Essential Elements of a Check Deposit Receipt

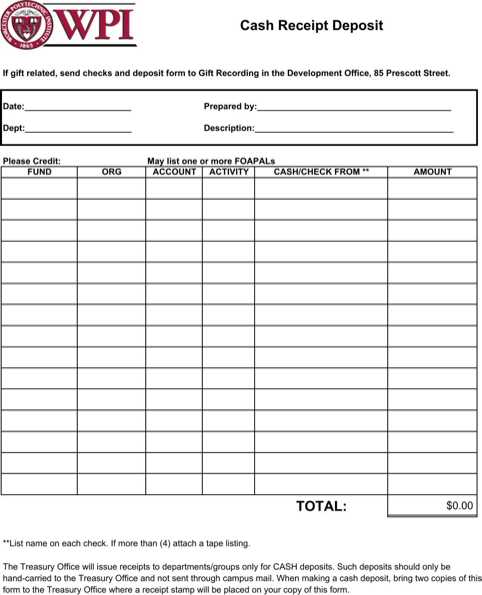

A check deposit receipt confirms a transaction and provides key details for record-keeping. Banks and businesses should ensure their template includes the following information:

- Date and Time: The exact moment of the deposit for tracking.

- Depositor’s Information: Name and account number to associate the deposit with the right account.

- Bank Details: Name and branch of the financial institution processing the deposit.

- Check Information: Check number, issuing bank, and payer’s details.

- Deposit Amount: Total value of the check.

- Reference Number: Unique transaction ID for verification.

- Authorized Signature: If applicable, a bank representative’s signature for validation.

