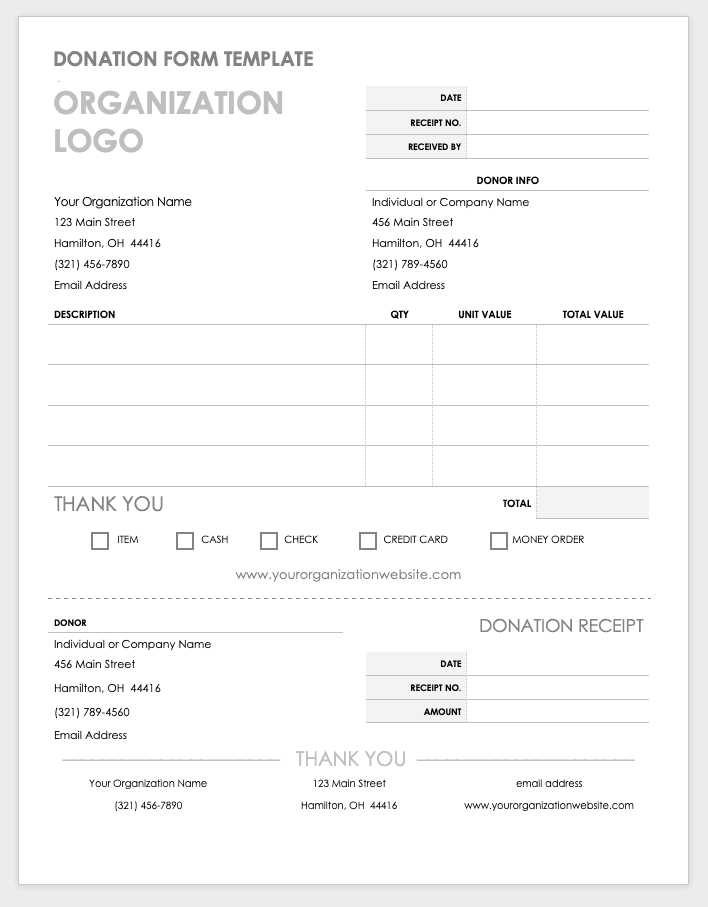

Read MoreReceipt template for 501 c donation

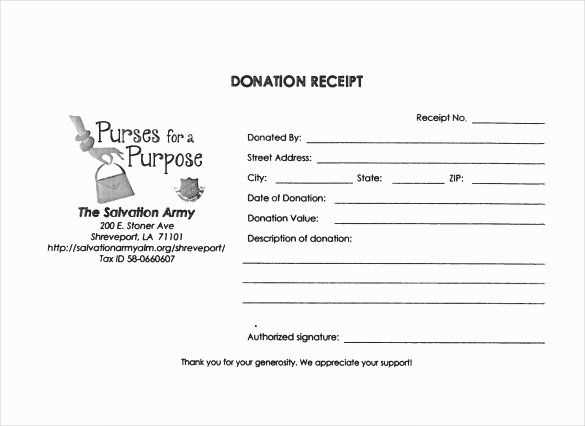

To create a receipt for a 501(c) donation, include all required details that make the document valid for tax purposes. This includes the name and address of the organization, the date of the donation, and the donation amount. Ensure the receipt is signed by an authorized person from the organization.

Read MoreCharitable donation receipt template

When preparing a charitable donation receipt, accuracy is key. A clear, concise document ensures that both the donor and the organization have proper records for tax purposes. Begin by including the donor’s full name, the donation date, and the specific amount or description of items donated.

Read MoreTax write off donation letter template with receipt

To claim a tax deduction for your charitable donation, ensure you provide a proper letter with an itemized receipt. This document should clearly detail the donation, including the amount, description of goods or services, and confirmation that no goods or services were received in exchange for the donation. A well-written letter simplifies your tax filing […]

Read More