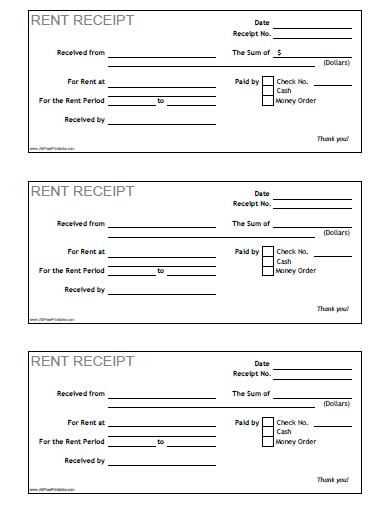

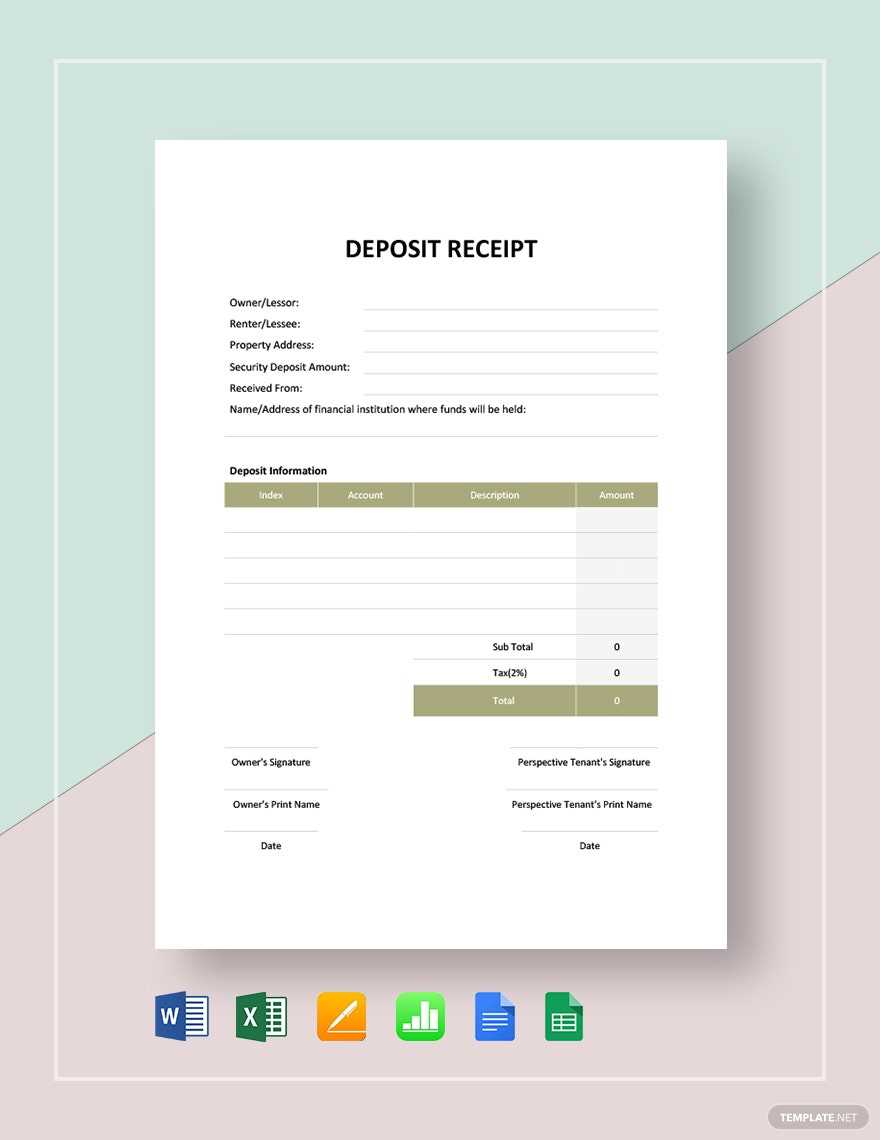

Sample Check Deposit Receipt Template

Use the following structured template for a professional and clear check deposit receipt:

CHECK DEPOSIT RECEIPT Date: _______________ Time: _______________ Depositor's Name: ___________________________ Account Number: ____________________________ Bank Name: _________________________________ Branch: ____________________________________ Check Number: _______________ Issuing Bank: _______________ Payer Name: ________________ Deposit Amount: $_____________ Transaction Reference Number: _______________ Authorized By: _____________________________ Thank you for banking with us!

Customizing the Template

Modify the template by adding a company logo, adjusting fonts, or including additional verification details. Ensure it aligns with banking regulations and internal policies for consistency and reliability.

Why Keep Check Deposit Receipts?

Maintaining copies of deposit receipts helps resolve disputes, track transactions, and provide proof of payment. Digital and physical copies should be stored securely for future reference.

Check Deposit Receipt Template

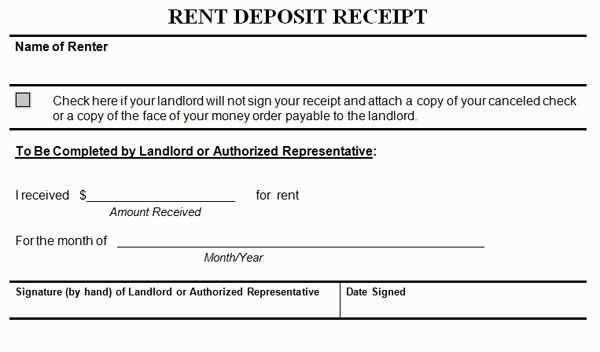

To create a check deposit receipt, include the following key elements:

Key Elements to Include in a Deposit Receipt

Deposit Date: Specify the date of deposit to keep track of when the transaction took place.

Depositor Information: Include the name and contact details of the person making the deposit. This helps with identification in case of discrepancies.

Check Information: Record the check number, the issuing bank, and the amount written on the check.

Deposit Amount: Clearly state the total amount of the deposit, matching the value of the checks being deposited.

Deposit Method: Indicate whether the deposit was made in person, via ATM, or online, to ensure accurate tracking.

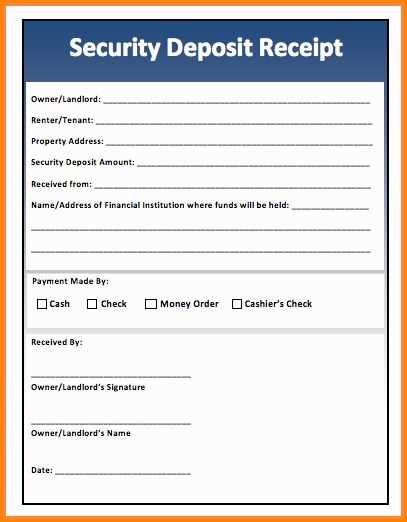

How to Customize a Deposit Receipt for Your Business

Personalize the receipt with your company name, logo, and address. This establishes your business identity on the document. You can also include a reference number to streamline tracking for internal records.

Ensure the receipt format aligns with your business’s operational needs. If you handle large volumes of deposits, consider using a digital receipt template for automated entries, which saves time and reduces human error.

Legal and Record-Keeping Considerations for Receipts

Deposit receipts serve as legal documents, so maintain a consistent and accurate record of each transaction. This helps in case of disputes or audits. Retain copies of all receipts for a specified period, as required by your local financial regulations.

Ensure all relevant details are accurate to avoid any compliance issues. An incomplete or incorrect receipt may cause problems in reconciling accounts or proving the legitimacy of deposits.